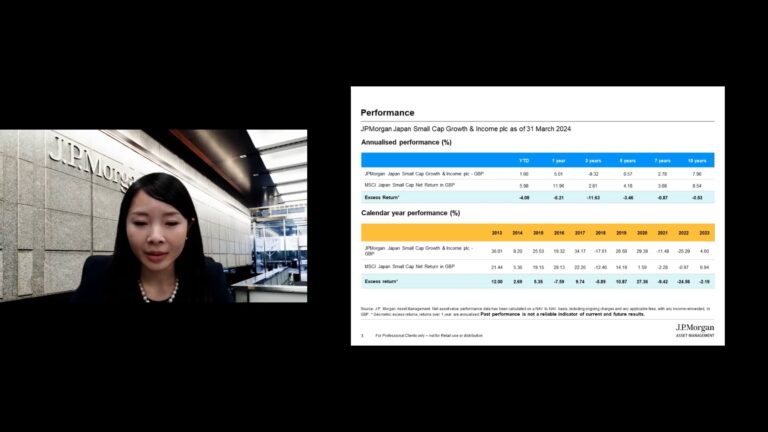

JPMorgan Japan Small Cap Growth & Income plc (LON:JSGI) recently published an update on Japan’s market outlook.

The Portfolio Manager Miyako Urabe noted:

“In Japan, while there are some concerns over cost and income pressures from global inflation trends and a weaker yen, there are thus far few signs of wage inflation domestically. The fundamentals of Japanese companies continue to be strong.

While the number of Covid-19 cases in Japan is rising again from a low base, the rollout of booster jabs is progressing. Meanwhile, the country continues to be closed to visitors from overseas.

On the ground in Japan, Covid-19 has been accelerating the structural changes that were already taking place, especially in the area of automation and information technologies. The trends have been providing many interesting investment opportunities for bottom-up investors, who are benefiting from the structural changes occurring in the country. Digitalisation is one of the structural changes that we have been seeing as a positive development and growth area.

On the political front, “continuity” and “stability” remain the watch words for Japanese politics. The Liberal Democratic Party has a strong mandate to remain in power for the next few years, and we expect it to continue with existing policies established by the two previous prime ministers over the last nine years. Digitalisation, demographics and the post-Covid recovery will remain key focus areas. We expect improvements in corporate governance to continue. The corporate governance story continues to develop, and looks increasingly structural in nature.”

Japan income fund, JPMorgan Japan Small Cap Growth & Income, targets Japan income without compromising on Japanese growth opportunities. This Japan income investing opportunity gives investors access to a diverse and fast growing sector managed by local managers. The Investment Trust offers a regular quarterly income without compromising on Japanese growth opportunities, by paying a higher dividend funded part by capital reserves as well as revenue returns.