Zotefoams plc (LON:ZTF), a world leader in cellular materials technology, today announced its interim results for the six months ended 30 June 2023.

Results highlights

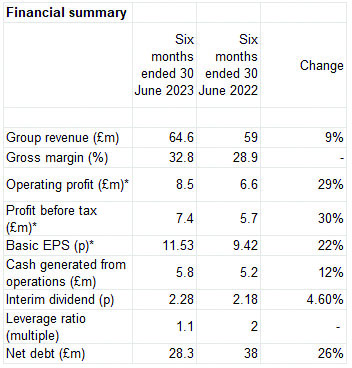

| • | Group revenue of £64.6m, 9% higher year-on-year (HY 2022: £59.0m)-High-Performance Products (HPP) sales up 11% to £26.4m (HY 2022: £23.7m)-Polyolefin foams sales up 10% to £37.7m (HY 2022: £34.3m) |

| • | Improved gross margin, up to 32.8% from 28.9% |

| • | Profit before tax (PBT) increased 30% to £7.4m (HY 2022: £5.7m) |

| • | Excluding MuCell Extrusion, PBT increased 49% to £9.4m (HY 2022: £6.3m) |

| • | Basic earnings per share increased 22% to 11.53p (HY 2022: 9.42p) |

| • | Continued strong cash generation of £5.8m (HY 2022: £5.2m), with leverage multiple at 1.1 |

| • | Interim dividend increased by 4.6% to 2.28p per share (2022: 2.18p per share), reflecting continuing confidence in the Group’s prospects |

Strategic highlights

| • | Margin recovery delivered with realignment of selling prices to input costs after a volatile post-COVID period |

| • | Well positioned to benefit from aviation market recovery |

| • | Exclusivity agreement with Nike extended to 31 December 2029 |

| • | Joint development agreement with a world-leading packager of beverages signed in July 2023, following good technical and pre-commercial progress on ReZorce® recyclable barrier packaging. Group profit delivered after absorbing £1.5m (HY 2022: £0.6m) of ReZorce-specific costs |

*Unadjusted for £131k (HY 2022: £121k) of amortisation on acquired intangibles

Commenting on the results and the outlook, David Stirling, Group CEO, said:

“The business has delivered strong revenue growth along with margin recovery, predominantly in our Polyolefin Foams business where cost inflation had been significant. With the benefit of currency tailwinds, profit before tax in the period has increased 30% to a record £7.4m (HY 2022: £5.7m). Particularly pleasing is the progress being made in the foam manufacturing side of our business (comprising our Polyolefin Foams and HPP segments), where operating profit increased 46% to £10.5m (HY 2022: £7.1m). We are also delighted to extend the exclusive supply agreement with Nike to the end of 2029.

“We have made demonstrable progress with ReZorce recyclable barrier packaging technology, including entering into a joint development agreement with a global leader of beverage packaging, and our ongoing investment, combined with the rest of the MEL business segment, generated a £2.0m (2022: £0.6m) operating loss. Investment in ReZorce recyclable barrier packaging technology in the second half is planned to be slightly above that of the first six months.

“The short-term outlook for the remainder of the year is somewhat tempered by market expectations of squeezed consumer spending and industrial deflation, resulting in inventory reductions in some of our markets. Other markets, such as aviation, are not expected to be impacted by this trend, with underlying structural growth drivers remaining robust. We expect energy and polymer input costs to be more beneficial while the US dollar, at a current rate of around $1.28, will provide a headwind to profitability for the remainder of the year, after benefitting operating profit by £1.1m in H1 2022 despite being partially hedged.

“Overall, the Board is pleased with the recent performance and current positioning of our business. We remain confident that the Company can deliver a full year performance in line with market expectations, underpinned by a strong first half performance. We remain optimistic that we can continue our positive momentum in the medium term.”

Results overview

Group revenue in the period increased £5.6m, or 9%, to £64.6m (HY 2022: £59.0m). On a constant currency basis, Group revenue increased £2.3m, or 4%, to £61.3m.

Gross profit increased £4.1m, or 24%, to £21.2m (HY 2022: £17.1m) and gross margin improved to 32.8% (HY 2022: 28.9%). Operating profit for the period increased £1.9m, or 29%, to £8.5m (HY 2022: £6.6m). Profit before tax increased £1.7m, or 30%, to £7.4m (HY 2022: £5.7m) and basic earnings per share increased 2.11p, or 22%, to 11.53p (HY 2022: 9.42p). Operating profit benefitted from £1.2m of currency movement.

Cash generated from operations was £5.8m (HY 2022: £5.2m). Closing net debt increased in the first six months of the year by £0.5m to £28.3m (31 December 2022: £27.8m) and the leverage multiple (net borrowings to EBITDA, see section “Net debt and covenants” for definition) at the end of the period was 1.1 (31 December 2022: 1.2), a material reduction on the equivalent period last year (HY 22: 2.0 on £38.0m net debt).

The Board remains confident in the cash generation of the business and an interim dividend of 2.28p per share has been approved by the Board (HY 2022: 2.18p per share).

Business unit review

Markets

Zotefoams’ speciality materials are used in a wide variety of applications globally. Our main markets are footwear, where we have an exclusive agreement to supply Nike that was recently extended to 2029, product protection and transportation, which includes aviation and aerospace, automotive and rail. Building and construction is the only other market segment traditionally representing over 10% of sales, while we also supply into medical, industrial and other markets.

In the first half of 2023, we delivered 9% revenue growth, with pricing initiatives and product mix driving this increase, as well as foreign exchange rates, which accounted for 5%. Sales volumes decreased 4%, mainly from the European and Far East regions of our Polyolefin Foams business.

Demand in most markets remained robust during the period. Footwear was our best performer, growing 14% compared with H1 2022, with volume and foreign exchange rates being the two main components, and accounting for 34% of Group sales (HY 2022: 33%). By geography, all major regions delivered sales growth, led by price increases and benefitting from favourable foreign exchange rates.

Polyolefin Foams

Polyolefin foams represented 58% of Group revenue (HY 2022: 58%), with sales increasing 10% to £37.7m (HY 2022: £34.3m) but sales volumes decreasing 5%. On a constant currency basis, sales were £36.0m.

In Continental Europe (46% of segment sales) sales increased 10% while volumes decreased 5% versus the comparative period, with automotive, construction and certain product protection markets being more negatively impacted by the current economic conditions. In the UK (16% of segment sales), sales increased 7% and in North America (32% of segment sales), sales increased 13%, with no significant change in volume in these markets. In Asia, where volumes are more dependent on a smaller number of specific high value-added programs, sales were unchanged on lower volumes. In all markets we have experienced product mix adjustments as customers switch to more cost-effective materials to combat price inflation. Often this aligns with improved sustainability across the supply chain, given that Zotefoams has solutions offering foams with lower-density or 30% recycled content, both of which reduce polymer and energy usage.

Segment profit increased 190% to £5.0m (HY 2022: £1.7m), yielding a segment profit margin of 13% (HY 2022: 5%). On a constant currency basis, segment profit was £4.3m. We believe that our market pricing was reflective of the input costs in the period with, in some cases, part of the price being a temporary surcharge reflective of high polymer and energy pricing. As these input costs fall, we are realigning prices in some products and markets. In the period, the average cost of low-density polyethylene (LDPE), which is our main raw material, was relatively similar to the long-run average polymer pricing after falling significantly in 2019 and 2020, rising from 2021 and peaking in Q2 2022. In the current year, labour cost across all geographies is likely to represent the largest inflationary component within our cost base.

Overall segment performance is also impacted by asset utilisation and operating efficiency. In the short term, our focus is on operating efficiency, particularly in our North American facility where we see the biggest opportunity to reduce costs and to release capacity to meet medium-term regional demand. In Europe, an increasing proportion of our Polyolefin Foams business is being served from our facility in Poland as the UK facility produces more foams for footwear and other HPP products.

High-Performance Products (“HPP”)

HPP represented 41% of Group revenue in the period (HY 2022: 40%), with sales increasing 11% to £26.4m (HY 2022: £23.7m). On a constant currency basis, sales were £24.8m, representing 5% growth. Sales volumes in HPP were 7% higher than the comparative period, with product mix weighted to slightly lower-priced products. Prices of HPP-related polymers have been relatively stable while other costs, such as labour and energy, despite experiencing inflation, represent a relatively lower percentage of sales. There were no major price adjustments in the period.

Sales of our largest application, footwear, continued to show growth in the period, increasing 14% to £22.3m (HY 2022: £19.5m). Our exclusive agreement with Nike was extended to 31 December 2029, reflecting the close and successful collaboration on technical foams for high-performance footwear.

ZOTEK® F technical foams are designed to be lightweight, insulating and non-flammable. Predominantly, sales are to the aviation market, but they are increasing into the space sector and other markets where insulation and safety are paramount. In all these markets, the underlying trends are positive, with aviation build rates increasing and additional applications for our foams being approved, which will help to drive strong sales growth. Given timing effects, the first half performance did not see a material benefit from these underlying trends, but we expect them to be strongly evident in the full-year performance. In the period, sales fell by 9% to £1.7m (HY 2022: £1.9m).

T-FIT® advanced insulation, which is mainly used for cleanrooms in pharmaceutical, biotech and semiconductor manufacturing, grew 9% in the period, to £2.2m (HY 2022: £2.1m), with good growth in India offset primarily by more challenging conditions in China, particularly in the pharmaceutical manufacturing industry.

The segment profit in HPP reflects a mix of products and markets at different stages of development. Within this portfolio, foams used for footwear and aviation have both reached a scale that makes them profitable. T-FIT technical insulation, which has attractive underlying margin potential, has a mixture of profitable lines and earlier stage products and the Group has continued to invest in operational and sales capability, mainly in China and India, but more recently in the USA and Poland. We intend to continue with this investment, which we believe offers good potential to support our ambitions over the longer term.

Segment profit in HPP increased by 11% to £7.2m (HY 2022: £6.5m), yielding a profit margin of 27% (HY 2022: 27%). On a constant currency basis, segment profit was £6.2m, mainly as a result of product mix and phasing, yielding a profit margin of 25%. Most HPP sales are in USD, while costs are in a mixture of GBP, USD and Euro, therefore the benefit of the stronger dollar was greater on the HPP segment than in Polyolefin Foams. Raw materials and other inflationary pressures were less marked in HPP than in the Polyolefin Foams business, partly as a result of larger inventory holdings in HPP, with correspondingly lower pricing adjustments in HPP foams and T-FIT insulation products.

MuCell Extrusion LLC (“MEL”)

MEL, which develops and licenses microcellular foam technology and sells related machinery, accounted for 1% (HY 2022: 2%) of Group revenue in the period with sales of £0.6m (HY 2022: £1.1m).

We continue to divert many of our existing resources away from our traditional MEL licensing business model and towards the business opportunity offered by our ReZorce® recyclable barrier packaging solutions. Moreover, as we have previously communicated, we have invested additional resources to deliver this opportunity. ReZorce is a mono-material, and hence fully recyclable, solution for packaging consumer products. We have focused on an alternative to liquid paperboard cartons, which are made using a combination of different materials and therefore cannot be easily recycled and are not considered to be circular (i.e. they do not use their own post-consumer recycled content in their manufacture). ReZorce, therefore, offers a potential improvement in carbon footprint and recyclability to a global industry. This is a high-risk development with the potential for commensurately high rewards for success.

We are working on developing a complete “end-to-end” solution for recyclable beverage cartons. This begins in our facility in Denmark with the manufacture of ReZorce material using recycled content. This is followed by printing to the required standard, then made into cartons, filled with liquid such as juice in a sterile environment using existing packaging infrastructure and finally, after consumption, getting recycled in common kerbside post-consumer recycling streams. In all aspects, we have made significant progress in the first six months of this year, culminating in the signing of a joint development agreement with a world-leading packager of beverages in July, who brings expertise in the field of consumer packaging and will accelerate our ability to scale up trials and move towards commercialisation.

During the period, we invested £1.5m in operating costs (HY 2022: £0.6m) to continue the development of ReZorce, while a further £1.0m of capex was incurred, split £0.8m (HY 2022: £0.7m) in intangible development costs and £0.2m (HY 2022: £0.2m) in tangible assets. Since the inception of this initiative, the Group has capitalised a total of £5.7m (31 December 2022: £4.7m).

MEL reported a segment loss after amortisation costs of £2.0m (HY 2022: loss £0.6m) as growth investment was diverted to ReZorce. The carrying value of MEL at 30 June 2023 includes intangible assets of £7.3m (31 December 2022: £7.1m), which mostly comprises goodwill and technology that arose on the acquisition of MEL in a previous accounting period (£3.4m) and capitalised development costs relating to ReZorce (£3.2m). While MEL has historically been loss making, we consider that no impairment is needed at this stage, based on the size and potential of the opportunity that the ReZorce technology offers. In this regard, the carrying value is supported by the Board’s ongoing commitment to funding the project and the progress made to date and expected in the second half of the year.

Environmental, Social and Governance (‘ESG’)

The Board understands that embedding ESG in our business creates sustainable long-term value for stakeholders. Zotefoams’ purpose, to provide “Optimal material solutions for the benefit of society” reflects our belief that plastics, when used appropriately, are frequently the best solution for the sophisticated, long-term applications typically delivered by our customers. We are making good progress on our ESG plans including reducing energy and polymer usage, minimising waste and developing new products which use recycled materials. A full ESG report was published in the 2022 Zotefoams Annual Report, setting out the Group’s ESG management framework, goals and performance to date. This will next be updated in the next Annual Report to be published in April 2024.

Employees and talent management

Hiring and retaining employees with the right skills and managing and further developing these talented people, is very important to Zotefoams as it grows and evolves globally. We have a wide scope of opportunities and need to identify and develop the right people to define and deliver our potential. We have now returned to direct engagement with all overseas operations, post COVID-19. We currently employ 580 people globally (HY 2022: 572 people), 43% (HY 2022: 42%) of whom are outside the UK.

On behalf of the Board, we would like to thank all our employees for their continued contributions and commitment to Zotefoams.