Morses Club Plc (LON:MCL) key message from the H1FY18 results is that it confirms MCL’s fundamental approach to business. It is building a long-term franchise, carefully assessing risk and returns and prioritising resource to the most value-added area. In this period, the unique opportunity in home collect credit (HCC) was clearly the priority. Book acquisitions and some other new product areas were temporarily less of a management focus although we expect growth from them in due course. The modest online lending pilot is still in pilot stage and will be rolled out carefully. FY19 estimates are broadly unchanged (EPS up 24% on FY17).

Morses Club Plc (LON:MCL) key message from the H1FY18 results is that it confirms MCL’s fundamental approach to business. It is building a long-term franchise, carefully assessing risk and returns and prioritising resource to the most value-added area. In this period, the unique opportunity in home collect credit (HCC) was clearly the priority. Book acquisitions and some other new product areas were temporarily less of a management focus although we expect growth from them in due course. The modest online lending pilot is still in pilot stage and will be rolled out carefully. FY19 estimates are broadly unchanged (EPS up 24% on FY17).

HCC agent opportunity: MCL confirmed that nearly 600 agents and managers joined (filling vacancies and replacing some underperforming agents the net territory builds was c400). Critically these agents have been added without disruption to the existing HCC business and are performing ahead of plan.

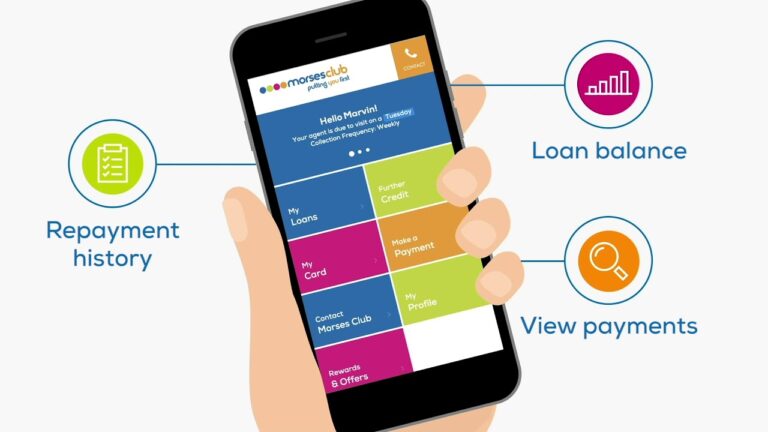

Other growth plans: There were no acquisitions in the period. This partially reflected market conditions and also the management focus on new agents which provide a longer-term revenue stream. H1FY18 was primarily a period of developing and integrating IT and risk model testing in the online loan area.

Valuation: Our range of absolute valuation approaches indicate a fair value would be around 178p (previously 177p) with the Gordon’s Growth Model (which capture both value added and growth) having the highest valuation at 198p. Both have increased sharply with the higher earnings and equity forecast.

Risks: Credit risk is high (albeit inflated by accounting rules) but MCL adopts the right approach. Regulatory risk is a factor. HCC has already been reviewed and high customer satisfaction suggests limited need for change. MCL was the first major HCC company to get a full FCA authorisation.

Investment summary: We believe Morses Club Plc is operating in an attractive market and has a dual-fold strategy which should deliver an improved performance from existing businesses and over time deliver new growth options. MCL conservatively manages risk and compliance, especially in new business areas. The agent network is the competitive advantage over remote lenders. The valuation has material upside. Our 2018E dividend yield is 5.2% with cover of. 1.9x (adj. EPS).