Versarien plc (LON:VRS), the advanced materials engineering group, has announced it has raised £454,822 (before expenses) by way of a placing of 165,389,817 new ordinary shares in the capital of the Company at a price of 0.275 pence per share.

Highlights

· Versarien has raised £454,822, before expenses, through the placing of 165,389,817 new ordinary shares in the capital of the Company at a price of 0.275 pence per share

· The net proceeds of the Placing will be used for corporate and working capital purposes, together with providing bridge finance to extend the Company’s cash runway ahead of any funds received from asset sales

· The issue of the Placing Shares is within existing authorities granted by shareholders at the general meeting of the Company held on 30 October 2023 and therefore no shareholder approval is required for the Placing

Use of Proceeds and Turnaround Strategy

The net proceeds of the Placing will be used for corporate and working capital purposes, together with providing bridge finance to extend the Company’s cash runway ahead of any funds received from asset sales.

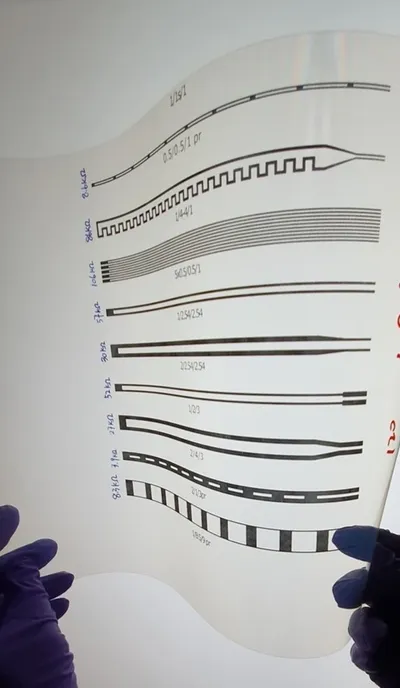

Versarien Plc continues to pursue its stated turnaround strategy:

· to maintain and strengthen the Company’s scientific teams;

· use its know-how in construction and textiles to be a manufacturing light operation;

· to licence Versarien’s technology, brands and manufacturing understanding; and

· divest non-core activities.

As previously announced, the mature businesses and the intellectual property and plant acquired from Hanwha Aerospace in 2020 continue to be marketed for sale and the Company is progressing discussions with a number of interested parties. The sale process for AAC Cyroma Limited, a manufacturer of moulded products, is the most advanced. However, the timing of any asset sales and the total quantum of the funds that may be received remains uncertain.

Stephen Hodge, Chief Executive Officer of Versarien plc, commented:

“As we have previously announced, the Company requires further funding to continue its turnaround strategy and we welcome the investor interest in this Placing. We continue to focus on this strategy, pursuing an encouraging pipeline of commercial and R&D projects, as well as technology licencing opportunities. We look forward to updating shareholders on continuing progress in the coming months.”

Admission and Total Voting Rights

Application has been made for admission of the Placing Shares to be admitted to trading on AIM on or around 13 November 2023. The Placing Shares will rank pari passu in all respects with the Company’s existing ordinary shares. Following Admission, the total number of ordinary shares in the Company in issue will be 496,169,507. This figure may be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in the Company under the FCA’s Disclosure and Transparency Rules.