Versarien plc (LON:VRS), the advanced materials group, has today announced that it that it will imminently acquire, subject to certain administrative completion conditions, 62 per cent. of the issued share capital of Gnanomat S.L..

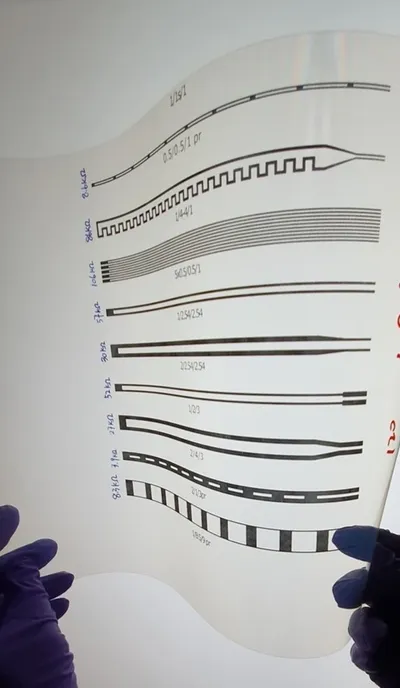

GNA, based in the Parque Cientifico Madrid, Spain, is a company capable of utilising Versarien’s graphene products in an environmentally friendly, scalable production process for energy storage devices that offer high power density, almost instant recharging and very long lifetimes for use in electrical vehicles and portable electronics products.

The consideration for the Acquisition is £2,647,000, to be settled by £673,000 in cash, from the Company’s existing resources, by way of GNA issuing new shares in GNA to Versarien, and the issue of 1,316,278 new ordinary shares of 1 pence each in the Company (“New Ordinary Shares”) to existing GNA shareholders at an agreed price of 150p per New Ordinary Share. The New Ordinary Shares will be subject to a lock-in agreement, with 50% subject to a 12 month lock in and 50% subject to a six month lock in.

The cash component of the consideration will be used by GNA to provide funding for the scale up of a pilot plant. The Acquisition will also provide Versarien with a centre of excellence for graphene enhanced energy storage devices in Europe, giving access to a proportion of the c.€1bn of research funding available in the EU post Brexit, and access to Spanish graphene research institutions. Roberto Clemente, GNA’s Chief Executive Officer, will continue to run the business on a day-to-day basis.

Versarien will additionally provide a loan of €1,250,000 to GNA, in the form of loan notes convertible into GNA equity in the event of a repayment default. €750,000 of the loan will be provided to GNA 12 months from completion and €500,00 18 months from completion. The loan notes are repayable in equal quarterly installments over three years post their provision and have a 6% interest coupon.

For the year ended 31 December 2017 GNA’s unaudited financial results show net assets of €325,000 and a loss before tax of €26,000.

Neill Ricketts, CEO of Versarien plc, commented:

“We are delighted with the acquisition of GNA and the opportunities it will brings us. The incorporation of graphene into energy storage devices has the possibility to radically enhance their capabilities, meeting the demands to increase power density and reduce charging times for everything from hand held devices to electric cars. GNA are at the forefront of developing this technology.“In addition, the Acquisition will provide Versarien with a European centre of excellence in addition to our existing graphene operations in Manchester and Cambridge, further enhancing our capabilities and access to research facilities and funding as we strive to be at the very leading edge of the commercialisation of graphene.”

Issue of New Ordinary Shares and Total Voting Rights

Application for admission to trading on AIM of the 1,316,278 New Ordinary Shares being issued pursuant to the Acquisition will be made following completion (“Admission”). The New Ordinary Shares will rank pari passu with the existing Ordinary Shares in issue.

In accordance with the provisions of the Disclosure Guidance and Transparency Rules of the FCA, the Company confirms that, following Admission, its issued share capital will comprise 153,536,200 ordinary shares of 1 pence each. All Ordinary Shares shall have equal voting rights and none of the ordinary shares are held in treasury. The total number of voting rights in the Company immediately following Admission will therefore be 153,536,200.