Ilika (LON:IKA) is the topic of conversation when Baden Hill’s Partner and Clean Tech Equity Specialist Tom McColm caught up with DirectorsTalk for an exclusive interview.

Q1: Ilika’s interims out this morning, can you give us your general high-level view of the results?

A1: At first glance, it could be construed as negative, the interims are pointing that the full-year forecasts that are out in market are not on target to be met, probably what amounts to a 20% downgrade and the market has reacted as such.

However, what’s actually going on I think is quite positive.

For the last 12-18 months, the company has been pursuing this full licencing and royalties model and the market has basically, effectively, been waiting for this big announcement when a large OEM does a huge licencing deal with them that completely transforms the business.

There still going after that but the problem with that is it’s a bit all or nothing and the timing of that is never in their control which makes it impossible to forecast. The timing is always going to be dictated by the larger OEM licensee.

You can’t forecast that happening partially and having a bit, giving it a 10% and therefore 10% of the revenue, it either happens or it doesn’t. So, the way they’re getting around this for the purposes of making the business easier to see visibility on revenues is they’ve applied a pragmatic tweak to the business model.

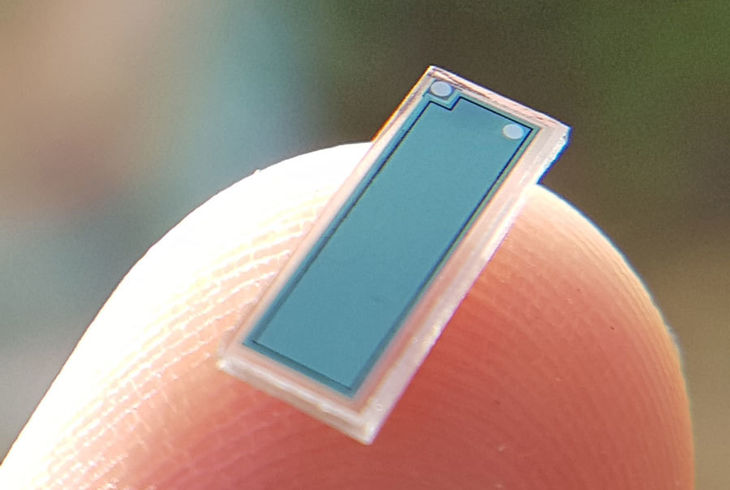

What they are now saying is look, we’ve got this pilot line, can do up to 10,000 units a year, we’re going to be maxed out this year. We can sell this Stereax batteries on a 50% gross margin to the people who may become large licensees and also top other potential customers and even outright small customers.

They’ll generate early commercial revenues that way, at the same time we’re going to scale up that commercial pilot level manufacturer with our manufacturing partners, go up to say 300,000 a year, and get the capacity for that over the next 12 months and do the first early commercialisation themselves basically. A little bit themselves, outsourcing to their manufacturing partners and get through breakeven with much more clarity on their commercial revenues.

So, that’s what’s going on and that’s my take on these results. At first glance negative, they’re not going to hit their numbers but second glance, they’ve done something about it and I think this visibility and their forecast in them is going to be a lot easier from this point forward.

Q2: So, based on what you’ve just said then, what news flow should holders and potential investors be looking out for in the next 6-12 months from them?

A2: Like I said, up to now we’ve all being holding out, looking for this big licencing deal, still that maybe a possibility, it may come but in reality, looking at this more visible revenue stream we just want to look for execution of this plan now.

So, obviously, it’s sales from their own pilot line in the near term and then also execution of outsourcing and constructing this scaled up commercial pilot which their partners so an announcement around the execution around this plan is what we should be looking for.

Q3: What do you think they would need to do for the share price to really catch fire and propel the company up to the next level?

A3: The glib answer to that is going back to plan a, the huge licencing and royalties deal with a large OEM, and I think it will come but the reality is let’s, in the meantime, get this plan b going where we generate some nice stable commercial revenues from sales of batteries made in-house or outsourced from in-house effectively.

Q4: Now, I understand that you attended a visit to the new Goliath large format battery pilot production facility, I think in Q4 last year. What did you make of it?

A4: I thought very impressive, from a standing start the company to get that up and running on time and on budget#, very encouraging. It’s a very different method of manufacturing these larger cells from what was their core Stereax smaller battery batteries but their ticking all the boxes, doing everything correctly.

The funding for that facility came through, Innovate UK grant funding from which there will be technological and commercial milestones and it’ll be interesting to see if they manage to hit those.

Q5: A lot of the cleantech stocks, including Ilika, such as Ceres Power, ITM power, AFC Energy and so on, they’ll all seen a significant upward trajectory in their share prices over the last 6-12 months. What are your thoughts on that?

A5: For me, who has been in this sector for a long time, it’d absolutely fantastic and we’ve been waiting for it for a long time, basically, the sector is really coming to fruition now.

What happened back in the early 2000’s when a lot of these companies first came to the market, they came to the market way too early with immature technologies, immature supply chains, the markets weren’t really there. Everyone could feel that this was a sector that wasn’t going to go away and it got the whole ‘jam tomorrow’ reputation, the revenues 2-3 years’ time. A lot of these companies now, they have got there, the supply chains are there, the technologies are commercial and the markets are in place and it’s actually happening.

At the same time, the public in large, are at last are becoming aware of the magnitude of this problem, climate change etc. You’ve got the young Swedish girl, Greta, accusing our generation of basically destroying the world, Australia’s on fire, you’ve got David Attenborough, it’s coming mainstream and people are thinking wow, we need to do something, what can I invest in to profit from this, if you like.

There aren’t that many pure play cleantech options out there so the ones that are out there are all benefiting.