Kingfisher plc (LON:KGF) has provided its Q3 23/24 sales.

Key points

· Q3 sales of £3.2bn; total sales -2.1% (reported) and -2.7% (constant currency)

· LFL -3.9% including a -0.4% calendar impact(1) with overall volumes continuing to show an improving trend

· Underlying retail and trade consumer trends resilient in the UK and improving in Poland, in line with our expectations; market trends in France weaker than expected

· Q3 by region:

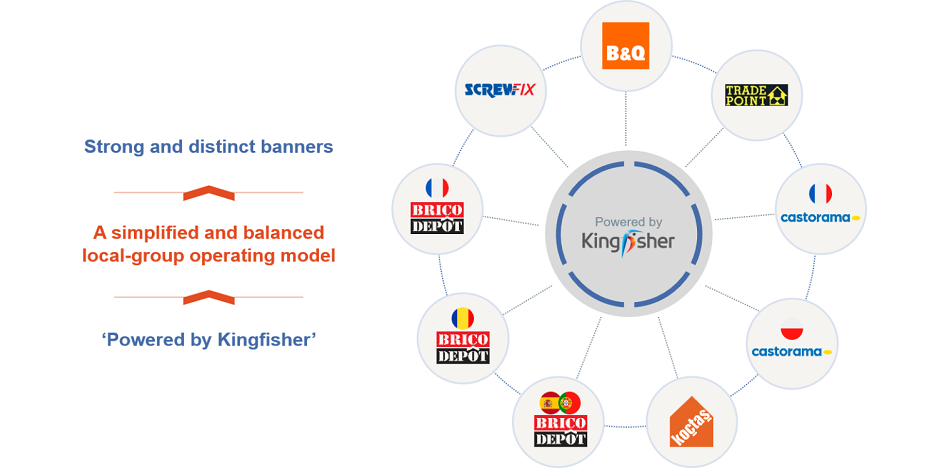

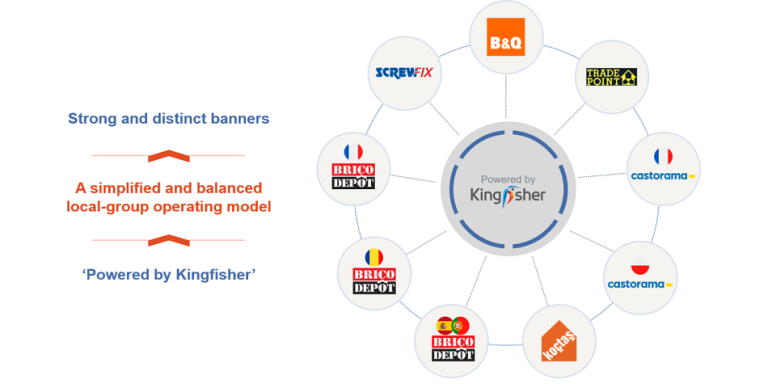

o UK & Ireland: market share gains at B&Q (including TradePoint) and Screwfix with resilient underlying sales trends

o France: Castorama performing in line with the market; underperformance at Brico Dépôt due to significantly higher weighting of building materials (including insulation) and electricals, plumbing, heating & cooling (EPHC) products (which have seen a delayed start due to the warmer weather, against strong prior year comparatives)

o Poland: improvement in sales trend since H1; market share remains up significantly on a two-year basis

· Opened four Screwfix stores in France in Q3 (13 in total); Screwfix online launched in six new European markets

· Total e-commerce sales growth of +7.4%, supported by continued strong growth of B&Q’s marketplace (reaching 35% of B&Q’s e-commerce sales(2) in October)

· Full year adjusted PBT guidance lowered to c.£560m(3) to reflect continuation of Q3 trends in Q4, including continued resilience in the UK and market weakness in France; now expect full year free cash flow of c.£470m

· Launched first tranche of new £300m share buyback programme, with c.£26m completed to date

Unaudited Q3 23/24 sales (three months ended 31 October 2023)

| Sales2023/24 | % TotalChange | % TotalChange | % LFLChange(4) | |

| £m | Reported | Constant currency | Constant currency | |

| UK & Ireland | 1,597 | +3.3% | +3.3% | +1.1% |

| – B&Q | 946 | +1.0% | +1.0% | +1.1% |

| – Screwfix | 651 | +6.8% | +6.8% | +0.9% |

| France | 1,034 | (8.7)% | (8.5)% | (8.6)% |

| – Castorama | 543 | (6.9)% | (6.7)% | (6.7)% |

| – Brico Dépôt | 491 | (10.6)% | (10.4)% | (10.6)% |

| Other International | 608 | (3.7)% | (6.8)% | (7.6)% |

| – Poland | 438 | (2.9)% | (7.5)% | (9.0)% |

| – Iberia(5) | 90 | (4.1)% | (3.9)% | (3.9)% |

| – Romania | 77 | (6.6)% | (5.8)% | (3.0)% |

| – Other(6) | 3 | n/a | n/a | n/a |

| Total Group | 3,239 | (2.1)% | (2.7)% | (3.9)% |

Thierry Garnier, Chief Executive Officer, said:

“Our UK banners performed well in Q3, with B&Q, TradePoint and Screwfix growing sales and market share. In France, our performance was impacted by a weak retail market, as well as a delayed start to insulation, plumbing and heating sales – to which Brico Dépôt is more heavily weighted – due to unusually warm autumn weather, and strong prior year comparatives in these categories. In Poland we are seeing early signs of recovery in the trading trend, against an incrementally more positive consumer and economic backdrop. Reflecting the weakness of the French market, and notwithstanding our proactive cost actions, we have lowered our Group profit guidance for the full year.

“We continue to focus on our execution and driving our strategy forward. Our online marketplaces are growing rapidly, with B&Q’s marketplace reaching 35% of its e-commerce sales in October. Screwfix has continued its international expansion, by launching as a pure-play online retailer in six new European countries, and opening four new stores in France in the quarter. We also continue to harness AI and data to support sales, profit and cash, including by growing our retail media proposition across the Group.

“As we move into 2024, we are focused on what is in our control. First, a continued focus on growing market share in the UK, France and Poland with delivery of our strategic growth initiatives. Second, driving productivity gains to offset wage inflation. And finally, delivering on our free cash flow and shareholder returns targets. We expect to see some product cost price inflation, albeit at a significantly lower level, and expect rational retail pricing and competitive price indices at all our banners.

“On the medium-to-longer term outlook, we remain very positive for home improvement growth in our markets, and our ability to grow ahead of our markets.”

Current trading and outlook

Q4 has started largely in line with the trends of Q3, including continued resilience in the UK and market weakness in France (with Brico Dépôt closing the gap in performance to Castorama). For the three weeks to 18 November 2023(7), Group LFL sales were -3.4%.

We continue to take decisive cost actions in France, more than offsetting the impact of inflation. However, given continued market weakness, this is not sufficient to offset the impact of lower sales in this region. Reflecting our expectation for this trend to continue in France for the balance of the year, we now expect FY 23/24 Group adjusted pre-tax profit (PBT) to be c.£560m (previous guidance c.£590m).

Our revised sales expectation flows through to cash, and so we now expect to deliver c.£470m of free cash flow for the year (previous guidance >£500m). This free cash flow is supported by ongoing sales and profit resilience in the UK as well as the unwind of working capital flows in the prior year. We continue to expect a positive contribution from inventory unwind, together with disciplined capital allocation, which underpin our expectation of free cash flow delivery. We also reaffirm our commitment to our recently commenced £300m share buyback programme.

Trading in France – Castorama in line with market, Brico Dépôt mix effect, cost actions being taken

As set out in our H1 23/24 results, Q3 in France started with a slight slowdown in the sales trend relative to Q2 (August LFL was -5.3% compared to the Q2 LFL of -3.5%). However, the French home improvement market deteriorated far more than expected in September with Banque de France sales data down 9.1%. Although the market and trading trends have improved in October (and in Q4/November to date) compared to September, we have assumed that the French market will remain at least as weak as October throughout Q4.

As a result of the subdued environment in France this year, we have been proactively managing our operating costs to align as far as possible to trading conditions. The business has strengthened actions on flexing staffing levels, lowered discretionary spend and has accelerated several structural cost reduction initiatives in H2. These actions will also support improved profitability in France over the medium-term.

However, at the assumed level of market weakness in Q4, the cost efficiencies described above and being achieved by the business are not sufficient to offset the bottom-line impact between now and the end of the financial year.

At Castorama, which is currently performing in line with the market, we continue to refine our competitive brand positioning. To support growth ahead of the market in 2024, the business will launch an e-commerce marketplace and will accelerate the development of its trade customer proposition. Brico Dépôt has been relatively more exposed to current French market weakness, due to its higher category weighting towards building materials (which includes insulation products) and electricals, plumbing, heating & cooling (EPHC) products. Sales in these categories have been delayed due to the warmer weather, while also facing very strong comparatives. The marketing issues at Brico Dépôt that we described in our H1 results have been fully resolved. Performance has improved since September, with Brico Dépôt closing the gap in performance to Castorama in Q4/November to date. The business continues to focus on building a differentiated discounter proposition, and maintaining a strong price index to deliver value to its customers.

Longer term, our strategy in France remains focused on improving sales densities and making our operating model more efficient.

Q3 trading highlights

All commentary below is in constant currency.

UK & IRELAND

Total sales +3.3% (LFL +1.1%), reflecting resilient consumer demand. Both banners grew faster than their respective markets (as measured by the British Retail Consortium, Barclays and GfK), with particularly strong market share gains seen at Screwfix.

· B&Q sales +1.0%. LFL +1.1%, with resilient retail trends outpaced by trade sales. The business saw good performances in surfaces & décor, tools & hardware and outdoor categories in the quarter, offsetting a slower start to autumn and winter product sales. B&Q’s total e-commerce sales increased by 31.8% YoY, with an overall e-commerce sales penetration of 12.9% (Q3 22/23: 10.1%), driven by the further scaling of B&Q’s e-commerce marketplace, which reached a participation of 35% in October (i.e., B&Q’s marketplace gross sales divided by B&Q’s total e-commerce sales). Marketplace gross merchandise value (GMV)(8) increased by over 290% YoY. B&Q opened one new store in Q3 (a B&Q Local compact format in Sutton). TradePoint, B&Q’s trade-focused banner, outpaced retail sales in the quarter with LFL sales of +3.1%, reaching a penetration of 23% of B&Q’s total sales (Q3 22/23: 23%). The banner continues to successfully strengthen its product and services proposition for trade customers, including trade-only deals and events. Customer engagement and loyalty also continues to strengthen, with membership sign-ups growing YoY.

· Screwfix sales +6.8%. LFL +0.9%, with robust demand from trade customers and good YoY growth in the tools & hardware and building & joinery categories. The unseasonably warm weather in the UK in September and October impacted sales of plumbing and heating products. Screwfix opened 11 net new stores in the UK & Ireland in the quarter, for a total of 23 net new stores opened in the nine months to 31 October. Note that total sales for Screwfix UK & Ireland include sales arising from the acquisition on 20 March 2023 of the assets of Connect Distribution Services (renamed Screwfix Spares). Since acquisition, Screwfix Spares has performed in line with expectations, contributing c.2% to total Screwfix sales growth in Q3. The results of Screwfix France are recorded within the ‘Other International‘ division – see below for further information.

FRANCE

Total sales -8.5% (LFL -8.6%), with trading in France impacted by a weak market backdrop affecting both consumers and trade. Similar to the UK, unseasonably warm weather in September and early October led to a slower start of insulation, plumbing and heating sales, and the businesses faced strong comparatives from Q3 last year (when consumers anticipated energy price increases and risks of power shortages, driving strong sales of heating and energy efficiency products).

· Castorama sales -6.7%. LFL -6.7%, with performance in line with the market. Market weakness in France was reflected broadly across the categories, while electricals, plumbing, heating & cooling (EPHC) lapped strong sales of heating and energy efficiency products in the prior year, with performance improving towards the end of the quarter.

· Brico Dépôt sales -10.4%. LFL -10.6%, a weaker performance relative to Castorama due to the impact of unseasonably warm weather, with the business exposed to a significantly higher weighting of building materials (including insulation) and autumn and winter season products. Sales were also impacted by exceptionally high sales of insulation, heating propellants and generators in the prior year. Since the correction to marketing budget allocation in mid-July, the business has seen an incremental progression of in-store traffic.

OTHER INTERNATIONAL

· Poland sales -7.5%. LFL -9.0%, with performance improving from H1 as consumer confidence, while still negative, continued to recover. Sales trends improved across most categories, apart from EPHC where performance was impacted by a comparative period of high demand in products such as heating propellants, as consumers anticipated energy price increases. On a two-year basis, Castorama gained market share in the quarter (to 30 September, as measured by GfK). Following the one new store opening in H1, Castorama opened one new medium-box store in Q3 and intends to open three further stores in Q4, in line with its target of five store openings in this financial year.

· Iberia sales -3.9%. LFL -3.9%, with good performance seen in the building & joinery, kitchen and bathroom & storage categories. Unfavourable weather impacted sales of seasonal categories.

· Romania sales -5.8%. LFL -3.0%, reflecting a resilient performance against strong prior year comparatives (+4.2%). Positive YoY growth was achieved in EPHC, bathroom & storage and outdoor categories.

· Other consists of the consolidated results of Screwfix International, NeedHelp and franchise agreements. While these businesses are in their early investment phase, we continue to be encouraged by the results we have seen to date. With four new openings in the quarter, there are now 13 Screwfix stores in operation in France. Following the early positive results in France, we launched Screwfix as a pure-play online retailer (under the domain name Screwfix.eu) in six new European countries (Poland, Spain, Belgium, the Netherlands, Sweden and Austria), leveraging Screwfix’s distribution centre in France for fulfilment.

Footnotes

(1) Calendar impact represents the impact of the annual calendar shift on LFL sales growth due to different days of the week falling into or out of the current period compared to the prior period. For example, historically, higher trading is seen on a Friday and Saturday as compared to a Sunday.

(2) B&Q’s marketplace gross sales divided by B&Q’s total e-commerce sales. Please refer to the glossary in Kingfisher’s 2023/24 Half Year Results announcement for definitions of e-commerce sales and penetration metrics.

(3) Guidance assumes current exchange rates.

(4) LFL (like-for-like) sales growth represents the constant currency, year-on-year sales growth for stores that have been open for more than one year.

(5) Brico Dépôt Spain and Portugal.

(6) ‘Other’ consists of the consolidated results of Screwfix International, NeedHelp, and revenue from franchise agreements.

(7) ‘Q4 23/24 LFL sales (to 18 November 2023)’ represents the period from 29 October to 18 November 2023 compared against the equivalent period in the prior year (i.e., 30 October to 19 November 2022). The figures are provisional and exclude certain non-cash accounting adjustments relating to revenue recognition.

(8) Marketplace gross sales is the transaction value (excluding VAT) from the sale of products supplied by third-party e-commerce marketplace vendors. Returned and cancelled orders are excluded. Marketplace gross merchandise value (GMV) is the total transaction value (including VAT, and including returned and cancelled orders) from the sale of products supplied by third-party e-commerce marketplace vendors. Marketplace GMV is the basis on which our commissions from third-party vendors are determined.

Q3 trading update and data tables

This announcement and data tables for Q3 23/24 sales can be downloaded from www.kingfisher.com/investors.

We can be followed on Twitter (@kingfisherplc) with the Q3 results tag #KingfisherResults.

Full year 23/24 results

Our next scheduled results announcement will be our results for the 12 months ending 31 January 2024, on 25 March 2024.

American Depository Receipts

Kingfisher American Depository Receipts are traded in the US on the OTCQX platform: (OTCQX: KGFHY) http://www.otcmarkets.com/stock/KGFHY/quote.