KEFI Gold and Copper plc (LON:KEFI), the gold and copper exploration and development company with projects in the Federal Democratic Republic of Ethiopia and the Kingdom of Saudi Arabia, is hosting a General Meeting today at 9.00 a.m. GMT in Cyprus. At the GM, Harry Anagnostaras-Adams, Executive Chairman of the Company, will make the following statement:

“Today we bring shareholders up to date and strive to convey a picture of where your company is heading.

Ethiopia

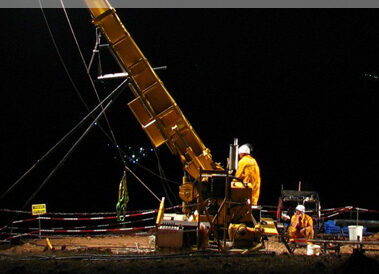

We will start by focusing on Ethiopia where the identified US$320 million funding package for the Tulu Kapi Gold Project is now progressing through the approval process of each of the syndicate members.

In October 2023, the National Bank of Ethiopia (the central bank) approved essential exemptions from exchange and capital controls. This satisfied the third of the three critical conditions precedent for the syndicate to proceed, as had been foreshadowed. Then, in December 2023, the lead lending bank, Eastern and Southern Trade and Development Bank, a key member of the financing syndicate, gave final credit committee approval for its US$95 million project loan. This was also ratified by its country-members’ board in February. The other members of the syndicate, being the co-lender (US$95 million) and the equity risk note investors (US$100 million) (all major regional corporations) duly activated their approval processes. A longstanding and a large MNC investor in the Equity Risk Note (“ERN”) has now received its initial board approvals.

The steps now underway to progress Tulu Kapi funding package are:

· Finalisation of approvals by the rest of the financing syndicate following the recent approval by the lead bank;

· Preparation of the community for resettlement;

· Satisfaction of conditions precedent such as readiness of security, insurances, title confirmations, perfection of banks’ security and similar formal documentary requirements; and

· Completion of detailed definitive documentation which will require all syndicate parties to approve counterparty rights and obligations, among other things.

After approval by all syndicate members, we can then proceed by mid-2024 to:

· Sign the Definitive Documentation between the respective syndicate counterparties;

· Place insurances and complete other administrative tasks;

· Draw down first capital, starting with project equity and then debt months later;

· Commence staged resettlement of approximately 350 households near Tulu Kapi; and

· Begin procurement and tendering local sub-contractors.

We are following this clear roadmap, and we will report material milestones along the way.

The end result will be the launch of Ethiopia’s first industrial-scale mining project and its largest single export generator and, in so far as environmental, social and governance aspects are concerned, the project is designed to be in compliance with World Bank IFC Performance Standards, creating direct and indirect employment for 5,000 to 10,000 people.

Its NPV is £304 million for KEFI’s projected net beneficial interest, assuming a gold price of US$2,166/oz, being the spot as at 22 March 2024 and discounting at 5% of net estimated after tax cash flows for equity, the industry standard approach, so as to allow market comparisons of listed developers. At the long-term consensus gold price of US$1,864/oz, the NPV is £204 million.

Saudi Arabia

Tulu Kapi is one of KEFI’s three advanced projects, the other two being Jibal Qutman Gold and Hawiah Copper-Gold in Saudi Arabia, conducted via our 25%-owned GMCO operating company. Both projects are GMCO’s own discoveries and are enjoying very positive regulatory support as the preferred development plans are considered.

Both projects are enjoying growth, illustrated by recent announcements of further discoveries and the associated drilling results.

At Jibal Qutman, initial drilling at the Asfingia prospect has intercepted near-surface gold such as 13m at 8g/t gold.

At Abu Salal, approximately 50km south of Hawiah, drilling has intercepted massive and semi-massive sulphide mineralisation containing copper, gold, zinc and silver in multiple horizons across a 2,600m strike length, with true widths of up to 11m.

Work remains ongoing with respect to the development feasibility studies. Given the continued and expected expansion in resources, the Company is focused on establishing the optimal scale, recoveries and start-up strategies. We look forward to reporting further positive results as the extent of mineralisation at both projects is better understood.

Summary

After many demanding years in highly prospective, but extremely challenging jurisdictions, we believe we are now well placed to charge ahead.

I am pleased to report that your company has not only maintained its excellent record of safety and of tenure protection, but has also drawn together first-tier partnerships, banking relationships and contractors into project-finance alliances in each of Ethiopia and Saudi Arabia.

Our operating alliances are with the following strong organisations:

· Partners:

o in Ethiopia:

§ Federal Government of the Democratic Republic of Ethiopia

§ Oromia Regional Government

o in Saudi Arabia: Abdul Rahman Saad Al Rashid and Sons Ltd (“ARTAR”)

· Principal contractors:

o for process plants in both Ethiopia and Saudi Arabia: Lycopodium Ltd

o for mining in Ethiopia: PW Mining

· Senior project finance lenders:

o For Tulu Kapi:

§ Eastern and Southern African Trade and Development Bank Ltd

§ African Finance Corporation Limited

o For Saudi Arabia:

§ Saudi Industrial Development Fund

KEFI has deliberately assembled its development funding at the in-country subsidiary level in a manner which has minimised dilution (to KEFI) of the intrinsic value of the underlying assets. Of course, we need to convert this into value per KEFI share by closing the project financings, de-risking the projects and getting them into production. KEFI is also examining dual-listings in those countries’ fledgling stock exchanges because of the strong demand for investments in the mining sector.

Conclusion

Our host countries have turned markedly better for the minerals sector and for KEFI. We are preparing to construct Tulu Kapi, advancing development studies on Jibal Qutman and Hawiah and conducting reconnaissance over exploration targets in Ethiopia and Saudi Arabia.

As stated last year, along with my fellow Directors, I am very sensitive to the need to generate returns on investment. It was frustrating that the political reforms and ensuing conflicts in Ethiopia and the suspension of licencing for some years pending Saudi Arabia’s sweeping deregulation in effect suspended our progress. However, as foreshadowed last year, our operating environment has indeed turned for the better in both countries and we now progress on all fronts.

The fundamental value to KEFI of the three advanced projects is estimated at £372 million (calculated as set out above for Tulu Kapi and ascribing market average metrics to preliminary production projections in respect of the advanced Saudi projects which are still at the pre-Definitive Feasibility Study stage). This valuation indicator is c.12 times KEFI’s current share market capitalisation. This is no more than just one indicator for the estimate of intrinsic valuation and requires that the projects are implemented as assumed. However, it is a notable indicator that there is plenty of scope for share price rerating as the projects progress and de-risk. The dedication our teams and syndicates have already demonstrated augers well given the expected ongoing improvements to the investment climate in our host countries.

The KEFI Gold and Copper directors are deeply appreciative of all personnel’s tenacity, as well as the support the Company receives from our shareholders, our in-country partners, lenders and contractors, our host communities, and other stakeholders.”