Morses Club PLC (LON:MCL), an established provider of non-standard financial services, has announced its interim results for the 26 weeks ended 29 August 2020.

Operational Highlights:

· Rapid and comprehensive response to Covid-19, leveraging existing digital technology and expertise

· Reconfiguration of lending, collecting and operating processes to ensure the safety of customers, employees and agents

· Remote lending to existing HCC customers recommenced just three weeks after March lockdown, in strict accordance with government guidance

· Focus on quality of lending which gives confidence in future repayment levels

· Remote lending to new HCC customers launched in July 2020

· Very positive customer response to digital HCC offering

· Significant progress in the development of a new loan management platform, now in final test phase to go live in December

· Customer satisfaction maintained at 97%

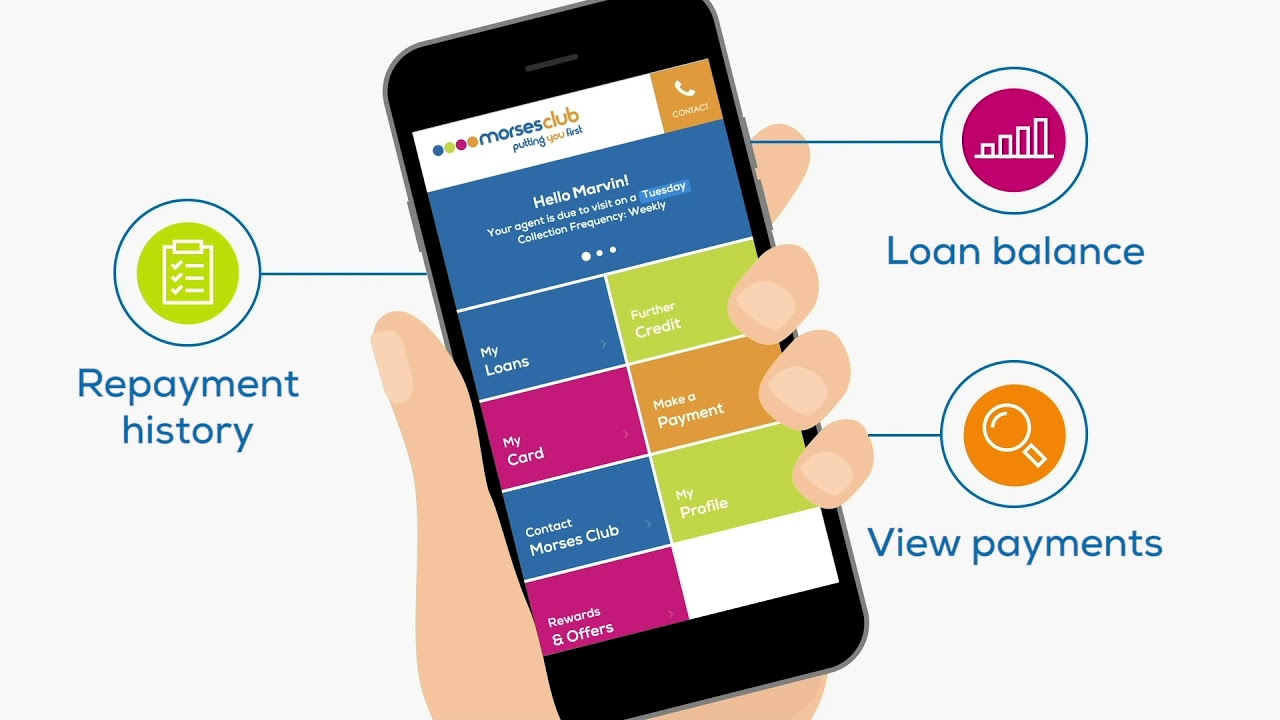

· Over 117,000 customers registered for customer portal as at 29 August 2020, rising to 124,000 currently (H1 FY20: nil)

· New service agreement with Modulr will provide enhanced products and services for U Account customers, due from early Spring 2021

· No staff furloughed nor any Government debt or other support packages applied for

· Total Group customer numbers: 205,000 (H1 FY20: 276,000)

Financial Highlights:

· Revenue decreased by 24.3% to £50.2m (H1 FY20: £66.3m)

· Total credit issued to all customers of £60.2m (H1 FY20: £91.0m)

· Total credit issued to HCC customers was 40.2% lower at £51.1m (H1 FY20: £85.5m)

· Net loan book of £55.6m, reduced 23.0% (H1 FY20: £72.2m)

· Adjusted profit before tax1 of £2.3m (H1 FY20: £9.6m)

· Statutory profit before tax of £0.8m (H1 FY20: £6.7m)

· Adjusted HCC profit before tax1 of £6.8m, a decrease of 48.1% (H1 FY20: £13.1m)

· Statutory HCC profit before tax of £5.6m, a decrease of 52.1% (H1 FY20: £11.7m)

· Adjusted loss before tax1 in Digital division of (£4.5m) as a result of enhancing scale and capability of recent acquisitions (H1 FY20: (£3.5m))

· Statutory loss before tax in Digital division (£4.8m) (H1 FY20: (£5.0m))

· Impairment as a percentage of revenue1 for the period 23.5% (H1 FY20: 19.0%)

· Adjusted return on assets1 of 9.9% (H1 FY20: 24.0%)

· Adjusted EPS1 of 0.6p (H1 FY20: 5.9p)

· Statutory EPS of 0.5p (H1 FY20: 4.1p)

· Proposed interim dividend of 1.0p pence per share (H1 FY20: 2.6p)

1. Definitions are set out in the Glossary of Alternative Performance Measures on page 35

Alternative Performance Measures & Key Performance Indicators

| Key performance indicators | 26-week period ended 29 August 2020 | 27-week period ended 31 August 2019 | % +/- |

| Revenue | £50.2m | £66.3m | (24.3%) |

| Net Loan Book | £55.6m | £72.2m | (23.0%) |

| Adjusted Profit Before Tax1 | £2.3m | £9.6m | (76.0%) |

| Statutory Profit Before Tax | £0.8m | £6.7m | (88.1%) |

| Adjusted Earnings per share1 | 0.6p | 5.9p | (89.8%) |

| Statutory Earnings per Share | 0.5p | 4.1p | (87.8%) |

| Cost / Income ratio | 67.5% | 63.9% | (5.6%) |

| Return on Assets | 7.0% | 19.1% | (63.4%) |

| Adjusted Return on Assets1 | 9.9% | 24.0% | (58.8%) |

| Return on Equity | 9.5% | 22.6% | (58.0%) |

| Adjusted Return on Equity1 | 13.4% | 28.4% | (52.8%) |

| Tangible Equity / average receivables1 | 74.2% | 84.5% | (12.2%) |

| No of customers (000’s) | 205 | 276 | (25.7%) |

| Number of agents | 1,584 | 1,817 | (12.8%) |

| Credit Issued | £60.2m | £91.0m | (33.8%) |

| Impairment as % of Revenue1 | 23.5% | 19.0% | (23.7%) |

1. Definitions are set out in the Glossary of Alternative Performance Measures on page 35

Paul Smith, Chief Executive Officer of Morses Club, commented:

“In response to the Covid-19 pandemic, Morses Club responded decisively, leveraging its digital expertise and capabilities to accelerate its strategy of servicing customers remotely.

“Within just three weeks of lockdown in March, we recommenced lending to existing HCC customers and launched digital lending to new HCC customers in July 2020. Credit issued and collections in the HCC division were inevitably impacted by the loss of face-to-face interaction, but customers responded very positively to our remote HCC lending product with c. 65% of loans now being delivered through bank transfer. The acceleration of the digitalisation of our business can only serve to improve choice and flexibility for our customers, employees and agents.

“Our Digital division continues to make strong progress. In August, we announced a new strategic relationship with Modulr, which will enable us to offer services not typically available outside of mainstream banking providers. The forthcoming launch of our improved mobile application and new lending products by the end of this financial year will deepen and broaden our customer base further.

“The way in which Morses Club has responded to the unprecedented challenges posed by Covid-19 is something that I am extremely proud of. I am hugely grateful to our colleagues across the company, all of whom went the extra mile to ensure that our customers’ needs were met and continued to receive excellent customer service.

“The speed of progress we have made across the Group in the period is testament to our investment in technology over a number of years and Morses Club is well-placed to become a more complete financial services provider in the growing and fragmented non-standard credit sector.

“Whilst we are pleased with the undoubted resilience shown by the business during H1, we are fully cognisant of the impact on consumer confidence due to the ongoing lockdowns across the UK, which directly affects the communities we serve. We accept that market conditions remain challenging but are confident that our approach will continue to deliver improvements.”