KRM22 plc (LON:KRM), the technology and software company focused on risk management in capital markets, has announced its audited results for the year ended 31st December 2020.

Financial highlights

· Total revenue recognised of £4.6m (2019: £4.1m)

· A significantly improved adjusted EBITDA loss1 of £0.2m (2019: £3.1m)

· Annualised Recurring Revenue (ARR)2 as at 31 December 2020 of £4.3m (2019: £4.3m) at the 2020 constant rate (£4.1m at current rates)

o New contracted ARR in the year ended 31 December 2020 of £0.8m

· Gain on extinguishment of debt (net) of £0.7m

· Impairment of intangibles of £3.0m (2019: £2.3m)

· Loss before tax of £5.7m (2019: loss of £7.3m)

· Group Cash at 31 December 2020 of £2.0m (2019: £1.1m)

· Net increase in cash and cash equivalents of £0.9m (2019: outflow of £2.3m)

· Completed two capital raises in the year

o An equity fundraise in May 2020 raising gross proceeds of £1.3m through a placement and subscription for new ordinary shares

o Replacement of the Harbert £10.0m loan facility, of which we had drawn down £1.0m in 2019, with a new £3.0m convertible loan facility with Kestrel Partners in September 2020

Operational highlights

· Acquisition of remaining 40% shareholding in KRM22 Market Surveillance in April 2020

· Managing the impact of COVID-19 with KRM22 with the Company being fully operational, globally, from home as a result of internal infrastructure and process implemented from launch

· Group restructure, with annual cost savings of £0.7m

· Soc 2 accreditation approved in March 2021

Keith Todd, Chief Executive Officer and Chairman of KRM22 plc, commented:

“2020 was a challenging year but we made good progress with new customer wins, improved quality of the customer base, the expansion of the Global Risk Platform (GRP) and a significant reduction in the Adjusted EBITDA loss. We now have a strong sales pipeline and suite of risk products on the GRP that will be the springboard for our future growth and delivery of the market expectations.”

1Adjusted EBITDA is the reported loss for the year, adjusted for recurring non-monetary costs including depreciation, amortisation gain on extinguishment of debt, unrealised foreign exchange loss, deferred salary bonus accrual write back and share-based payment charges and non-recurring costs including profit/(loss) on tangible/intangible assets, impairment charges, reorganisation costs and acquisition and funding costs.

2 Annualised Recurring Revenue (ARR) is the value of contracted Software-as-a-Service (SaaS) revenue normalised to a one year period and excludes one-time fees.

CHAIRMAN’S STATEMENT

KRM22 continued to make good progress in 2020, winning top tier institutions and broadening its product offerings delivered through the Global Risk Platform. We are creating a powerful platform to help capital markets participants manage risk. The Company reported a small, adjusted EBITDA loss for the year of £0.2m compared with an adjusted EBITDA loss of £3.1m in 2019 on revenue of £4.6m (2019: £4.1m).

We completed one equity capital and one debt capital raise in 2020 to provide working capital and strengthen the balance sheet. This, together with the improving financial performance, provides KRM22 with a strong financial base for 2021.

When we started 2020, we did not envisage the dramatic impact the pandemic would have on the operating environment. In April 2020, we implemented cost cutting actions through a voluntary salary waiver that all team members participated in and general overhead reductions. In June 2020, we made some roles redundant as we continued to adjust to a slowing business climate. Travel was suspended and all team members operated from home from March 2020. There was little impact on our operating effectiveness as a result of the infrastructure and processes that we implemented from launch in 2018.

Our customers and prospects were however significantly impacted. Across the board the high volume of trading in March 2020 and April 2020, at a time when they were implementing home working for the first time, meant that there was no time for new initiatives and therefore consideration of our products was not an immediate priority. Whilst trading activity had evened out by the middle of the third quarter, adjustments to normal business practices had to be absorbed to support prospect and customer engagement through remote channels versus in person visits. The consequence of this was significant delays in new customer signings. However, despite this new contract wins in the year included the sale of new risk products to existing customers and the signing of a new contract for a suite of risk products with a major London based brokerage firm, with the customer seeing the benefits of our ability to simplify the cost and complexity of risk through technology delivered on one platform as a one-stop service. This impacted the carrying value of our intangibles, including goodwill, asset base too. We experienced an unprecedented impact of churn in the year as traders withdrew from trading while the trading pits were closed or suspended as well as some customer retrenching and reducing external spend. While some churn in 2021 can be expected as part of any market, we anticipate the level of churn going back to more normalised levels.

Market

As we enter 2021, we are seeing strong engagement from prospects and existing customers.

Regulators are moving to an enforcement phase with increasing fines and threats of fines covering a plethora of regulatory areas. The pressure on cost efficiency, alongside regulatory compliance is top of the agenda.

Vision and mission

Our vision ‘A world in which organisations operate at their optimal threshold of risk to drive increased returns’ and mission ‘To bring increased visibility and lower cost risk management to capital market organisations’ have not changed since our inception.

Our ability to offer integrated functionality as a technology service significantly reduces the cost and complexity of managing risk for our customers. Most organisations are, in today’s market, tackling the challenges of an increase in costs added to historically costly infrastructure leading to a motivation to reduce cost. We are however on a journey with our customers to help them optimise business performance and thus deliver superior returns to their shareholders. We do this by providing cost effective risk tools as a service that eliminate multiple distinct applications that demand separate infrastructure and data sources. The replacement solution is one holistic Global Risk Platform that operates a series of risk based business processes, increasingly supported by AI tools, that operate on one single data source. As our journey progresses, and with customer agreement, we will be able to create risk benchmarks and indices that will fundamentally change how the industry measures itself. It is a truly exciting journey we are on.

What we sell

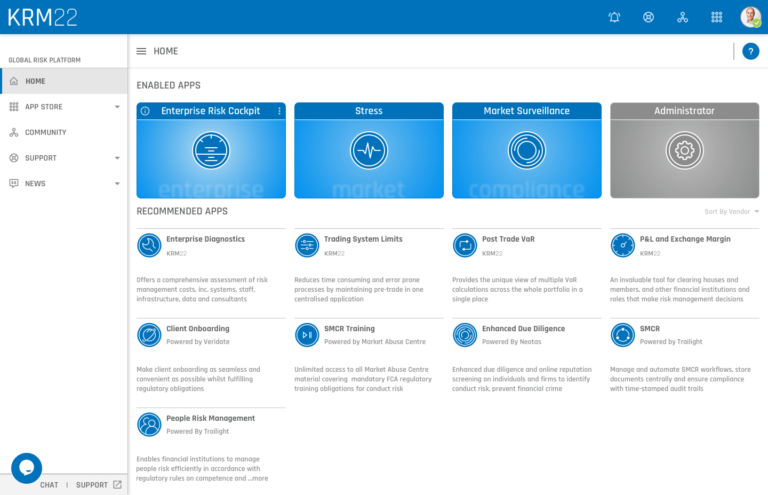

We position our product offerings within five domains of risk Enterprise, Market, Compliance, Operations and Technology. They are delivered through our single Global Risk Platform.

The Global Risk Platform is not sold as a separate product, it comes with any functional offering and includes the ability to receive news feeds, raise support questions and provides insight to other integrated risk offerings that are not currently used by the customer. The Global Risk Platform provides the unifying glue between the offerings, reduces integration costs and provides a platform for our growth. Our product offerings are supported by experienced subject matter experts which prospects and customers leverage to help define and manage risk on new instruments, respond to regulatory changes and build the ultimate risk platform tailored for each customer.

Our ‘Risk Cockpit’ offering has a full range of functionality to support real time enterprise risk as well as other department use cases. We have found that the application of what we know as the Risk Cockpit to have specific use cases within operations, compliance as well as others such as people and culture risk. The structured accountability framework, along with integrated risk functionality and dashboards, provides customers with a holistic view of a risk area and the ability to track and improve risk management. We are now exploring the use of AI to help predict risk events. This will become an add on sale to the core Risk Cockpit.

Our Market Risk offerings cover the life cycle of risk: Pre-trade, At-trade and Post-trade risk. The offerings are used across the spectrum of customers from Tier one banks to traders.

Our Compliance offerings cover a full range of regulatory requirements, the anchor of which is surveillance but extends across market abuse online training, digital on boarding (Know Your Customer) as well as regulatory reporting, enhanced individual due diligence and senior management regime. Our Compliance offering includes many partner products which expand what we can do for customers and leverages the partners investment in offerings as well as subject matter expertise.

We launched our People and Culture Risk offering in February 2021 in conjunction with Kintail Consulting as part of our Operations offering. This will leverage the Risk Cockpit functionality and online training partnerships and specifically addresses one of the industries key risk areas as identified by the Regulators – people and culture.

How we sell

We have a clear focus for increasing sales, starting with expanding sales to current customers and then targeting people we know and who are within our addressable market. We are increasing our online marketing presence as we are no longer able to attend physical industry conferences due to the pandemic. We specifically target a range of buying points within a customer organisation so that we can benefit from the master services agreement we have and internal cross referencing about the positive KRM22 experience.

Strategy

Our strategy consists of six core pillars that ensure we build a successful company.

| ‘Foundation of the business’ | ‘Driving Growth’ |

| Technology as a service | Organic growth |

| Business automation | Acquisitions |

| Team effectiveness | Partnerships |

Technology as a service

At the heart of our philosophy is the concept of reducing the cost and complexity of risk management for customers through technology delivered on an open platform, while driving increased business margins for investors.

Organic growth

Organic growth is the central tenant of our business approach. In 2020 we secured £0.8m of new business however this organic growth was offset by an unprecedented level of existing customer churn in the year. We have implemented a sophisticated customer relationship management system that provides visibility and allows us to manage and track sales activities through completion of sales opportunities. We have a very strong pipeline of prospects across Enterprise, Market, Compliance and Operations risk.

Business automation

We have implemented extensive business automation to ensure we have a scalable operational foundation covering customer acquisition, service delivery and through to financial control and administration. This will ensure that as we increase margin, we will also improve the bottom line performance.

Acquisitions and commercial partnerships

We have been clear from the start of KRM22 that we build, acquire and partner to bring products to the Global Risk Platform and therefore to our customers and prospects. We have established partnerships to complement our existing portfolio across Market, Compliance and Operations risk. We had to hold back on acquisitions and further partnerships in 2020 but we look to reignite these initiatives in 2021.

Team effectiveness

The investment in the team we have recruited and acquired is at the heart of our business. Team members know their roles and that KRM22 operates under the philosophy that business is a team game. The Board and I would like to thank the team for their commitment and work during a difficult year.

We are fully committed to our stakeholders including the communities in which we work. The Executive team and Board will take further action to establish a more comprehensive Environmental, Social and Governance (“ESG”) programme in 2021.

Outlook

After a challenging 2020, we have entered the new financial year stronger than last year. A higher quality of customers that can grow with us and an extensive sale opportunities and prospects list, together with vaccines helping to bring the pandemic under control, we are confident of continuing our growth and delivering market expectations.

Keith Todd CBE

Executive Chairman and CEO