Morses Club plc (LON:MCL), an established provider of non-standard financial services, has announce that it has successfully launched a remote lending process for new home collect credit customers. This enables Morses Club to lend to new HCC customers for the first time since lockdown began in March 2020.

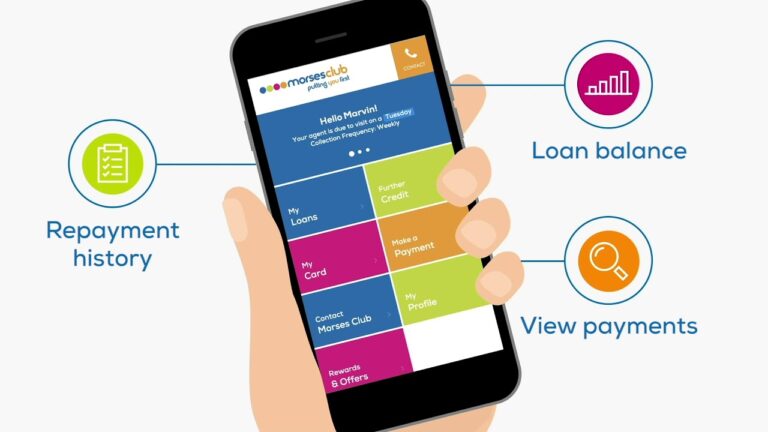

The introduction of the new remote lending process allows Morses Club agents to deal with new loan applications whilst still adhering to social distancing rules and represents a further step forward in the digitalisation of the Group to meet changing customer demands. The process utilises an electronic KYC system which meets Morses Club’s high standards of customer care and satisfies all regulatory requirements. Customers’ details and credit scores will be electronically verified using independent data sources and loans will be paid directly into the customer’s own bank account.

Paul Smith, CEO of Morses Club commented,

“This represents a significant step forward for Morses Club, as we have been restricted to lending to existing HCC customers since the beginning of lockdown in March. We are delighted to be able to leverage our existing technology platform to meet the regulatory requirements necessary to serve new customers remotely. We continue to operate carefully, with the safety of our customers, managers and agents of paramount importance and we look forward to being able to provide new customers with the support they need in these difficult times.”