KEFI Gold and Copper Plc (LON:KEFI), the gold and copper exploration and development company which has focused on the Arabian-Nubian Shield since 2008, has provided an operational update for the Hawiah Copper-Gold Project in the Company’s minority-owned Gold & Minerals Ltd (GMCO) joint venture.

Highlights

· At Hawiah, over 50,000m of the 65,000m infill drilling programme is complete in preparation for updating the existing 29.0Mt Mineral Resource Estimate (“MRE”) (see announcement on 9 January 2023), with results in-line with expectations as modelled.

· Recent drilling highlights include:

o HWD_222 intersecting 8.6m (7.5m ETW) of massive sulphide averaging 0.8% copper, 0.4% zinc, 0.5 g/t gold and 8.1g/t silver from 970.2m; and

o HWD_246 intersecting 9.3m (8.4m ETW) of massive sulphide averaging 0.7% copper, 1.0% zinc, 0.6 g/t gold and 10.2 g/t silver from 872.7m.

· These intercepts have extended the vertical depth of known mineralisation at Hawiah to 740m and increased the down-plunge extent of the Crossroads Extension Lode by a further 270m.

· At the satellite Al Godeyer deposit, a second phase of drilling comprising 4,500m has recently commenced to infill and expand its maiden MRE reported in 2023 (see announcement dated 3 April 2023).

· These two drilling programmes are on track to upgrade at least 90% of the >30 million tonne combined MRE to the Indicated Resource category, forming the basis for Ore Reserves.

· Earlier-stage exploration is also ongoing at other potential Hawiah satellite deposits, including at the recently announced Abu Salal discovery.

· Hawiah’s status as the third largest base-metal development project in the now burgeoning Saudi Arabian minerals sector has been reaffirmed by this highly successful exploration programme.

Harry Anagnostaras-Adams, KEFI Gold and Copper’s Executive Chairman commented:

“Exploration near our Hawiah copper-gold-zinc-silver deposit has quickly yielded validating results and unveiled two additional discoveries. The 65,000m Hawiah infill and expansion drilling programme is now more than 75% complete, with excellent confirmatory results. GMCO is also focused on upgrading and expanding the Al Godeyer resource (12km west of Hawiah) through diamond drilling.

“The enlarged MRE of +30Mt copper-gold-zinc is scheduled to be issued in late 2024 based on the current infill and extensional drilling programme.

“Exploration also addresses additional targets within the Wadi Bidah Minerals District. Whilst GMCO discovered the Hawiah VMS deposit in 2019 and the nearby Al Godeyer VMS deposit in 2022, recent drilling based on geological modelling and interpretation has now discovered a similar VMS copper-gold-zinc-silver system at Abu Salal located around 50km south of Hawiah.

“The recent Abu Salal discovery has confirmed that the large Hawiah deposit itself is only the first in a cluster of deposits as often occurs with this style of mineralisation and has confirmed proof of concept in our understanding of regional geology and genesis of this style of VMS deposits.

“Similar VMS signatures can be witnessed elsewhere on our portfolio of assets, where we would accordingly expect further discoveries to be made. GMCO has a portfolio of 15 exploration licences in Saudi Arabia.

“Saudi Arabia is indeed fast-tracking its exploration and mining sector with GMCO at the forefront. We expect significant progress over the coming weeks and months, which will reinforce the value being created through GMCO’s aggressive and technically leading-edge exploration programme.”

Drilling Continues to Extend GMCO’s First Discovery at Hawiah

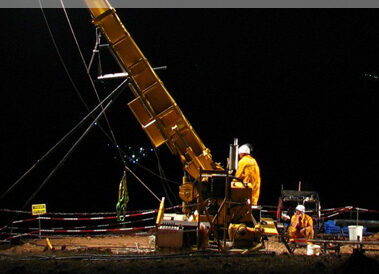

Since initial grant of the Hawiah Exploration Licence (“EL”), GMCO has completed more than 105,000m of drilling. The ongoing 65,000m infill and expansion drilling programme continues with three diamond rigs onsite and c.52,000m of this programme completed to the end of March 2024.

The first stage of this programme was designed to further test the depth limits of the Crossroads Extension area of the Hawiah orebody. This has been highly successful with notable intercepts including:

– HWD_222 intersecting 8.6m (7.5m ETW) of massive sulphide averaging 0.8% copper, 0.4% zinc, 0.5 g/t gold and 8.1g/t silver from 970.2m; and

– HWD_246 intersecting 9.3m (8.4m ETW) of massive sulphide averaging 0.7% copper, 1.0% zinc, 0.6 g/t gold and 10.2 g/t silver from 872.7m.

The above intercepts have extended the vertical depth of known mineralisation at Hawiah to 740m and increased the down-plunge extent of the Crossroads Extension Lode by a further 270m (see Figure 5 in the appendix).

Overall, the Hawiah infill drilling has been returning results in line with expectations and confirmed the 2022 MRE result. This has provided further confidence in the geological model ahead of the next MRE update which is scheduled for Q4 2024.

Highlights from the infill drilling at Camp lode include:

– HWD_268 intersecting 33.09m (18.87m ETW) of massive sulphide averaging 1.3% copper, 0.1% zinc, 0.4g/t gold and 4.8g/t silver from 353.41m; and

– HWD_340 intersecting 22.35m (13.36m ETW) of massive sulphide averaging 1.0% copper, 1.5% zinc, 0.6g/t gold and 49.6g/t silver from 572.4m.

A key aim of this infill drilling programmes is to convert the majority of the 30 million tonne Hawiah (including its satellite deposit Al Godeyer) to the Indicated Resource category as well as to expand the MRE in several areas. In conjunction with the various development studies being undertaken, this is expected to enable the estimation of substantial Ore Reserves.

Upgrading Al Godeyer Maiden Mineral Resource Estimate

Located only 12km west of the proposed Hawiah processing plant site (see Figures 1 and 2 in Appendix), Al Godeyer is a satellite deposit to the main Hawiah orebody. GMCO exploration activities began in 2022 with the maiden MRE announced in April 2023 of 1.35 million tonnes (“Mt”) at 1.4g/t gold, 0.6% copper, 0.54% zinc, and 6.6g/t silver.

Al Godeyer offers an excellent opportunity to provide additional near-surface ore to the proposed regional processing centre at Hawiah. Recent exploration focus has been aimed at increasing the current 1.35Mt Inferred Resource to a c.2Mt Indicated Resource, which would allow the Al Godeyer deposit to be incorporated into mine designs and Ore Reserves, as part of the planned Hawiah Definitive Feasibility Study (“DFS”).

The first phase of the Al Godeyer infill drilling programme was completed in August 2023. This short eight-hole programme was designed to confirm mineralisation in unclassified portions of the potential open-pit environment ahead of the main infill drilling programme. The first programme was a success with all holes intercepting the mineralised zone in-line with modelling (see Figures 3 and 4 in Appendix). Highlights from the first phase include:

– AGD_024: 7.0m (6.1m estimated true width (“ETW”) at 1.8g/t gold, 1.0% copper, 0.1% zinc and 4.1g/t silver from 123.0m; and

– AGD_018: 3.1m (2.3m ETW) at 1.1g/t gold, 0.6% copper, 3.3% zinc and 15.5g/t silver from 114m.

The next 4,500m of infill drilling, designed to close the drill spacing to the anticipated Indicated Resource classification requirement, is now underway and expected to complete in mid-June 2024.

Exploration elsewhere within the Al Godeyer and Al Godeyer East ELs is still at an early stage and a focus during 2024 is to explore southeast of the main Al Godeyer gossan where it continues at surface as narrow, discontinuous gossanous outcrops. The first stage of this will be a deeper penetrating geophysical survey to help delineate sub-surface targets, which will cover major portions of the two licences.

Advancing Hawiah Towards Development

Hawiah already ranks as the third largest base-metal project in the emerging Saudi Arabian minerals sector.

Triggering of the Hawiah DFS is scheduled to occur following the availability of the updated MRE in late 2024.

Hawiah is a larger development project than the Jibal Qutman discovery and entails underground and open-pit mining, coupled with technically more advanced processes to treat the polymetallic orebody comprising copper, gold, zinc and silver. Additional metallurgical testwork studies are ongoing to assess and optimise various processing and mining options.

Hawiah’s status has recently been further highlighted by the granting of EL’s, contiguous to GMCO’s within the Wadi Bidah, to the Saudi Government-controlled company (“Ma’aden”) and its local exploration joint venture with Ivanhoe Electric, which has announced that the Wadi Bidah is one of the top 4 priority targets for their proprietary deep-probing geophysical survey technology (the ‘Typhoon’ electromagnetic ‘EM’ method).

KEFI Gold and Copper’s GMCO joint venture partner ARTAR has agreed to fund the ongoing programme at present to ensure swift progress continues in Saudi Arabia whilst KEFI triggers project launch in Ethiopia at the high-grade Tulu Kapi Gold Project. This much-appreciated support from ARTAR reflects the strong partnership relationship and the combined priority given to production start-up in both countries.