Versarien plc (LON:VRS), the advanced materials engineering group, has today provided an update on its progress in China, previously announced on 15 April 2019 and referenced in more recent Company announcements including those on 9 August 2019, 24 September 2019, 12 December 2019 and 25 February 2020.

Versarien Graphene (Hong Kong) Limited, a wholly-owned subsidiary of Versarien has signed a joint venture agreement with Young-Graphene (Beijing) Technology Company Limited. YG has appointed the Secretary General of the China International Graphene Industry Union to act for it in this matter and is supported by both CIGIU and Beijing Institute of Graphene Technology Co. Ltd. Versarien’s wholly foreign owned enterprise (Beijing Versarien Technology Co., Ltd.) will become the joint venture company with YG for the development of its activities in China.

Key Highlights (to be read in conjunction with further details set out below):

- Agreement signed with YG to form a 50%-owned Chinese Joint Venture (the “Joint Venture” or “JV”) for the development of applications for Versarien’s technologies in the region.

- RMB1 million (c.£121,000) initial investment each by Versarien and YG over the next 12 months subject to certain milestones.

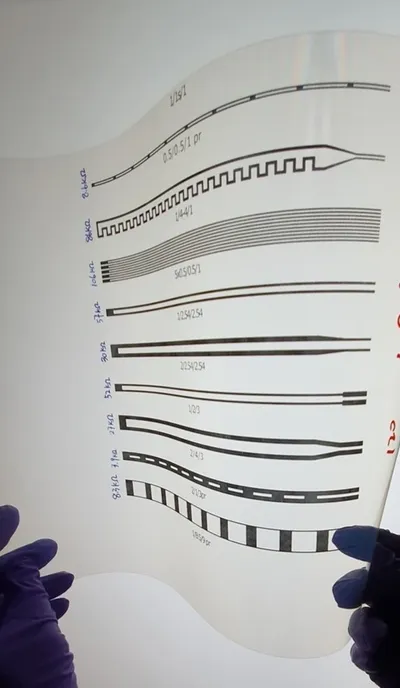

- The Joint Venture will have exclusive use of Versarien’s technologies in the PRC. Versarien will retain rights to its existing technologies and intellectual property, with newly developed intellectual property being retained by the JV and/or the end users.

- Agreement includes, and is contingent on, a commitment by YG to procure subscription for Versarien ordinary shares from third parties in three tranches, which in aggregate will total up to 15% of Company’s current issued share capital (“Versarien Share Subscriptions”).

- Half of any gross funds raised in these subscriptions will be committed to investment in the JV’s activities in the PRC.

- Any investment remains subject to, inter alia, further due diligence and agreeing acceptable terms and there can be no certainty that any of these subscriptions will occur.

Summary of Main Terms (such terms to be governed by the laws of the PRC)

- YG and VGHK will each subscribe to an increase in the share capital of BVT, in an amount of RMB1 million (approximately £121,000) each so that VGHK and YG shall each hold 50% of BVT’s registered share capital. BVT will retain its name as Beijing Versarien Technology Co., Ltd (“BVT”). The capital contribution to BVT by YG shall be paid in cash instalments within one year according to the business needs of BVT. The capital contribution to BVT by VGHK of RMB1 million shall be paid in cash within thirty days of either: (i) Versarien receiving technology license fees, technical service fees or other income totaling no less than RMB35 million (approximately £4.2 million) from the Head Licence agreement referred to below; or (ii) Versarien receiving the first equity investment tranche arising from a placing of 5% of its issued share capital to investors to be procured by YG (see below for further details).

- Versarien will introduce to the PRC the graphene technologies owned or developed by Versarien (the “Versarien Technologies”) initially through the Graphene Seed Incubation Park located in Beijing.

- Versarien will grant exclusivity to BVT for the use and promotion of the Versarien Technologies in the PRC providing certain terms are met in relation to a placing of new ordinary shares of Versarien.

- Once an end user or third-party collaborator of Versarien’s technologies in the PRC (the “End User”) is identified by BVT, Versarien and BVT shall jointly discuss and negotiate the terms of a technology license to or collaboration with the End User. Once all the terms and conditions of the use of Versarien Technologies are finalised by the relevant parties, Versarien shall enter into a technology license or collaboration agreement with BVT (the “Head License Agreement”) in order for BVT to sub-license the Versarien Technologies to, or further collaborate with, the End User, under a separate agreement entered into with the End User (the “Sub-License Agreement”).

- The terms and conditions of the Head License Agreement and those of the Sub-License Agreement shall be the same except that the license fees (including related technical service fees) under the Head License Agreement shall be 70% of the license fees under the Sub-License Agreement. The remaining 30% of the license fees under the Sub-License Agreement will be retained by BVT to fund its operating and management costs.

- Versarien will remain the owner of existing Versarien Technologies intellectual property licensed to the End User under the Head License Agreement and Sub-License Agreement. Any new technologies or new intellectual property generated during the process of promotion and industrialisation of Versarien Technologies by BVT shall belong to BVT or jointly belong to BVT and the End Users.

Equity Investment in Versarien

The Agreement also sets out the conditional heads of terms for a staged equity investment in Versarien on the following terms. In particular:

- The Joint Venture is conditional on Versarien receiving a strategic equity investment of up to 15% of its current issued share capital in three equal instalments with a long-stop date of 30 June 2021. Within five business days after receiving each instalment of subscription proceeds for the Versarien Share Subscriptions, Versarien will remit 50% of the gross proceeds of the subscription to a Graphene Fund to be managed for the benefit of BVT.

- The equity subscriptions set out above are expressly conditional on any investor being allowed to conduct customary and proper due diligence on Versarien and the due diligence findings being materially consistent with all the public disclosures made by Versarien; and on the terms and conditions of the equity subscription agreements (other than the subscription price) being standard and customary for similar transactions in the United Kingdom.

- It should be noted that no party has committed to acquire any new shares in the Company or underwrite any equity fundraising pursuant to the Versarien Share Subscriptions and there can be no certainty that any of these subscriptions will occur.

- The execution of definitive agreements to complete each stage of the equity subscription will depend on a number of other practical factors, including:

o Due diligence;

o Identification of an appropriate investor;

o Versarien confirming certainty of the proposed investor’s funding; and

o If the ultimate investor once identified proposes funding from within mainland China, such funding is likely to be subject to PRC currency exchange controls.

Backstop Arrangements

- If Versarien has not received income under the Head License Agreement totaling RMB 35 million (approximately £4.2 million) within twenty-four months of issue of the Joint Venture business licence VGHK shall be entitled to purchase from YG its entire equity interest in BVT at a nominal price of RMB10 (approximately £1) and YG shall accept such purchase of its equity interest.

- If YG fails to procure a definitive agreement for Versarien for the first Versarien Share Subscription due by 30 June 2020, Versarien shall be entitled to purchase from YG all its equity interest in BVT at the nominal price of RMB10 (approximately £1) and YG shall accept such purchase of its equity interest.

Commenting on the Agreement, Neill Ricketts, Chief Executive Officer of Versarien, said: “Despite the impact of Covid-19 around the world, the Company has been able to continue to make progress on executing its strategy in China, as illustrated with the confirmation of this joint venture agreement. As highlighted in our February 2020 update, discussions are continuing to facilitate an equity investment in Versarien.”