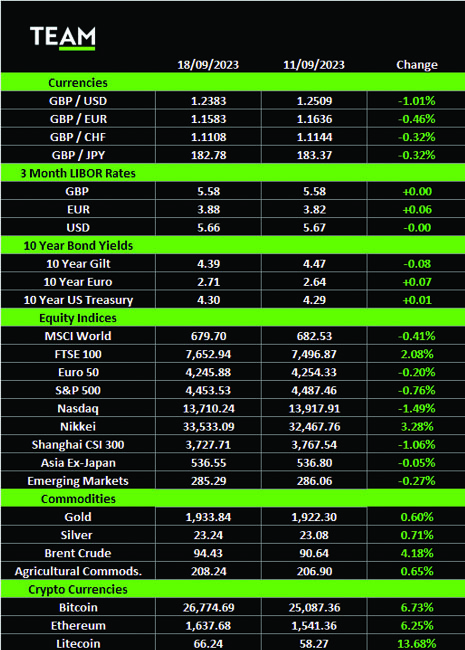

TEAM Asset Management’s global weekly market review for week commencing 11th September. TEAM Asset Management is a Jersey-based independent asset management company of AIM-listed parent, TEAM plc (LON:TEAM).

Most markets slipped back last week as investors awaited interest rate decisions from central banks returning from their summer breaks. The blue-chip S&P 500 and technology focused Nasdaq indices fell 0.8% and 1.5% respectively.

The European Central Bank raised its deposit rate by another 0.25% to an all-time high of 4% on Thursday in a bid to counter stubborn inflation. The bank revised its inflation forecasts higher for this year and next, reflecting higher wage pressures in a tight labour market, and a majority of members on the Governing Council felt it was necessary to tighten policy further.

However, in a nod to dissenting members on the council, President Christine Lagarde acknowledged that higher interest rates could weigh further on the economy, the ECB lowered next year’s growth forecast from 1.5% to 1%, and suggested the bank is now ready to pause after hiking interest rates for a 10th consecutive time.

Eleven more central banks, including the Federal Reserve, Bank of England and Bank of Japan will announce their interest rate decisions this week. The Fed and BoJ are unlikely to announce any changes but the BoE is expected to raise its benchmark interest rate by another 0.25% to 5.5%.

Annual consumer price inflation in the UK was 6.8% in August, the highest rate in the G7, and the buoyant labour market suggests it will take some time before inflation slows to the BoE’s 2% target rate. Wages in the UK grew 7.8% from a year earlier in the three months through July, matching the fastest pace since records began in 2001.

If, as expected, the BoE do raise interest rates on Thursday, money markets are pricing in any more hikes this year as a coin-flip. Whilst there is still work to do to curb inflationary pressures, there are also some signs the economy is starting to crack which may make officials more reluctant to tighten monetary policy too much further.

The ONS reported last week that the UK economy contracted 0.5% in July, in part due to industrial action and the wet weather which impacted construction and retail, and the housing market is in a downturn. The RICS survey, which measures the difference between the percentage of surveyors seeing rises and falls in house prices, fell to -68 in August, the lowest level since 2009.

In corporate news Arm Holdings, the British chip design company, priced its initial public offering (IPO) at $51 a share and valuing the company at $54.5 billion before it started trading on the Nasdaq. The largest IPO so far this year attracted a lot attention amidst the frenzy surrounding artificial intelligence and shares popped nearly 25% in their first day of trading on Thursday. However, some of the froth has come off over the past couple of days and shares closed at $58 on Monday.

Arm was acquired by Japan’s Softbank in 2016 for $32 billion and the shares sold in the IPO represented 9.4% of the company’s stock. Masayoshi Son, founder and chief executive of the Japanese group, is expected to use the proceeds from the share sale for deals in AI, including a potential investment in Microsoft-back OpenAI.

BP shares fell 2.8% on Wednesday following the sudden resignation of chief executive Bernard Looney amid a review of his personal relationships with colleagues. Looney had led the oil giant since 2020 and oversaw a strategy repositioning BP as a leader in the energy transition with substantial investments in renewable energy. Oil prices extended their rally last week and Brent Crude rose above $95 a barrel for the first time since November. Demand for global oil has climbed to a record 101.8 million barrels a day this year whilst Saudi Arabia and Russia continue to restrict supply – Saudi Arabia has extended its voluntary 1 million barrels per day export cuts until at least the end of the year. In the past, the US has released barrels from its strategic reserves to reduce the pressures on prices but following the huge draw downs last year in the wake of Russia’s invasion of Ukraine, it has less scope to do so.