Morses Club plc (LON:MCL) Chief Executive Officer Paul Smith caught up with DirectorsTalk for an exclusive interview to discuss how COVID-19 has changed HCC, what this means for the business and the importance of a digital division within the company.

Q1: Preliminary results for the 52 weeks ended 29th of February 2020, just reflecting on the period, has COVID-19 changed the face of HCC forever?

A1: I believe it has actually, yes. As you may know, historically there have been approximately 400 independent home collect credit firms in the UK, the vast majority of those are quite regional, small family-owned businesses, without any form of external funding available to them. I believe that the vast majority of those firms, if not all of them, will not manage to emerge from the pandemic in any fit state to continue trading.

So, I think that the 1.6 million consumers that use home collect credit will be polarised around the three major players, ourselves, Provident Finance and Non-Standard Finance. I also believe that the vast majority of people now are completely open to the alternatives that are available to them from a digital perspective.

Historically, the vast majority of our cash issuance and our cash collections were face-to-face on the doorstep but over 70% of our business now is transacted digitally and I truly believe that consumers actually want that flexibility and that it’s changed the place of home collect credit for good.

Q2: I’ll come to digital in a minute, but what does all this mean for Morses Club and I suppose for the sector as well?

A2: I think it’s a great opportunity for us because over the past eight years, we’ve invested very, very heavily in our technology platform and none of us could have foreseen the effect of the pandemic.

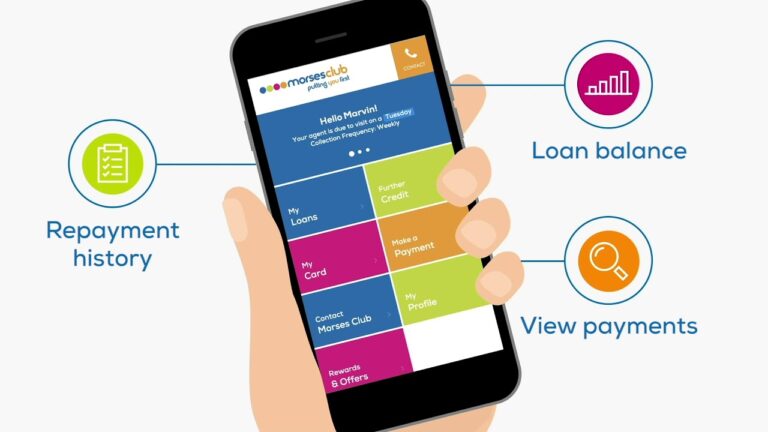

Serendipity led us to a juncture where we were highly invested in our platform, it was very flexible and when the pandemic struck, we were able to react with a great degree of speed. We were able to place all of our people on a homeworking basis, we were able to furnish them with a requisite software and hardware that they needed to work on home, to have virtual dialler systems in place and to transfer the vast majority of our customer base onto our customer portal, which only 18 months had zero subscribers.

It’s now approaching 120,000 customers that use that portal to request loans, to repay loans, uh, and to keep up to date with communications with us. It’s transformed us permanently and we were very fortunate that we were already on the front foot from a technological point of view and we stole a genuine march on all of our competition.

Q3: Just coming back to digital, what are your views on the importance of a digital division within Morses Club?

A3: So, there are two things really with regards to digital, the first is that our traditional home collect credit business has been digitalised so you go back a few years and we were using paper forms, we were using handheld PDA’s and we transformed our home collect credit business into something that was far more digitally sophisticated.

We automated all of our old paperwork, processes, and procedures, and we’ve made it a slicker, lower cost business with much higher efficiencies so that that’s one side of our digital progress.

The other side of our digital progress has really been to invest in different markets, different demographics and different channels to market so, I already mentioned that home collect credit has 1.6 million consumers in the UK but there are a further 9 or 10 million consumers that have checkered credit histories that rely on non-standard credit products. They rely on online lending or guarantor loans or other forms of non-standard credits that are not home collect credit and we’ve managed to significantly drive into that market.

Last year, as our results show, we absorbed higher losses than we originally anticipated but the trading update for the current financial year, the year that will end at the end of February 2021, is showing that we’ve really made significant improvements in that part of our business. It is a tremendous growth market and it will really propel us forward in the future because it’s such a much larger market for us to serve.

So, for us, it makes all the difference, there are significantly less competitors in that market now because they were bedevilled by their history in payday lending and therefore, they weren’t subject to lots of claims and lots of redress from the regulators. We’d never been in that market so we don’t suffer from that kind of legacy issue.

I’m confident that we have a 10 or 11 million consumer market that is more or less being served by only a handful of suppliers, ourselves and maybe two or three others so the opportunities for us going forward are immense.