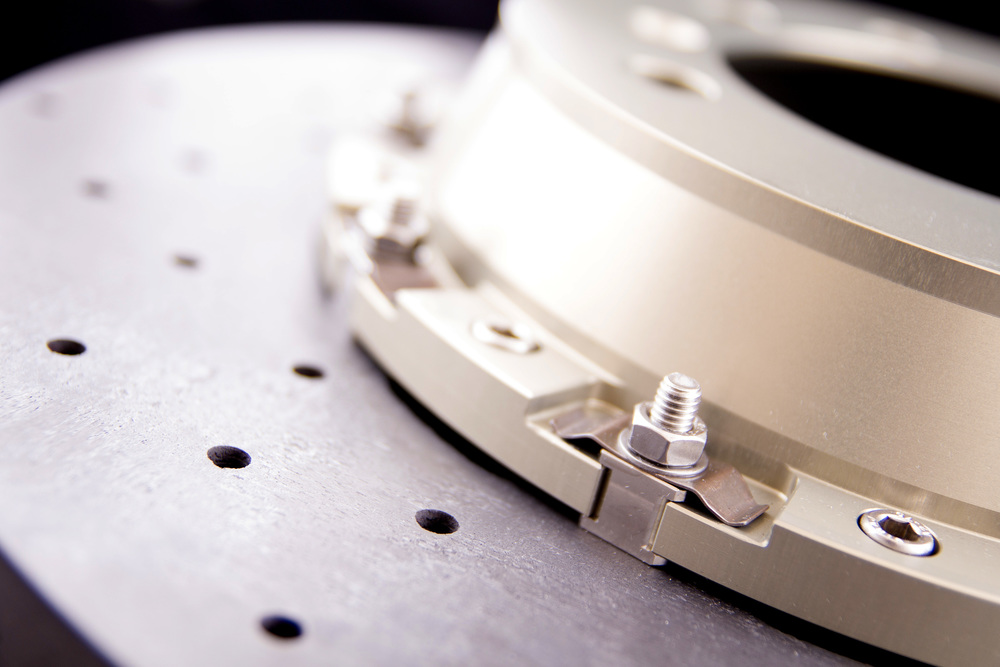

Surface Transforms plc (LON:SCE), manufacturers of carbon fibre reinforced ceramic automotive brake discs has provided an update on trading for the year ended 31 December 2020, OEM pipeline, operations and increased Knowsley footprint revenue capacity.

Trading update

In line with the Company’s trading statement issued on 14 September 2020, revenue for the year to 31 December 2020 was £2.0m (2019: £1.9m). Cash as at 31 December 2020 was £1.1m (2019: £0.8m) and to this cash sum can be added an estimated £0.6m tax credit, expected to be received in July 2021. Other interest bearing loans and asset finance totalled £0.5m (2019: £0.6m).

The Company has maintained operations throughout the Covid-19 pandemic and whilst all OEM customers have been impacted, the Company has continued to win new contracts in each of its OEM, near OEM and retrofit segments.

Progress with OEM customers

The Company continues to work both with a number of potential new customers and, increasingly importantly, with existing customers making use of existing product approvals, for nomination on their future models (known in the automotive industry as “carry over”). All the tests, and carry-over discussions are proceeding to plan and the Board remain confident of being nominated on further vehicles in the near future.

Operations update

The new machines in OEM Production Cell One are being commissioned in line with the Company’s installation plan to be ready for series volume production in Q2 2021. Recruitment is also continuing and the Company is pleased to announce that it has appointed its first Human Resources Executive – Rebecca Hooper, reporting to the Chief Executive, Kevin Johnson. Rebecca has worked at both large and small companies, including Raytheon and Unilever and in both traditional engineering and newer digital companies. She brings considerable experience in what has previously been a gap in the management team.

Increased Knowsley footprint revenue capacity

Revenue capacity of OEM Production Cell One plus the existing small volume production cell) is circa £20m. This capacity will be available in Q2 2021. The Company has contracts stretching into 2024 and 2025 and thus has an improved view of expected average selling prices (ASP). Even allowing for the “cost down” and “volume break” clauses in our contracts, these ASPs are higher than originally anticipated. Accordingly the Board has now concluded that, primarily for reasons of the ASP, the total potential revenue of the five OEM cells in Knowsley is likely to be circa £75m per annum and not the previously stated £50m with no change to the anticipated cost of building each cell.

Outlook

David Bundred (Surface Transforms Chairman) commented: “2020 has been transformational for the Company with new vehicle nominations and a significant increase in contracted pipeline revenues. Moreover testing and negotiations with both existing and new OEM clients alike are progressing well and we remain confident of being nominated on further vehicles in the near future. We continue to expect to see the impact of this success in the 2021 results and beyond.”

Preliminary Results

The Company expects to report its preliminary results for the year ended 31 December 2020 in May 2021.