One Health Group plc (AQSE:OHGR) Chief Executive Officer Adam Binns caught up with DirectorsTalk for an exclusive interview to discuss what the Group does, financial highlights, operational metrics, growth plans, and closing thoughts for investors.

Q1: First off, Adam, could you just provide listeners with a brief overview of what Group does?

A1: One Health Group is a supporter of the NHS on a fairly wide and growing region so all our activity and therefore turnover is generated by NHS activity. All our services to patients are free, we’re paid by the NHS to carry out the services.

The way we derive that activity is when a patient goes to the GP and needs a consultation with a specialist, they can be referred to either the NHS Trust network or a number of independent providers of which we are one. It’s something called ERS, it’s a choice system with the GP, and the GP theoretically offers the patient a choice of where to go for that treatment, and increasingly One Health is becoming more prominent in that choice through promotion ourselves, but also informing patients of their statutory right to choose. Not a particularly well-known fact, but that’s where we generate our income from.

Our three major USPs are:

- We are local, I’ll explain how that works in a second.

- We are quick, we have very short lead times to surgery. For example, we’re currently doing hips and knees from first consultation in around 6-7 weeks, in the NHS, that could be as long as a year, unfortunately at the moment, down to the problems we’ll come on to in a minute.

- We are free.

Those are the three major attractions or USPs of the Group.

We support the four highest demand outsource specialties: Orthopaedic, which includes all bones, so hips and knees and the rest of it, spines, general surgery, and gynaecology. Importantly, we also provide all the aftercare. So physiotherapy, for example, post-orthopaedic work, that’s all part of what we offer free to the patient funded by the NHS.

In terms of the business model, we operate on a hub and spoke model so in simplistic terms, we have 30 outreach clinics across the regions where we operate, that being the first point of contact for the patient in the community. When the patient needs surgery procedures, and it’s around 40 to 50% of all the patients we see need some sort of surgery, 50% don’t, we bring them into a local hospital, which is a network of eight independent hospitals, mainly the large groups, the likes of Circle and Spire, where we subcontract capacity.

So to be clear, the whole model we operate, other than the employed workforce within the Group, which is effectively an administrative function in Sheffield, around 40 staff that manage the relationship and dynamics, all activities subcontracted. The consultants we use are NHS consultants who sell their spare time into the business so it works very effectively.

In terms of where we operate, we operate in Yorkshire, Derbyshire, Nottinghamshire, Leicestershire and Lincolnshire, but that’s growing all the time. We’re always looking for reasons we can expand into.

Certainly from last full year, so to March 23, we’re a fundamental part of the NHS supply chain and we supported over 60 NHS commissioners and increasingly contracts with local trusts, which we’ll come on to as we get further through conversation.

So, supporting NHS, we don’t do private work, it’s all NHS work. We’re local, we’re quick and we’re free.

Q2: Could you tell us some of the financial highlights for the six months to the 30th of September 2023?

A2: Yes, so we released our half-year results just before Christmas, well-received, I have to say.

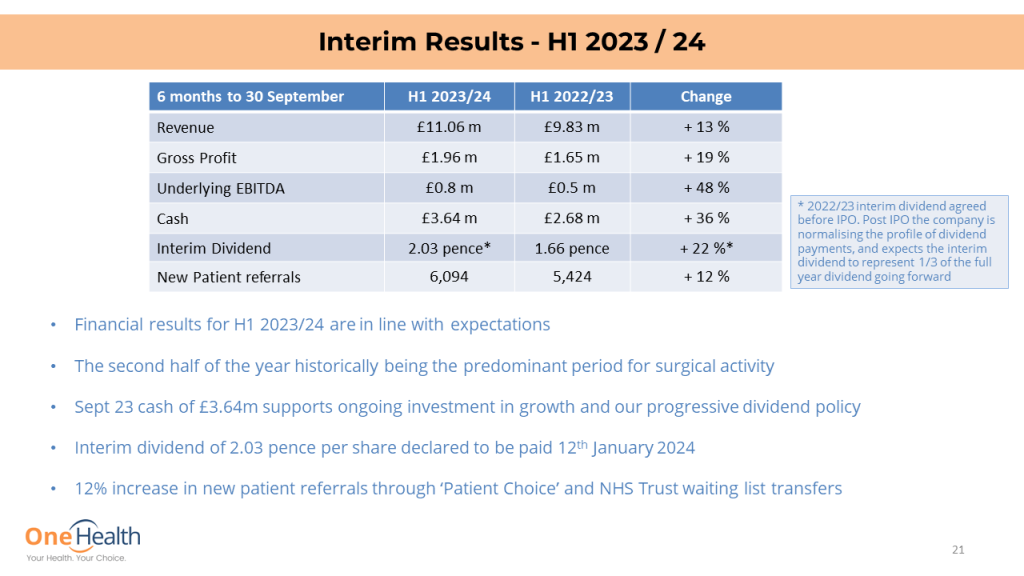

We saw some good trading activity on the markets after, which is always a good sign, and I think it’s fair to say that when we set the targets for this financial year, and indeed half year, we were fairly ambitious on growth targets, but we’ve exceeded them so I’m happy with the numbers we’ve achieved. Certainly year on year, as you’ll see from the metrics on the slide, there’s some pretty strong growth across the board, including notably an increase in the dividend.

We’re entering our 20th year this year as a business so we’re not newly formed. We’ve been around for 20 years, although we only listed in November 22, but we have a fairly progressive dividend policy and have increased that this year following floatation.

I think the key metric on that slide for me is the bottom one, which is the growth in new patient referrals so these are patients that choose the Group through going to the GP. Some of that’s word of mouth, some of that is the huge demand now, given the NHS waiting lists, but we’re seeing growth there across every region we operate in. So, it’s a good set of results from our perspective, and we were very pleased internally.

In terms of looking forward, we’ll be issuing a trading update at the end of April and full results in June in terms of our accounting timetable.

Q3: It is clear from the strong set of H1 results that demand for your services have never been stronger. Could you talk us through some of the operational metrics and what’s been driving that growth, and also how you’re supporting it?

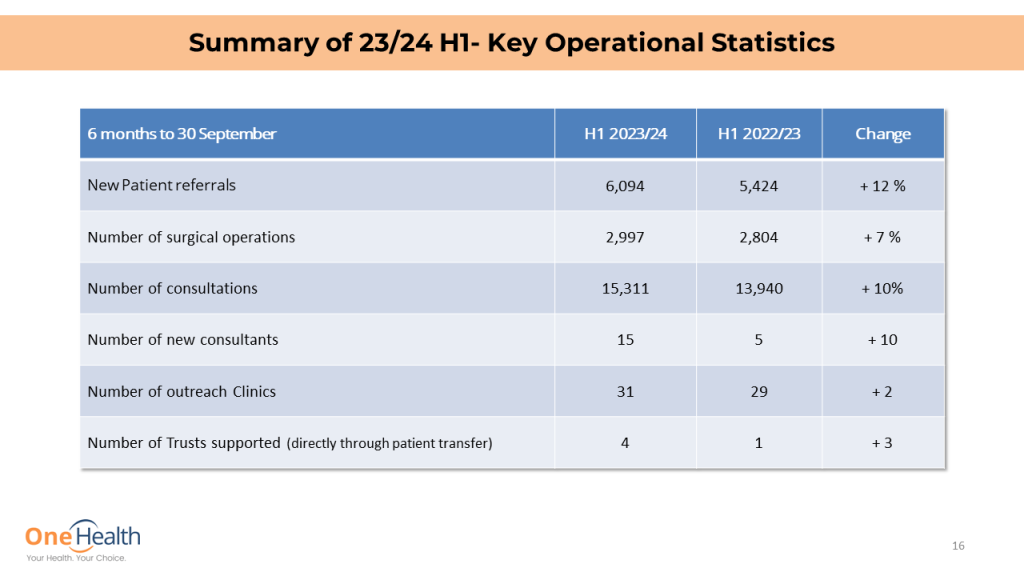

A3: On that slide there are the key metrics for the business, there are many more, but they’re the headline ones for us.

So again, going back to the new patient referrals of 12%, that’s a record so far this year, than in six months ago, which we’ll come on to later. Also surgical operations so they’re the patients that do need surgery having had a consultation, again, around 40 to 50%, but again, growing demand across the board.

It’s also worth highlighting in terms of the post-pandemic world, when, as I’m sure many people know, activity stopped for a long period of time, we’re seeing poorlier patients when they get to us. So, there’s probably more complex treatment required when they get around to, which in financial terms is a benefit because the more complex the procedure, the higher payment we receive for that procedure from the NHS.

Another key one there as well is the number of new consultants so, as mentioned at the outset, we operate a subcontractor model buying the time of NHS consultants. We’ve seen a real shift post-pandemic of consultants approaching us for work rather than us chasing consultants to grow the business. That’s been notable and certainly very well received.

Importantly, the last line on that slide, which I think is a really interesting one. Historically, all our patient activity comes through GP referrals, but over the past 2 years post-pandemic, certainly almost 3 years, we’ve seen local trusts asking us if we can help them directly with their internal waiting lists. So, as well as GP referrals, the traditional route, we’ve also been taking patients from internal hospital waiting lists into the Group for treatment and discharge, reducing their internal waiting lists and indeed helping them demonstrate better performance, which is obviously really in the spotlight across all media at the moment in terms of NHS waiting lists and hospital waits.

So, that’s been a marked shift in revenue streams over the past 2-3 years and very, very well received, and importantly, developed some really strong relationships from the back of those local trust relationships, as well as relationships with commissioners, which we’ve had for many years, as I mentioned a second ago, 20 years this year.

Q4: It’s nice to see a business whose mission puts patient choice and patient care at the heart of what you do.

A4: Absolutely, you couldn’t be more right.

Patient satisfaction is absolutely crucial to us, we take very great pride in all the patient feedback that we receive, we actively chase feedback, looking to ways to improve ourselves.

Certainly the team which I employ in Sheffield, where I am today, they’re absolutely driven around almost customer service levels of performance and we train them in that regard as well. As I say, there’s a great pride in what they do because we’re not selling tins of beans, we’re making people’s lives better. I know it sounds a bit of a cliche, but it’s very true.

It’s also quite important as the business model that unlike the traditional hospital model where all activities in a local hospital, we take the consultants out to the patient in the outreach clinics, which they’re around 30 around the region. So, the first point of contact for the patient will be in their community, which obviously avoids disruption, reduces travelling, and these days really important, reduces cost. That’s a really attractive feature to the patient in terms of the One Health Group relationship.

Again, that 40-50% of the new patients that do require surgery will travel to a local independent hospital where we buy capacity or book capacity., that’s the only time they’ll do some significant journey based in terms of where they are.

Q5: Just looking at 2024 and beyond, what can investors expect in terms of your growth plans?

A5: I think touching on the results, or the metrics at half year, when I’ve talked to kind of growth in consultations and outreach clinics, we’ve made some really good progress in the last six months, also at the back end of the year, this financial year in growing capacity across the board.

So in terms of the three key metrics, it’s more outreach clinics and again, another subcontractor solution, we buy capacity like GP surgeries or community centres where the patients can be seen, we’ve got more of that. We’ve got more inpatient capacity, the Group’s model is very attractive to independent hospitals who predominantly, in certain regions, rely on private and self-pay work, but they have spare capacity that they can’t or don’t use. We can buy that capacity from them so utilizing their assets better so very attractive then in terms of inpatient growth, and again, going back to the earlier point, we’ve seen a significant increase in consultants approaching the Group.

Those key metrics, outreach clinics, inpatient capacity consultants, have all seen significant growth in the last six months, which feeds next year very, very well.

The other thing to think that we are considering proactively is exploring building, leasing, or buying additional surgical capacity to accelerate growth. That’s on our strategy and has been for the last certainly year, and we’re making some good progress in that regard as well.

So as well as relying on subcontracts, we’ll look to develop’ owned’ for want of a better word surgical capacity.

Q6: Finally, just before we finish, do you have any closing thoughts for investors?

A6: I think, as I mentioned before, we’re now approaching our 20th year this year, into the celebration of our birthday, and we’ve always seen good growth, and certainly we can see good growth next year based on work and foundations put in place this year.

It’s notable, I think we showed in the earlier slide, we do generate a fair amount of cash, we’re sat on just short of £3.6 million at half year. We generate a lot of cash, we’re a cash generative business, which leads to dividend payments, clearly from an investor’s perspective, that can be quite attractive. Also those cash reserves support acquisition, which I touched on a second ago, and investment in growth so we’re not reliant on necessarily equity raise or bank funding, we’re sat on a fair bit of cash, and we’re always on the lookout for complimentary services or businesses that can bolster the model and give us growth that way.

A notable point, and it was last year now, we listed November 22, but prior to that, we did establish a share option scheme, which covered many staff, but also a good number of the subcontracted NHS consultants. It was very flattering to see that virtually every single one exercised their options at the first opportunity and held onto them so I think it’s a demonstration of their confidence in what we do, as almost third parties to the relationship.

I guess in terms of finishing off, if you look at, it’s widely put in the media, the unprecedented levels of waits in the NHS now, there’s no doubt in my mind, and certainly anybody within our sector, that the NHS needs the independent sector more than ever before. We are very well-placed to support, given we are 100% NHS, we’re not looking for private and self-pay, we’re looking to grow the NHS activity, because that’s what we do.

So, we remain a profitable, growing, highly cash-generative business, and we pay dividends with a progressive dividend policy.