Team Asset Management, a specialist, investment-led active fund manager and part of Team Plc (LON:TEAM), have provided a detailed 4th Quarter 2022 investment review and market outlook for 2023 in this downloadable PDF.

In addition to the Q4 investment review, Craig Farley, Head of Multi Asset Investments at TEAM, looks forward to assess whether 2023 will offer some hope for investors. He provides further insight into TEAM’s asset allocation and positioning.

Craig notes, looking forward, three interlinked risks, and potential catalysts, are likely to determine the future path of asset prices in 2023:

- A Fed pause, or pivot

- The depth of a US recession

- Prospects for a sharp decline in corporate earnings

Recessions portend job losses. Companies including Amazon, Goldman Sachs and Twitter have already revealed plans to lay off thousands of workers. Those gainfully employed are also feeling the pinch from inflation and a surge in borrowing costs. Savings built up during the COVID lockdowns have been exhausted, and spending on discretionary consumer goods and services, including holidays and travel, eating out, entertainment and big-ticket items will be lower in aggregate.

This will negatively impact corporate earnings. Many companies will have less flexibility and pricing power to pass on higher input costs, putting downside pressure on margins. With January upon us, publicly listed companies are about to commence the publication of earnings that will include both the fourth quarter and full-year 2022 results. Forward guidance for the remainder of 2023, and the associated demand and supply trends that companies are experiencing, will be very closely watched.

Scepticism regarding aggregate earnings estimates is prevalent, with many sell-side strategists forecasting a full-year earnings contraction of between -10% and -20%. With that said, we must acknowledge that markets are forward-looking, and the level of wealth destruction experienced last year should already reflect prospects of a recessionary outcome. The blue-chip S&P 500 large-cap index fell -19% in 2022, bringing down its price-to-earnings ratio from 26x at the beginning of 2022 to 18x.

US valuations are certainly cheaper than they have been, albeit not screamingly cheap from a historical perspective.

At the same time, it is difficult to foresee a meaningful recovery in risk appetite and a sustained rally in asset prices until there is more visibility on when central banks will cease hiking rates. Peering back at history, the Federal Reserve’s mid-December 2022 50 basis-point hike should be the last of this cycle. In every previous case where the 2-year US Treasury yield crosses below the Federal Funds Rate (the current scenario), the Fed has paused, or cut, rates in the year following.

However, the issue for investors regarding this current cycle is an emboldened Fed Chairman Powell, who has signalled his desire to keep the pedal to the metal and maintain course in efforts to achieve broad price stability. In addition, the current macro backdrop does not resemble the typical ‘pause’ environment.

Excluding 1978, the headline US Consumer Price Index (CPI) and American average hourly earnings are growing faster than at the time of any other pause, whilst unemployment remains at historical lows. Conversely, economic data including manufacturing data, leading economic indicators, consumer confidence surveys and the yield curve are all at trough levels consistent with a pause. Simply put, the economic data is screaming for a pivot, but the inflation data is not there yet.

Expect the Fed to remain outright hawkish through the first few months of 2023.

Forecasting

Whilst we prefer to shy away from predictions and forecasts for the most part, instead channelling our resources towards delivering resilient investment portfolios for our clients, we are prepared to venture that the sharp dislocation between equity and bond markets in 2022 might be suggestive of a more ominous, tectonic shift in the underlying financial market regime.

Globalisation, open trade, just-in-time supply chains and dependence on one supplier, combined with China’s entry to the WTO and major technological advances, created hugely disinflationary forces over the past thirty years. This was fantastic for bonds, and even better for equities. It is plausible that the COVID pandemic, and the extraordinary government response to it, has bookended this unique period in financial market history.

Balkanization, autocracy, the sourcing and hoarding of commodities amid efforts to secure energy supplies, duplication of supply chains, and a surge in military spending look set to gather pace in the coming months and years ahead.

The consequence is likely to be a more unstable, volatile world, with inflation moving up to a higher plateau, which could translate to a more difficult environment for equities and a need to access alternative revenue streams.

At TEAM, we feel that we are positioned for this new world.

Asset Allocation & Positioning Summary

TEAM enters the 1st quarter of 2023 with much the same message as we welcomed 2022; central bank activity, a critically important earnings season and geopolitical risks all have the capacity to destabilise markets, particularly in the first half of this year.

We continue to advocate a relatively conservative posture in terms of equity risk, with a focus on playing ‘good defence’ rather than blindly chasing riskier pockets of the market.

Equities

With central bank activity likely to keep asset prices rangebound, our preference is to invest in quality companies with strong balance sheets and superior pricing power in their sector that generate consistent, dependable cash flow. Many of these companies are found in traditionally lower beta sectors, such as healthcare and consumer staples. Activity by the Fed that points to a pause or pivot in hikes in due course should provide a rotation opportunity into longer duration, higher growth stocks.

Emerging market (EM) equities have underperformed developed markets for two straight years on the back of the surging US dollar, China’s zero-COVID policy and risk aversion across asset classes. However, the recent depreciation, of the dollar, China’s move towards a full re-opening, and a widening growth and earnings expectations gap over developed markets should provide tailwinds for a better year for EM.

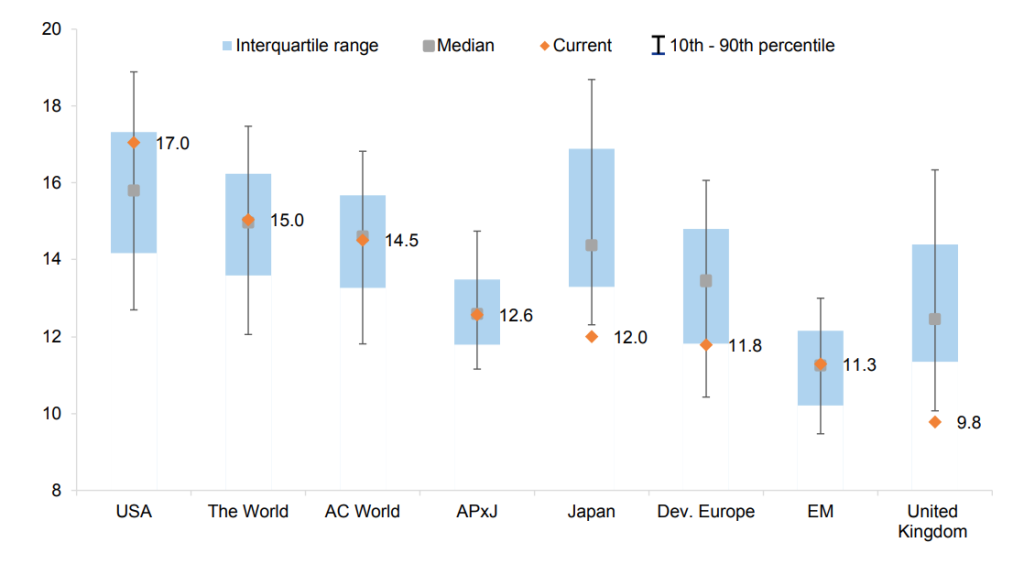

From a regional perspective, we also have healthy exposure to both Japan and the UK which stand out in a valuation context, whilst also providing attractive yields. Shown below are the 12-month forward P/E ratios, with averages based on the prior 20 years:

(Source: FactSet, Goldman Sachs)

Fixed Interest

TARA (There Are Reasonable Alternatives) finally replaced TINA (There Is No Alternative) in 2022.

Having held close to zero conventional bond exposure for 16 months, we stepped in and bought high-quality sovereign and investment grade debt early in the fourth quarter of 2022 given the significant and swift repricing witnessed across the asset class.

We anticipate a rebound in bond markets as economic activity and inflation slow in 2023. Typically, slowing inflation and corporate earnings fuel strong bond returns, particularly at the shorter duration end of the spectrum. Government and investment grade corporate bond yields are the highest they have been in more than a decade and can regain their status as a haven asset in portfolios.

Our preference is to own selective, good quality investment grade corporate bonds which provide an attractive yield above government bonds. The average GBP investment grade corporate bond now yields 5.75% compared to just 2% at the start of last year.

Cash has returned as a viable strategic allocation, offering low-to-mid single digit, risk-free returns that have been unavailable to investors for years. We anticipate holding modest levels of cash throughout the year and get paid as we patiently sit and take advantage of attractive entry points in other assets.

Alternative assets

After years in the wilderness, macro is back, evidenced by selective hedge fund returns in 2022.

Absolute-return strategies that offer uncorrelated return streams, have an established market edge, and act as an effective equity hedge/bond proxy during downdrafts for risk assets are a sensible investment vis-à-vis bonds and equities in our view.

We also like ultra-short term cash funds that can assist in dampening portfolio volatility during periods of heightened stress in markets.

Real assets

Gold, gold miners and energy commodities were mainstays of TEAM’s real asset sleeve in 2023. We enter 2023 positioned for a repeat.

Top of the list of asset classes we will avoid is property. Higher borrowing costs and the squeeze on incomes will have a big impact on affordability and we expect to see a correction in house prices. The outlook for commercial property looks even more challenging. In addition to the headwinds of higher interest rates, a recession will claim many casualties, especially in cyclical sectors such as retail and hospitality, leaving more premises vacant.

TEAM’s flexible investment framework, underpinned by a diverse asset allocation universe and the ability to tactically allocate, has continued to serve our clients well. Our approach has delivered respectable risk-adjusted returns during what can be described as a ‘robust’ stress-test of our portfolios in 2022. We anticipate taking advantage of further opportunities over the coming quarters.

TEAM Asset Management provides discretionary investment management for a global client base that includes private and UHNW individuals, family offices, corporate and personal trusts. TEAM Asset Management is a Jersey-based independent asset management company of AIM-listed parent, TEAM plc (LON: TEAM).