Palladium is an extremely rare, silver-white Precious Metal with a relatively low melting point and low density. As a naturally white Precious Metal, Palladium will keep its brilliant color for life. Over 50% of the Palladium supply is used in the automotive industry to create catalytic converters, which reduce the amount of carbon monoxide emitted from automobiles. Palladium is also used in electronics, dentistry, jewelry, groundwater treatment and chemical applications.

Palladium is an attractive investment because of its numerous applications, limited supply and increasing demand. Physical Palladium has a high value-to-density ratio and is an efficient way for investors to achieve exposure to the Precious Metal.

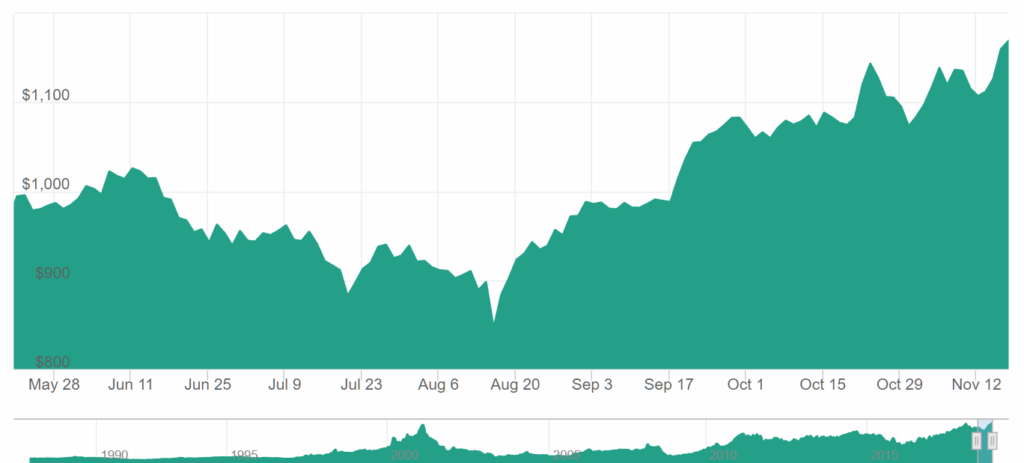

Palladium surged to a record amid bets that the Chinese auto industry will boost global demand amid tight supplies of the metal used in vehicle pollution-control devices.

Leon Coetzer CEO at Jubilee Metals Group said:

“Palladium is flying again on the back of tighter air emission controls in China vehicles. New record prices. Great timing for Jubilee producing record production of PGM’s and palladium at this time.”

Jubilee Metals Group Plc (LON: JLP) is a diversified metals recovery company, focusing on the reprocessing of historical mine waste and surface materials. Jubilee’s shares are traded on the AIM Market of the London Stock Exchange and the South African Alt-X of JSE Limited. Its strategy is a secure low risk, low capital intensive, long-term commodity production from mine surface waste materials without the risk or burden of mining implementing advanced environmentally sustainable metal recovery techniques and ensuring a significant lower cost entry point to produce metals compared to traditional mining. Its aim is to diversify across multiple commodities to hedge income risk and to align with global trends.