KAZ Minerals Plc (LON:KAZ), today announced audited results for the year ended 31 December 2018.

FINANCIAL HIGHLIGHTS

· Revenues increase by 12% to $2,162 million compared to Gross Revenues of $1,938 million in 2017, supported by increased copper production1 and improved copper prices

– 2018 full year copper sales volumes of 296 kt (2017: 256 kt)

· EBITDA of $1,310 million at a margin of 61% (2017 Gross EBITDA: $1,235 million)

– Operating profit increased by 19% to $851 million (2017: $715 million)

· First quartile net cash cost of 85 USc/lb (2017: 66 USc/lb), amongst the lowest of any pure-play copper miner

– Gross cash costs of 144 USc/lb, 4% higher than 2017 (138 USc/lb)

– Structural factors continue to support cost position, including low strip ratios, energy efficiency, favourable water and transport costs, automation and the use of modern, large scale equipment

– Increase in net cash cost position compared to 2017 mainly due to higher volumes from Aktogay, where by-product output is minimal

· Free Cash Flow of $585 million (2017: $452 million)

– Cash flow from operations of $673 million, lower than $752 million in 2017 due to receipt of $232 million of non-current VAT refunds in the prior year

· Net debt $1,986 million (2017: $2,056 million)

– Gross borrowings of $3,453 million (2017: $3,877 million) and Gross Liquid Funds3 of $1,467 million (2017: $1,821 million)

– Reduction in net debt driven by higher free cash flow despite expansionary capital expenditure of $530 million during the year

– Approximately $130 million of sustaining and expansionary capital expenditure guided for 2018 carried over into 2019

– $386 million of initial $436 million cash consideration for Baimskaya acquisition paid in January 2019

· Final dividend of 6.0 US cents per ordinary share recommended, which together with the interim dividend of 6.0 US cents per ordinary share paid on 3 October 2018, brings the total dividend for 2018 to 12.0 US cents per ordinary share

OPERATIONAL HIGHLIGHTS

· Copper production1 increased by 14% and gold production2 by 3% compared to 2017

– Copper production1 of 295 kt at upper end of guidance range of 270-300 kt, gold2 and silver2 above guidance

– 2019 copper production1 expected to be in the region of 300 kt, as continued growth at Bozshakol and Aktogay offsets lower forecast output from East Region

NEAR AND LONG TERM GROWTH IN COPPER

· The Group has established a pipeline of value-accretive growth projects

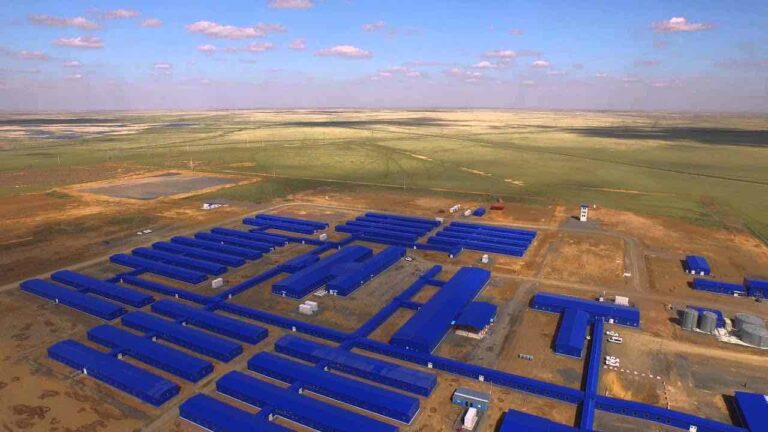

– Aktogay expansion project underway to deliver low risk brownfield growth with first production from 2021

– Completed acquisition of the Baimskaya licence area in January 2019, one of the top ten largest undeveloped copper resources in the world, for $900 million in cash and shares

Andrew Southam, Chief Executive Officer, said: “KAZ Minerals increased copper production by 14% and delivered a net cash cost of just 85 USc/lb in 2018, maintaining the Group’s position in the first quartile of the industry cash cost curve. We also progressed our high growth strategy, commencing work on the expansion of Aktogay and securing a new world class project through the acquisition of Baimskaya in Russia. Our proven asset base is generating strong cash flows, enabling the Group to invest in significant growth in copper production in both the near and long term, through value-accretive greenfield and brownfield projects. Over this period, the outlook for the copper price remains positive as supply from existing mines is set to decline, whilst demand from both traditional and new markets is forecast to continue to grow.”