KEFI Gold and Copper plc (LON:KEFI), a gold and copper exploration and development company focused on the Arabian-Nubian Shield with a pipeline of projects in the Federal Democratic Republic of Ethiopia, and the Kingdom of Saudi Arabia, has announced its audited financial results for the year ended 31 December 2023.

AGM and Annual Report

The notice convening the Company’s Annual General Meeting, which is currently expected to be held on 22 July 2024 in Ethiopia, will be sent out in the week commencing 17 June 2024 and will be available for download on the Company’s website: https://www.kefi-goldandcopper.com. A further announcement will be made when the Notice of AGM is published. The timing of the AGM coincides with meetings of Tulu Kapi project partners and financiers in Addis Ababa, including also the general meetings for KEFI subsidiaries being organised to facilitate development financing plans.

Mark Tyler, a non-executive director of the Company, has stated his intention to retire from the Company at the conclusion of the AGM after 6 years of greatly appreciated support, especially in respect of African project debt financing, as one of the continent’s long-standing leaders in the field. The Company plans to continue to add to the range of skills and appropriate board expertise in preparation for the substantial changes as KEFI moves into its exciting next stage with the development of its projects.

Highlights

· In Ethiopia, with our partners and banks:

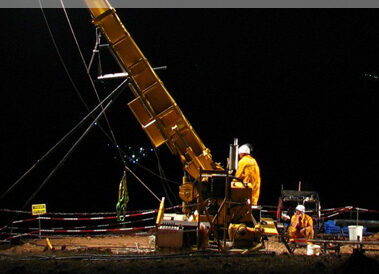

o our focus is now on successfully completing the Early Works at Tulu Kapi so that we can close the $320 million project finance package and launch Major Works in October 2024. Gold production would then commence in mid-2026;

o Tulu Kapi’s projected net cash flow to KEFI’s planned 80% beneficial interest is estimated at approximately £80 million per annum. At the current gold spot price of $2,346/ounce, KEFI’s planned beneficial interest in the cash flow is estimated to be approximately £100 million per annum; and

o The end result will be the launch of Ethiopia’s first industrial-scale mining project and its largest single export generator and, in so far as environmental, social and governance aspects are concerned, the project is designed to be in compliance with World Bank IFC Performance Standards, creating direct and indirect employment for 5,000 to 10,000 people.

· In Saudi Arabia, with our partner and bank:

o Jibal Qutman and Hawiah are enjoying very positive regulatory support as we assess the choices of development plans. Substantial drilling programmes at both projects over the past year have better defined the known Mineral Resources as well as discovering nearby deposits; and

o Given the expected expansion in resources, the ongoing development feasibility studies are focused on establishing the optimal start-up strategies and ultimate potential scale.

· As regards the KEFI Gold and Copper’s funding:

o Financial markets, and the AIM Market in particular, have recently shown some volatility and weakness flowing from global and UK political events. This continues to reinforce KEFI’s strategy of sourcing predominantly project-level and subsidiary-level project financing to develop our projects; and

o Successful implementation of our plans will result in KEFI being a leader in the Arabian-Nubian Shield with holdings in three production assets coming on stream in sequence from 2026.

Note: All $ figures in this report are US$