Resilience continues to define US equity markets, with the S&P 500 Index and the Dow Industrials Index chalking up their 12th weekly advance in 13. Quite some going. The technology-laden Nasdaq also recorded a modest gain on the week, led by chipmakers Nvidia and Advanced Micro Devices, on expectations that both companies are likely to deliver standout earnings results in the coming weeks. They will need to, given the eye-watering valuation each is commanding, leaving no room for disappointment.

Markets remain hyper-sensitive to data releases concerning the outlook for growth, inflation, and employment. Part of the reason is how quickly asset prices moved during the fourth quarter of 2023 to reflect anticipated interest rate cuts in response to softening language and rhetoric from the US Federal Reserve (‘The Fed’). This past week offered a mixed picture regarding the health of the American economy.

On Tuesday, the New York Manufacturing Index reached its lowest level since early in the pandemic. Conversely, Wednesday’s retail sales figures comfortably exceeded expectations, with October’s online sales growing +1.5% and hitting a new record high in value terms. On Friday, the University of Michigan’s preliminary report of consumer sentiment jumped by the most in 19 years, signalling that inflationary pressures are subsiding.

Meanwhile, the US economy exceeded most economists estimates in the fourth quarter as GDP expanded at a +3.3% annual rate. Although the data is backward looking, robust economic growth has historically provided tailwinds for corporate earnings for the following 6-12 months. This indicates that S&P 500 Index estimates for 2024, currently an average of 5% revenue growth and 12% profit margins, can be achieved.

On the inflation front, the Personal Consumption Expenditures Price Index (PCE), posted a modest +0.2% month-on-month increase in December. Core PCE, a measure that strips out the more volatile components of food and energy and remains the Fed’s preferred gauge for tracking inflation, rose by +2.9% in 2023, far below 2022 levels.

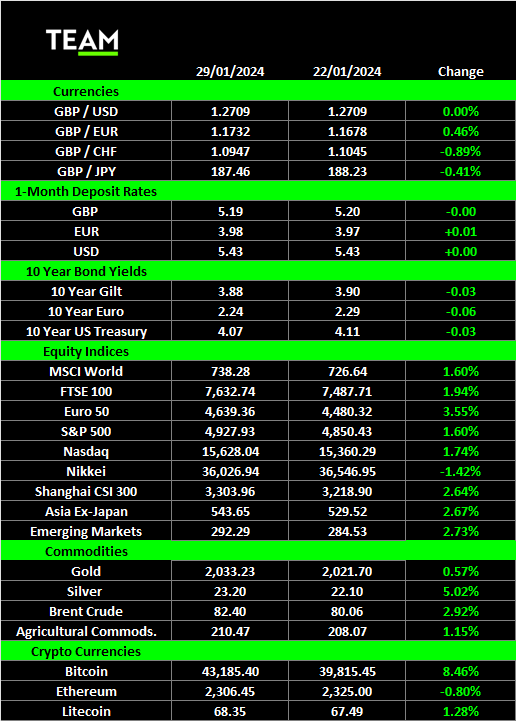

Markets digested the data as showing a US economy, on balance, humming along beautifully with rates where they are. Consequently, expectations for Federal Reserve rate cuts this year were slashed over the week, with markets now pricing only a 13% chance of 7(+) rate cuts in 2024 versus over 60% odds the prior week. Chances of a rate cut in March fell also to less than 50%. The yield on the bellwether 10-year US Treasury Yield rose sharply to a six-week high.

Outside of the US, Japan was the standout performer, with the Nikkei Index climbing to a 34 year high. Japan’s representation in global equity indexes has diminished substantially over the past three decades, but a combination of excitement over corporate governance reform and the enhancement of shareholder returns through a combination of increased dividends and shareholder buybacks is creating interest in the market.

Turning to the commodities sector, US crude oil advanced nearly 7% on the week, touching 2-month price highs. The latest weekly gain comes amidst an escalation in geopolitical conflict after missiles launched by militants killed US troops in Jordan, triggering a ramp up in tension.

Finally, in the cryptocurrency space, Bitcoin fell to around $38,500 before rebounding back above $43,000. Market data is signalling that it is mainly retail investors trading the ETFs, utilising it as a safer way to gain exposure without the self-custody pressure and perceived risks of safe storage. The upcoming Bitcoin halving in April could be the core catalyst for more high-ticket flows into the Bitcoin ETF.

This week brings a U.S. Federal Reserve policy meeting that concludes on Wednesday and a monthly jobs report on Friday. The Fed is widely expected to keep interest rates unchanged; investors will be watching the jobs report closely for any signs of a change in trend. The unemployment rate has remained below 4% for 25 months, a stretch last accomplished in the 1960’s.