The boards of JPMorgan Japanese and JPMorgan Japan Small Cap Growth & Income plc (LON:JSGI) are pleased to announce that the companies have agreed heads of terms for a combination of the two companies. The combination will be undertaken through a scheme of reconstruction by JSGI under s110 of the Insolvency Act 1986, under which JSGI’s assets will be rolled into JFJ in exchange for the issue of new JFJ shares to the continuing JSGI shareholders. Under the terms of the Scheme, JSGI shareholders will be entitled to realise up to 25 per cent. of their investment in JSGI for cash.

The current investment manager of both companies, JPMorgan Asset Management, and JFJ’s lead portfolio managers, Nicholas Weindling and Miyako Urabe, will, following the successful completion of the Transaction, continue to manage the enlarged JFJ, investing in accordance with JFJ’s existing investment objective and policy. Pending completion of the Transaction, Miyako Urabe will remain lead portfolio manager, alongside Xuming Tao, of JSGI.

The respective boards and JPMorgan believe that the outlook for Japanese equities remains compelling with a combination of improving economic fundamentals, structural transformation and corporate governance reforms. The new combined entity, JFJ, will represent a very attractive way to invest in this opportunity. The Transaction would result in a company with net assets of up to approximately £1.0 billion, depending on the uptake of the cash exit opportunity, and an estimated ongoing charges ratio of 0.63%. As such, JFJ will continue to offer access to the compelling investment opportunity in Japan, led by Nicholas Weindling and Miyako Urabe and the substantial JPMorgan investment team based locally in Japan.

Benefits of the Transaction

The combination is expected to result in substantial benefits for both JSGI and JFJ shareholders:

· Broad All-Cap strategy to capture a compelling investment opportunity: The JPMorgan portfolio managers have an unconstrained approach. This means that they can and do invest anywhere in the market cap spectrum, depending on where they see the best opportunities. The investment opportunity in Japan stretches across the full market capitalisation spectrum and JPMorgan anticipate that a blend of investments in larger, mid and small cap Japanese companies should enable investors to fully capture the revitalisation of the Japanese equity growth story through the corporate governance revolution.

· Continued access to the market leading resources of JPMorgan: The investment manager of both companies is JPMorgan, an institutional asset manager with $2.9 Trillion of AUM, including $15.5 billion in Japanese equities as at 30 June 2024. JFJ will continue to benefit from the expertise of its portfolio managers, Nicholas Weindling and Miyako Urabe, with Miyako providing continuity from her other role as lead portfolio manager of JSGI.

· Increased scale: JFJ is a constituent of the FTSE 250 Index, with a market capitalisation of £773.0 million and net assets of £847.6 million as at 29 July 2024. It is the largest Japanese equity investment trust. The Transaction will increase the net assets of JFJ to up to approximately £1.0 billion, depending on the uptake of the cash exit opportunity. The expected benefits should include increased secondary market liquidity, a larger marketing presence, and a greater relevance to larger investors as a direct consequence of size.

· Reduced management fees: Subject to the successful completion of the Transaction, the Board of JFJ has agreed a new and reduced investment management fee with JPMorgan Funds Limited (“JPMF”) for the enlarged JFJ that is expected to reduce the blended annual management fee from 0.58% on net assets to 0.49% on net assets, depending on the uptake of the cash exit opportunity. The marginal fee rate will be 0.35% on net assets in excess of £750 million. For JSGI shareholders rolling into JFJ, this represents a significant reduction in headline management fees from 0.83%.

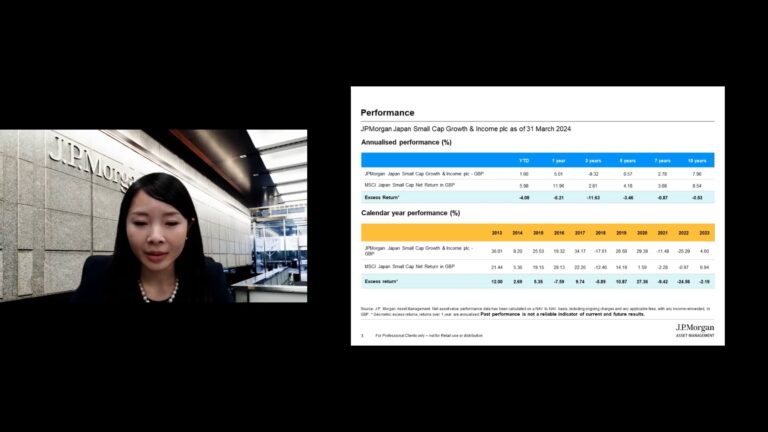

· Lower ongoing charges: JFJ’s expected ongoing charges ratio (OCR), pro forma for the Transaction (and excluding the costs and cost contribution in relation to the Transaction) is expected to be 0.63% in the 12 months following the Transaction. This compares to JFJ’s OCR of 0.75% in the half year to 31 March 2024 and JSGI’s OCR of 1.20% in its financial year ending 31 March 2024.

· Active approach to discount management: The JFJ Board takes an active approach to managing the discount and has done so since early 2022. The JFJ Board believes that this approach has dampened share price volatility and moderated the discount. This has contributed to JFJ consistently trading at a narrower discount than its immediate direct peer group. Over the 12 months to 29 July 2024, JFJ has repurchased 7.83 million shares, representing 5.15% of the opening number of shares.

· Direct cost neutrality: JPMF has agreed to cover the direct costs of the Transaction such that there is no NAV dilution for either JFJ or JSGI shareholders receiving new JFJ Shares pursuant to the Transaction from these costs.

· Economic uplift for JSGI Shareholders: JFJ is currently trading at a c.8.8% discount to NAV – its 12-month average is 8.7%. This compares to a current discount of c.13.8% for JSGI, with a 12-month average of 12.5%. JSGI’s shareholders are therefore expected to receive an uplift in the value of their holding following completion of the Transaction. In addition, JSGI shareholders may elect for the Cash Option, up to an aggregate limit of 25% of JSGI’s outstanding shares, at a 2% discount to the JSGI Residual FAV (as defined below) less the costs of realising the assets required to create the cash pool.

The Transaction

The Transaction will be effected by way of a scheme of reconstruction of JSGI under section 110 of the Insolvency Act 1986, resulting in the voluntary liquidation of JSGI and the transfer of JSGI’s assets to JFJ in exchange for the issue of new ordinary shares of JFJ (“New JFJ Shares”) to existing JSGI shareholders. The number of New JFJ Shares issued to JSGI shareholders will be determined on a Formula Asset Value (“FAV”) for FAV basis.

In accordance with customary practice for such transactions involving investment trusts, the City Code on Takeovers and Mergers is not expected to apply to the Transaction. The Transaction will be subject to, inter alia, the approval of JSGI shareholders and the shareholders of JFJ, in addition to necessary regulatory and tax approvals.

Subject to, and conditional on, the Scheme becoming unconditional and the Transaction completing successfully, qualifying JSGI shareholders will be entitled to elect to receive in respect of some, or all, of their JSGI shares:

(i) New JFJ Shares; and/or

(ii) a cash distribution (the “Cash Option”) which, on an aggregate basis will be limited to 25 per cent. of JSGI’s shares in issue (excluding treasury shares). Should total elections for the Cash Option exceed 25 per cent. of JSGI’s shares in issue (excluding treasury shares), excess elections for the Cash Option will be scaled back on a pro rata basis.

New JFJ Shares will be issued as the default option under the Scheme in the event that JSGI shareholders do not make a valid election under the Scheme or only elect for the Cash Option in respect of a proportion of their shares, or to the extent elections for the Cash Option are scaled back as a result of the Cash Option being oversubscribed.

The Cash Option will be offered at a discount of 2 per cent. to the JSGI Residual FAV (the “Cash Discount”) less the costs of realising the assets allocated to the cash pool. The JSGI Residual FAV will be the NAV of JSGI adjusted for the liquidation pool, dividends declared but unpaid (if applicable), portfolio realignment costs and the costs of the Transaction.

JPMF has agreed to cover the direct costs of the Transaction incurred by both JFJ and JSGI in the form of a fee waiver on the enlarged JFJ, subject to the Scheme being implemented (the “JPMorgan Cost Contribution”). The JPMorgan Cost Contribution will be for the benefit of JFJ and those JSGI shareholders receiving New JFJ Shares, offsetting actual direct costs incurred by each company.

The New JFJ Shares will be issued on the basis of the ratio between the JSGI Rollover FAV and the JFJ FAV. The “JSGI Rollover FAV” will be the JSGI Residual FAV adjusted for portfolio realignment costs, the JPMorgan Cost Contribution, and the benefit of the aggregate Cash Discount (capped at the value of the portfolio realignment costs). The JFJ FAV will be the JFJ NAV adjusted for portfolio realignment costs, dividends declared but unpaid (if applicable), direct transaction costs and the JPMorgan Cost Contribution.

Gearing

It is expected that JPMorgan Japan Small Cap Growth & Income’s existing debt facilities will be repaid and closed prior to the implementation of the Scheme. There will be no change to the gearing policy of JFJ following completion of the Transaction.

New Management Fee Structure

As part of the Transaction, and conditional upon the Transaction being implemented, JPMF has agreed a new management fee structure for JFJ pursuant to which JPMF will be paid an annual fee for its management services, as follows:

- 0.6% up to and including the first £500 million of net assets;

- 0.4% on net assets between £500 million and up to and including £750 million; and

- 0.35% on net assets in excess of £750 million.

The new management fee structure will apply with effect from 1 October 2024. This compares to: (a) the existing management fee structure for JFJ of 0.65% p.a. on the first £465 million of net assets; 0.485% p.a. on net assets between £465 million and £930 million; and 0.4% p.a. on net assets in excess of £930 million and (b) the existing management fee structure for JSGI of 0.85% p.a. on net assets up to £150 million; and 0.75% p.a. on net assets in excess £150 million.

Board Structure

Following completion of the Transaction, it is expected that the Board of the enlarged JFJ will consist of seven directors, with six from the current board of JFJ and one director from the board of JSGI. The JFJ Board is expected to revert to six directors over the medium-term.

Dividends

It is expected that JSGI will declare a pre-liquidation dividend on or around 1 October 2024 of 1% of the Net Asset Value as at 30 September 2024, in lieu of a second interim dividend. Such dividend shall be paid to JSGI Shareholders on or around the proposed date for completion of the Transaction and the aggregate amount of such dividend shall be reflected in the JSGI Residual FAV.

New JFJ shares will rank pari passu for the expected final JFJ dividend, which is expected to be declared in December 2024.

The Board of JFJ notes that JSGI has paid an enhanced dividend since 2018. Following the completion of the Transaction, the enlarged JFJ Board intends to undertake a review of JFJ’s dividend policy, including consulting with JFJ’s major shareholders.

Timetable

It is intended that the documentation in connection with the Transaction will be posted to each of JFJ’s and JSGI’s shareholders in September 2024, with a view to convening general meetings in October 2024. The Transaction is expected to conclude by the end of October 2024.

Stephen Cohen, Chair of JPMorgan Japanese, commented:

“The JFJ Board is pleased to have agreed heads of terms for a combination with JSGI which will result in a larger, more liquid investment trust with net assets approaching £1 billion and a highly competitive ongoing fee structure. JFJ will continue to benefit from the expertise of its Tokyo-based portfolio managers, Nicholas Weindling and Miyako Urabe. JFJ offers a broad all-cap strategy and is ideally positioned to capture Japan’s compelling investment opportunity.”

Alexa Henderson, Chair of JPMorgan Japan Small Cap Growth & Income, commented:

“Over recent months, the board of JSGI, together with its advisers, have considered a number of possible alternatives for the Company. Following the conclusion of this process, the board is delighted to propose the combination of JPMorgan Japan Small Cap Growth & Income plc and JPMorgan Japanese Investment Trust plc. The board believes that the proposed combination will provide continuity of investment process and philosophy within a broader market opportunity. The proposed combination will provide a much larger investment trust with significantly lower costs for shareholders.”