Surface Transforms (LON:SCE) has announced its preliminary results for the year ended 31 December 2022.

Financial highlights

· Revenues improved 116% to £5.1m (2021: £2.4m)

· Gross margin was 60% (2021: 65%)

· Net research costs of £5.6m (2021: £3.4m) after capitalising £1.6m (Year to 31 December 2021 £0.3m) of gross expenditure. Research costs also partially offset by accrued R&D tax credit of £1.3m (2021: £0.7m)

· Loss after taxation was £4.8m (2021: £4.0m)

· Loss per share of 2.34p (2021: 2.08p)

· Cash used in operating activities increased by £2.8m to £6.5m (2020: £3.7m)

· Cash at 31 December 2022 was £14.9m (2021(restated): £10m) whilst capital expenditure in the year was £8.3m (2021: £3.9m)

Customer and Operational highlights

· Increased order book by £175m (lifetime value) to £290m at end of the year

· Added a new customer – US based OEM 9 – to the growing portfolio of customers

· Demonstrated the ability to win “carry over” business with existing customers OEM 10 and OEM 8

· With the £100m OEM 10 contract award took a further step towards reducing customer concentration risks

· Post balance sheet, resolved a long-standing technical problem that impacted P&L in both Q4 2022 and Q1 2023. The last major impediment to meeting ongoing daily customer requirements

· Progressively implemented new production capacity to reach phase 1 target of £20m p.a sales in the year and ordered equipment (delivery Q2 2023) to reach phase 2 target of £50m p.a sales, operational by September 2023

Board Changes

· During the year the Company welcomed Ian Cleminson to the board as a new Non-Executive Director. Ian has taken on the role of chair of the audit committee, effective from October 2022.

· Matthew Taylor has stepped down as chair of the audit committee but remains as senior independent non-executive director.

· David Bundred (Chairman) resigned from the audit committee in November 2022 ensuring it is now composed solely of wholly independent directors.

· After 13 years on the Board, Richard Gledhill retired with effect from 31 October 2022

· In December Michael Cunningham announced his resignation and will step down from the board on 31 May 2023

Posting of Annual Report and Notice of Annual General Meeting:

The Company’s Annual Report and Accounts for the year ended 31 December 2022, together with a notice convening the Company’s Annual General Meeting (“AGM”) are expected to be posted to shareholders in early May 2023 from which time they will also be available on the Company’s website www.surfacetransforms.com.

The AGM will be held at the offices of finnCap at 1 Bartholomew Close, London, EC1A 7BL on Tuesday 27 June at 10.00 a.m.

Chairman’s Statement

“A transitional year that leaves us ideally placed for the future”

The twelve months to December 2022 was one of exceptional commercial success catapulting the Company from being regarded as a start-up to becoming a serious participant in the plans of mainstream automotive companies. The Company won £175m (lifetime value) of new orders in the year taking the total order book to £290m (lifetime value). The wins demonstrated both the Company’s ability to deepen relationships with existing customers (carry over contracts) as well as developing new long-term relationships as we added a £100m lifetime value contract award to our relationship with OEM 10, thereby alleviating customer concentration risks

Our operational performance did not match this commercial progress, albeit resolved post balance sheet in Q1 2023. Our primary launch customer, OEM 8, had its own challenges and delayed its start of production (SOP) by six months. In addition, the Company had several individual but unrelated technical problems in its own production – explained in more detail below – which further contributed, albeit less significantly to the 2022 sales being behind our expectations. This technical problem persisted into Q1 2023 but is now resolved.

The Company continues to provide capacity for its increasing contracted demand. During the year, the Company completed its plan to increase capacity to support sales of £20m p.a. In 2021, the Company raised £19m (net of expenses) to increase this current £20m p.a. capacity to £50m p.a. sales. This equipment was specified and ordered during 2022, is being delivered in Q2 2023 and will be operational in Q3 2023.

Additionally, in September 2022 the board concluded that even this increase in capacity was insufficient to meet the expected mid-decade sales forecast and raised a further £17m (net of expenses) to ultimately lift capacity to £150m p.a. in two phases, initially to £75m p.a. sales on the existing site, and then, by building a second factory, raising sales capacity by 2026 to £150m p.a. To this end, post balance sheet, the Company agreed heads of terms on a new building adjacent to its current site.

Throughout the year Environmental, Social and Governance (ESG) concerns were at the forefront of our thinking. We are proud that our products assist in reducing both engine and brake dust particle emissions. To ensure that we do not lose these environmental credentials through the production process our actions have included buying new equipment with power consumption requirements that will materially reduce our per unit carbon footprint. Our work on the social aspect of the ESG agenda continues our objective of being “employer of choice” in Knowsley was strengthened again this year. Additionally, we have also strengthened our educational activity both within the company and the community. Within the factory 14% of our workforce is in some form of formal, externally approved, apprenticeship (including 10 graduate apprentices). Within the community we have partnered with two local schools in Knowsley and Liverpool. In respect to the third element of ESG our governance improvement included increasing the number of independent directors in addition to changing membership and chairmanship of the audit committee.

Progress on Customers:

For the customer’s own reasons we must seek their permission to use their true names in any written or social media external communications and therefore we use nomenclatures OEM 1 to (currently) 10 whenever we describe them.

The Strategic Report, below, explains how our products are now at the centre of the changes taking place in the automotive industry. In summary the industry is currently undergoing radical and fundamental change. The changes began with the increasing focus on emissions, initially engine emissions, driving the growth in Electric Vehicles (EV) but now also with major focus on brake dust emission; the use of carbon ceramic (CC) disks halves brake dust emissions. CC discs are a key part of the industry response to these changes.

It is the combination of our innovative technology with these underlying forces that is the strategic foundation underpinning our commercial success.

Building on this strong strategic foundation, our commercial priority over the past few years has been to deepen our presence with existing customers, with a particular focus on winning carry over contracts with these existing customers. This objective has been achieved with all key customers having now awarded carryover contracts, the ultimate accolade of market acceptance.

At the same time we have set ourselves the objective of establishing a balanced portfolio of customers – mid-decade – with four roughly equal pillars OEMs 5, 8 and 10 being the three stand-alone customer legs with the fourth being the combined total of our other mainly specialist car customers. We already have firm awards that will provide sales in excess of £20m p.a, each with OEM 8 and 10 by mid-decade. Our contract wins to date with OEM 5 are currently less than that level but there is more opportunity in the pipeline with that customer.

During the strains of our technical problems we were pleased that our customers understood the issues the Company was facing, noted the progress and, throughout the period continued discussions on future programmes. Our order book (£290m) is unchanged, and our prospective contract pipeline (£393m) has grown in the year.

With our technical problems now resolved and new capacity in place, we can now also return to the task of widening our customer base beyond OEM 10. This will not be immediately visible to shareholders as the work is necessarily commercially confidential and it takes many years from opening discussions to SOP; But shareholders can be comforted both that the pipeline contracts discussions are still very active and that this next phase of seeking additional customers is underway, thereby maintaining our explosive sales growth.

Progress on Operations:

We have demand that has increased from £2m sales in 2020 to approximately £20m in 2023 and £30m in 2024. Installing the capacity to meet this demand and troubleshooting the technical problems incurred in the initial volume production runs was the prime focus of 2022.

· Technical problems: Almost all our, more than 20, manufacturing sub-processes have had scale-up problems, albeit with most of these individual, separate, problems being resolved in a few weeks or less. However there has been one core problem that has taken several months to satisfactorily resolve, made worse by supply chain issues for furnace insulation. This issue particularly impacted financial performance in Q4 2022 and Q1 2023. In January 2023 we informed shareholders that it had impacted the end of 2022 (by about £2m sales in 2022), we had made improvements but said, at the time that we wished to see several weeks of consistent output before being comfortable to confirm that the problem had been resolved. This caution was prescient, as the problem continued into Q1.

However, detailed, quite fundamental process changes were made post balance sheet date in January and February, resulting in continuous successful manufacture since that time; we are confident that this problem has finally been resolved. This was the last major impediment to meeting ongoing daily customer requirements.

· Capacity: However, the fact that these technical problems are in the public domain also reflects the reality that we have been capacity constrained. Arguably, technical problems are an ever-present factor in high complexity manufacturing. We can reduce them through our work on process variability and planned maintenance, but never eliminate them. Therefore, process resilience through capacity is of equal importance to fixing the problem as they arise. Technical problems only impact the customer and shareholder perspective when we don’t have spare capacity to catch up after problems are resolved. Delivering the additional capacity is therefore an equal partner to fixing the technical problems.

The timetable for delivering the new capacity has been described above. The key is that the two key bottleneck relief furnaces are being delivered in Q2 and will be operational by Q3. We should then have capacity of over £4m per month against demand of £2m to £3m per month in the second half of the year.

This will certainly make a significant difference to our H2 resilience and thus confidence in our revised production projections.

· Gas and Energy Cost: As a result of negotiating fixed price energy contracts pre-Ukraine war the Company was protected from the energy price surge throughout 2022 with gas prices protected until April 2023. Post balance sheet Q1 2023 has seen a reduction in energy pricing such that energy pricing is now back to planned levels. Accordingly, the Company is in the process of fixing new agreements that will secure this pricing level for the next two years.

Shareholders will recall that we also reported during the Q4 2022 fund raising that our new furnaces would significantly reduce energy costs per disc. This is still the expectation but is regarded as a contingency not yet in the forecast.

· Operational Management: The Board has been reviewing the managerial capacity of our current operational management: Accordingly, we have decided to introduce a more strategic level of management above the current team with the appointment of a Chief Operating Officer reporting to the Chief Executive to take a broader view of the operational processes and the three operational responsibilities. Given the immediacy of the task we have initially appointed an interim executive to assist the board, who has been working with us since January 2023; in parallel we have been undertaking a search for a permanent appointment that is almost complete.

· Recruitment: the pace of growth has inevitably led to significant recruitment needs, 47 new starters in 2022 continuing at that rate into 2023. Whilst there are always (often national) skill shortages in specific areas, we have largely been able to find the skills we want, particularly as we assume that the unique nature of our processes often requires further training by the Company. For example, even the best metal machinists need increased skills to machine carbon ceramic, the Company provides that training.

· Cost reduction: The unit cost will further reduce as the phase 2 (£50m p.a.) capacity comes on stream post balance sheet in 2023. But we will not stop there. The Company regards reduction in unit disc cost as a continuous process and is already well advanced on further unit cost reduction plans.

Progress on Environment Social and Governance:

· Environment: The Company continues to prioritise the actions required to further extend our ESG investment credentials. Our products reduce engine carbon emissions on internal combustion engine (ICE) vehicles through reduced vehicle weight; a benefit that is needed even more on heavier, faster accelerating electric vehicles and thus our technology is particularly assisting the transition to electric vehicles. Our products also reduce emissions by significantly extending product life, contrasted with its iron alternative. Additionally, carbon ceramic brake discs significantly reduce brake pad particles being released into the atmosphere and watercourses, an area that is increasingly being identified for legislation. Finally, our end-of-life disc product acts as a carbon sink as the aluminium bell can be recycled and carbon and silicon are almost the only remaining elements at the end of the product’s life.

Our task however is to ensure that these environmental benefits are not lost in the manufacturing process, including our supply chain through excessive energy usage. Our environmental focus is therefore in this area. The Company has focussed on specifying and ordering furnaces which will significantly reduce the amount of energy required to manufacture our product. Specifically new furnaces have been ordered which should reduce consumption of electricity to around half that previously used in the older furnaces. Additionally, the Company is actively planning re-use of its waste streams through a combined Heat and Power Plant; further reducing our carbon footprint.

· Social: We believe that our prime social goal is the provision of well-paid, safe employment in one of the most disadvantaged areas in the country. There are few companies expanding employment on the Knowsley Industrial Park at the rate of Surface Transforms. The Company has adopted the policy of meeting the real living wage as set by the Living Wage Foundation for all employees. As part of our employee welfare concerns, we are proud that we are on target, in April 2023, to reach the anniversary of our fourth year without a reportable accident. Given the hazardous nature of our furnace processes and cutting machinery this is no mean achievement.

We have also increased our commitment to education both within the factory and the community. Within Surface Transforms 24% of our employees are graduates or above, thus training and education is key to future success, as a result 14% of our workforce are in formal apprenticeships including a graduate apprentice scheme that was started in the year. We are taking the view that our technology is so unique we need to grow our own people to meet our long-term personnel needs.

Within the community we have partnered with two local schools one in Knowsley and the other in Liverpool. Our partnership with the Knowsley school who do not have a sixth form (the norm in Knowsley) is aimed at encouraging younger teenagers, particularly girls, to see science as being fun and in the real world. Many of these children have little aspiration to or even understanding of why you should study STEM subjects. Success will be measured by an increase in pupils selecting STEM subjects for GCSE and then going onto further education in those subjects outside the borough. The Liverpool school is, by contrast, a high achieving UTC specialising in STEM subjects and our partnership includes internships, work experience, visits and some modest sponsorship. The partnership is already seeing success with some of their A-level students having applied for graduate apprenticeships with the Company. We also see other internal benefits as our own employees greatly enjoy working with both partnership schools.

The Company also regards its separate positive engagement with the smaller “retail” investors as being part of its social goals. To this end the Company offers research notes aimed at the smaller investor, site visit Capital Market days for non-institutional investors, and webinars where non-institutions can hear management presentations and quiz senior executives.

The Company maintains its certifications in ISO 45001 and ISO 27001.

· Governance: The Company adheres to the QCA corporate governance code. Following the findings of the last self-assessment carried out by the Company which identified independence as an issue, a further independent non-executive director has been appointed and the Company believes itself to be fully compliant with the code. The Company also strengthened the independence and accounting technical capability of the audit committee. The Board conducts an internal review of its effectiveness using a questionnaire. The survey was last conducted in Q1 2021. Accordingly, questionnaires have been completed in Q1 2023 and the Board will meet in April 2023 to discuss the feedback.

Summary:

The management team are justifiably proud of their commercial achievements, in 2022. However, the year saw several technical problems, both externally and internally. Externally our major customer OEM 8 delayed their SOP causing a major shortfall in sales outcome. Internally almost all our processes had challenges as we scaled tenfold from our £2m p.a. base. Most were dealt with quickly, but one particular problem persisted for many months.

Nonetheless, albeit six months late our customer announced SOP at the end of the year, and we believe that we finally fixed our technical problem in February 2023. We can now deliver the large order book.

Achieving forecast revenue and profitability targets in 2023 remains our key goals. We will achieve ongoing monthly profitability during Q2 of 2023, however we do not yet know the extent to which we can catch up the first quarter shortfall and thus the overall result for the year.

Strategic Report

Operational Review and principal activity

Our strategic objective is to be a profitable, series production supplier of carbon ceramic brake discs to the large volume OEM automotive market. To achieve this, we work directly with OEMs and closely with Tier One suppliers to meet the customers’ requirements on product, price, quality, capacity and security of supply.

In addition, we supply carbon ceramic brake discs to small volume vehicle manufacturing and retrofit high performance kits for performance cars.

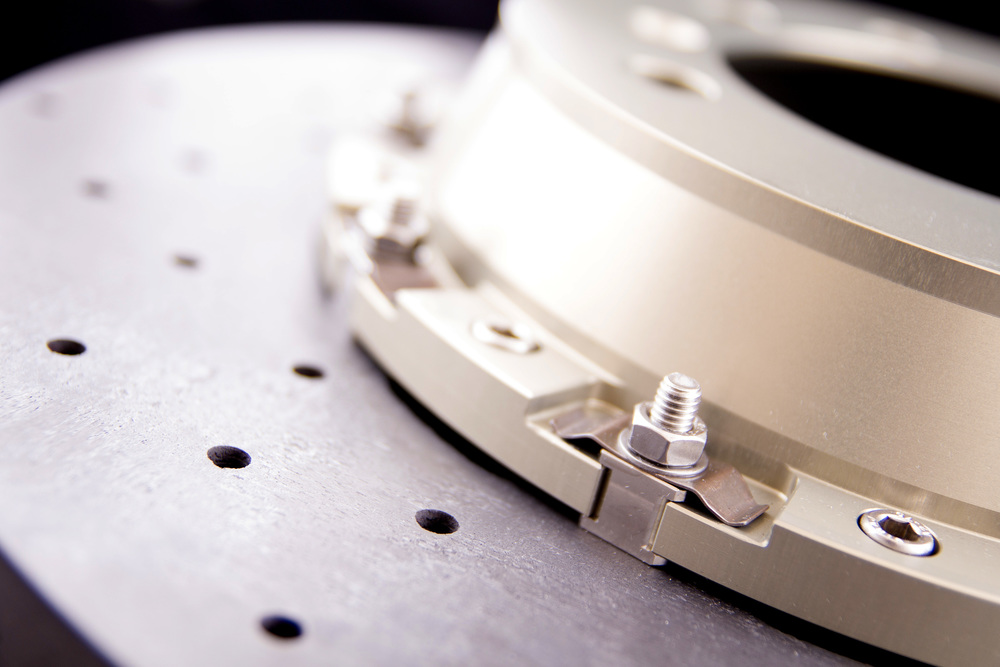

The Company utilises its proprietary next generation carbon ceramic technology to create lightweight brake discs for high‐performance road and track applications for both internal combustion engine and electric vehicles. While competitor carbon‐ceramic brake discs use discontinuous chopped carbon fibre, Surface Transforms interweaves continuous carbon fibre to form a 3D matrix, producing a stronger and more durable product with improved heat conductivity compared to competitor products. This reduces the brake system operating temperature, resulting in lighter and longer life components with superior brake performance. These benefits are in addition to the benefits of all carbon‐ceramic brake discs vs. iron brake discs: weight savings of up to 70%, extending product and service life, consistent performance, environmentally friendly through reducing both CO2 emissions and brake pad dust, reducing the total cost of ownership, corrosion free and are highly desirable.

· Support our customers across key geographical markets, achieving contract awards to multiple OEMs with products for multiple models with multiyear supply agreements

· Engineer market leading carbon ceramic brake products, which deliver best in class performance for the luxury and performance brakes markets, which we estimate to be a circa £2 billion market

· Build manufacturing capacity revenue of circa £50m p.a., with the footprint available to reach circa £75m capacity revenue p.a. for which we raised £17m in Q4 2022

· Operate lean manufacturing processes, enabling the Company to produce products that are competitively priced with good margins

· Be a ‘Quality Company’ with a culture that lives and breathes its world-class business processes and management systems. We surpass the automotive quality standards (IATF16949), and thus, have the confidence that we are able to pass all customer audits, as evidenced by recent contract wins

· Protect the environment by minimising the environmental impacts arising from our activities, products and services and be committed to continuous improvement of our environmental performance

· Support and manage our supply chain which can deliver to our customers’ requirements on product, price, quality, capacity and sustainability of supply

Succeeding in these activities generates highly desirable, environmentally friendly, world leading quality products, which are price competitive and profitable to the business.

Furthermore, our products and processes are protected by a high level of intellectual property through deep, complex process knowhow and a product which cannot be reverse engineered.

Delivering our objectives:

Automotive OEMs

The continued progress on building capacity for our game changing contracts provides a clear path to achieving its strategic objective of profitability and cash generation. Coupled with this the continued success of winning additional ‘carry over’ contracts and new major OEM customer contracts has significantly strengthened the revenue growth curve for the Company over the coming years.

The Company also continues its successful engineering development objectives in anticipation of further contract awards for both ‘carry over’ customer contracts and new customer contracts during 2022 and beyond.

The Company’s internal activities are therefore focused on supporting series supply for these contracts and on Companywide continuous improvement objectives across all functions.

· Health and Safety – maintain and improve our health and safety record. We have an excellent health and safety record which we will continue to maintain.

· Quality – continue to have excellent in-service quality. Improving quality is a never-ending process, therefore our primarily focus is on continuous improvement and reducing the internal cost of quality.

· Environmental – protect and improve our environment. Our products make a fantastic contribution to reducing CO2 emissions in use, significantly reducing brake dust pollution, and over the lifetime of the car reducing the carbon footprint. Our internal goals are aimed on reducing our manufacturing environmental footprint.

· Customer supply performance – maintaining our performance as a good supplier. As we enter series supply with our OEM customers a key objective is to deliver good supplier performance.

· Capacity improvements – ensure we have the manufacturing capacity and manufacturing resilience in line with our customer requirements. We have a manufacturing strategy which will deliver £50m of capacity revenue during 2022 and 2023.

· Productivity and cost reduction – perpetual improvement of our productivity through cost reduction. We have halved the cost to manufacture over the last ten years and have a programme to repeat this success going forward to maintain good margins and support our customers to achieve their pricing goals.

· Supply chain performance – Improve the sustainability and productivity of our supply chain, including but not limited to, our ethical standards. As with any manufacturing process we are only as good as our supply chain. We have improvement plans with our existing suppliers and are adding new suppliers to our approved supplier list.

Section 172 statement

In accordance with the requirements of section 172 of the Companies Act. The board believes that during the year it has acted in a way that they consider, in good faith, would most likely lead to the success of the Company in the long term and to the benefit of all stakeholder groups. During the year, Surface Transforms successfully raised funds to support the Company’s current and future growth strategy and to meet contracted and expected orders.

The board believes that governance of Surface Transforms is best achieved by delegation of its authority of the executive management of Surface Transforms to the CEO. The board regularly monitors the delegation of authority, updating regularly whilst retaining responsibility.

The board has identified 6 key stakeholder groups and engages with them to foster strong relations and to act fairly between them:

· Customers: Surface Transforms engages with customers throughout the development process, building strong collaborative environments for long term mutual benefit. This is highlighted by carry over contract awards from existing customers and meets the Company’s strategic aims of growing our customer base;

· Employees: Our employees are critical to the success of Surface Transforms, and we engage through an environment of openness and inclusivity and trying to create a sense of ownership. All employees receive some share options after a qualifying period of employment and the Company is committed to paying more than the living wage to all employees. The Company has recently commenced employee surveys to monitor employee sentiment and is placing a higher focus on employee recruitment and retention. In addition, with the current stresses on the workforce the Company has made available counselling services for employees. These actions align with the Company’s aim to be an employer of choice within the Knowsley area;

· Government and regulators: The Company is committed to engaging with all relevant government organisations and ensuring adherence to all statutory requirements. The Company has a strong working relationship with the environmental agency and regularly enters dialogue as to the fulfilment of our responsibilities;

· Investors and shareholders: The board gives opportunities for both institutional and retail investors to meet with the Company and to see the progress of the Company. During the year the Company has held a number of webcasts allowing investors to question the board on progress and on our strategy. The Company has engaged one to one with advisors and investors on environmental, social and governance (ESG) issues with a view to improving the Company’s performance in this area and the Company has invited shareholders and other interested stakeholders to visit the site at a Capital Markets Day in April 2022;

· Partners and suppliers: The Company engages collaboratively with its partners and behaves in a responsible manner and expects partners to act ethically and in a responsible manner. The Company aims to build long term collaborative relationships and has signed long term contracts with suppliers for material supply, giving certainty to their businesses; and

· Society: The Company engages on social media and welcomes engagement with the wider public. In addition, the Company is conscious of its position as a growing employer within the Knowsley area, an area of recognised social disadvantage. To this end the Company has maintained an apprentice scheme and started its own graduate apprentice scheme in September 2022.

The board considers these stakeholders within its strategy discussions, the performance of the Company, the workforce and in its governance.

Financial Review

Revenue increased in the year to £5.1m against a figure of £2.4m in 2021, an increase of 116%. This growth has been driven by both increased development revenues from the contracts already won and from series production into 3 OEM contracts. Revenue was down on expectations due to several issues, not least being a delayed start to production by OEM 8 followed by a halt to delivery because of our own technical problems described in the Chairman’s statement.

Gross profit margin dropped to 60% from 65% in 2021. This has been driven by product mix and by the yield issues encountered in some of our processes. This deterioration is not expected to be long term and as previously communicated the new furnaces due on site in early 2023 will improve energy consumption within the process significantly.

During the year the Company spent significantly more on research and development activities to deliver robust processes for series delivery. This product R&D is now mostly complete with future R&D expenditure earmarked for process and cost improvements. The Company expects R&D activities to carry on at these levels over the coming years but with the focus being heavily skewed to process optimisation now that the product is well understood.

The cash figure for 2021 has been restated due to the reclassification of cash on deposit as security for an irrevocable letter of credit, disclosed prominently in last years statutory accounts, being reclassified as current asset investments. As already disclosed this letter of credit was for a furnace and stage payments related to its delivery.

Gross cash at the year-end was £14.9m (2021(Restated): £10.0m). Included in the 2021 cash figure was £3.0m of cash deposits related to security for an irrevocable letter of credit which have been restated and which was satisfied during the year, consequently no liability currently exists under any letters of credit. Total loans amounted to £1.2m (2021: £1.8m) giving a net cash position of £13.7m (2021(restated): £8.2m).

Administrative expenses were £3.4m an increase of 38% on the prior year figure of £2.4m. The increase in expenses were driven by the rapid expansion of the workforce in preparation for the delivery of series production.

During the year the Company was again supported by shareholders with a fundraise of £17m after fees to support the future growth of the Company and to give prospective customers the confidence in the Company’s ability to expand it’s capacity. Indeed this confidence lead to the award of a £100m contract with OEM 10 almost immediately following the fundraise.

Following the budget announcements, the Company is pleased with the improvement in the R&D tax regime for smaller companies. The impact is that the Company will have a tax credit in the coming year that is similar to previous years. The Company had previously guided that the tax credit would be minimal.

Loss before taxation was £6.0m (2021: £4.6m) leading to a loss per share of 2.34p (2021: 2.08p).

Key performance indicators

The Directors continue to monitor the business internally with several performance indicators: order intake, sales output, gross margins, profitability, supply chain capacity, health and safety, quality and manufacturing cost of automotive discs. A set of business milestones has been agreed and are discussed as part of the monthly board meeting. The board has assessed the results against these KPI’s and believe that solid progress has been made against the Company’s targets.

In addition to these financial metrics the board assesses the performance of the Company against 6 business development KPI’s:

· Contracted models;

· Lifetime contract value;

· Carry over contracts won;

· Average contract life;

· Contracts in series production;

· Contracted OEMs; and

· Prospective contract pipeline.

During the year the Company has performed well against KPI’s relating to Health and Safety with no reportable accidents during the year and in excess of 1,000 days since the last lost time incident. In addition, the Company measures its environmental impact through its Environmental management framework and through Performance in Environment Agency audits which have resulted in an A grade score during the year.

The Company produces an annual business plan and full monthly forecasts detailing sales, profitability and cash flow to help monitor business performance going forward.

Management meetings are held on a weekly basis, all senior managers attend and discuss production, engineering, financial and quality issues.

Risks and uncertainties

The Company has embedded risk management activities and maintains through regular reviews throughout the year an effective risk register of the issues that may affect the strategy of the Company or the delivery of its aims.

The principal short-term risk is the execution risks associated with ramping production to series volumes. This is being managed on a daily basis by a team comprised of senior leads within the production team. Whilst issues have been encountered regarding furnace reliability the team are focussed on identifying these issues rapidly and resolving them. In addition, the team are focussed on creating excess capacity in order to mitigate the risks when furnace and equipment failures occur. Significant Capex has been committed to this subject and by mid-year 2023 there should be no processes that do not have adequate levels of resilience.

There is also a risk to customer Start of Production (SOP) dates and the speed at which the customers move from initial to mature build rates. It is also normal in the automotive industry that customers do not contract minimum build rates. These risks are managed by continuing dialogue with the customers to ensure early notification of possible changes.

As in previous years another major risk faced by the Company is considered to be the speed at which our customers and potential customers adopt the new carbon ceramic product technology. The contract awards in the period indicate the strengthening desire from a number of volume automotive OEMs to incorporate the Company’s product in their respective platforms. This risk is constantly assessed by regular customer review meetings but is now clearly much reduced.

The Company has an exposure to exchange risk however this is partially mitigated through natural hedging activities. The contracts for OEM 6, 7, 8 and 10 have been negotiated in sterling to mitigate any exchange risk and this is the Company’s policy where possible.

In terms of uncertainties, product sales are still expected to grow with future OEM projections now supported by contracts. The Board expects continuing growth with Near OEM customers, but sales growth is expected to be modest in the retrofit market. This uncertainty is constantly assessed by regular customer meetings and monitoring the level of enquiries and orders for both the Company’s products and industry wide.

In summary, the Company has made satisfactory progress in its automotive projects and is progressing well with its expansion plans.

Events after the reporting period

The Company has signed heads of terms over a new property with the intention to double the potential capacity of the Company to £150m.

Directors and staff

Directors: In April the Company announced the appointment of Ian Cleminson as an independent non-executive director.

Ian joins the board from Innospec Inc, an international speciality chemical business employing 2100 personnel in 25 countries and with a turnover of $1.5 billion, where he is the current Executive Vice President and CFO. Innospec is a $2.5 billion NASDAQ listed company.

In August Richard Gledhill announced his retirement from the board after 13 years to be effective from October.

In December Michael Cunningham announced his resignation from the board. Michael will continue with the Company to effect a managed handover and leave on 31 May 2023. The Board is at an advanced stage of a search for Michael’s successor and an announcement is expected to be made in the near future.

Management Team: The Company continued its policy of strengthening management as the Company matures and the managerial needs evolve.

| Managerial roles as at 31 December 2022 | Managerial roles as at 31 December 2021 | ||

| Male | Female | Male Female | |

| Directors | 5 | 1 | 5 1 |

| Senior managers | 4 | 2 | 3 2 |

| 9 | 3 | 8 2 | |

Outlook

Achieving forecast revenue and profitability targets in 2023 remain our key goals.

With the technical issues now resolved, and demand remaining strong. the board remains confident that the Company will be profitable in Q2 2023 and thereafter. We can now deliver the strong demand. However, given the issues experienced in Q1 2023, and the ongoing production ramp in Q2, we communicated to the market, on 3 April 2023 that, notwithstanding ongoing profitability, it is premature to assume that we can catch up these delayed sales.

In respect to cash we have modelled our cash flows on this most pessimistic assumption, that the sales lost in H1 are lost for the year and confirm that we still have sufficient cash to maintain the momentum of our capital expenditure programme.

On behalf of the board

David Bundred Dr Kevin Johnson

Chairman Chief Executive