KEFI Gold and Copper plc (LON:KEFI), the gold exploration and development company with projects in the Democratic Republic of Ethiopia and the Kingdom of Saudi Arabia, has announced its unaudited interim results for the six months ended 30 June 2024.

The interim results for the Group encompass the activities of KEFI Minerals (Ethiopia) Ltd, Tulu Kapi Gold Mines Share Company in Ethiopia, and Gold & Minerals Ltd in Saudi Arabia.

The Tulu Kapi Gold Project is currently 95% beneficially owned by KEFI through KEFI’s wholly owned subsidiary KME. The Hawiah Copper-Gold Project), the Jibal Qutman Gold Project and other Saudi projects are held by GMCO in which KEFI currently has a 24.75% interest.

Both TKGM and GMCO are being developed by KEFI and its partners as separate operating companies so that each can build a local organisation capable of developing and managing long-term production and exploration activities, as well as fully exploit future development opportunities.

Highlights

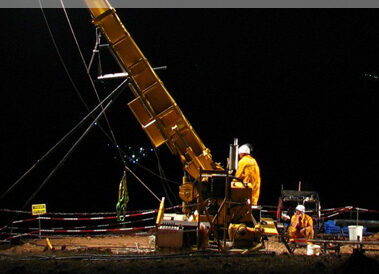

KEFI is swiftly advancing its Early Works at Tulu Kapi in Ethiopia, benefiting from the overtly supportive local community. The lack of legacy social or environmental issues at Tulu Kapi, such as those often associated with artisanal mining found in other mining regions, has simplified the task at hand for our Company. The general country environment has also become increasingly development-focused and pro-mining in particular, with significant site activities commencing over the past two months due to the deployment of extensive safety-protection forces. During this time, Ethiopia has introduced national pro-development reforms, positioning the country once again among the top 10 globally for growth, a status it held for nearly two decades.

Recent reforms in Ethiopia include the floating of the currency, the launch of the first IPO on the new Ethiopian Stock Exchange, the opening of the local financial sector to foreign investment, the rescheduling of international debt, and the implementation of a significant IMF financial support package.

Recent reforms for the mining industry spearheaded by KEFI include exemption from exchange and capital controls, capital ratios of up to 80:20 for mining, market-based interest rates and specialised security deployment for strategic mining projects. KEFI is positioned to launch the first Ethiopian listed securities in the Ethiopian mining sector.

In Saudi Arabia, the joint venture has made two core discoveries, which continue to grow in size, as well as several satellite discoveries. To support the next phase of GMCO’s development, the local leadership team has been expanded and feasibility studies for the Jibal Qutman Gold and Hawiah Copper-Gold projects are being refined and re-focused, while GMCO’s regional exploration efforts are being further elevated.

As previously reported this quarter, we remain on track with our high-grade Tulu Kapi project in Ethiopia, our flagship and most advanced venture. Thanks to the Ethiopian Government’s substantial efforts to ensure safe and internationally compliant development, the Tulu Kapi funding package can now progress towards project launch. The Early Works programme was launched in Q2-2024 to demonstrate readiness for Major Works and the next steps are to finalise second bank credit approval, sign the definitive detailed financing agreements, drawdown the equity funding and then launch Major Works – all targeted within Q4-2024.

Other than completing the Early Works programme generally, the current focus is particularly on:

· Reinforcing our social licence to operate at site via an intense consultative process to demonstrate our readiness on the ground for Major Works;

· the co lender’s credit approval which now includes a discussion in respect increasing the financing amounts on offer;

· the book build for the issuance of the Equity Risk Notes to local subsidiaries of multinational corporations and local sophisticated investor; and

· preparing for possible additional stock exchange listing of KEFI or regional listing of the Ethiopian subsidiary, to follow the launch of Major Works at Tulu Kapi.

Our patient work with the local and regional finance community is working well in mitigating against an over-reliance on development support from what has been a cyclically weak stock market for the junior mining sector during much of the past decade. The current record gold prices could begin to put the investment spotlight onto our sector.

Working Capital

The Company successfully raised gross proceeds of approximately £5.0 million, comprising £4.5 million from the placing and £495,916 from the retail offer in March 2024. Additionally, the Company issued remuneration shares to certain KEFI directors valued at £500,000 in lieu of cash for accrued fees and, during May 2024, the Company issued shares totalling £1.4 million to key advisers in recognition of their services in supporting various value-enhancing initiatives following the launch of the Early Works programme at the Company’s Tulu Kapi Gold Project.

Board and Management Team

After appointing in 2023 independent Non-executive Director of KEFI Gold and Copper Dr Alistair Clark, a world-recognised social and environmental expert, the Company also recently appointed Mr Addis Alemayehou as an independent Non-executive Director of the Company with effect from the closing of the Company’s Annual General Meeting (“AGM”) held on 22 July 2024. Addis is a senior figure in the Ethiopian business community, including a prominent role advising major international corporations with long-standing operations therein.

Mark Tyler, a non-executive director of the Company, retired from the Company at the conclusion of the AGM.

The senior project planning and finance teams are unchanged, the project management team in Ethiopia has been expanded with Early Works and most recruitment will trigger with the launch of Major Works.