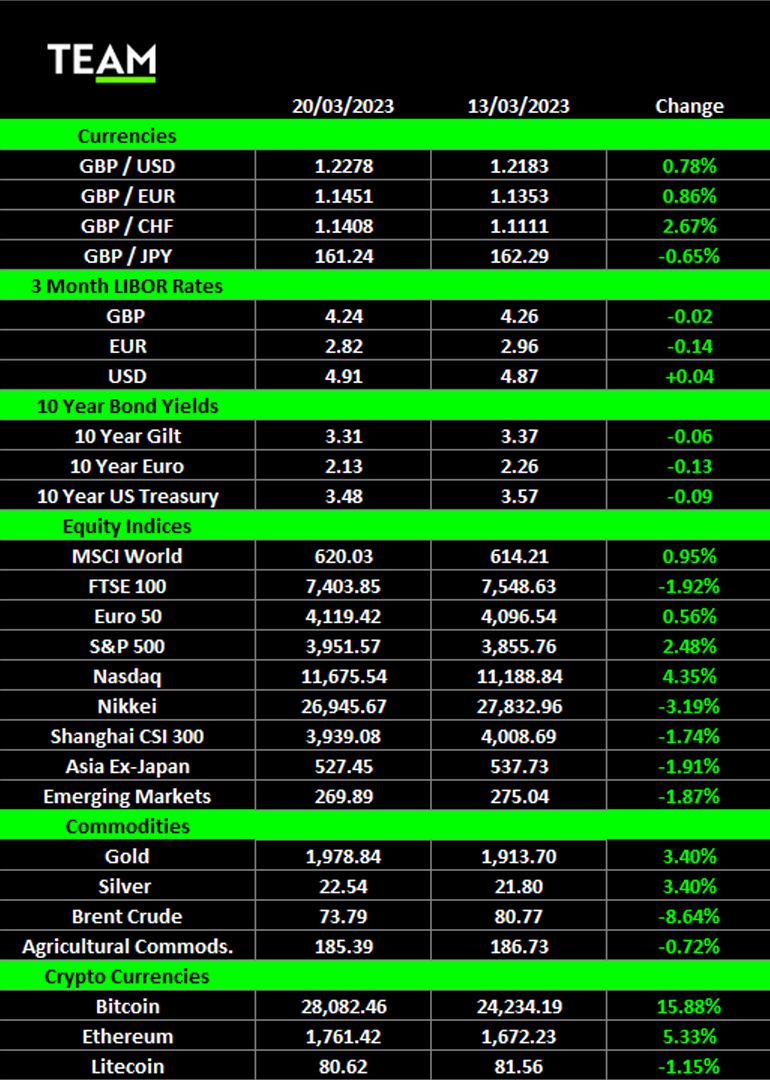

TEAM Asset Management’s global weekly market review for week commencing 13th March 2023. TEAM Asset Management is a Jersey-based independent asset management company of AIM-listed parent, TEAM plc (LON:TEAM).

Markets endured another volatile week as banks lurched from one crisis to another. Investors sought refuge in tradition safe-haven assets, government bonds and precious metals, before appetite for risk recovered. The blue-chip S&P 500 index ended up 2.5% higher.

Silicon Valley Bank’s failure led to a run on US regional banks and claimed another victim, Signature Bank. Another, First Republic Bank, has been propped up by $30 billion of deposits from the largest US banks but its share price continues to crater and it remains vulnerable.

However, when Credit Suisse moved into the spotlight, it became much more serious. The 167-year-old bank has a global footprint with a balance sheet around twice the size of Lehman Brothers’ when it collapsed in 2008. Credit Suisse has been beset by scandal over the past 3 years but a restructuring plan was underway under new leadership.

On Wednesday the chairman of its largest shareholder, Saudi National Bank, told reporters that they would “absolutely not” provide any more financial assistance to the Swiss lender and by the end of the weekend, an agreement was in place for UBS to buy Credit Suisse for just 3 billion Swiss francs. In between there was another run on deposits as clients raced to get their cash out of the bank.

The government-brokered rescue will impose large losses on holders of Credit Suisse shares and bonds. Shareholders will receive CHF0.76 a share in UBS stock, 70% less than where Credit Suisse shares were trading at the start of last week.

The outcome for holders of its Additional Tier 1 bonds was even worse. FINMA, the Swiss financial regulator, determined that the bank was no longer a viable going concern without which triggered the bonds with a face value of $17 billion to written down to zero.

AT1 bonds, or ‘CoCos’, were created in the wake of the 2008/09 financial, designed to be loss absorbing at times of distress. However, the rules are clear and equity holders should be hit before anyone else in an insolvency. A different rule book was applied for Credit Suisse and shareholders remain in the game.

The move caused some chaos in the wider $260 billion AT1 market on Monday and bonds issued by other major European banks fell as much as 20% as it struggled to absorb investors wanting to offload positions. Regulators in the EU and UK were compelled to step in and reiterate that holders of AT1 bonds should bear losses after equity which helped to restore some calm later in the day.

Prior to the events in Switzerland over the weekend, the European Central Bank’s interest rate decision was a focal point for in investors. Many thought the stresses in the financial system would persuade policymakers to ease up but in the end they voted to increase Europe’s benchmark deposit rate by 0.5% to 3.0%.

Inflation continues to run hot in Europe, annual CPI was 8.5% in February, and higher rates are needed to bring it back down towards the ECB’s target rate. The majority of the governing council were also mindful that the interest rate hike would demonstrate confidence in the health of the Eurozone’s banks despite the stresses elsewhere.

Amidst the noise, it was understandable the UK budget received less attention than usual and after the bombshell mini-budget in the autumn, it was also a relief that Chancellor Jeremy Hunt kept it low key.

The Office for Budget Responsibility gave the chancellor a boost, predicting the UK will avoid falling into recession this year and inflation to ease back to around 3% by the end of the year due to lower energy prices. The more upbeat outlook gave Jeremy Hunt a bit more room for manoeuvre, including expanding free childcare and scrapping the £1 million tax-free pension cap to encourage more individuals to go back to work.

The turmoil in the banking sector pulled Brent crude down to a 15-month low of $70 a barrel on Monday as members of the OPEC+ cartel voiced some concern that there could be a rerun of the 2008 crisis. However, it recovered to $74 by end of the day, in line with moves in the broader markets.

Author: Andrew Gillham, TEAM Asset Management, Senior Investment Manager, ([email protected])