TEAM Asset Management’s global weekly market review for week commencing 30th January. TEAM Asset Management is a Jersey-based independent asset management company of AIM-listed parent, TEAM plc (LON:TEAM).

In a noisy week for news, blowout earnings reports from tech giants Amazon and Meta Platforms pushed US blue-chip stocks to new record highs.

Shares in Meta, the parent of social media platforms Facebook and Instagram, jumped more than 20% on Friday after reporting that its revenues increased 25% to $40.1 billion in the fourth quarter, the fastest rate of growth since mid-2021, on the back of a rebound in online add spending.

It’s a first sign that Meta’s “year of efficiency” in 2023 is beginning to pay off. The company laid off more than 20,000 workers and cut overall expenses by 8% to $24 billion, enabling it to ramp up investment into Artificial Intelligence (AI). Meta plans to create AI virtual assistants for every user, content creator and advertiser.

The $197 billion surge in the value of the company on Friday, added $28 billion to the wealth of CEO and co-founder Mark Zuckerberg’s wealth. He will also receive $174 million when Meta pays its first ever dividend of 50 cents per share later this month.

Shares in Amazon rose 8% on Friday in the wake of its fourth quarter earnings announcement. The online retailer enjoyed a bumper holiday season, posting its strongest online sales growth since the start of the pandemic, but it was performance in its cloud computing division AWS which grabbed most of the headlines. Sales at AWS increased 13% to $24.2 billion and CFO Brian Olsavsky predicted the upswing will “continue into 2024”.

Amazon has also reduced costs, including more than 35,000 jobs last year, to improve profits and is similarly investing heavily into AI technologies, including Rufus, a generative AI shopping assistant.

Away from tech, earnings reports were more mixed and shares in McDonald’s fell 4% on Monday on weaker than expected same-store sales in the fourth quarter. Performance in its international markets was a drag, which the fast-food chain blamed on a drop in demand in the Middle East due to the Israel-Hamas conflict and “misinformation”.

Despite the lacklustre fourth quarter performance, management vowed to press on with its plans to rapidly expand its presence in international markets, particularly China. It is due to open around 1,000 restaurants in the country this year, accounting for almost two-thirds of new overseas outlets.

Ryanair revealed its profit after tax fell to €15 million in the final three months of 2023, down from €211 million in the same period a year earlier. Although the Dublin-based budget airline saw a 7% increase in passenger numbers, and a 13% rise in airfares, it was hit by booking sites, including booking.com and Kayak, removing its flights from their searches in December. Fuel costs also increased by 35%.

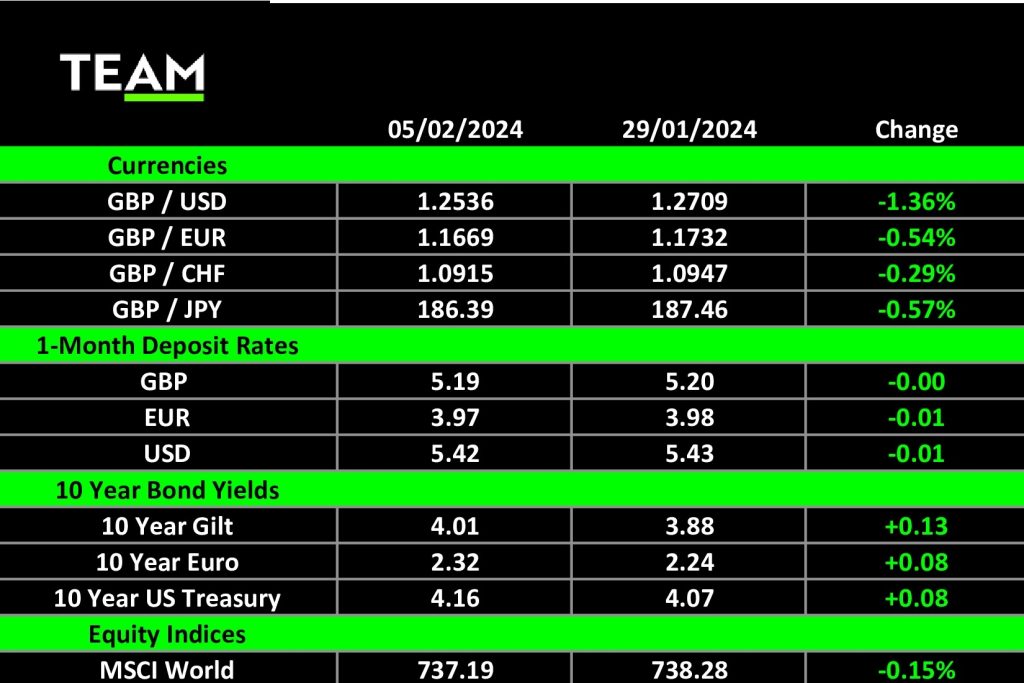

In economic news, central bank policy remained in sharp focus with investors looking for signals on when interest rates will start going lower. Going into the new year, markets had priced in a series of cuts starts as soon as March, but policymakers have sought to temper expectations with economies proving more resilient than expected.

The Federal Reserve repeated this message on Wednesday evening after in left its benchmark interest rates unchanged at a 23-year high of between 5.25% and 5.5% with officials stressing they need “greater confidence” that inflation will fall back to its 2% target rate. According to money market futures, the probability of an interest cut in March has fallen from 80% to 17% since mid-January.

The Bank of England’s Monetary Policy Committee also decided to leave UK interest rates unchanged at 5.25%, although the decision wasn’t unanimous. Two out nine members voted for a 0.25% increase whilst another called for a 0.25% cut.

Annual consumer price inflation (4%) is higher than in other developed economies and futures markets are now pricing in just three quarter point interest rate cuts between now and the end of the year.

TEAM plc (LON:TEAM) is building a new wealth, asset management and complementary financial services group. With a focus on the UK, Crown Dependencies and International Finance Centres, the strategy is to build local businesses of scale around TEAM’s core skill of providing investment management services. Growth will be achieved via targeted and opportunistic acquisitions, through team and individual hires, through collaboration with suitable partners, and organic growth and expansion.