· Two Exploration Licences issued to facilitate development of the Jibal Qutman Gold Project

· Award of final Jibal Qutman Exploration Licence expected shortly

· DFS for Initial 500,000 oz gold development Q1 2023, first production 2024

KEFI Gold and Copper plc (LON:KEFI), the gold and copper exploration and development company with projects in the Federal Democratic Republic of Ethiopia and the Kingdom of Saudi Arabia has announced the issue of two of the three required Exploration Licences covering the Jibal Qutman Gold Project area through the Company’s Gold and Minerals Limited joint venture in Saudi Arabia. G&M is owned 30% by KEFI and 70% by its partner Abdul Rahman Saad Al Rashid and Sons Ltd.

Jibal Qutman Licences

· ‘Jibal Qutman North’ and ‘Jibal Qutman Southeast’ Exploration Licences (“ELs”) have been issued on an initial 5-year term, covering 174Km2.

· The original and outstanding Jibal Qutman Exploration Licence, covering an additional 99 Km2, is still undergoing renewal and is expected to be granted in the coming weeks.

· Upon its issuance, the three contiguous licences (collectively referred to as the “JQ EL”) will cover a combined area of over 270km2.

· The Definitive Feasibility Study (“DFS”) for the development is now focused on an initial production plan of c.500,000 oz gold over a 10-year period, rather than the initial Preliminary Feasibility Study target of c.200,000 oz gold, which was modelled on a gold price of US$1,200/oz.

· The JQ EL are situated on the highly prospective ‘Nabitah-Tathlith’ fault zone and offer additional exploration upside beyond the known 733,000 oz JORC gold resource, with further gold mineralisation already documented across the JQ EL.

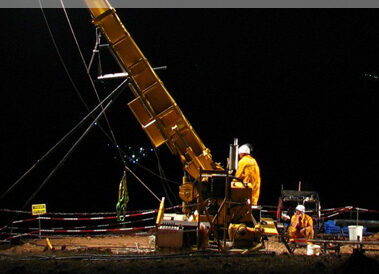

· Field programmes for the DFS, which includes confirmation drilling, environmental baseline studies, geotechnical and metallurgical drilling, are expected to commence in October 2022 following the award of the third exploration licence.

· Project development and exploration teams dedicated to this project have now been formed, with key elements currently in-country preparing to re-enter the area.

· The DFS is targeted for completion at the end of Q4 2022/early Q1 2023, depending upon the timing of the grant of the outstanding Exploration Licence. Environmental permits are targeted for Q1 2023.

· A subsequent Mining Licence Application (“MLA”) is expected to be resubmitted in early 2023

· Long lead items for the proposed Jibal Qutman processing plant are being scheduled, with the longest having an 18-month period from purchase to commissioning.

· Project financing in mid-2023 for Jibal Qutman is expected to be sourced and implemented within Saudi Arabia, which has well-developed international capital markets and a mandate to invest in the country’s mineral resources.

Broader Saudi Arabia Portfolio

· G&M is rapidly becoming a leading explorer/developer/producer in the fast-emerging Saudi minerals sector following the recent overhaul of the local regulatory system.

· In addition to Jibal Qutman, G&M is focused on the development of the Hawiah Copper-Gold Project, with an existing JORC resource of 24.9Mt at 0.9% copper, 0.85% zinc, 0.62 g/t gold and 9.81 g/t silver.

· Exploration teams are also mobilising to the recently awarded exploration projects, namely the Jabal Hillit and Qunnah ‘Al Qassim’ exploration licences (straddling the prospective Ad Dawadimi and Afif terranes in the eastern portion of the Arabian Shield in Saudi Arabia), and the Jadib Al Qahtanah exploration licence, 45km east of the Mahad Ad Dahab mine, the principal historic Saudi gold and silver mine.

· Going forward the Company’s Saudi assets are expected to have shorter approval, financing and development schedules given there is no need to resettle communities, less restrictive security protocols and established capital markets and funding options.

KEFI Production Targets & Economics

· The successful launch of Tulu Kapi and then Jibal Qutman within the following six months or so, should see first gold pour for both at the end of 2024.

· Combined initial production of the Jibal Qutman Gold and Tulu Kapi Gold Projects is expected c.200,000 oz per annum of gold (KEFI beneficial interest c.120,000 oz pa gold).

· Net Operating Cash Flow (Earnings Before Interest Tax and Depreciation less Royalties and Sustaining Capital Expenditure) at a flat gold price of US$1,645/oz (CIBC long term consensus forecast as at August 2022) of Tulu Kapi is estimated to average £74 million (US$86 million) over the following 7 years (KEFI beneficial interest estimated at £52 million (US$60 million)*.We have yet to publish updated estimates for Jibal Qutman which will further increase these estimates.

· These preliminary projections do not take into account any upside from the projects.

· Ongoing drilling at the Hawiah Copper-Gold Project, KEFI’s recent Saudi discovery, is also expected to yield increased resources and a Preliminary Feasibility Study in Q4 2022. Its mineral resources, in gold-equivalent terms, are already approximately those of Tulu Kapi and Jibal Qutman combined before any further resource uplift.

· KEFI have established development personnel and contractors with the wherewithal to develop these 2 million tonnes per annum gold open pit/CIL (Carbon-In-Leach) projects. These are complimented by in-country operations designed to maximise skills transfer and local employment.

*EBITDA is based on internal management modelling used for preparation of the 2021 Annual Report published on 1 June 2022 and updated for the most recent published long term consensus gold price. These estimates will shortly be updated for Tulu Kapi for the final model adopted for project finance. Jibal Qutman estimates will be published with the DFS.

KEFI Gold and Copper Executive Chairman, Harry Anagnostaras-Adams, commented:

“The regulatory processes in Saudi Arabia continue to facilitate fast-tracking development of the Jibal Qutman Gold Project for its construction to commence mid-2023 and first gold at the end of 2024. Our team at G&M has mobilised in anticipation that the third of our three Jibal Qutman licence applications will be issued within weeks.

“As a 2 million tonnes per annum open pit/CIL gold project, Jibal Qutman is similar to Tulu Kapi in Ethiopia. The estimated KEFI beneficial interest in the combined EBITDA of the Tulu Kapi Gold project Gold project is £52 million per annum ($60 million per annum) from 2025. That does not reflect any estimates for Jibal Qutman or our larger expectations for Tulu Kapi, such as anticipated resource growth of both open pit operations, the underground at Tulu Kapi, the satellite prospects at both projects and, of course, our Hawiah Copper-Gold discovery, the 2021 reported resources of which already approximated those of the other two projects combined (in gold-equivalent terms).”