Morses Club PLC (LON:MCL), an established provider of non-standard financial services, has announced its preliminary results for the 53 weeks ended 29 February 2020.

Financial Highlights:

· Revenue increased by 14.3% to £133.7m (FY19: £117.0m)

· Total credit issued to HCC customers was 2.2% lower at £174.2m (FY19: £178.1m). Total credit issued to all customers of £190.3m

· Net loan book, after Covid-19 adjustment of £1.7m, reduced 0.3% to £72.8m

· Normalised adjusted profit before tax1 of £15.5m (FY19: £22.0m)

· Statutory profit before tax of £11.5m (FY19: £20.2m)

· Normalised adjusted HCC profit before tax1 of £24.5m, an increase of 8.9% (FY19: £22.5m)

· Statutory HCC profit before tax £21.2m is an increase of 2.4% (FY19: £20.7m)

· Normalised adjusted loss before tax1 in Digital division of (£9.0m) as a result of enhancing scale and capability of recent acquisitions (FY19: (£0.5m))

· Statutory loss before tax in Digital division (£9.7m) (FY19: (£0.5m))

· Impairment as a percentage of revenue for the period, before the Covid-19 adjustment of £1.7m, was 26.0% (FY19: 22.4%)

· HCC normalised adjusted return on assets1 of 31.1% (FY19: 25.4%)

· Normalised adjusted EPS1 of 9.5p (FY19: 13.6p)

· Statutory EPS of 7.3p (FY19: 12.5p)

· Post balance sheet event estimated negative impact of Covid-19 (£5.2m) (FY19:£nil)

· No staff furloughed nor any Government debt or other support packages accepted

· Proposed final dividend of 1.0 pence per share (FY19: 5.2p) taking the total dividend for the year to 3.6p (FY19: 7.8p)

Operational Highlights:

· Group customer numbers increased by 9.0% to 255,000 (FY19: 234,000)

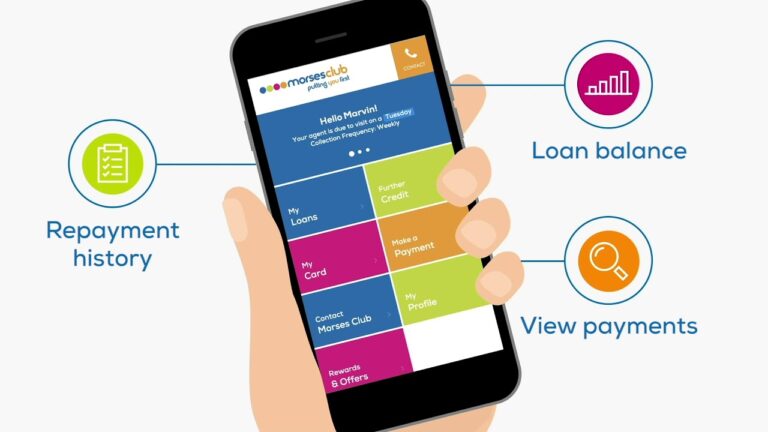

· Development and launch of fully online Customer Portal, with over 78,000 customers at end FY20 (FY19: nil)

· Acquisition of the business and certain assets of CURO Transatlantic Limited, an online lender, with 37,000 customers, operating under the Dot Dot Loans brand

· Acquisition of U Holdings Limited, an e-money current account provider, with 18,000 customers, operating under the U Account brand

· Commenced re-engineering of our online businesses to build our product offering and take advantage of the opportunity in the wider non-standard credit market

· Delivering further technology enhancements in our HCC business to provide a digital service to customers enabling a virtually paperless documentation process

· Due to Covid-19, reconfigured our lending, collecting and operating processes to ensure the safety of our customers, employees and agents

Alternative Performance Measures & Key Performance Indicators

| Key performance indicators | 53-week period ended 29 February 2020 | 52-week period ended 23 February 2019 | % +/- |

| Revenue | £133.7m | £117.0m | 14.3% |

| Net Loan Book | £72.8m | £73.0m | (0.3%) |

| Normalised adjusted Profit Before Tax1 | £15.5m | £22.0m | (29.5%) |

| Statutory Profit Before Tax | £11.5m | £20.2m | (43.1%) |

| Normalised adjusted Earnings per Share1 | 9.5p | 13.6p | (30.1%) |

| Basic Earnings per Share | 7.3p | 12.5p | (41.6%) |

| Proposed Dividend per Share | 3.6p | 7.8p | (53.8%) |

| Cost / Income ratio1 | 60.0% | 57.3% | 4.7% |

| Return on Assets | 12.8% | 23.4% | (45.3%) |

| Normalised Return on Assets | 16.6% | 25.4% | (34.6%) |

| Return on Equity | 17.2% | 27.2% | (36.8%) |

| Normalised Return on Equity | 22.3% | 29.6% | (24.7%) |

| Tangible Equity / averagereceivables1 | 74.4% | 85.9% | (13.4%) |

| No of customers (000’s) | 255 | 234 | 9.0% |

| Number of agents | 1,695 | 2,050 | (17.3%) |

| Total Credit Issued | £190.3m | £178.5m | 6.6% |

| Impairment as % of Revenue | 27.2% | 22.4% | 21.4% |

1 Definitions are set out in the Glossary of Alternative Performance Measures in Morses Club’s 2020 Annual Report

Paul Smith, Chief Executive Officer of Morses Club, commented:

“FY20 was a year of significant regulatory and operational change for Morses Club, with the Company making considerable progress in advancing its strategy, particularly in the development of the Digital division. HCC remained stable during the year while maintaining strong customer satisfaction levels of 97%. The launch of our online customer portal exemplified the strong progress made in terms of our customer service and digitalisation, with over 78,000 customers registered on the platform by year end, and over 117,000 customers now registered to date.

“The acquisitions of the business and certain assets of CURO Transatlantic Limited and U Holdings Limited enhanced our offering across online loans and digital current accounts. While the division’s losses due to the ongoing re-engineering of the businesses were slightly higher than anticipated, Morses Club is confident that the resulting offering will position the Group well to take market share in the online non-standard current account and credit space. The Digital division is on track to report a break-even position during FY22.

“Since the impact of Covid-19 on our markets, I have been impressed by the resilience and adaptability of the Group during a period of unprecedented change. The way in which we were able to quickly implement wide-ranging operational changes and leverage our platform to continue to lend to customers is testament to the dedication of our employees and agents, and the customer-centric culture we strive for at Morses Club. It has also been pleasing to see the acceleration of the digitalisation of the Group as a result of Covid-19, with demand for our digital products increasing since the first national lockdown in March.

“With the progress made last year, our strategy remains to focus on our customers, leverage and progress our digital capabilities and drive market share growth within the wider non-standard finance market. Morses Club is financially robust, and I look forward to further progress being made across the Group during the rest of the year. Morses Club is well placed for a post Covid-19 recovery in consumer borrowing.”

Chief Executive Officer’s Review

We have made significant progress in enhancing our product offering to our core customers.

Performance

FY20 was a year of significant regulatory and operational change for the business, as well as significant progress in our digital acquisition strategy. Total credit issued in our home collected credit division was £174.2m, slightly lower at -2.4% relative to the previous year (FY19: £178.5m), with our gross loan book marginally reduced by 2.4% from the FY19 figure.

The whole HCC sector saw a drop-off in sales following FCA changes to lending rules, however, our business was the least affected and consequently gained share. Our customer numbers remained broadly stable at 221,000, and we maintained our high levels of customer satisfaction of 97% and above. 99% of our employees scored Treating Customers Fairly (TCF) as part of the daily mindset of the business, with 90% believing that we offer good customer service. The self-employed agents who support our business gave a score of 96% meaning that TCF is part of the daily mindset of their business, with 95% understanding the importance of TCF.

During the year we have made significant progress in developing our Digital division. Following the acquisitions in February 2019 of the business and certain assets of online loan provider CURO Transatlantic Limited (now trading as Dot Dot Loans) and online e-money current account provider U Holdings Limited in June 2019 we have been rightsizing the businesses to move their cost bases to an appropriate level for their size. The losses were slightly deeper than we had anticipated, but we are on track to transition the digital business to a break-even position over the coming 2 years.

Since the end of the year we have faced the challenge of managing the impact of Covid-19. The business has quickly introduced wide-ranging adaptations to our operating model to ensure the safety and wellbeing of our staff and self-employed agents and to enable us to maintain our high levels of customer service during this period. More information on the steps we have taken are set out later in my review.

Principal drivers of performance

HCC

We are delighted that – less than a year since launch – around 35% of our customers are interacting with us via our Morses Club online portal, which now has more than 78,000 users. Customers using the portal generate significantly higher levels of interest in further credit options, since they are able to request credit at any time, rather than relying on the weekly visit with their agents under our traditional model. In addition to the portal, customers have responded positively to remote payment methods and 41% of all collections were being made remotely by the end of the year.

The move to digital has been embraced by our agents, who understand that, although they earn lower commission on digital repayments, the reduced need for physical visits allows agents to serve a larger base of customers. Increasing penetration of digital transactions has increased our customer satisfaction levels and reduced cost. The shift to digital has also given us scope to allow the gradual natural attrition of our agent base. As agents retire or leave, we can reallocate their loan books to agents in adjacent areas, enabling us to reduce costs. These agents benefit from an increased customer base, which our enhanced technology, and remote payment methods enables them to manage. We are targeting the removal of £1m of cost pa in HCC field-based costs over the next 5 years, and are well on track to achieve this.

We continue to be open to high-quality acquisitions as a means of growing our customer base, where attractive opportunities arise.

Digital

The portal platform will be extremely important to our online lending and e-money current account businesses. Our research with HCC customers indicates that a high proportion of them want to use online banking services, and the portal will allow them to manage their home collected credit loans, agent interaction, Morses Club Card and their bank account.

Our HCC customers have an average of 27% of their debt with HCC providers and a further 36% with other providers, for example overdrafts. The portal allows us to offer customers the opportunity to consolidate their debt in one place. The independent market research we undertake monthly shows us that linked services continue to be of interest to our customers. In future we will seek to provide offerings to help customers manage their budget and access services such as utility switching and comparison services; if customers give us permission to access the data on their spend on these services, it will help us to tailor our offering still further to support their financial wellbeing.

Systems

Our technology platform developments are now significantly complete for HCC. We have made further enhancements to our Customer Relationship Management (CRM) telephony system and how this is used in our Nottingham contact centre, which will help to enhance and integrate the support across all our businesses as we target a substantial customer base using all 3 of our brands. Our loans platform, CRM platform and telephony are our focus for the next year for delivering integrated customer excellence and supporting our business plan.

External market

We saw minimal impact from the changes in lending regulations following the FCA’s review of high-cost credit, and implemented the small adjustments required to our processes in a timely manner.

Although HCC and parts of the associated market are generally unaffected by macroeconomic movements, increases to the national minimum and living wage levels are positive for our business as they support affordability decisions, and give our customers confidence in spending and borrowing. The impact of Covid-19 meant that from March 2020 onwards we adapted operational processes to ensure we maintained our service model for our existing customers.

In the digital space, we have observed a number of firms struggling to stay in business or acquire customers due to historical issues in relation to treating customers fairly. Providers with roots in payday lending have historical books that have since been classed as irresponsible lending, and claims management companies are targeting them. As some of these providers exit the market, there is scope for us to acquire good quality recently issued debt.

We are closely monitoring the impact of Covid-19 on our customers and the macroeconomic environment more broadly and have been able to adapt our business quickly to maintain business continuity and ensure we can support our customers.

Strategy

Our objective is to continue to listen to what customers tell us they want and to deliver it for them. Our research with our existing customer base indicates that consistently over 50% of them want to use our e-money current account services linked to a credit facility in the future, in addition to the relationship credit that they already have. We already have the technology platform in place, so our focus next year will be on the delivery of an intuitive customer journey and on communications and marketing as we seek to drive the penetration of e-money current accounts and digital credit products among our HCC customers to take an increased share of their credit demand away from the competition. We will also look to increase volume amongst the 8.5m non-HCC customers who are in the non-standard credit market of banking, long-term lending, revolving credit and short-term lending, as we strive to make our other 2 brands as profitable as our home collected credit brand in the longer term.

Capital allocation

At the end of April 2020 we secured an extension to our revolving credit facility of £40m to the end of November 2021. This funding level better reflects the ongoing requirements of the business, with reduced growth in the short/medium term, in a post Covid-19 world. This reduces the costs of funding whilst still giving us significant headroom in our existing facilities to achieve our ambitions and support the business at this challenging time.

People, culture and stakeholder engagement

We are delighted to have welcomed and retained the expertise of some highly experienced colleagues during the year.

Gary Marshall joined as Chief Operating Officer of Shelby Finance Limited in July 2019. His deep experience in online banking and insurance environments is already proving invaluable for the development of U Account and Dot Dot Loans as well as improving productivity and driving down costs. We are pleased to have retained the expertise of Les Easson, our previous Operations Director as he made the transition to a Non-Executive Director role. In addition, Andy Thomson, our previous Chief Financial Officer, has agreed to undertake the role of Interim Chief Financial Officer from 17 March 2020 and has stepped down from his current role as a Non-Executive Director.

We are proud of the people and culture at Morses Club. Our participation in the FCA’s Smaller Business Practitioner Panel is testament to the recognition by the regulator as a firm that does the right thing, treats customers fairly and has a deep-seated cultural belief in putting customers first.

During a period of significant change and innovation it is gratifying how the Morses Club team of employees and agents have continued to embrace developments. In recognition of the contribution made by our colleagues, we issued shares to all eligible staff and recently won an award for our employee share scheme. As part of our commitment to ongoing stakeholder engagement, we undertake monthly surveys with customers, to assess their satisfaction. In addition, we conduct quarterly surveys with customers to check their overall experience in dealing with us, as well as former customers annually. Our surveys include those customers whose loans may be in arrears, and who we may not lend to again. We take the time to consider all feedback from our customers, and their involvement in how we build our products and services is critical in developing our future strategy. It is encouraging that the consistent results of both surveys are 97% or more.

Covid-19

As a business, our focus will always be on lending responsibly and conservatively, putting the customer first whilst ensuring the safety and wellbeing of our employees and agents. We responded rapidly to the outbreak of Covid-19 just after the year end, successfully adapting our operating model to enable all our agents to work from home and replacing face-to-face customer visits with a remote customer communication strategy, which makes use of our existing technology platform and payment methods to maintain customer contact and collection activity. Our normal adherence to TCF principles and forbearance continues. The Company has decided not to furlough any of its staff and all staff and agents are continuing to work remotely in support of customers.

We have recently launched a new cashless remote lending product, which is available to all existing Morses Club HCC customers and is compliant with all regulatory requirements. All necessary checks and agreements are transacted via our online Customer Portal, leveraging our existing technology platform. Customers using the new remote lending product can choose to have funds deposited directly into their bank account or loaded onto a Morses Club Card, ensuring that existing customers can continue to access our products and services during this time.

Customer response to our remote operating model has been positive and we have successfully transitioned 40% of repayments from face to face to remote collections since the outbreak of Covid-19.

Outlook

The safety and wellbeing of our employees and customers remains our priority. Going forward we expect growing numbers of our customers to engage with us via our technology platform. We are also looking at ways to implement social distancing measures across our business to enable us to resume face-to-face visits and our loan offering to new customers in a safe environment. The Group remains highly cash generative as a result of the actions we have taken and post year end we have also secured additional funding to support the business at this challenging time. We will continue to focus on effective cash-flow management and this is supported by temporarily suspending home collected credit loans which involve cash, lending to new customers, significant tightening of online lending decisions, cutting discretionary expenditure and an increased focus on collections.

Over the longer term, in HCC, the growing adoption of the digital portal will create value for customers, agents and the Group, and the gradual evolution of our agent network will drive further economies in our cost base. In our Digital division, we are confident that our strategy of developing our digital lending and e-money current account brands will deliver a positive financial contribution, however, for the current year we anticipate continued losses, primarily as a result of not being able to increase volumes due to the impact of Covid-19, with profitability reached in FY22.

The Board recognises the difficulty in fully assessing the long-term operational impact of Covid-19 on the business and therefore considers it prudent to withdraw its financial guidance for FY21. In full consideration of all relevant circumstances, the Board will recommend payment of a dividend in February.

Paul Smith

Chief Executive Officer

Date: 27 November 2020