NQ Minerals (NEX:NQMI) Chairman David Lenigas caught up with DirectorsTalk for an exclusive interview to discuss his new role as Chairman, what investors can expect over the coming months and the value of the NQ shares.

Q1: First off, congratulations on becoming the Chairman at NQ Minerals. David, what can you tell us about why you’ve joined the company?

A1: Well, not for a long time since I was brought into Emperor Mines in the 80’s and 90’s that I’ve actually joined a company that’s actually making money so this is a far cry from the things I’ve normally done in the past which is trying to build companies from scratch which have been very successful.

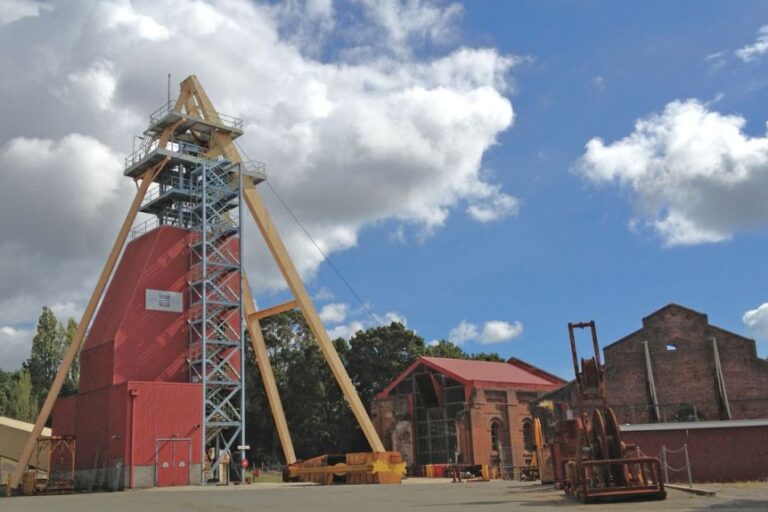

I was asked to come on as the new Chairman of NQ, when I saw the potential and the profitability of this mining operation in Tasmania, I thought this is a good opportunity to re-whet my mining engineering appetite and help the guys build something quite sizable here and get the story out to the global marketplace.

I see very exciting potential here for the company.

Q2: So, what can investors expect to see over the coming months with you on board?

A2: For starters, one of my roles is to start telling the international community that the company exists, for the last 6-12 months it’s been fairly unloved in the London markets and I think deliberately so. The management team, up until now, has focussed more on, and it’s a very interesting way they’ve done it, they’ve funded it in an upside down way.

Normally, London companies focus on raising equity, diluting shareholders to fund a growing operation and here, the company have funded principally from debt and listed bonds the Helier operations to bring them back into production. Since about July, its really started to hit its straps and really turning into quite a profitable operation.

So, there’s lot of good news to come, in fact I was down in Tasmania looking at the operations a week and a half ago and met a very dedicated management team on site who are really kicking some serious goals on the production and profitability side. Over the last few months, they’ve been producing record lead/zinc/gold and silver revenues and looking at way things are going this month, the lads are really kicking it right out of the park at the moment.

So, an operation like this which has got very very long mine life, some 10 years with a lot of room to grow on its existing operations, before the whole situation really starts swinging towards back to underground and open pit operations, this has got a good fundamental background to build something quite sizeable.

As I’m on the Board and there’s lots of news to come over the coming months, I see that this is something that shareholders could find quite interesting, and potentially new shareholders.

Q3: Just thinking about shareholders, do you think the NQ Minerals’ shares are good value at the moment?

A3: NEX is a very difficult market but as people start to work out how NEX works, I think once people start trading the stock a bit more actively as the good news comes out from the robust operations in Tasmania, we’ll see some good liquidity pick up on this marketplace.

To sit here with a company, market capped at £9 million, with 10 years of pretty much proven reserves, making millions of dollars a year, with huge scope for upside potential particularly on the exploration, I can only see one way for this to go.

Very rarely have I seen an opportunity listed in London that I see tremendous upside in, particularly from a market cap of £9 million. If you look at the institutional groups that have funded Hellyer, some of them are pretty big global players and we’ve got a very good relationship with our offtake partners, Traxys, a lot of the product goes off into China and that’s a great relationship for us.

So, it’s interesting from the people who have funded the quite substantial amount of debt and listed bonds down at the Hellyer level, really what we’re looking at here from the main Topco which owns 100% of the Hellyer operations is very little activity so I see that changing quite quickly as life progresses.

So, do I see real value in this stock at this market cap? Absolutely and it’s time to start telling the world about it now its kicked through into the very profitable scenario and I see profitability improving quite substantially for the rest of 2019 and 2020 and beyond.