Tirupati Graphite plc (LON:TGR, TGRHF.OTCQX), the specialist flake graphite company and supplier of the critical mineral for the global energy transition, has provided an update on its flake graphite operations and further outlook as it evolves as a globally significant flake graphite producer:

Overview

· H1 FY 2024 performance significantly ahead of the same period in the prior year with production up 160% and revenues up 170%, prior to significant further productivity improvements expected in Q3.

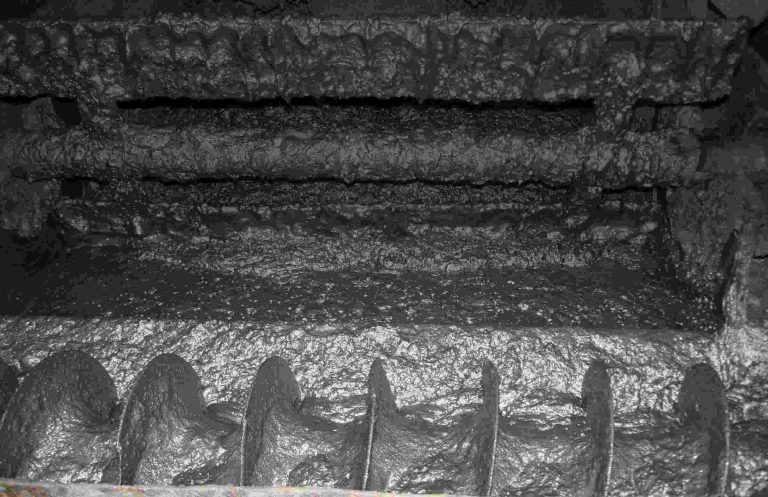

· During the period the Company continued the optimisation of its facilities including:

o Successfully addressing the bottlenecks in the mining and processing activities;

o c.50kms road kms road network with c.20bridgwes and culverts which enabled operations sustained through the recent rainy season without any disruptions; and

o Extensive training of onsite personnel to improve skillsets and enable better implementation of the standard operating practices resulting in more efficient operations.

· As a result, operations at the mine and plant are running uninterrupted at a consistent rate since the start of Q3 FY24.

· Run rates during Q3 FY24 are averaging:

o C,1,800 tons per day ore feed representing 75% of rated ore feed capacity;

o Flake graphite throughput of 40 to 45 tons per day of operations varying primarily with head grade;

o Average head grade across the two projects remains below 3% as against 4.5% used for plant design, average recovery remaining >80%

o Owing to saprolite ore type, which does not allow ideal separation of inter and over burden in bulk mining operations, the Company considers it prudent to assume head grade to remain c.3% and reorient its future plans accordingly;

o Consistent production rate of c.50% of rated capacity is now achieved in spite of the head grade remaining significantly lower than the plant design assumption; and

o The Company is currently engaged in increasing ore feed rate to rated capacity on a consistent basis.

● The key outcomes from the Company’s operational experience over the past six months, when no significant development activities were ongoing, include:

o The advantages envisaged by the Company in processing plant split implemented across its two projects have been effective in meeting operations stabilisation; and

o The limitation in production can be addressed by installing additional preconcentrate units, as output from these are susceptible to be impacted by various factors.

● The Company is considering steps to increase ore feed beyond 2,400 tons per operating day and set up of additional new PCU’s across the two projects to address the limitation of head grade and exploit more of its overall plant capacity:

o The Final Concentrate Unit (“FCU”) at Sahamamy is designed to produce up to 2.4 tons flake graphite concentrate per hour (18,000 tpa); and

o The FCU at Vatomina has a current design capacity of 1.6 tons flake graphite concentrate per hour and can be upgraded to 2.4 tons per hour (18,000 tpa).

To meet its needs for these developments and working capital requirements, TG has initiated engagements to obtain institutional debt finance.

Key operating results for H1 FY23 and Further Overview for H2FY24

| Particulars | Unit | H1 FY24 | H1 FY23 | % Change YoY |

| Quantity Sold & Shipped | MT | 4,785 | 1,691 | +183% |

| Revenue from Sales | £ | £3,146,589 | £1,165,195 | +170% |

| Revenue from Sales | $ | $3,955,690 | $1,441,923 | +174% |

| Price realised | £/MT | 658 | 689 | -4% |

| Price realised | $/MT | 827 | 833 | -1% |

| Quantity Produced | MT | 4,508 | 1,731 | +160% |

● The price realised remained similar to H1 previous year in spite of subdued market prices during the current year period.

● Substantial growth was registered in production, sales and revenues albeit adversely effected by working capital constraints .

● The company continues to engage in alternative sources of finance to bridge the gap of working capital and for further investments.

● Upgrading of the overall ore feed capacities to mitigate the limitations caused due to head grade are targeted to be completed in FY24 subject to financial arrangements availability.

● In H2 FY 24, the Company estimates base case production of 7,500 tons though working towards reaching 10,000 tons, given the limitations of head grade.

Renewable Energy

● The operations of 100 KW hydro power plant have completely stabilised and meet the power requirement of concentrate finishing section at the Sahamamy plant while also illuminating homes of the communities around the project.

● Studies for an additional 500 KW hydro power plant have been completed and once installed, would be sufficient to substantially meet the power requirements of the Sahamamy project.

● In addition to saving emissions and reducing costs, renewable energy initiatives provide an edge to the Company with ESG conscious customers.

● The Company intends to further the development arranging debt funding for the same alongside the targets outlined above.

Shishir Poddar, Tirupati Graphite Executive Chairman, said:

“We continue to improve the Company’s performance despite the graphite markets being subdued in recent months, reflecting confidence in our business strategy. We are confident that this is the time when developing further will provide opportunities for the future. Sailing through the current suppressed markets with growth and addressing the subdued share of the Company are on our priority at this time.”

“We have been constrained by working capital limitations but the debt markets are getting increasingly buoyant for critical mineral development opportunities in Africa. Our advanced stage into production and growing financial outcomes are handy in dealing with interested institutions. As perhaps the only Graphite Company to have had positive operating margins since inception, and with the scale of operations now reaching the point where the Company is expecting a strong financial, we are furthering potential debt engagements with institutional providers.”

“We are confident that our efforts will be recognised by the markets as we continue our progress, and the boost in graphite demand expected to result in a significant supply deficit in the near term will be an eye opener for increased investment interest in this critical mineral.”

“Our projects are globally significant and have industry leading positive operating margins compared with our whole ex-China peer group, even at the early stage of ramping up development and production. As our strategy makes us apparent as a promising player in the evolving graphite ecosystem, we will continue our endeavours in the best interest of the Company and our shareholders.”

“The success of the first hydro power plant is a significant step in our green credentials. Further development of renewable energy will be a priority for us in the forthcoming stages of development.”