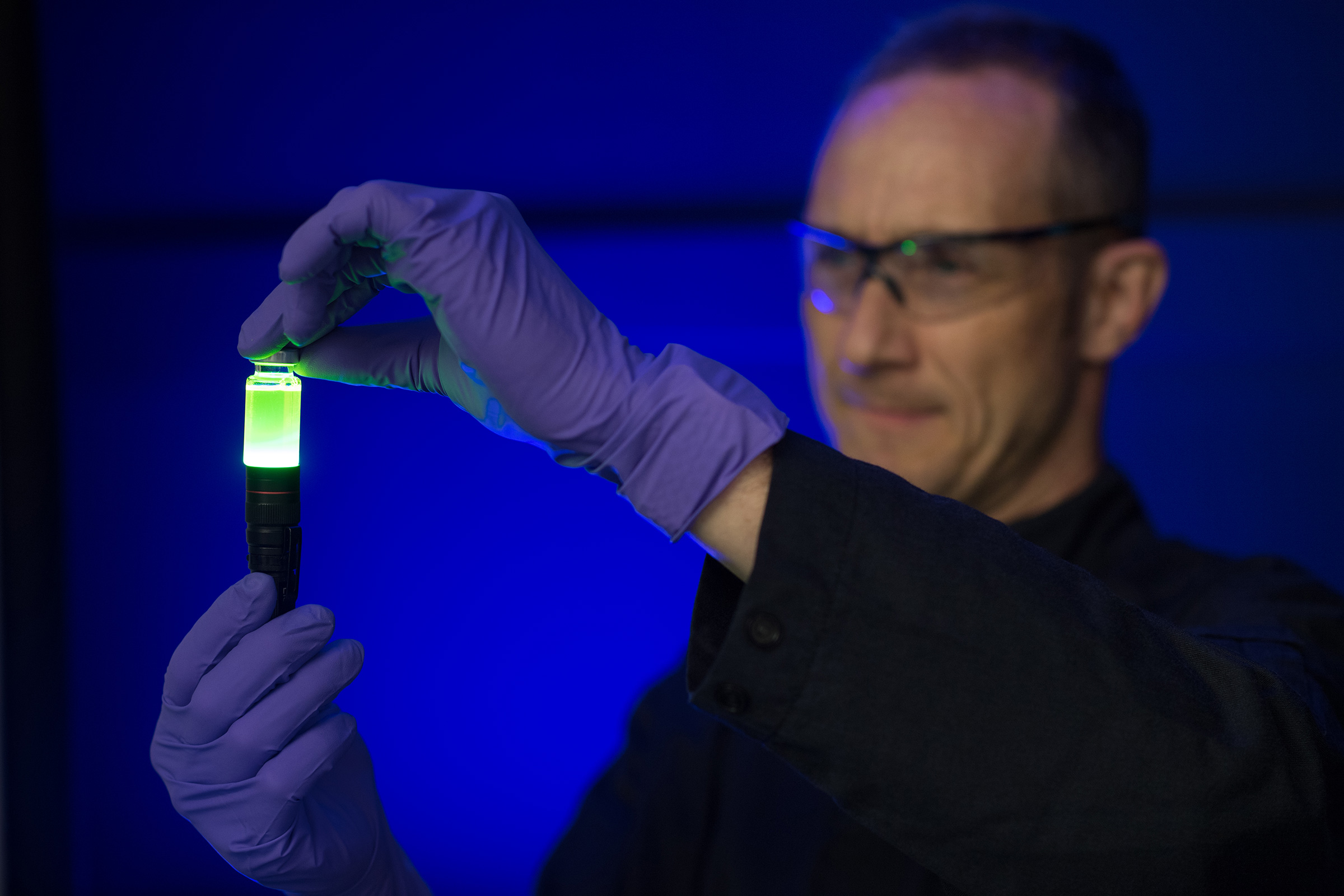

Nanoco Group plc (LON:NANO), a world leader in the development and manufacture of cadmium-free quantum dots and other specific nanomaterials emanating from its technology platform, has announced that it will today post a Circular setting out details of a Proposed Capital Reduction to create distributable reserves in order to facilitate future returns to Shareholders. The Circular will also contain the Notice of General Meeting to be held on 7 July 2023.

Highlights of the Circular:

· The Company is proposing to undertake a Capital Reduction in order to facilitate the return of capital to Shareholders. The Company is currently restricted from returning capital to its Shareholders as it does not have distributable reserves.

· The Board intends to initiate a return of between £33 million and £40 million (or approximately 10 pence to 12 pence per share) using the second tranche of the proceeds of the Samsung litigation ($75 million) which is expected to be received during February 2024. No final decision has yet been taken as to the method of any such return of capital.

· Nanoco Group intends to retain approximately £20 million of cash (following the return to shareholders) to invest in R&D and commercial activities, a proactive IP licensing programme, payment of debt obligations, and to provide working capital through to the self-financing position that is expected to be achieved during 2025.

· The Board is confident that the near term opportunities for commercial production of sensing materials, together with the current interest in the Group’s display materials following the successful IP litigation and the growing display market for CFQD® cadmium free quantum dots, fully merit the allocation of funds noted above.

Christopher Richards, Non-Executive Chairman of Nanoco Group, said:

“The Proposals in relation to a Capital Reduction and the proposed return to Shareholders are consistent with our stated intention to balance the investment needs of Nanoco’s growing organic business whilst delivering a material return of capital to Shareholders following the Samsung litigation.

“The Board considers the Resolutions to cancel the Company’s share premium account and capital redemption reserve to be in the best interests of the Company and its Shareholders as a whole and the Board unanimously recommend that Shareholders vote in favour of the Resolutions to be proposed at the General Meeting.”