Touchstone Exploration Inc. (TSX, LON:TXP) has today reported its operating and financial results for the three and nine months ended September 30, 2022. Selected information is outlined below and should be read in conjunction with our September 30, 2022 unaudited interim condensed consolidated financial statements and related Management’s discussion and analysis, both of which will be available under our profile on SEDAR (www.sedar.com) and on our website (www.touchstoneexploration.com). Unless otherwise stated, all financial amounts herein are rounded to thousands of United States dollars.

Third Quarter 2022 Financial and Operational Highlights

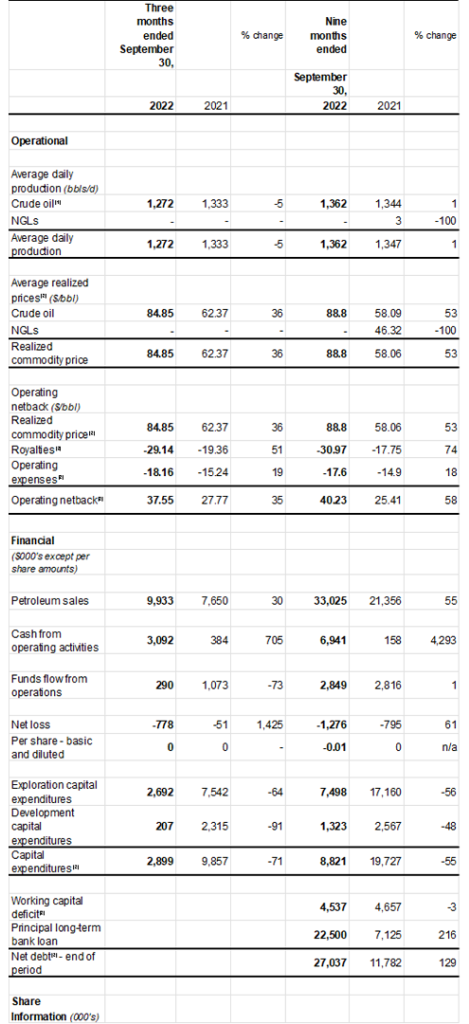

· Produced quarterly average crude oil volumes of 1,272 bbls/d, representing a 10 percent decrease relative to the preceding quarter and a 5 percent decrease from the 1,333 bbls/d produced in the third quarter of 2021, as three key wells were down in the quarter.

· Realized petroleum sales of $9,933,000 from an average crude oil price of $84.85 per barrel compared to $7,650,000 from an average realized price of $62.37 per barrel in the comparative quarter of 2021.

· Generated an operating netback of $37.55 per barrel, a 17 percent decrease from the second quarter of 2022 and a 35 percent increase from $27.77 per barrel in the third quarter of 2021, with the variances primarily attributed to movements in realized crude oil pricing.

· Recognized current income tax expenses of $1,381,000 in the quarter compared to $377,000 in the third quarter of 2021, driven by $1,173,000 in supplemental petroleum tax (“SPT”) expenses based on our average realized oil price exceeding the $75.00 per barrel threshold in the period.

· Our funds flow from operations was $290,000 in the quarter compared to $1,073,000 in the prior year equivalent quarter, and our year to date funds flow from operations increased 1 percent from the same period of 2021.

· Recognized a net loss of $778,000 in the quarter compared to a net loss of $51,000 reported in the same period of 2021, principally driven by higher current income tax expenses.

· Capital investments of $2,899,000 primarily focused on facility and pipeline expenditures related to the Coho-1 natural gas facility and investments directed to the Cascadura natural gas and liquids facility.

· Exited the quarter with cash of $8,732,000, a working capital deficit of $4,537,000 and a $28,500,000 term credit facility balance, resulting in a net debt position of $27,037,000.

Post Period-End Highlights

· Delivered first natural gas from the Coho facility on October 10, 2022, with net October sales over 19 operating days averaging 7.3 MMcf/d (1,212 boe/d).

· In conjunction with initial Coho production, we sold the gathering pipeline from our Coho facility to the third party natural gas facility for net proceeds of $1.2 million.

· Daily crude oil sales averaged 1,304 bbls/d in October 2022 with a realized price of $81.32 per barrel.

· Clearing of the surface location expansion area has been completed at the Cascadura facility site.

Paul Baay, President and Chief Executive Officer, commented:

“The focus of the third quarter was the completion of the Coho natural gas facility which is currently on production, providing us with our first natural gas revenues in October. Our base oil production continues to generate positive operating cash flows while we progress on construction of the Cascadura natural gas and liquids facility. Production from our Cascadura discoveries will mark an inflection point for Touchstone, both from a cash flow and production volume basis. As we plan for our next stage of production growth, we are targeting further expansion of our onshore asset portfolio, through both the Trinidad 2022 onshore bid round and by considering other licence acquisition opportunities to expand our exploration and development acreage in prospective areas in Trinidad.“

Financial and Operating Results Summary

Notes:

(1) References to crude oil production volumes in the above table and elsewhere in this announcement refer to light, medium and heavy crude oil product types as defined in National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities. Our reported crude oil production is a mix of light and medium crude oil and heavy crude oil for which there is not a precise breakdown given our oil sales volumes typically represent blends of more than one type of crude oil.

(2) Non-GAAP financial measure. See “Advisories: Non-GAAP Financial Measures” for further information.

Operational Update

Coho

On October 10, 2022, we achieved first natural gas production from our Coho facility located on the Ortoire block, in which we have an 80 percent operating working interest. In conjunction with initial production, we sold the 2.7-kilometre, 6-inch gathering line tying in the Coho facility to the Baraka natural gas facility to The National Gas Company of Trinidad and Tobago Limited for net proceeds of $1,200,000.

Over 19 operational days in October, the Coho-1 well delivered average net October sales of 7.3 MMcf/d (approximately 1,212 boe/d) on a controlled choke. We will continue to optimize production from the well as conditions stabilize.

Cascadura

On August 16, 2022, we received a Certificate of Environmental Clearance to conduct development operations within the Cascadura area of the Ortoire block from the Trinidad and Tobago Environmental Management Authority. On September 15, 2022, we received approval from the Forestry Division of the Trinidad and Tobago Ministry of Agriculture, Land and Fisheries to commence lease building operations.

Work on the surface location is progressing, as the clearing of the lease expansion area has been completed, and we are currently levelling and preparing the area for pouring of the concrete foundation. Components for the facility are currently being fabricated by local contractors or being imported to Trinidad in completed form. Once the concrete foundation has been completed, delivery of the facility equipment will commence. We are currently targeting completion of the facility by the end of the first quarter of 2023.

Licences and work obligations

Under the terms of our lease operating agreements with Heritage Petroleum Company Limited (“Heritage”), we are required to fulfill minimum work obligations on an annual basis over the specific licence term. With respect to these obligations, we have four development wells and three heavy workover commitments to perform in 2022. Touchstone has notified Heritage its intent to defer the development drilling commitments to 2023.

We have completed all of our minimum work commitment obligations pursuant to our Ortoire block exploration and production licence. In March 2022, we were notified that the Trinidad and Tobago Ministry of Energy and Energy Industries approved an extension to the exploration period of the licence to July 31, 2026. The licence amendment agreement has been approved by the Trinidad and Tobago government and is awaiting formal execution. Upon execution, we will be required to drill three exploration wells prior to the end of the amended term.

Trinidad fiscal regime

In October 2022, the Trinidad and Tobago government proposed an amendment to the current SPT regime, allowing small onshore liquids producers to access the increased $75.00 SPT threshold incentive post 2022. If enacted, this fiscal measure will potentially reduce the SPT expenses applicable to liquids produced from our two Trinidadian subsidiaries in 2023 and beyond. More importantly, we welcome the news that an energy sector review will be performed and are hopeful that additional measures to support the Trinidad energy sector are considered.

Non-GAAP Financial Measures

Certain financial measures in this announcement do not have a standardized meaning as prescribed by International Financial Reporting Standards (“IFRS” or “GAAP”) and therefore are considered non-GAAP financial measures. These financial measures may not be comparable to similar financial measures disclosed by other issuers. Readers are cautioned that any non-GAAP financial measures referred to herein should not be construed as alternatives to, or more meaningful than, measures prescribed by IFRS and they are not meant to enhance the Company’s reported financial performance or position. These are complementary measures that are commonly used in the oil and natural gas industry and by the Company to provide shareholders and potential investors with additional information regarding the Company’s performance, liquidity and ability to generate funds to finance its operations. Below is a description of the non-GAAP financial measures, non-GAAP ratios, capital management measures and supplementary financial measures disclosed herein.

Funds flow from operations

Funds flow from operations is included in the Company’s consolidated statements of cash flows. Touchstone considers funds flow from operations to be a key measure of operating performance as it demonstrates the Company’s ability to generate the funds necessary to finance capital expenditures and repay debt. Management believes that by excluding the temporary impact of changes in non-cash operating working capital, funds flow from operations provides a useful measure of the Company’s ability to generate cash that is not subject to short-term movements in non-cash operating working capital.

Operating netback

The Company uses operating netback as a key performance indicator of field results. The Company considers operating netback to be a key measure as it demonstrates Touchstone’s profitability relative to current commodity prices and assists Management and investors with evaluating operating results on a historical basis. Operating netback is a non-GAAP financial measure calculated by deducting royalties and operating expenses from petroleum sales. Operating netback per barrel is a non-GAAP ratio calculated by dividing the operating netback by crude oil and NGL sales volumes for the period.

Capital expenditures

Capital expenditures is a non-GAAP financial measure that is calculated as the sum of exploration and evaluation asset expenditures and property, plant and equipment expenditures included in the Company’s consolidated statements of cash flows and is most directly comparable to cash flows used in investing activities. Touchstone considers capital expenditures to be a useful measure of its investment in its existing asset base.

Working capital and net debt

Touchstone closely monitors its capital structure with a goal of maintaining a strong financial position to fund current operations and future growth. Working capital and net debt are capital management measures used by Management to steward the Company’s overall debt position and assess overall financial strength. Management monitors working capital and net debt as part of the Company’s capital structure to evaluate its true debt and liquidity position and to manage capital and liquidity risk. Working capital is calculated as current assets minus current liabilities as they appear on the consolidated statements of financial position. Net debt is calculated by summing the Company’s working capital and the principal (undiscounted) long-term amount of senior secured debt.

Supplementary Financial Measures

The following supplementary financial measures are disclosed herein.

Realized commodity price per barrel – is comprised of petroleum sales as determined in accordance with IFRS, divided by the Company’s total production volumes for the period.

Royalties per barrel – is comprised of royalties as determined in accordance with IFRS, divided by the Company’s total production volumes for the period.

Operating expenses per barrel – is comprised of operating expenses as determined in accordance with IFRS, divided by the Company’s total production volumes for the period.

Refer to the “Non-GAAP Financial Measures” advisory section in the Company’s September 30, 2022 Management’s discussion and analysis for reconciliations of non-GAAP financial measures included herein to applicable GAAP measures.