SmartSpace Software Plc, (LON:SMRT) the leading provider of ‘Integrated Space Management Software’ for smart buildings and commercial spaces – ‘visitor reception, desks and meeting rooms’, today provided an update on trading and the expected financial performance of the Group for the six month period ended 31 July 2021.

Key highlights:

· Forward looking Group Annual Recurring Revenue (“ARR”) as at 31 July 2021 up 28% in the 6 month period to £3.8m (up 51% since July 2020)

· Half year revenues expected to be approximately £2.5m (HY20: £2.3m) of which 63% is recurring revenue (HY20: 45%)

· SwipedOn

o Forward looking ARR up 22% in the six-month period to £3.2m on a constant currency basis (up 43% since July 2020)

o Monthly Average Revenue Per User (“ARPU”) up 22% in the six-month period to NZ$111.8 (£56.1) (HY20: $85.3 (£42.8))

o Locations up to 7,003 (31 Jan 2021: 6,741) and customers up to 4,747 (31 Jan 2021: 4,735) as SwipedOn target higher value multi-location customers

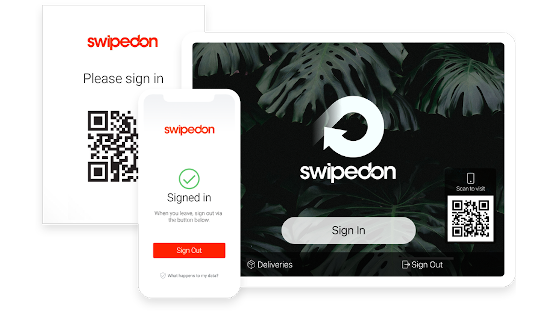

o First SwipedOn Desks customers signed and deployed

o SwipedOn desks will be available to all customers from August and will include new mapping module

· Space Connect

o ARR up 157% in the six-month period to £0.4m driven primarily by successful reseller agreements including Softcat

o 14 new partner agreements signed in the period, including 5 further reseller agreements signed in July alone

o First Space Connect partners located in Poland, Ireland, Canada, Belgium and USA

o Naso sales lower than expected but first significant order received in July 2021

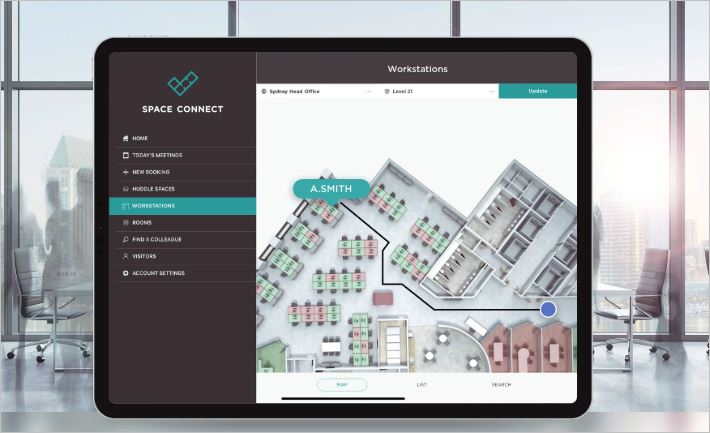

o New Space Connect mapping module released

· Anders & Kern (A+K)

o Sales below expectations due to Covid lockdown in H1, but significant increase in orders and improved revenue and sales pipeline since July

· Cash as at 31 July 2021 of £3.4 million (31 January 2021: £4.5 million)

The Board is very pleased with the progress made by the business in the last six months. During what was a challenging and unpredictable environment, Group ARR grew by 28% (on a constant currency basis) from £2.9m to £3.8m in the period and by 51% over the 12-month period, with good ARR expansion for both SwipedOn and Space Connect. Importantly, we also made considerable progress in establishing the foundations for further expansion of ARR and ARPU, with increased number of resellers, enhanced functionality and streamlined processes.

Revenue for the six-month period amounted to £2.5m (2020: £2.3m) of which 63% was recurring (2020: 45% recurring). Whilst revenues from hardware sales in the A+K business were impacted by uncertainty around the lifting of lockdown restrictions in the UK, the business is well placed to support office re-openings through provision of both workplace hardware and software solutions. With growth expected to accelerate in the second half of the year as lockdown restrictions continue to be eased, the Board remains confident of achieving future growth in line with market expectations.

Cash as at 31 July 2021 totalled £3.4 million (31 January 2020: £4.5 million).

SwipedOn

SwipedOn ARR growth is in line with Board expectations, increasing by 22% in the six month period on a constant currency basis from £2.6m to £3.2m. Our strategy of increasing ARPU from existing customers, increasing the focus of new sales into higher value multisite opportunities continues to positively impact SwipedOn and remains the key driver for growth over the coming years.

In May 2021 we reported ARPU was at NZ$99.3 (£49.9) (up from $91.8 in Jan 2021). By the end of July ARPU increased to NZ$111.8 (£56.1) (an increase of 22% since the beginning of the year). Our main sales focus has shifted to higher value customers, who opt for our more expensive Business and Enterprise plans, and who have potential for multilocation and SwipedOn Desk sales. This has resulted in an increase in average locations per new customer signed in the period to 1.8, compared to a historic average at the beginning of the year of 1.4 locations per customer. Churn is still significantly below budgeted levels and is currently running at 1.1% per month for customers and 0.7% per month for revenue. The majority of churn is from our lower value Starter Plan customers with limited, if any, ‘land and expand’ opportunity. These lower value customers cost as much to acquire as the higher spending customers and can take a disproportionate amount of support time.

Notwithstanding the churn of lower value customers, growth has occurred in both customers, and more importantly, locations. The number of locations SwipedOn is deployed into has increased during the period from 6,741 to 7,003. Net new customers have slightly from 4,735 to 4,747, as we focus on higher value multi-location clients. This is well illustrated by the recent client win in June with major airline catering group, Gategroup.

We have signed and implemented our first SwipedOn Desks customers in the UK and we are now ready to offer this product across our entire SwipedOn customer base. An example of one of our most recent customer wins for SwipedOn Desks is Jamie Oliver Group, taking their ARPU from £39 to £375.

Space Connect

Space Connect saw significant increase in demand for its products in the period leading to 157% ARR growth over the six month period to £0.4m. We are seeing a strong pipeline from our resellers, reinforcing the momentum seen in the business and underpinning our confidence in the opportunity for Space Connect, its product capabilities and the potential market.

This increase in ARR was driven largely by the successful relationship with partners such as Softcat. In the six months to 31 July 2021 Space Connect added a further 14 partners along with our first partner signings in Poland, Ireland, Belgium, Canada and the USA. We have also started to make good progress in signing Crestron partners globally. Of these new signings, Insight Partners and XMA are key, as they have significant customer bases and we envisage they will become major resellers of Space Connect in the UK.

We have had a number of significant orders for Space Connect recently from new clients including Travis Perkins, XPS Pensions, Rank Leisure Group and NHS Highlands.

The ARPU for Space Connect customers is now £804 per month.

In July we released our new Space Connect Mapping module. This product has been developed inhouse allowing customers to upload their floorplans, and, intuitively and quickly identify desks on these plans and give access to employees. Previously we used a third-party service provider to undertake this mapping task which, depending on complexity, could take up to three weeks to complete. With this new module, customers can get up and running instantly. The Mapping module has been well received by both existing and new customers, and will be critical to our ‘speed of deployment’ differentiator as customers can activate their applications immediately. As this module is enhanced further, it will also create new revenue opportunities, as customers will be able to use it on a standalone basis to continuingly model floorplan schemas as their requirements changes.

Sales of our strategic partner’s meeting room panel (the “Evoko Naso”) for which Space Connect receives both licence fees and SaaS revenues, were less than we expected in the first half of the year. As detailed below, indications of improvement occurred in July with the first significant strategic order for Naso products being placed by a major international hospitality brand. As Evoko partners progressively reopen, we expect this momentum to continue.

The shortfall in sales of Naso was mainly a result of Evoko partners in key markets such as Germany, Spain and Austria being closed due to lockdown. These partners experienced what we ourselves experienced in A+K – a reluctance to place orders for hardware when their customers were not in the office. Evoko have used the time during lockdown to ensure partners are fully trained in Naso and to further develop and release Naso marketing collateral. Evoko have also confirmed that all partners now have active engagements with Naso prospects which they expect will transform into orders in the second half of the year. Evoko’s sales estimates for the remainder of the year are in excess of our assumptions. They are confident in achieving their estimates and have sufficient Naso units in stock to fulfil orders.

Anders & Kern (A+K)

As lockdown in the UK was extended, a large number of A+K’s customers were closed and a number of end-user customer investment decisions for hardware were delayed. This led to lower revenues for A+K in April to June. However, since July, there has been a significant uptick both in revenues and in near-term pipeline. This is as a direct result of removal of lockdown restrictions in the UK and a reluctance to invest when there was no clear date to return to the office. During the period A+K continued to furlough a small number of employees taking advantage of the UK Government’s job retention scheme. Whilst we remain confident that the recent increase in orders for A+K products will continue in the second half of the year, any return to further lockdown conditions is likely to place uncertainty on this business.

Outlook

We continue to build on the foundations we have set over the past year, with our focus on building ARR and ARPU.

We have also centralised our product support operation under a newly appointed Head of Customer Service based in Mildenhall. This structure will allow us to offer 24-hour global support to both SwipedOn and Space Connect customers. These changes together with the development of our own mapping tool and streamlined sales process were essential to the roll out of SwipedOn Desks. The initial soft launch of SwipedOn Desks aimed at customers based in the UK demonstrated demand for the product. Therefore, from August 2021 onwards we will be targeting our entire SwipedOn customer base. This will contribute to further growth in ARR and ARPU for SwipedOn in the second half of the year.

With lockdown restrictions progressively easing around the globe, we believe Naso will start to generate new sales momentum as seen in the recent order from a major international brand for the Naso product.

As Covid and lockdowns ease across the globe and businesses gradually return to the office, many will adopt hybrid working, implement systems for more efficient space utilisation, creating a better employee experience. In this environment, demand for Space Connect will continue to grow. The agility of Space Connect to rapidly deploy to customers with a high degree of user control means that we are, particularly from a competitive perspective, ideally placed to assist these customers with their requirements.

There has been a noticeable change in A+K customer activity since lockdown restrictions eased in July. Orders that had been put on hold during the earlier part of the year are now being placed and we now have good visibility over our sales orders for the coming months.

Commenting on the announcement, Frank Beechinor, CEO of SmartSpace said:

“Both SwipedOn and Space Connect have successfully achieved strong growth and demonstrated robust business models through these challenging and unpredictable times. As we move forward, we will continue to globalise the businesses and enhance our product offerings, with the continued focus of becoming a leading workplace optimisation SaaS business.

Our focus through to FY22 will be on maintaining and increasing ARR, through increased ARPU, further expansion of reseller channels, further internationalisation of the business and continuing to offer enhanced functionality. This will support the Group in subsequent years in becoming a leading global SaaS business.

In particular, SwipedOn Desks, along with enhanced features and a focus on larger multi-location contracts, continue to be major catalysts for achieving our growth objectives for SwipedOn. In Space Connect the continued successful partnership with our existing partners will continue to develop, whilst more recently-signed resellers are already growing their sales pipelines. We will continue to expand the reseller base in new international geographies.

Whilst Evoko Naso sales have been slower than originally anticipated, we understand the reasons why, as we have experienced similar delays in investment decisions from A+K customers, due to Covid restrictions. However, we are optimistic that through the second half of the year and beyond, Naso will contribute significant revenues to the business. This confidence is underpinned by both the reopening of resellers in important overseas markets for Evoko and the signing of the first strategic contract for Naso.

As a result, the Board is confident growth will accelerate in the second half of the year, allowing us to achieve our expected growth for the full year in line with market expectations.”