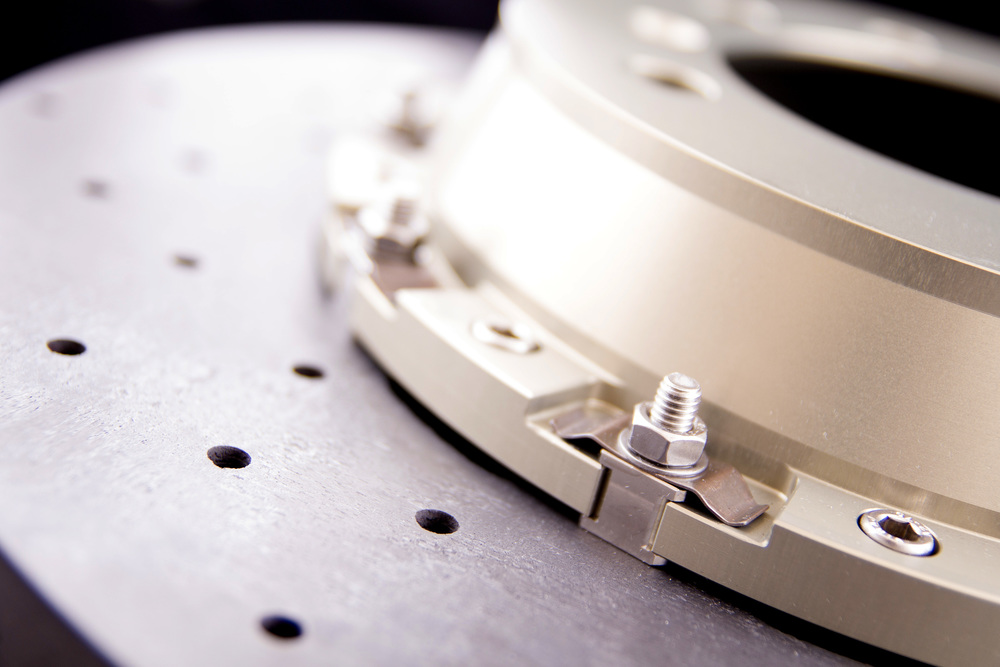

Surface Transforms plc (LON:SCE), manufacturers of carbon fibre reinforced ceramic automotive brake discs, has announced its unaudited interim results for the six months ended 30 June 2024 (“H1-2024”).

Financial highlights:

• Revenue increased 58% to £4.7m (H1-2023: £2.9m)

• Gross profit margin of 56% (H1-2023: 61%) includes a larger proportion of lower margin volumes and increased outsourcing

• Operating loss £7.4m (H1-2023: £5.6m (including exceptional items))

• Loss before tax £7.6m (H1-2023: £5.6m)

• £8.9m equity placing and open offer proceeds (net of costs) completed to support working capital requirements

• Cash as at 30 June 2024 was £5.0m (H1-2023: £4.5m)

All H1-2023 figures have been restated for the revised interpretation of IFRS 15 relating to system integration services and described in detail in the 2023 Annual Report (page 81)

Q3 highlights:

• Andrew Kitchingman appointed as Chair on 16 September 2024

• Expected Q3 revenues of £2.7m improved over Q2 but significantly behind plan

• Yield improved during Q3 but is behind Q3 average yield target of 85%. The improving trend means our run rate in recent weeks is broadly achieving Q3 average target

• Customers remain supportive and encouraged with our improvements in capacity and output

• Yield improvement benefits being partially offset by new consequential downstream process losses, effectively delaying the full benefits of the yield improvements

• Q4 revenues are expected to be approximately £3.5m, 40% down on plan. Expected revenues for the full year of approximately £11m (with no engineering revenues prudently assumed) will be significantly behind current market guidance of £17.5m

• Investments in capacity upgrade projects, improving yield and supporting working capital is consuming our cash headroom

• We are managing cash and working capital carefully and reviewing all funding options to improve our cash flow

CEO statement

2024 continues to be a year with contradictory positions. Real progress on scaling up and delivering growth is being made, however the pace of growth is not as we had anticipated.

Output and revenue have improved post period end, with volumes having more than doubled during Q3 compared to Q2. The key drivers for achieving this growth have been the delivery of capacity upgrade projects and process/equipment refinements which are leading to increases in overall manufacturing yield.

The rate of growth in output and revenue growth is however slower than we had planned. H2 revenues are expected to be circa 40% down on plan, excluding engineering revenues. The key drivers that are resulting in a slower pace of growth are delays to enhancing capacity and also yield improvement projects.

Capacity upgrades are the largest contributor to our gap in output growth and are taking longer to implement than planned, further details provided in the section below.

Manufacturing yield projects are also slowing the pace of output growth but to a much lower degree than capacity upgrades. Yield improvement projects are being delivered, but we are seeing the benefits from these projects being partially offset by consequential downstream process losses. These new consequential losses are easier to resolve and are being addressed. Nonetheless, they have the effect of delaying the benefits of the yield improvements.

Our customers continue to work closely with us. They understand the challenges of building capacity and achieving the required yields and are encouraged by what they are observing with the improving outputs and capacity. They are supportive as we work to improve the pace of growth further.

No engineering revenue (estimated value £1.7m) has been recognised to date, due to ongoing performance obligation assessments under IFRS 15. While customer development work continues to be delivered and invoiced as milestones are reached, revenue recognition is currently under review. We are actively collaborating with our advisors and auditors to determine when the necessary criteria for revenue recognition will be met.

Cash at June 30, 2024, stood at £5.0m however current levels at the end of Q3 are significantly reduced. Operational and working capital continues to consume cash as we deliver new capacity and increased output, but with a slower pace of revenue growth than we anticipated.

The Company is actively implementing strategies to accelerate the release of cash tied up in working capital, including ongoing discussions with key customers and suppliers to optimise payment terms.

New capacity update

Specific upgrade projects to our existing £20m revenue capacity manufacturing equipment are enhancing our current capacity. Our £50m manufacturing revenue programme has also introduced additional capacity across all but one process and is providing much needed resilience, by resolving a key risk from single points of failure. The remaining furnace, which is a capacity constraint, was planned for installation in Q4 2024 but has now moved to a mid-2025 installation.

We continue to draw down from our £13m ERDF loan and are progressing with the investment in the £75m manufacturing revenue capacity programme. First equipment is expected on site during 2025 and will continue throughout 2025 and into 2026.

Financial review

Revenue increased by 58% to £4.7m in the first half of 2024, primarily driven by growth in OEM customer sales. Gross profit margin declined to 56% due to increased outsourcing costs and product mix. There is no revenue recognised for work carried out on system integration services in the period.

Operating loss widened to £7.4m, primarily reflecting increased R&D spending at £7.2m in H1-2024 (£4.1m in H1-2023) to enhance manufacturing processes and improve yield. We are making progress in expanding production capacity to meet customer demand.

The Company has determined that it will not capitalise intangible assets at the half-year end and this decision is based on an ongoing assessment of the criteria set out in International Accounting Standard 38 “Intangible Assets” (IAS 38).

This has resulted in higher development expenses being recognised in the income statement leading to a larger loss for the period due to the increased expense burden. However, it is important to note that this decision does not reflect a change in the Company’s long-term strategy and the potential value that will be generated by our R&D activities. Surface Transforms will continue to evaluate the appropriateness of capitalisation in accordance with IAS 38 in the full year financial statements.

Cash at June 30, 2024, stood at £5.0m, and we are implementing measures to improve working capital, particularly in terms of accelerating collection of trade receivables.

We continue with R&D to optimise our manufacturing operations, improve yield and reduce cost per disc. We believe these initiatives will position us for sustainable growth and profitability in the future. Planned capital expenditure of £3.4m occurred in the period, primarily aimed at delivering capacity. £3.4m of the ERDF facility which completed in December 2023, has been drawn down to support our capital investment programme.

Summary and outlook

While we are delivering new highs in terms of output and revenues in 2024, the pace of growth is significantly behind plan. Revenues in Q3 are expected to be significantly down on plan and we have revised our output and revenue plans for Q4 materially downwards. As a result, revenues for the full year are now expected to be circa £11m which is significantly lower than current market expectations of £17.5m.

The strategic objectives of building capacity and improving yield are being overcome, providing a stronger position to work from going forward; however, the delays in pace of growth are proving very difficult to anticipate correctly. Demand for our product remains strong and our customers continue to be supportive.

The impact of delays to the pace of growth has led to operational inefficiencies and cash constraints. We continue to manage cash flows carefully and are reviewing all available funding options to enhance our cash flow going forward.

Finally, I want to take the opportunity to thank employees for their dedication and commitment during another challenging period and to thank all shareholders for their support.

Board and Management

We were pleased to announce the appointment of Andrew Kitchingman as Non-Executive Chair, who brings a wealth of experience in corporate finance and public company governance. We are confident that his leadership will guide Surface Transforms towards continued success.

We would also like to express our sincere gratitude to David Bundred for his invaluable leadership as Chair over the past 12 years. Under David’s leadership, the Company successfully navigated the development of our technology and secured significant contracts for its innovative carbon ceramic brake discs. His strategic vision and unwavering commitment to excellence were instrumental in positioning the Company as a key supplier in this rapidly growing industry. His dedication and expertise have left a lasting legacy.

A well-prepared leadership team can better navigate challenges and uncertainties. The board have approved an executive team leadership development programme, with the programme starting in Q4 and continuing into H1 2025. The goal is to enable the senior management team to scale operations efficiently and reliably by empowering our leaders with the skills to navigate challenges and drive continuous improvement.

Andrew Kitchingman, Surface Transforms Chair, commented:

“These remain difficult times for the Company as it works to grow output and revenue. There remain numerous challenges and, following a period of further underperformance expected to continue through Q4, the Company will miss current market expectations by a significant margin. Cash is constrained at present, and we are working to evaluate all available options to improve this.”