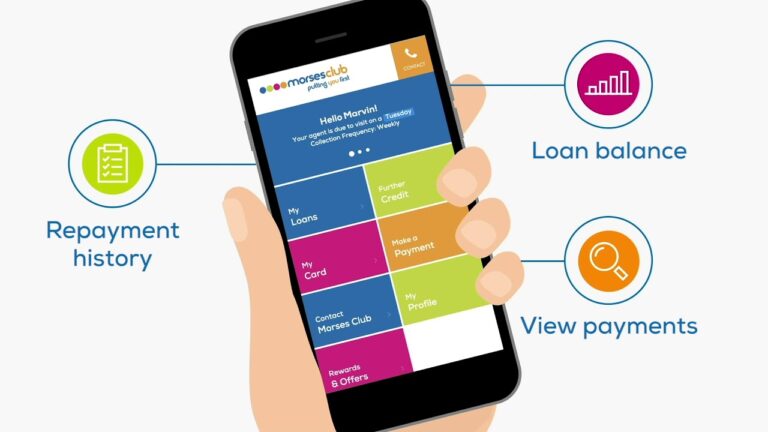

Morses Club Plc (LON:MCL) having completed a major integration, management is now focussing on carefully controlled growth. Technology is driving efficiency improvements, aiding credit management (impairments are at the lower end of expectations) and improving compliance and controls. MCL is the number 2 in UK home-collect credit (HCC) market, and is around twice as large as the number 3. It is attracting and acquiring performing agents and portfolios of loans. Revenue margins have been increased and MCL is introducing new products where it has a competitive advantage from existing operations, or risk management expertise. We see 28% valuation upside.

Morses Club Plc (LON:MCL) having completed a major integration, management is now focussing on carefully controlled growth. Technology is driving efficiency improvements, aiding credit management (impairments are at the lower end of expectations) and improving compliance and controls. MCL is the number 2 in UK home-collect credit (HCC) market, and is around twice as large as the number 3. It is attracting and acquiring performing agents and portfolios of loans. Revenue margins have been increased and MCL is introducing new products where it has a competitive advantage from existing operations, or risk management expertise. We see 28% valuation upside.

HCC is an attractive market: HCC is a product valued by customers (95-97% overall satisfaction). Market-wide high credit risk and administration costs are reflected in appropriate interest costs, generating profitability and cashflow for investors. A well-managed business, like MCL, is significantly counter-cyclical.

MCL strategies should add value: MCL is improving the operational efficiency of the business, has raised revenue yields and focussed on better quality, lower risk customers. Looking forward, it has developed a range of profit growth options from the existing business and related areas of competitive advantage.

Valuation: Our range of absolute valuation approaches indicates a fair value would be around 152p with the Gordons growth model (which capture both value added and growth) having the highest valuation at 168p. The average peer group relative measure has 20% upside (to 142p).

Risks: Credit risk is high (albeit inflated by accounting rules) but MCL adopts the right approaches for this market. Regulatory risk is an issue for all financial companies, but HCC has already been reviewed and high customer satisfaction would suggest limited need for change. MCL has no pension risk.

Investment strategy: We believe Morses Club Plc is operating in an attractive market and has a dual-fold strategy which should deliver an improved performance from existing businesses and deliver new growth options. MCL conservatively manages risk and compliance, especially in new areas. The agent network is the competitive advantage over remote lenders. The valuation has material upside and we forecast a 2017E dividend yield of 5.3% with cover of 1.7x (adj. earnings).