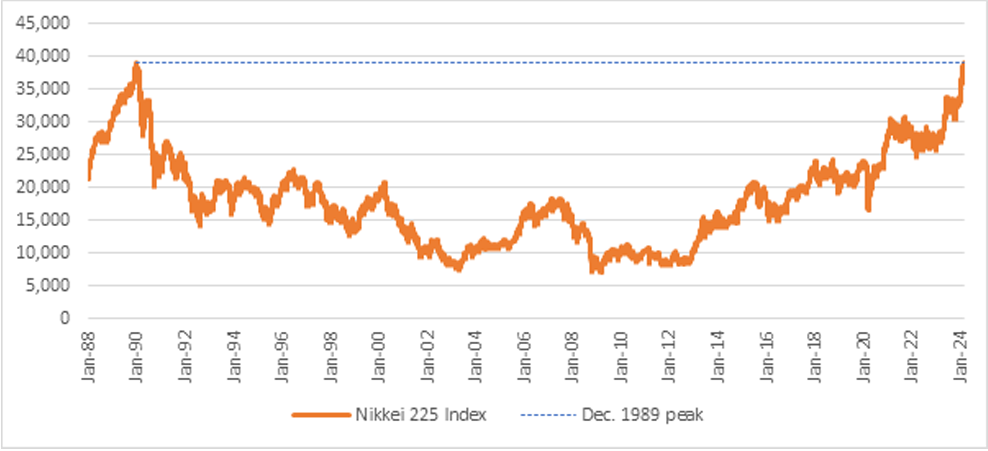

Fidelity Japan Trust plc (LON:FJV) is well positioned as Japanese stocks reached an all-time high for the first time since December 1989 overnight1. The Nikkei 225 has been on a sustained upward trajectory for over a year, supported by a number of factors including corporate governance reforms and a normalising economy. Despite the strong recent returns, Jeremy Osborne, Investment Director of Fidelity Japan Trust PLC, thinks Japanese equities still offer compelling value and investors are underexposed to the market.

Nikkei 225 Index passes December 1989 peak

Source: Bloomberg as of 22 February 2024. Past performance is not a reliable indicator of future returns. Returns may increase or decrease as a result of currency fluctuations.

| PAST PERFORMANCE | |||||

| Jan 19 – Jan 20 | Jan 20 – Jan 21 | Jan 21 – Jan 22 | Jan 22 – Jan 23 | Jan 23- Jan 24 | |

| Nikkei 225 Index | 11.93% | 18.47% | -9.23% | -2.28% | 14.21% |

| Past performance is not a reliable indicator of future returns. Source: RIMES as at 31.01.2024 | |||||

Japanese stocks power ahead year to date, continuing on from 2023

The strong performance of Japanese equities since last year has been supported by several key supports. Chief among them are the country’s shift towards moderate inflation, corporate governance reforms enacted by the Tokyo Stock Exchange (TSE), the Bank of Japan’s accommodative policy stance and accompanying weakness in the yen, and renewed buying among overseas investors. There is also a sense that investors are favouring Japan for its relative stability compared to other markets, which has contributed to the direction of flows.

“More recently, corporate governance reforms have gained further momentum with the TSE’s publication of companies that have complied with its call to disclose plans aimed at improving capital efficiency. So far, 49% of Prime market companies and 19% of Standard market ones have responded to the TSE2.

“Upbeat earnings results, including from index heavyweights, accompanied by share buyback announcements have also served to galvanise market sentiment. And the broader shift in the economy to moderate inflation supports growth in wages and consumer spending, and investment.

“The major active buyers in the Japanese market have been overseas investors year-to-date, with net buying concentrated in cash equities rather than futures, which suggests increased interest among traditional long-only investors. With Japanese companies remaining proactive in share buybacks, domestic corporations have been the other key buyers in the market.

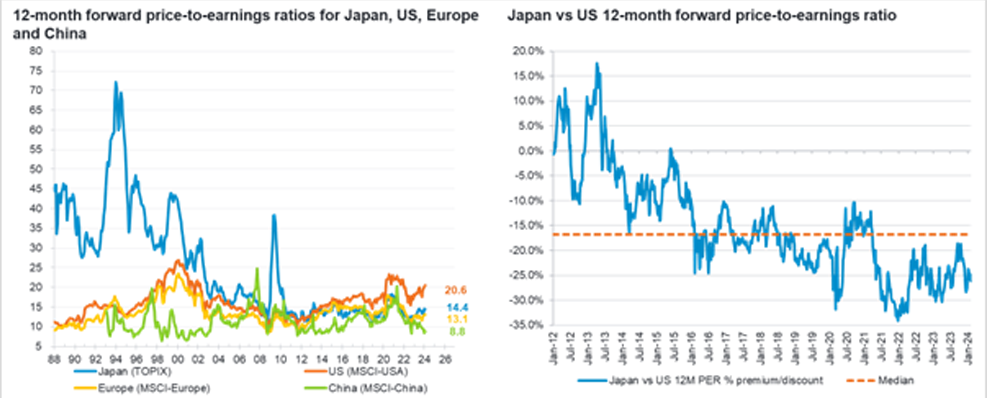

We believe Japanese stocks are not excessively priced despite reaching an all-time high,

“Japanese equities traded on a forward price-to-earnings (PE) multiple north of 50x during the bubble period, so the current multiple of around 15x3 does not look expensive historically nor relative to other markets4, especially considering current interest rates.

Source (1) Factset, compiled by Daiwa Securities as of 8 February 2024. (2) Bloomberg as of 9 February 2024.

“Moreover, a sustained improvement in returns on equity (RoE) would support a higher price-to-book (PB) multiple, and the economic trend towards moderate inflation supports higher earnings-based valuations. The TSE has also taken an important step with its guidance on how companies should be managed around governance and capital allocation, and this directly encourages executives to make decisions that are conscious of stock prices.

“As well as concrete measures to foster sustainable growth such as returns that exceed the cost of capital, the TSE also promotes essential initiatives such as research and development (R&D), human and capital investment, and realigning business portfolios to better allocate resources.

Since the 1990s, Japan has been battling with deflation, which made it difficult for corporations to invest for the future. However, in the current environment where we are becoming increasingly confident about overcoming deflation, companies are more likely to accept the TSE’s requests and engage in strategies that are conscious of capital allocation and stock prices.

“In this environment, we believe companies are increasingly embracing stock price indicators such as PB and RoE as a barometer of performance, and as Japanese corporations progress, these indicators could be valued as highly as they are in Europe and the US.

Both overseas and domestic investors remain underinvested in Japanese stocks

“Cumulative net buying by overseas investors remains well below the 2015 peak witnessed during the era of ‘Abenomics’, which was characterised by the growth-led approach of loose monetary policy, fiscal stimulus and structural reforms. Although we have seen renewed buying since March 20235, global active funds remain net underweight in Japan, albeit less so than they were during the Covid-19 outbreak.

“Japanese households are also relatively underweight equities when it comes to their mix of financial assets compared to their counterparts in the US or Europe6. Domestic stocks account for only 11% of their financial assets7, but it is likely that this will rise as households shift from cash deposits to inflationary assets such as stocks, driven by inflation and the expansion of the Nippon Individual Savings Account (NISA), which is a tax-exempt investment scheme originally modelled on the UK’s ISA.

“These significant structural underweights in investor portfolios suggest there is ample room for inflows into Japan’s markets. If the corporate sector, guided by more shareholder-friendly policymaking, can continue to build on its success in recent years in boosting returns, then inflows could persist.

Shift to moderate inflation and progress in reforms supports Japan’s longer-term outlook

“The biggest risk to Japan’s equity market is a return to deflation – but we believe the chances of this are low. There are risks around inflation and how rising interest rates can impact market valuations, but the likelihood is that in Japan any increase in rates will be gradual.

“Ongoing signs of weakness in China’s recovery and a slowdown in the US also present potential headwinds that could prompt a near-term adjustment in Japanese stocks. Additional shocks from energy prices, driven by an escalation in geopolitical events, remain a risk that we are closely monitoring, although this is likely to be a global headwind rather than isolated to Japan.

“Despite the presence of various external risk factors, we believe that Japan’s shift to moderate inflation and its impact on spending and investment decisions by households and corporates, combined with steady progress in governance reforms and light positioning among investors, support the longer-term outlook of the Japanese stock market.”

- Source: Bloomberg as of 22 February 2024.

- Source: Tokyo Stock Exchange, January 2024.

- Source: Factset, compiled by Daiwa Securities as of 8 February 2024.

- Source: Bloomberg as of 9 February 2024.

- Source: Ministry of Finance; compiled by Daiwa Securities as of 31 January 2024.

- Source: Bank of Japan, as of August 2023.

- Source: EPFR, Refinitiv DataStream. Data: January 2002 to December 2023. Note: Percentage of Japanese stocks in actively managed equity funds (including ETFs) that invest globally, excluding the U.S., compared with the MSCI EAFE Index. The fund’s weighting is calculated as an asset-weighted average.

Important information

Past performance is not a guide to future returns. The value of investments and the income from them can go down as well as up, so you may get back less than you invest. Fidelity Japan Trust PLC invests more heavily than others in smaller companies, which can carry a higher risk because their share prices may be more volatile than those of larger companies and the securities are often less liquid. Changes in currency exchange rates may affect the value of investments in overseas markets. The shares in the investment trust are listed on the London Stock Exchange and their price is affected by supply and demand. This investment trust can gain additional exposure to the market, known as gearing, potentially increasing volatility. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser. Investors should note that the views expressed may no longer be current and may have already been acted upon.

The latest annual reports, key information document (KID) and factsheets can be obtained from our website at www.fidelity.co.uk/its or by calling 0800 41 41 10. The full prospectus may also be obtained from Fidelity. The Alternative Investment Fund Manager (AIFM) of Fidelity Investment Trusts is FIL Investment Services (UK) Limited. Issued by FIL Investment Services (UK) Limited, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM00224/386280/ ISSCSO00154/NA