TEAM Asset Management is a Jersey-based independent asset management company of AIM-listed parent, TEAM plc (LON:TEAM).

In TEAM’s weekly market commentary, TEAM’s investment managers provide a stock market review for week commencing 2 January 2023.

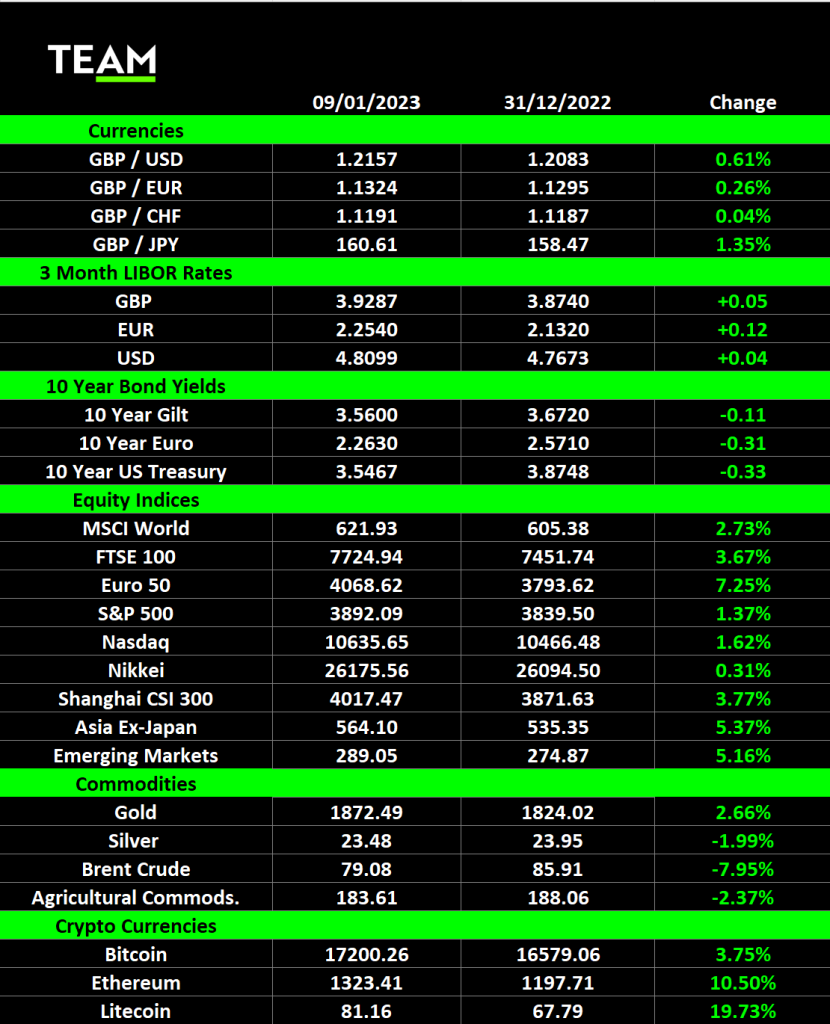

Stock markets around the world got off to a positive start in 2023, buoyed by more evidence that inflation is slowing and optimism over China reopening its borders. Global stocks returned 2.7%, led by strong gains in Europe (+7.3%).

Markets ended 2022 on the back foot after central banks warned they will keep hiking interest rates well into this year but inflation reports released last week offered some hope that they will be able to take their feet of the peddle.

Annual inflation in the Eurozone fell faster than expected in December to 9.2% according to the European Statistics agency. It ends a two-month run of double digit inflation, including a record 10.6% in October, and in large part reflects lower energy prices.

Natural gas prices have fallen from a peak of €350 per megawatt hour in August to €72, lower than at the start of the conflict in Ukraine. Europe has managed to secure shipments of gas from alternative sources away from Russia, including Qatar and the United States, and higher temperatures than normal for this time of year have reduced demand for energy for heating.

Later on Friday, the monthly nonfarm payrolls report revealed the US economy added a better than expected 223,000 jobs in December and the unemployment rate fell to an historic low of 3.5%. However, the biggest surprise from the report was the cooling in annual wage growth to 4.6%, the smallest increase since August 2021.

Emerging markets are off to a fast start to 2023, led by improving investor sentiment towards China as authorities rapidly unwind its zero-Covid policy. Over the weekend, China relaxed its rules further to permit inbound travellers to visit without any need to quarantine so long as they have proof of a negative PCR test taken within 48 hours of travel. Ten of thousands crossed the border between Shenzhen and Hong Kong and the high speed rail linked will be re-established by mid-January.

A couple of British banks with long established presences in the region have been standout performers in the FTSE 100 in the early days of the new year. Standard Chartered and HSBC have gained 12.0% and 10.3% respectively. Aside from the re-opening of the Chinese economy, both were lifted after First Abu Dhabi Bank revealed it had explored an offer for Standard Chartered before deciding against it. The interest has led to speculation it may encourage others to have a closer look at the bank.

Whilst stock indices are higher across the board in the new year, there are some high-profile companies which have missed out so far, including Tesla and Microsoft. Tesla shares, which fell 65% last year as demand weakened and Elon Musk sold almost $40 billion worth of stock to fund his acquisition of Twitter, tumbled another 12% on the first day of trading in 2023. Although it reported that it delivered a record 1.31 million electric vehicles in 2022, including 405,278 in the fourth quarter, it fell short of analysts’ expectations.

Microsoft shares, down 40% last year, fell another 5% in the early days of 2023 after analysts at UBS downgraded their recommendation for the company to neutral from a buy. The change reflects their concerns that revenue growth at its cloud platform Azure will slow more than investors are expecting over the next couple of years.

Energy markets have been another notable laggard in the new year and Brent crude fell 8% to $79 a barrel in anticipation that slowing economic growth in the US and Europe will dampen demand in the year ahead. The spike in reported cases of Covid-19 coming out of China also impacted sentiment.

TEAM plc (LON: TEAM) is building a new wealth, asset management and complementary financial services group. With a focus on the UK, Crown Dependencies and International Finance Centres, the strategy is to build local businesses of scale around TEAM’s core skill of providing investment management services. Growth will be achieved via targeted and opportunistic acquisitions, through team and individual hires, through collaboration with suitable partners, and organic growth and expansion. TEAM Asset Management is a Jersey-based independent asset management company of AIM-listed parent, TEAM plc.