Morses Club plc (LON:MCL) Chief Executive Officer Paul Smith joins DirectorsTalk to discuss its latest trading update. Paul explains how the company has performed since lockdown, changes implemented over the period, an accelerated shift towards the Company’s digitalisation and how Paul sees the rest of the year for Morses Club.

Morses Club is an established provider of non-standard financial services in the UK. The Group consists of Morses Club, the UK’s second largest home collected credit provider, and Shelby Finance Limited, the company’s digital division, which operates under two online brands, Dot Dot Loans, an online lending provider, and U Account, which offers online e-money current accounts. The Group’s growing digital capabilities and scalable, highly invested IT platform has enabled it to deliver an increasingly broad range of financial products and services to the non-standard credit market.

UK HCC is considered to be a specialised segment of the broader UK non-standard credit market. UK HCC loans are typically small, unsecured cash loans delivered directly to customers’ homes. Repayments are collected in person during weekly follow-up visits to customers’ homes. UK HCC is considered to be stable and well-established, with approximately 1.6 million1 people using the services of UK HCC lenders.

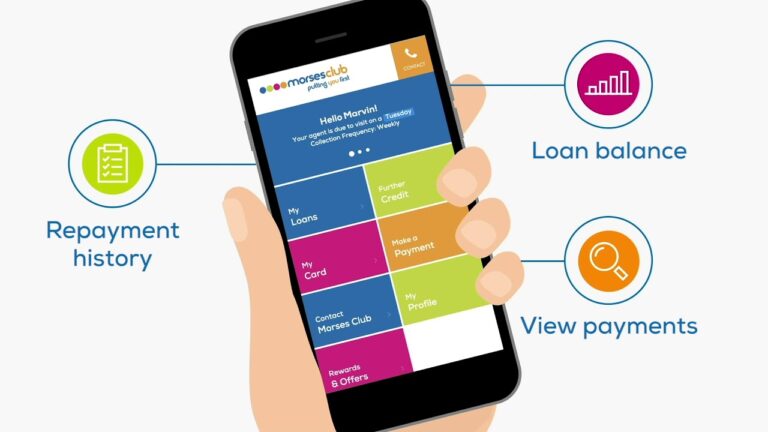

The HCC division is the second largest UK Home Collected Credit (HCC) lender with 224,000 customers throughout the UK. The majority of the Company’s customers are repeat borrowers and the HCC division enjoys consistently high customer satisfaction scores of 97%2. In 2016, the Morses Club Card, a cashless lending product, was introduced and in 2019 the Company introduced an online customer portal for its HCC customers, which now has over 109,000 registered customers.

The Group’s growing digital division, Shelby Finance, operates under two online brands. Dot Dot Loans provides online instalment loans of up to 48 months to 37,000 active customers. U Account is a leading digital current account provider offering an alternative to traditional banking by providing a fully functional agency banking service. U Account currently has c. 18,000 customers.