KRM22 plc (LON:KRM) has today announced a trading update for the 12 month period to 31st December 2020.

The Company continued to make good progress during the year, winning top tier institutions as customers. Increases in new contracted ARR have been offset by churn in its existing customer base as firms inevitably adjusted to the new trading environment as a result of COVID-19.

For FY2020 the Group expects to report:

· A significantly improved adjusted EBITDA loss of approximately £0.1m (FY2019: loss of £3.1m)

· Revenue of approximately £4.6m (FY2019: £4.1m)

· Gross cash as at 31 December 2020 was £2.0m (FY2019: £1.1m)

· ARR at 31 December 2020 of £4.3m (FY2019: £4.3m) at the 2020 constant exchange rate (£4.1m at current rates)

o New contracted ARR in FY2020 of £0.8m, reflecting a gross organic growth rate of 19%

The Company has a near term pipeline of a further £0.5m ARR of deals which are in final contract negotiations and which are expected to be signed in Q1 2021. In addition to this the Company has a strong pipeline of opportunities for 2021. Whilst the net contracted ARR has remained static at £4.3m, the new contracted ARR in FY2020 is made up of higher quality customers. Sterling’s continued strengthening against the US dollar has had a negative impact on contracted ARR as described above.

The Board is pleased to note that the Company signed contracts with two, tier one banks in the second half of the year. One of the contracts covered a pre implementation phase for the At Trade Market Risk product, which will lead to significant contracted ARR in 2021. The second contract for £0.2m ARR was signed in December for the Pre Trade Market Risk product.

The total new contracted ARR in FY2020 of £0.8m is spread across different risk domains including £0.5m on Market Risk products, £0.2m on Compliance Risk products and £0.1m on Enterprise Risk products. The new contracted ARR is derived from six new customers, including top tier institutions, and two existing customers. The sale of new risk products to existing customers and the signing of a contract for a suite of products to a UK Brokerage firm, as referred to in the announcement of August 2020, demonstrates KRM22’s ability to simplify the cost and complexity of risk management through technology delivered on one platform as a one-stop service.

The total churn in FY2020 for institutional customers was £0.8m which included some legacy customers acquired through previous acquisitions. In addition, a number of our trader customers were lost as they were unable to trade due to the CME floor being closed as a result of the COVID-19 lockdown. The overall level of churn in FY2020 has been significantly higher than we have experienced historically or was expected but management expects this to stabilise in 2021. We settled the disputed contract referred to in previous announcements in December. While in our view our case was strong, we decided that the agreed settlement was pragmatically the right action to avoid the uncertainty, distraction and cost of litigation. The balance has been written off in FY2020.

Costs continue to be under tight control however we have started to phase back the voluntary salary sacrifices in Q4 2020, with phased full reinstatement starting in January 2021 and expected to complete in January 2022.

The Group’s net debt as at 31 December 2020 was £1.0m (31 December 2019: £0.9m) and included cash of £2.0m and gross debt, relating to the three-year convertible loan that was signed with Kestrel Partners LLP in September 2020, of £3.0m (31 December 2019: cash of £1.1m and gross debt of £2.0m).

The Company expects to report full year results for the year to 31 December 2020 on 16 March 2021.

Keith Todd, Executive Chairman and CEO at KRM22, commented: ‘The year has been challenging but we have made good progress in improving the quality of our customer revenue base with increased cross sale opportunities and a significant reduction in our adjusted EBITDA loss. The strengthened balance sheet provides a sound financial base for 2021.

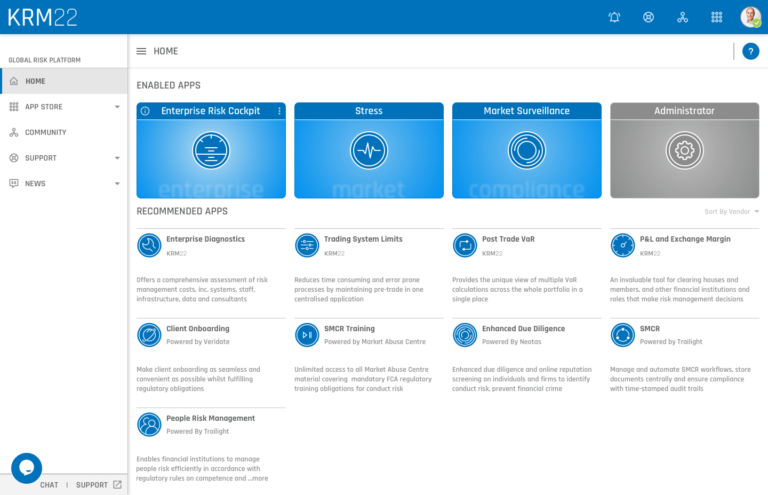

Our Global Risk Platform has matured well and has an increasing positive impact in creating new sales opportunities.

The KRM22 business is in a much stronger position than a year ago and is well placed for growth in 2021.’