Kingfisher plc (LON:KGF) has provided its Q1 22/23 sales.

Key points

· Sales significantly ahead of pre-pandemic performance (3-year LFL +16.2%), supported by strong market share gains

· Sales of £3.2bn in line with our expectations (total sales -4.2% in constant currency and LFL -5.4%)

· Good momentum into the second quarter with 3-year LFL +21.8%, and LFL -2.5% for the 2 weeks to 14 May 2022 including a c.1% adverse calendar impact

· Resilient demand from both DIY and DIFM/trade segments

· Omni-channel engagement remains high with e-commerce sales 3-year growth of 164%; representing 16% of Group sales (Q1 19/20: 7%)

· Continuing to manage inflation pressures effectively

· Good product availability, approaching pre-pandemic levels

· Full year guidance reiterated; anticipate FY 22/23 adjusted pre-tax profit of c.£770m

· Announcing return of a further £300m of surplus capital via a share buyback programme; first tranche to commence soon

Unaudited Q1 22/23 sales (three months ended 30 April 2022)

| Sales2022/23 | % TotalChange | % TotalChange | % LFLChange(1) | % 3-year LFLChange(2) | |

| £m | Reported | Constant currency | Constant currency | Constant currency | |

| UK & Ireland | 1,568 | (14.2)% | (14.1)% | (15.8)% | +16.7% |

| – B&Q | 996 | (17.8)% | (17.8)% | (18.3)% | +16.3% |

| – Screwfix | 572 | (7.1)% | (7.0)% | (10.9)% | +18.0% |

| France | 1,103 | (6.3)% | (3.1)% | (3.7)% | +13.7% |

| – Castorama | 565 | (3.1)% | +0.1% | – | +13.9% |

| – Brico Dépôt | 538 | (9.3)% | (6.3)% | (7.5)% | +13.5% |

| Other International | 575 | +29.7% | +36.2% | +37.1% | +22.2% |

| – Poland | 423 | +50.5% | +59.0% | +54.5% | +22.8% |

| – Iberia(3) | 87 | (3.5)% | (0.3)% | (0.3)% | +11.8% |

| – Romania(4) | 62 | (13.5)% | (9.7)% | +13.9% | +32.8% |

| – Other(5) | 3 | n/a | n/a | n/a | n/a |

| Total Group | 3,246 | (5.8)% | (4.2)% | (5.4)% | +16.2% |

Thierry Garnier, Chief Executive Officer, said:

“Kingfisher has delivered a good first quarter of trading, with LFL sales 16.2% ahead of our pre-pandemic performance. While facing very strong comparatives in the prior year, our continued strategic progress has enabled us to retain a significant proportion of the increased sales during the pandemic.

“We continue to effectively manage inflationary and supply chain pressures. As a result, our product availability is now very close to ‘normal’ levels across all our banners, and we continue to deliver value for our customers through our own exclusive brands and competitive prices.

“Looking forward, we are reiterating our profit guidance for FY 22/23. We are focused on delivering on our strategic objectives and growth initiatives, including the growth of our scalable e-commerce marketplace, the expansion of Screwfix in the UK and France, new store openings in Poland, further increasing our trade customer base.

“We remain committed to delivering attractive returns for our shareholders and are today announcing a further £300m share buyback programme. This reflects our strong cash generation and our confidence in the Group’s outlook.”

Current trading and outlook

The Group has good momentum going into the second quarter. For the 2 weeks to 14 May 2022(6) LFL sales were -2.5% (including a c.1% adverse calendar impact) and +21.8% on a 3-year basis. Demand remains resilient and trading in all banners and across all customer segments (DIY and DIFM/trade) is in line with our expectations, supported by strong execution and much improved product availability.

Looking ahead, we remain mindful of the heightened macroeconomic and geopolitical uncertainty that has emerged since the start of the year. Our priority remains top line growth, and strong and consistent execution. We are targeting further share gains in our markets, and continue to focus on our strategic objectives and investments for growth.

We are committed to continue managing our gross margin effectively in an inflationary environment, as we did successfully last year. Furthermore, we remain active and responsive in managing our operating cost base.

As a result of the above, we are reiterating our profit guidance for this year: we anticipate FY 22/23 adjusted pre-tax profit(7) of c.£770m. Additional financial guidance for FY 22/23 is provided on page 4 of this announcement.

New £300m share buyback programme

In line with our capital allocation policy, the Board has determined that there is surplus capital available to return to shareholders. Further to the ordinary dividend(8) and the recently completed £300m share buyback (as announced on 28 April 2022), the Board is pleased to announce the return of a further £300m of surplus capital via a share buyback programme. The first tranche of this programme will commence soon.

Board appointment

Kingfisher has appointed Bill Lennie as a Non-Executive Director, with effect from 1 May 2022. Bill retired in 2021 after 26 years of service with The Home Depot, most recently as Executive Vice President, Outside Sales and Services. During his time there, Bill held many senior leadership roles including President, Canada and Senior Vice President, International Merchandising, Private Brands and Global Sourcing. Bill has also been appointed as a member of the Audit and Nomination Committees.

‘Teach-in’ event on 5 July 2022

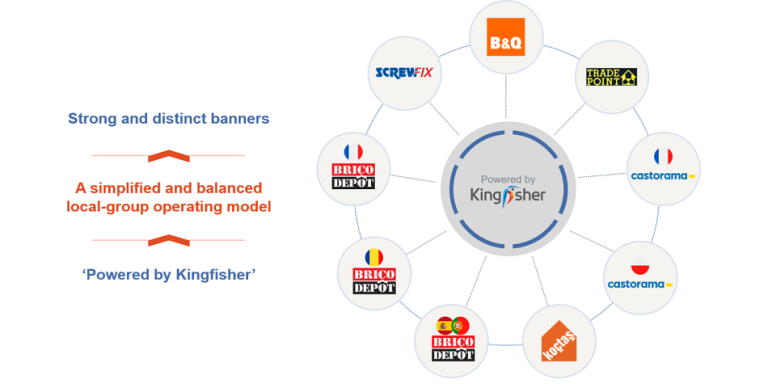

Kingfisher is hosting an in-person ‘teach-in’ event for analysts and institutional investors, on the afternoon of Tuesday, 5 July 2022. The event will take place in London, and will provide deeper insights into the e-commerce/technology and Responsible Business pillars of the ‘Powered by Kingfisher’ strategy. Please contact Kingfisher Investor Relations (contact details on page 5) for registration information.

Q1 trading highlights

All commentary below is in constant currency.

UK & IRELAND

Total sales -14.1% (LFL -15.8%; 3-year LFL +16.7%). Significant market share gains over the past two years, and good retention of revenue from new and existing customers.

· B&Q sales -17.8%. LFL -18.3% (3-year LFL +16.3%), reflecting very strong prior year comparatives and the impact of storms in the UK in February. Good performance across all categories on a 3-year basis, in particular in the building & joinery, outdoor and bathroom & storage categories. Own exclusive brands (OEB) performed well in the quarter, supported by resilient demand in the kitchen and bathroom & storage categories. LFL sales of weather-related categories were -28% (+25% on a 3-year LFL basis). LFL sales of non-weather-related categories, including showroom, were -14% (+13% on a 3-year LFL basis). TradePoint, B&Q’s trade-focused banner, continued to outperform with LFL sales -8% and 3-year LFL sales +32%. TradePoint sales were 21% of B&Q sales in Q1.

· Screwfix sales -7.0%. LFL -10.9% (3-year LFL +18.0%), with resilient demand from trade customers and despite very strong prior year comparatives. Strong 3-year performance in tools & hardware and EPHC (electricals, plumbing, heating & cooling) categories. During the period, Screwfix continued to roll out Screwfix ‘Sprint’, with good results. ‘Sprint’ offers customers an industry-leading 60-minute home delivery service (average delivery time c.45 minutes), currently covering 40% of the UK population. Screwfix opened 13 new stores in Q1 in the UK and Republic of Ireland, and remains on track to open 80 new stores in these countries during this financial year. The business will also open its first stores in France in the second half of 2022.

FRANCE

Total sales -3.1% (LFL -3.7%; 3-year LFL +13.7%). France continued to grow sales ahead of the market in Q1, driven by the performance of Castorama (five percentage points ahead of the market). LFL sales for the home improvement market in Q1 (as measured by Banque de France data(9)) were -5.2% YoY.

· Castorama sales +0.1%. LFL flat (3-year LFL +13.9%), reflecting resilient demand from both DIY and DIFM/trade customers. The continued strong performance at Castorama reflects work to extend and improve ranges, by introducing more local and international brands and by launching new OEBs, as well as ongoing work to improve our logistics operations and our competitive price positioning. Strong 3-year performance in outdoor, building & joinery, kitchen and EPHC categories. LFL sales of weather-related categories were -8% (+27% on a 3-year LFL basis). LFL sales of non-weather-related categories, including showroom, were +3% (+11% on a 3-year LFL basis).

· Brico Dépôt sales -6.3%. LFL -7.5% (3-year LFL +13.5%), reflecting resilient demand against the backdrop of strong prior year comparatives, and a continued focus on strengthening its discounter credentials and differentiated ranges. Strong 3-year performance in outdoor, building & joinery, EPHC and kitchen categories.

OTHER INTERNATIONAL

· Poland sales +59.0%. LFL +54.5% (3-year LFL +22.8%), supported by market share gains, notwithstanding weak prior year comparatives due to temporary store closures in Q1 last year. Strong 3-year performance across all categories, in particular in the kitchen category. LFL sales of weather-related categories were +89% (+33% on a 3-year LFL basis). LFL sales of non-weather-related categories, including showroom, were +49% (+21% on a 3-year LFL basis). Poland opened one new big-box store in Q1.

· Iberia sales -0.3%. LFL -0.3% (3-year LFL +11.8%), with resilient demand against strong prior year comparatives, though impacted by abnormally cold and wet weather during the period. Strong 3-year performance in the building & joinery, kitchen and surfaces & décor categories.

· Romania sales -9.7%(4), reflecting one additional month of sales in the prior year comparative (January 2021), which facilitated alignment to Kingfisher’s financial reporting calendar last year. LFL +13.9% (3-year LFL +32.8%) reflecting robust demand across most categories, despite the impact of COVID-related trading restrictions (lifted in March 2022).

FY 2022/23 Technical guidance

Significant updates to our previous guidance are noted below in italics. Please refer to page 6 for further details regarding forward-looking statements.

Income statement:

· Space

– Anticipate net space growth to impact total sales by c.+1.5%, largely from Screwfix and Poland

· New businesses

– Anticipate ‘Other’ retail losses of c.£20m (FY 21/22: £10m). ‘Other’ consists of the consolidated results of NeedHelp, Screwfix International, and franchise agreements, and is recorded within the ‘Other International’ division

– Anticipate retail loss of c.£5m in relation to investment in B&Q’s e-commerce marketplace, recorded within the results of B&Q in the ‘UK & Ireland’ division

· Central costs

– Expected to be broadly flat year on year (FY 21/22: £60m)

· Net finance costs

– Expected to decrease by c.£15m mainly as a result of lower lease liability interest rate (FY 21/22: £137m)

· Adjusted pre-tax profit

– Anticipate full year adjusted pre-tax profit(7) of c.£770m

· Tax rate

– Group adjusted effective tax rate expected to be c.22%(10) (FY 21/22: 22%)

Cash flow:

· Capital expenditure – targeting gross capex of c.3.5% of total sales (FY 21/22: £397m)

· Tax – in February 2022, a payment of €40m was made to the French tax authorities with regards to a historic tax liability. The amount was fully provided for in prior periods

· Share buyback – c.£445m outflow for share buybacks (c.£145m for previous programme completed in April, and further £300m announced today)

· Dividend – dividend policy target cover range of 2.25 to 2.75 times, based on adjusted basic earnings per share

Footnotes

(1) LFL (like-for-like) sales growth represents the constant currency, year on year sales growth for stores that have been open for more than one year. Stores temporarily closed or otherwise impacted due to COVID are also included.

(2) 3-year LFL is calculated by compounding the current and prior two periods’ LFL growth. For example, Q1 22/23 LFL growth of 5%, Q1 21/22 LFL growth of 4%, and Q1 20/21 LFL growth of 3%, results in 3-year LFL growth of 12.5%. Russia (sale completed on 30 September 2020) is excluded from Group and Other International 3-year LFL calculations.

(3) Brico Dépôt Spain and Portugal.

(4) Kingfisher’s subsidiary in Romania historically prepared its financial statements to 31 December. In FY 21/22, Romania migrated to Kingfisher’s financial reporting calendar (year ended 31 January 2022). Its quarterly sales presented in FY 21/22 therefore included one additional month of results (April 2021) in order to facilitate the alignment to Kingfisher’s financial reporting calendar. Therefore, reported and constant currency variances for Romania sales are for February to April 2022 (compared against January to April 2021). Romania’s LFL and 3-year LFL sales growth compares equivalent periods in the current and prior years.

(5) ‘Other’ consists of the consolidated results of NeedHelp (acquired in November 2020), Screwfix International (launched online in France in April 2021), and revenue from franchise agreements.

(6) LFL sales growth for the two weeks to 14 May 2022 represent the period 1 May 2022 to 14 May 2022 compared against the equivalent period in the prior year (i.e., 2 May 2021 to 15 May 2021). The corresponding 3-year LFL represents the period 1 May 2022 to 14 May 2022 compared against the equivalent period in FY 19/20 (i.e., 5 May 2019 to 18 May 2019). The figures are provisional and exclude certain non-cash accounting adjustments relating to revenue recognition.

(7) Guidance assumes current exchange rates.

(8) On 22 March 2022, the Board proposed a final dividend per share of 8.60p (FY 20/21 final dividend: 5.50p), resulting in a proposed total dividend per share of 12.40p in respect of FY 21/22 (FY 20/21: 8.25p). The final dividend is subject to the approval of shareholders at the Annual General Meeting on 22 June 2022, and will be paid on 27 June 2022 to shareholders who were on the register at close of business on 20 May 2022.

(9) Banque de France data for DIY retail like-for-like sales (non-seasonally adjusted). Includes relocated and extended stores http://webstat.banque-france.fr/en/browse.do?node=5384326.

(10) Subject to the blend of profit within Kingfisher’s various jurisdictions.