KRM22 plc (LON:KRM), the technology and software investment company, with a particular focus on risk management in capital markets, announced its unaudited interim results for the six months ended 30th June 2021.

Highlights

Financial

· Annualised Recurring Revenue* (“ARR”) of £3.7m at 30 June 2020 (H1 2020: £4.0m)

· Total revenue recognised of £2.2m (H1 2020: £2.3m)

· Adjusted EBITDA loss** of £0.3m (H1 2020: loss of £0.3m)

· Loss before tax of £1.7m (H1 2020: £1.2m)

· Cash and cash equivalents at 30 June 2021 of £1.4m (FY 2020: £2.0m)

Operational

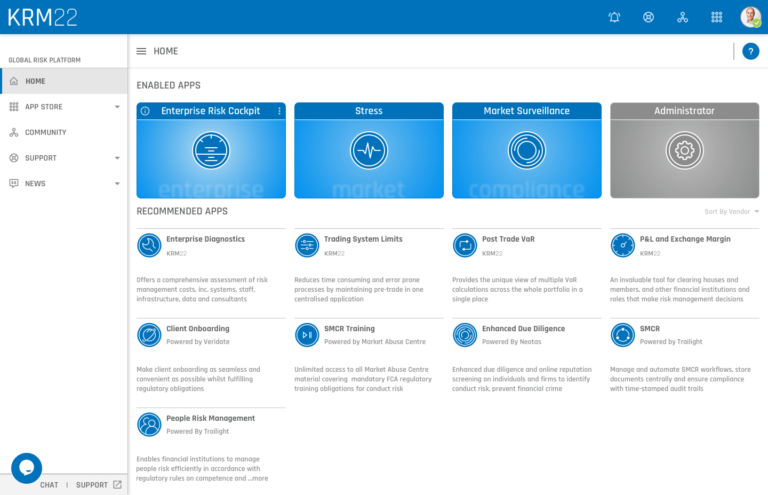

· Two new Market Surveillance customers

· An existing Pre-Trade Risk customer adding the Market Surveillance product to their Global Risk Platform

· A five-year renewal with a major European Bank for the Market Surveillance product, with increased ARR on an annual basis over the term of the contract

· Launch of People and Culture Risk offering in February 2021

· New partnerships signed with Waymark, to provide compliance scanning of regulatory changes, and Lexis Nexis, to provide Exchange Data News Service to the Global Risk Platform

· Soc 2 accreditation approved in March 2021

Post-Period Events

· Signed a three-year contract extension with to an existing tier one customer, with ARR of £0.4m per year, an increase in existing ARR of £0.15m per year

· Growth in ARR to £3.9m

* Annualised Recurring Revenue (ARR) is the value of contracted Software-as-a-Service (SaaS) revenue normalised to a one year period and excludes one time fees

** Adjusted EBITDA is the reported profit/(loss), adjusted for depreciation, amortisation, share-based payment charges and unrealised foreign currency gains/losses and non-recurring exceptional costs including impairment charges, reorganisation costs, gain on extinguishment of debt and acquisition and funding costs, gain/loss on disposal of property, plant and equipment

Commenting on the results, Executive Chairman and CEO of KRM22, Keith Todd CBE, said:

“We have made good progress in the year expanding our offering and improving the quality of our recurring revenue while maintaining a tight handle on costs. Delays in signing some larger orders is frustrating but larger customers will lay the bedrock for further shareholder value creation in the future.”

CHAIRMAN’S REPORT

The Company has made progress in the first half of 2021, with new Annual Recurring Revenue (“ARR”) derived from new customers, sales of new products to existing customers and existing customer contract renewals with extended contract terms and increases in ARR over the new contract term, all of which has further strengthened the quality of the Company’s ARR.

Annual recurring revenue

As of the date of this report, the Company has total ARR of £3.9m. In addition to the new ARR signed in the year to date of £0.4m, the pipeline of sales opportunities remains strong with £0.5m of ARR with agreed contracts awaiting signature plus a further £0.2m in final discussion ahead of contract negotiation. We are also seeing strong engagement with new high-quality prospects. The delay in signing these contracts is frustrating but unfortunately not uncommon when dealing with global banks.

As previously announced in the update on 22 July 2021, the Company did see two customer losses worth an aggregate of £0.5m ARR, one as it transitioned legacy business to its current business model of delivering Software as a Service and a second due to the impact of a customer non-payment of invoices and therefore non-renewal.

Our new business since the start of the year includes two new Market Surveillance customers, an existing Pre-Trade Risk customer adding the Market Surveillance product to their Global Risk Platform, a five-year renewal with a major European Bank for the Market Surveillance product with increased ARR on an annual basis over the contract term and a three-year contract extension with a tier one customer for use of the Enterprise Risk Cockpit, increasing ARR by £0.1m to £0.4m per year, with the contract including an option to increase ARR further by up to £0.2m from March 2022.

Since KRM22 was set up in 2018, new business wins have increased from £0.2m in FY 2018, £0.7m in FY 2019, £0.8m in FY 2020 and £0.4m in the year to date in 2021. The Company also has further opportunities across its product suite and is anticipating increased ARR contract signings in the second half of the year.

We are working on several initiatives to reduce the time to convert opportunities to contracts including:

· Transition of our historic ARR contracts to a Master Services Agreement (“MSA”) under longer-term contracts which reduces significantly the time to contact for additional sales. These, together with new business wins that are also contracted under an MSA, now represent 58% of total ARR;

· Achieving SOC2 Type 1 accreditation in March 2021 and working towards SOC2 Type 2 accreditation. This globally recognised security certification should speed up the Tier one Bank internal sign off process related to cyber security as the accreditation provides customers with confidence that their information is protected and secure; and

· Looking to expand our distribution partnerships in particular working with top tier capital markets technology suppliers to add our product offering to their own offering. These firms are already approved suppliers to tier one banks and therefore it should reduce the on boarding time to close new deals.

Our Market

The market we serve is adapting to the new norm and we anticipate an increase in new projects and opportunities particularly as we enter our customers and prospects new budgets for 2022. Most of the European and North American markets are replacements opportunities that play well with our proposition to reduce the cost and complexity of risk systems. The cryptocurrency market is an exception where there is increasing focus on professionalising the marketplace as it moves more mainstream and is seeing larger financial institutions investigating it. The Asia market still has new opportunities in addition to cryptocurrency as Chinese capital markets firms expand outside of mainland China.

Products

We have continued to invest in our products with over thirty functional and operational enhancements delivered in the year to date. This includes functionality for the first customer deployment of our new Pre Trade product that provides risk limit management integrated into the firm’s electronic execution platforms though predefined authorisation workflow with full audit trail and will go live in the third quarter. We also announced partnerships with Waymark, to provide compliance horizon scanning of key regulatory changes from more than 2,500 global data sources, Kintail Consulting, to develop a People and Culture Risk Cockpit, and Lexis Nexis, to add an Exchange Data News Service to the Global Risk Platform.

Additional product features and launches for the remainder of 2021 include the release of the enhanced Risk Cockpit which will provide enriched functionality and the ability for a customer to ‘self-set-up’ thus allowing for “Low Touch” sales of the product. We are working with a partner company to deliver AI as a service across our suite of products, initially focusing on Market Surveillance and Operational Risk, and we will shortly be announcing our first technology and cyber risk offering delivered through the Risk Cockpit.

Selling

We have expanded the number of active prospects so that we can increase the ability to convert the sales pipeline. Actions include expanding our opportunities through distributor networks and launching new sales campaigns that leverage our Global Risk Platform capability such as the redefining of Compliance Risk with a Holistic Surveillance offering that includes four of our existing product offerings integrated into one package. In September, and in conjunction with our partner, Acuiti, the first report on the KRM22 risk sentiment will be released which will provide an initial view of the critical risk factors as seen by the community we address.

Vision and mission

Our vision ‘A world in which organisations operate at their optimal threshold of risk to drive increased returns’ and mission ‘To bring increased visibility and lower cost risk management to capital market organisations’ has not changed since our inception.

Our ability to offer integrated functionality as a technology service significantly reduces the cost and complexity of managing risk for our customers. We are already seeing existing customers adding new KRM22 products to their existing suite of risk products and new customers buying a suite of KRM22 risk products through the Global Risk Platform, thus eliminating the requirement for multiple distinct applications that demand separate infrastructure and data sources

Strategy

Our strategy has not changed. The core of which is to drive organic growth from our suite of products and our partners products delivered through the Global Risk Platform. We will also be looking again at acquisitions and investments to further drive our growth and scale. Our business is built on a highly scalable administrative and operational platform which will ensure that our growth delivers high margins.

Outlook

We have a compelling set of product offerings and broad base of prospects within our 2021 and 2022 sales pipeline which underpins our confidence in delivering the market expectations.

Keith Todd CBE

Executive Chairman and CEO

31 August 2021