The Top Telecoms Trends for 2024 are predicted by Cerillion plc (LON:CER) in their annual report. The report provides an in-depth analysis of the current state and future directions of the telecom industry.

Firstly, Harold Evans, Senior Equity Analyst, TMT at Singer Capital notes in his most recent research report Cerillion’s very strong positioning and progress in the telecoms sector:

“Cerillion has continued to trade very strongly in FY2023, as customers recognise how investing in modern B/OSS systems (the enterprise software layer that connects networks to end-customers) enables better monetisation and improved operational efficiency of existing network infrastructure. Cerillion has proven this to be true in both expansionary environments and in a down-cycle”. Harold highlights the current strong sector tailwinds in particular for fibre and 5G rollouts. Moreover, he says that in today’s more cost conscious environment, Cerillion’s ‘out-of-the-box’ product offering gives it a significant advantage over the traditional bespoke approaches of its competitors.

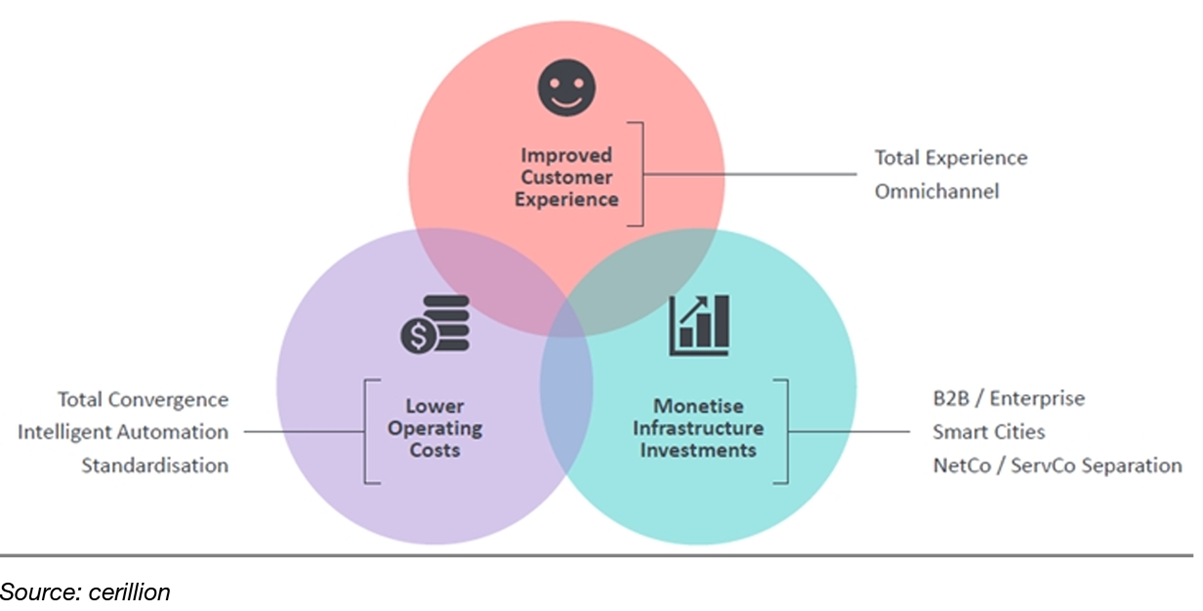

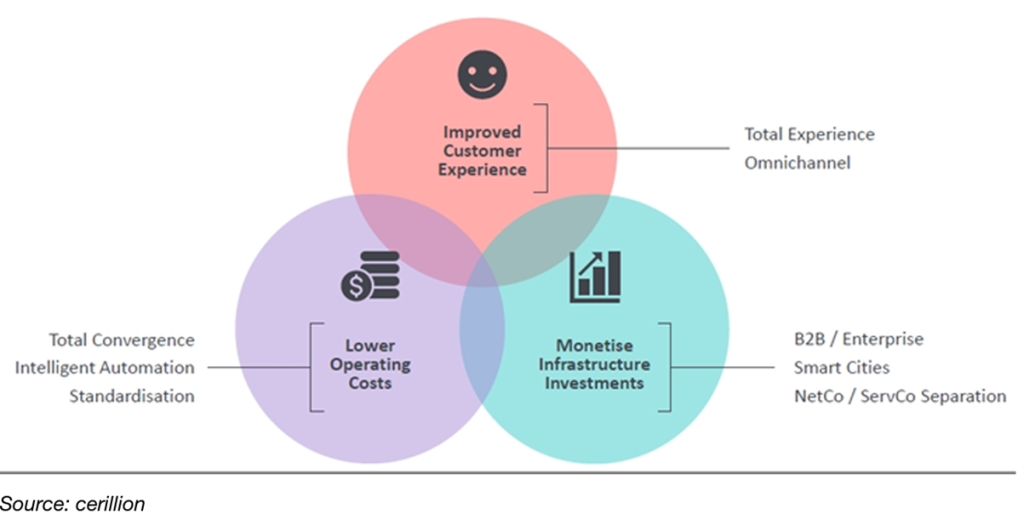

At Cerillion’s Capital Markets Day at the end of November 2023, Liberum noted in their December report that Cerillion highlighted three main drivers of demand for their solutions, encapsulated in the diagram below:

- Improved customer experience: the use of software to drive greater customer and employee satisfaction, including through omnichannel use of CRM and digital channels such as apps and chatbots.

- The monetisation of infrastructure investments, such as Smart Cities, B2B and open access (ServCos, aggregators and NetCos).

- Lower operating costs, including through convergence, which was described as ‘Cerillion’s bread and butter’ of the last 20 years, automation and standardisation. Liberum believes that Cerillion’s recent Tier-1 win represented a significant saving for the client over the legacy products being used from the incumbent provider.

Drivers of telco spend on BSS/OSS – Cerillion

Here’s an overview of the main points from Cerillion’s Top Telecom Trends Report for 2024, chosen by the Cerillion team.

The report acknowledges the ongoing impact of generative AI, economic turbulence, and inflation for the telecom industry in 2024. It poses the question of whether the telecom industry needs a reboot to adjust its course in the mid-2020s. Key trends are as follows:

- Artificial Intelligence (AI): AI is predicted to be a dominant trend, says Brian Coombs, Product Director, with every aspect of telecom operations becoming AI-assisted. The report anticipates advancements in AI models and a decrease in their cost, making them more accessible and integrated into telecom processes.

- 5G Standalone (SA): There is an expected shift towards 5G SA as operators shut down older networks like 3G to free up spectrum. The report suggests that recommitment to 5G, coupled with investments, could drive broader adoption and unlock its potential.

- Simplification: Telecom companies are moving towards simplifying their offerings and operations to improve customer satisfaction and efficiency, utilizing automation to streamline workflows.

- Build vs. Buy: The report discusses the ongoing debate among telecoms regarding whether to build in-house solutions, buy off-the-shelf products or take a hybrid approach. The latter leverages pre-integrated components for standard or mission-critical functionalities and invest in custom development for unique requirements and differentiators. Cerillion notes ‘with many BSS/OSS and SaaS providers catering for a wide range of software needs, buying may be the best course of action for most telcos’.

- De-integration: There is a shift from vertically integrated models to more specialized and flexible services, driven by technological advancements and changing consumer demands.

- Security: Cybersecurity is highlighted as a growing concern, with an increase in security requirements and threats, particularly from state actors. Richard Doughty, Business Development Director, states ‘this is probably the single largest growth item that we’ve seen in requirements over the last five years. These days an RFP will have 300-400 security-related requirements driven by recently recruited CISOs.

- Satellite Communications: The report notes a rising interest in satellite communications, especially for business and rural coverage, with an increase in the number of commercial satellites.

- Predicts consolidation in the alternative network (altnet) market due to unsustainable competition and overbuilding.

- Decrease in Streaming Spend: Observes a decrease in consumer spending on streaming services, impacting telecoms that are entering the content market.

- B2B Self-Service: Digital channels are becoming the main route for B2B sales, with a shift towards omnichannel strategies.

- Private 5G Networks: Highlights the growth of private 5G networks for secure, high-performance business connectivity.

- Product-Based Solutions: Emphasizes the role of product-based solutions in enhancing services and meeting consumer demands with new technologies, leveraging cloud platforms and AI. Tiago Lopes, Product Manager at Cerillion, states “Machine learning and AI-driven solutions are becoming integral components of product-based solutions, providing instant and personalised experiences for customers, or supporting backend actors through predictive maintenance and network optimisation”.