JPMorgan Japan Small Cap Growth & Income plc (LON:JSGI) has announced its final results for the year ended 31 March 2024.

CHAIRMAN’S STATEMENT

Investment Performance

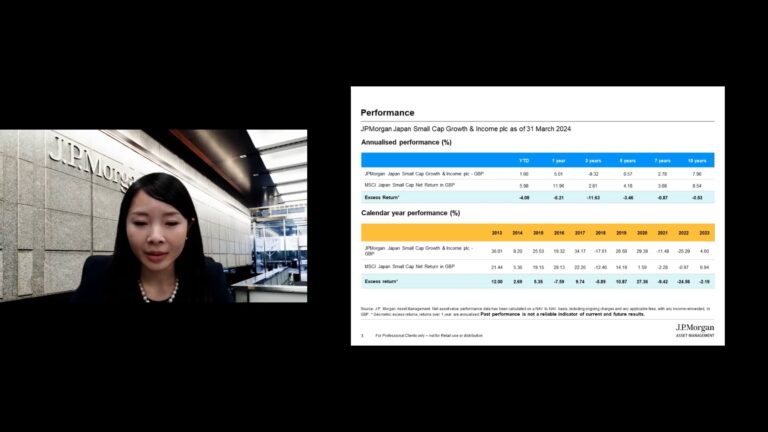

During the 12-month period ended 31st March 2024, the Company produced a total return on net assets of +5.0%, while its benchmark, the MSCI Japan Small Cap Net Return Index (in sterling terms), produced a total return of +12.0%, resulting in an underperformance of 7.0%. The MSCI Small Cap Growth Index which better reflects the Company’s portfolio rose by 6.6% during the 12-month period ended 31st March 2024.

This is a disappointing result, which is due in part to the Company’s investment style which has a bias towards smaller cap, quality, growth names. During the year, the market has favoured larger, lower-quality value-oriented stocks which do not meet the Company’s investment criteria, due to their unappealing growth characteristics. However, the Board shares the Portfolio Managers’ conviction that good quality companies with strong growth prospects will always perform well over the longer term. Indeed, the Company delivered an annualised returnA on net assets of +8.0% over the ten years ended 31st March 2024, not far below the benchmark, which returned 8.5% over the period.

The Company’s recent portfolio activity is detailed in the Investment Manager’s Report. The Portfolio Managers also outline the reasons for their optimism about Japan’s very favourable long-term prospects, and the positive implications this has for the Company’s ability to rebuild strong performance.

Dividend Policy and Discount Management

JPMorgan Japan Small Cap Growth & Income’s dividend policy aims to pay, in the absence of unforeseen circumstances, a regular dividend equal to 1% of the Company’s NAV on the last business day of the preceding financial quarter, being the end of March, June, September and December. Over the year, this approximates to 4% of the average NAV, paid from other reserves. For the year ended 31st March 2024, quarterly dividends paid out totalled 14.2p per share (2023: 14.2p). Based on the current share price, the Company offers an attractive dividend yield of 4.5%.

A resolution to approve the Company’s dividend policy will be submitted to shareholders at the forthcoming Annual General Meeting (‘AGM’).

The Company’s discount widened over the review period, ending the year at 12.5%, up from the 9.8% discount reported at the same time last year. This widening is broadly in line with the experience of many other investment trusts over this period. The Board closely monitors the discount and recognises that it is in shareholders’ interests that the Company’s share price does not differ excessively from the underlying NAV under normal market conditions. Given the prolonged period of discount widening and the Board’s conviction that the current discount to NAV is unwarranted, during the period under review the Board decided to resume share buybacks for the first time since March 2018. During the year, 166,117 shares were repurchased, amounting to 0.3% of shares in issue, and held in Treasury. A further 175,029 shares have been purchased so far this financial year. At the time of writing, the discount stands at 13.4%.

Gearing/Borrowing

The Portfolio Managers seek, at times, to enhance investment returns for shareholders by borrowing money to buy more assets (‘gearing’), subject to their view on prevailing market conditions. The Company’s gearing is discussed regularly by the Board and the Portfolio Managers, and the gearing level is reviewed by the Directors at each Board meeting.

The Company currently has a Yen 4.0 billion two-year revolving credit facility with ING Bank. This facility has a maturity date of December 2024, and the Investment Manager will seek to renew or replace this facility, at the best available terms, on expiry.

A Alternative Performance Measure.

Access to this credit facility provides the Portfolio Managers with the ability to gear tactically within the set guidelines. The Company’s investment policy permits gearing within a range of 10% net cash to 25% geared. However, the Board requires the Portfolio Managers to operate in the narrower range of 5% net cash to 15% geared, in normal market conditions. During the past 12 months the Company’s gearing level ranged between 4.1% and 7.4%, ending the financial year at 6.1% (2023: 5.6%).

Revised Management Fee Arrangements

As recently announced, with effect from 1st April 2024, the Company’s Manager agreed to reduce its investment management fee. The investment management fee will be charged at the rate of 0.85% (previously 1%) per annum on the net asset value of the Company’s portfolio up to £150 million, and at the rate of 0.75% thereafter.

The revised fee agreement balances the need for the Company’s ongoing charges ratio to remain competitive, whilst rewarding the Manager for its efforts.

Investment Manager Personnel Changes

The Board was informed by JPMAM that Naohiro Ozawa, one of the Company’s Portfolio Managers, would be stepping down as Portfolio Manager to the Company with effect from 1st April 2024. Miyako Urabe and Xuming Tao will continue to manage the assets of the Company. On behalf of the Board, I would like to express our sincere gratitude to Naohiro for his contribution to the management of the Company’s portfolio and wish him well in his future endeavours.

The Board and Corporate Governance

The Board reviews its composition on a regular basis, giving due account to the need to refresh its membership and maintain diversity, whilst also ensuring the necessary degree of continuity of Board experience. Yuuichiro Nakajima, a member of the Board since April 2014 retired from the Board following the conclusion of the Company’s AGM held in July 2023. On behalf of the Board and the shareholders I would like to thank Yuuichiro for his dedication to the Company since his appointment. Deborah Guthrie, who became a Director in 2015, has indicated that she wishes to retire at the conclusion of the Company’s AGM in July 2024. The Board has benefited immensely from Deborah’s commitment to the role and her specialist knowledge of the Japanese market. She will leave with our gratitude and best wishes for the future. The Board has commenced the search for a new Non-Executive Director.

In accordance with good corporate governance practice, all Directors, with the exception of Deborah Guthrie, will stand for re-election at the forthcoming AGM.

Shareholders who wish to contact the Chair or other members of the Board may do so through the Company Secretary or the Company’s website, details of which appear below.

Task Force on Climate-related Financial Disclosures

As a regulatory requirement for the Company’s Manager, on 30th June 2023, JPMAM published its first UK Task Force on Climate-related Financial Disclosures (‘TCFD’) Report for the Company in respect of the year ended 31st December 2022. The report discloses estimates of the Company’s portfolio climate-related risks and opportunities according to the Financial Conduct Authority (‘FCA’) Environmental, ESG Sourcebook and the TCFD. The report is available on the Company’s website under the ESG documents section.

This is the first report under the new guidelines and disclosure requirements. The Board is aware that best practice reporting under TCFDs is still evolving with respect to metrics and input data quality, as well as the interpretation and implications of the outputs produced, and will continue to monitor future developments.

Stay Informed

The Company delivers email updates on the Company’s progress with regular news and views, as well as the latest performance. If you have not already signed up to receive these communications and you wish to do so, you can opt in via https://tinyurl.com/JSGI-Sign-Up or by scanning the QR code in the Annual Report.

Annual General Meeting

The Company’s AGM will be held on Thursday, 25th July 2024 at 12.00 noon at 60 Victoria Embankment, London EC4Y 0JP.

We are delighted to invite shareholders to join us in person for this event, to hear from the Portfolio Managers, who will make a presentation to shareholders via video link from Tokyo. Their presentation will be followed by a live question and answer session. Shareholders wishing to follow the AGM proceedings but who choose not to attend in person will be able to view them live and ask questions (but not vote) through conferencing software. Details on how to register, together with access details, will be available shortly on the Company’s website at www.jpmjapansmallcapgrowthandincome.co.uk or by contacting the Company Secretary at [email protected].

My fellow Board members, representatives of JPMorgan and I look forward to the opportunity to meet and speak with shareholders after the formalities of the meeting have been concluded.

Shareholders who are unable to attend the AGM are strongly encouraged to submit their proxy votes in advance of the meeting, so they are registered and recorded at the AGM. Proxy votes can be lodged in advance of the AGM either by post or electronically: detailed instructions are included in the Notes to the Notice of the AGM on pages 92 to 95 of the Annual Report.

If there are any changes to the above AGM arrangements, the Company will update shareholders through an announcement to the London Stock Exchange and on the Company’s website.

Outlook

The Board is positive about the Company’s prospects for several reasons. Foremost signs that the Japanese economy is emerging from its long period of deflation are most welcome. Rising wages should also encourage consumer spending, while exporters are enjoying the competitive benefits of the weak yen. Other structural trends, including digitalisation, de-carbonisation, changing demographics and technological innovation all augur well for productivity and profits over the medium term. As well, ongoing reforms to Japan’s corporate governance also promise to drive increases in shareholder returns for years to come. Despite these positives, equity valuations are still relatively low compared to other markets or relative to the market’s own history. After years of disinterest, it is gratifying to see that recent developments in the Japanese equity market seem to be finally capturing the attention of investors, including international investors.

In short, Japan’s investment environment is more congenial than it has been for some time, especially for innovative smaller companies with exposure to the structural changes underway across the economy. The Board believes that the Portfolio Managers’ focus on quality and growth, supported by JPMorgan’s extensive, global and Tokyo-based research resources, mean that the Company is ideally placed to identify and capitalise on the many interesting opportunities this environment is generating for smaller cap businesses. We therefore share the Portfolio Managers’ confidence in the Company’s ability to deliver attractive levels of capital growth, combined with a regular income, to shareholders over the long term.

Alexa Henderson

Chair 20th June 2024

INVESTMENT MANAGER’S REPORT

Performance and Market Review

The 12-month period to March 2024 was another difficult year for the Company’s relative performance, following the underperformance of the two previous years, although on an absolute basis the Company continues to claw back some of its previous losses, and, during the past year, it made a positive absolute return. The Company produced a total return on net assets of +5.0% over the period, while the benchmark, the MSCI Japan Small Cap Net Return Index (in sterling terms), produced a total return of +12.0%, meaning the Company underperformed the benchmark by 7.0%. The MSCI Japan Small Cap Growth index which better reflects the Company’s portfolio rose by 6.6% during this period.

Historically, the Japanese equity market has been under-owned, but it has come back into focus over the past year, and encouragingly the Nikkei Index reached its highest levels in 34 years earlier this year. Key reasons for the positive market sentiment include: ongoing improvements in corporate governance, signs that the economy is finally emerging from a long period of deflation, and a weaker Japanese yen, which is supporting export earnings.

Corporate governance reforms are no longer a new story. Developments on this front have been underway over the past decade, thanks in large part to the Corporate Governance Code introduced in 2015. The reforms have delivered rising shareholder returns, via increased dividends and share buybacks, and greater board independence and transparency. However, recently we have witnessed further pressure on corporates to improve their governance. Early in 2023, the Tokyo Stock Exchange (TSE) announced initiatives requiring corporates whose share price is consistently below 1x price to book to take steps to raise their valuations. Since then the Financial Services Authority (FSA) has urged non-life insurance companies to sell their strategic shareholdings, following a price fixing scandal. Such strategic shareholdings have long been viewed as problematic for corporate governance and capital efficiency.

Japan is also finally seeing some modest upward pressure on prices and wages, which led the Bank of Japan (BoJ) to begin raising interest rates in March 2024, for the first time in seventeen years. This is consistent with market expectations for a gradual normalisation of the BoJ’s ultra-loose monetary policy, although expectations are not for aggressive monetary tightening.

While the broader Japanese equity market has performed well, value stocks have continued to outperform growth as interest rates remain high globally. Large caps have also been in favour compared to small caps, thanks in part to foreign buying. In addition, the weaker Japanese yen has increased the appeal of exporters, which are mainly large cap stocks.

These developments have adversely impacted the Company’s performance, given its bias towards quality and growth stocks and its focus on smaller cap companies. While we are very disappointed to report another year of weak relative performance, our investment strategy looks beyond short-term market fluctuations and adopts a long-term perspective, based on the view that excess returns take time to accumulate, especially for smaller cap stocks. We continue to believe this is an attractive area of the market in which to invest over the long term, as the sector includes many interesting businesses geared towards new technology and themes such as e-commerce and digitalisation, technology hardware, and healthcare. We intend to maintain our current investment strategy.

Performance attribution

Year ended 31st March 2024

| % | % | |

| Contributions to total returns | ||

| Benchmark return | 12.0 | |

| Sector allocation | -1.4 | |

| Stock selection | -6.1 | |

| Gearing/cash | 1.7 | |

| Return relative to benchmark | -5.8 | |

| Portfolio return | 6.2 | |

| Management fee/other expenses | -1.2 | |

| Return on net assetsA | 5.0 | |

| Return to shareholdersA | 2.3 |

Source: Factset, JPMAM, Morningstar.

All figures are on a total return basis.

Performance attribution analyses how the Company achieved its recorded performance relative to its benchmark.

A Alternative Performance Measure (‘APM’).

A glossary of terms and Alternative Performance Measures is provided on pages 96 and 97 of the Annual Report.

Spotlight on sectors and stocks

Our bias towards growth and quality companies means that the portfolio differs substantially from the benchmark. This variance can often lead to notable volatility in performance relative to the benchmark over the short term, as we have seen in recent years.

During the 12 months under review, both our sector allocation and stock selection decisions had a negative impact on performance.

The biggest positive contributors at the sector level include our overweight in Semiconductors & Semiconductor Equipment and Materials, and our underweight in Equity Real Estate Investment Trusts (REITs). We are positive on the semiconductor supply chain, as we expect the sector to see sustained growth in demand over the long term, backed by structural trends such as the rapid spread of artificial intelligence (AI), the growth of the internet of things (IoT), and the increasing use of electronics in vehicles. Our holdings in Materials include a broad range of quality companies with strong competitive positions, ranging from industrial gas producers to the suppliers of key materials used in the healthcare space. The underweight to REITs is driven by the lack of attractive growth stories in this area of the market.

On the other hand, the main detractors at the sector level were our underweight position in Banks and overweight positions in Software & Services and Commercial & Professional Services. Banks performed strongly in response to the BoJ’s gradual monetary policy normalisation. While increased interest rates will likely support banks’ earnings, it is difficult to find any legacy banks with sustainable long-term growth opportunities, or clear competitive advantages. The only bank stock we own is Rakuten Bank, which is a fast-growing online bank with the ability to leverage the broader Rakuten group ecosystem to acquire new business. We continue to believe that the Software & Services sector offers many attractive opportunities, especially related to digitalisation, where demand will remain strong over the mid/long-term, as Japan plays catch-up with other major economies in areas such as e-commerce, cloud software services and cashless payments.

At the stock level, several names made significant positive contributions to returns, including Nippon Sanso, Sanwa Holdings and OSAKA SODA:

• Nippon Sanso is Japan’s number one supplier of industrial gas and the fourth largest supplier in the world. We believe that industrial gas is an attractive industry, with high barriers to entry, increasingly consolidated market shares, strong cashflow generation and a favourable pricing environment. Nippon Sanso has been successfully expanding its presence both organically and through M&A activity. Over the past year, the industrial gas industry has continued to demonstrate strong pricing power under an inflationary environment, with successful price hikes globally.

• Sanwa Holdings is the number one shutter maker in Japan. The domestic market is very stable, dominated by three companies, and Sanwa has the strongest position with over 50% market share. The company also has a presence in the US and Europe, mainly through acquisitions. While the end-demand is cyclical, the company is very well managed, with consistently positive free cashflow, steady margins and proactive shareholder returns. Execution on pricing strategy through the current inflationary environment has also been strong.

• OSAKA SODA is a chemical company that holds the top global position in multiple niche product categories. The company’s biggest future growth driver is silica gel, which is used in the production of obesity drugs. OSAKA SODA has the largest share of the world market for this material, and profitability is very high, as the obesity drug market is growing rapidly. The company is currently expanding its manufacturing capacity accordingly. Developments on the governance front are also positive. The company has announced a medium-term plan to enhance its shareholder return policy and it is now targeting a total payout ratio of 40%, compared to around 20% previously.

Unfortunately, the positive performance effect of these stock selection decisions was more than offset by the adverse impact of other positions, notably Milbon, Taiyo Yuden and Square Enix. However, these names all remain in the portfolio due to our still favourable assessments of their longer-term growth prospects.

• Milbon is Japan’s number one manufacturer of salon exclusive hair care products. With a strong consulting sales approach, the company has been expanding market share at home, and abroad, including in China and Korea. In the near-term, rising raw material costs have dampened profitability, but our positive assessment of Milbon’s positioning, and its scope to expand both domestically and overseas, remains unchanged. The company has recently announced plans to raise prices.

• Taiyo Yuden manufactures electronic components such as multi-layer ceramic capacitors (MLCCs) used in cars and industrial equipment. It is benefiting from rapid technological innovation in the auto industry, including the rising popularity of electric vehicles, autonomous driving, and ‘connected cars’ that use mobile internet technology. This is translating into significant potential demand for high quality MLCCs over the medium term. In the near-term, however, demand has been sluggish for all MLCC makers due to an inventory correction.

• Square Enix develops and publishes video game software, including long-running titles from its Dragon Quest and Final Fantasy IPS. A consistently rising digital download ratio is a favourable industry trend, as digital downloads have higher profitability than packaged games thanks to easier and much cheaper distribution. Square Enix possesses strong intellectual property in the form of a library of popular games and is thus set to benefit from this trend. Near-term earnings have, however, been disappointing, with weaker than expected title sales. The new CEO is focusing on raising profitability to improve the business’s performance, and we will monitor execution going forward.

About our investment philosophy

The Company aims to provide shareholders with access to the innovative and fast-growing smaller companies at the core of the Japanese economy. Our investment approach favours quality and structural growth, and we target companies – other than Japan’s largest 200 – which we believe can compound earnings growth over the long term, supported by strong competitive advantages, good management teams and judicious capital allocation. We believe the strong and durable market positioning of such businesses will allow them to substantially increase their intrinsic value over time. We avoid stocks that have no clear differentiation and those that operate in industries plagued by excess supply and structural decline.

Our stock selection is based on fundamental analysis, ‘on-the-ground’ knowledge and extensive contact with the management teams of prospective and current portfolio companies. The Company is managed by a team of two, supported by over 20 Tokyo-based investment professionals. Their knowledge of the local market provides us with what we believe to be a significant competitive advantage in identifying investment opportunities in small cap companies – a sector of the market which is under-researched and overlooked by many investors.

The starting point in our bottom-up investment process is our Strategic Classification framework, where we address the key question ‘Is this a business that we want to own?’. Through this process we assign a rating of Premium, Quality, Standard or Challenged to each stock, based on its fundamentals, governance and the viability of its revenues over the long term. We aim to have a high exposure to Premium and Quality companies, and where possible, we invest from an early stage, to benefit fully as companies realise their growth potential.

This patient approach is key to generating excess return over the long term, although the portfolio’s focus on quality and growth means it tends to struggle during value rallies. Having said that, the Company does not target ‘growth at any price’. We always strive to acquire shares at a reasonable price. To this end, we use a five-year expected return framework to consider whether a stock’s price is at an attractive level. We believe it is also important to construct a well-balanced, diversified portfolio, to minimise exposure to unintended risks. The Company’s current and prospective portfolio holdings encompass a broad range of sectors, including not only IT hardware and software, but materials, chemicals, construction, machinery and consumer goods and services.

We believe that well-run companies, which exhibit behaviour that respects the environment and the interests of their shareholders, customers, employees and other stakeholders, are most likely to deliver maintainable, long-term returns. Such environmental, social and governance (‘ESG’) considerations are thus integral to our investment process and a key driver of our quest to generate financial returns. Financially material ESG factors influence our decisions both at the portfolio construction stage and thereafter, once companies are held in the portfolio, when ongoing engagement with managers can be effective in encouraging them to realise and maintain acceptable ESG standards. Our long-term holding in DTS, a business information services provider, is one instance where our engagement with a company has resulted in considerable progress in its corporate governance practices, including, in DTS’s case, in greater board independence and diversity and a better shareholder return policy.

Trends and themes

While our decisions are based on company-specific factors, there are also structural, long-term trends and themes that underlie and inspire much of our stock selection.

The investment themes which help shape the portfolio include:

• Changing demographics: Japan’s ageing and declining population is creating significant challenges for Japanese policymakers. The government is committed to tackling these issues through regulatory reforms and greater use of technology, and this is providing opportunities for innovative smaller companies working to improve the quality of life for the elderly, for example, by reducing the need for face-to-face medical consultations. The telemedicine company, Medley, is an example of a portfolio holding benefiting from such innovation.

• Raising labour productivity via digitalisation: Japan’s ageing population profile is also leading to a contraction in labour supply, and technology is a key part of the solution to this problem, as it raises labour productivity. The government wishes to encourage the adoption of digital technology across the economy, and to this end it has established an agency which is focused on digitalising the operations of national and local governments, as well as Japan’s education and healthcare systems. Portfolio holdings Rakus, a cloud services provider, and Infomart, a business-to-business trading platform for the food industry, are examples of holdings that benefit from this long-term trend.

• Technological innovation: While certain areas of the Japanese economy lag other markets in terms of their technological sophistication, Japan’s manufacturers are world class. The country is a leading global supplier of factory automation equipment, robots, electronics parts and materials, presenting attractive investment opportunities for portfolio companies such as MEC and Rorze that specialise in niche technology markets.

• De-carbonisation: The Japanese government’s commitment to reduce carbon emissions to net zero by 2050 has galvanised efforts to transition the economy to renewable energy sources and take other necessary steps to mitigate climate change. Some smaller Japanese companies possess unique technologies related to the production of electric vehicles, solar and wind power and other forms of clean energy, and we continue our search for companies such as Canadian Solar Infrastructure Fund that are well-positioned to benefit from the global push towards carbon neutrality.

• Overseas growth: The Asian region is experiencing rapid structural growth. Japanese luxury goods producers and other strong brands captured by our investments in Milbon, a supplier of exclusive hair products (discussed above), and watchmaker Seiko, are likely to continue experiencing strong demand from new customers in China, Korea, India and other increasingly prosperous Asian countries.

• Corporate governance: Japan’s corporate sector is making a concerted effort to strengthen governance standards via enhanced shareholder returns, the appointment of more independent, external directors to company boards, tighter internal controls and more transparent disclosure rules. As discussed above, the Japanese authorities, and the TSE, continue to encourage these efforts and there is room for further improvement. We engage in constructive dialogues with portfolio companies and potential investments on this broad theme, on the view that the market is likely to keep rewarding companies that upgrade their governance practices.

Portfolio Activity

Key new purchases during the reporting period included Azbil, LIFEDRINK and Sohgo Security Services.

• Azbil is a building solutions provider. The company provides integrated solutions for building control systems, including architectural design, efficient and environmentally friendly heating and cooling systems and custom-made key components, as well as on and off site management and maintenance services. Azbil is the dominant player in Japan, with a domestic market share of 80%, and it is a very steady and recurring business with maintenance and repairs accounting for 70% of its activities. We see a continued healthy business environment as customers focus increasingly on energy saving solutions.

• LIFEDRINK is a beverage company focused on private label products for retailers. The company has a vertically integrated business model which allows it to offer lower prices and enjoy higher margins. We believe the company has a healthy growth runway, as the Japanese market for private label products is still under-developed compared to overseas markets such as US, and the inflationary environment is ensuring strong demand, as consumers prefer the company’s lower priced items to national brands.

• Sohgo Security Services is a security service provider focused on the installation of sensors and monitoring equipment and station security services for home and commercial use. The company has the second largest share of the domestic market and is expected to gradually build on this thanks to regulation that favours largescale players. The business has defensive characteristics and has also recently started to increase shareholder returns, although we believe there is potential for further progress on this front given its net cash position.

To fund these and other acquisitions, our largest divestments over the past year included Marui Group, Paltac and Nextage. We continue to believe retailer Marui Group has made excellent progress in recent years by shifting its retail business to a lower risk model and focusing on its finance business, while stepping up shareholder returns, including via a large scale buyback. However, as this story has now largely played out, we have used this position as a source of cash for new ideas. Paltac is the domestic number one wholesaler for daily necessities and toiletries. We expect the company will continue to expand market share and execute topline growth, but we closed the position as we have some concerns over rising labour costs. Nextage is one of Japan’s top three used car sellers. The used car market is highly fragmented, with scope for consolidation over the long-term, and Nextage has been expanding through new store openings. However, there have been media reports of fraudulent insurance claims by various companies within the industry, including Nextage, so we exited the position.

Outlook and strategy

After a long period of being unloved and under-owned, we are optimistic about the outlook for both Japanese equities and our portfolio. We believe the global investment community’s perception of the Japanese market is starting to improve, with the key structural supports being the continued progress on corporate governance reforms and signs of an exit from deflation.

Reforms to corporate governance over the past few years (as highlighted in the Performance and Market Review section above) have already lifted shareholder returns, and with many Japanese companies still awash with cash, we expect further significant efforts to return cash to shareholders, and increase investment returns accordingly. This expectation is based on our conversations with hundreds of companies. We sense an acceleration in corporate reform efforts this year, particularly after the Tokyo Stock Exchange’s (TSE) initiatives announced last year. We anticipate further broad-based progress on the corporate governance front, not only by companies trading below book value. Balance sheet inefficiency is an issue across the Japanese market, and even high-quality companies with strong competitive positions have room to up their game, and shareholder returns will rise accordingly. The portfolio’s exposure to several other significant, very positive, long-term structural trends should provide further impetus to performance over the longer term.

There are also signs the country is finally emerging from a long period of deflation. The spring wage negotiations, also known as the Shunto, agreed to a 5.3% wage increase this year, which is the highest level in the past three decades, and well ahead of inflation. A rise in real wages should help to boost consumer sentiment and domestic demand and hopefully eradicate consumers’ deflationary mindset.

All these factors – in particular the longer-term potential for improved shareholder returns – bode well for Japanese equities. Meanwhile, despite the market’s positive prospects, Japanese equity valuations do not look demanding, either compared to other major markets, or relative to the market’s own history. With valuations at attractive levels, and global investors still mostly underweight Japanese equities, even after last year’s net investment, prospects appear bright. This is especially the case for small caps with growth characteristics.

We are well-positioned to benefit from this favourable environment. Japan’s smaller and more entrepreneurial companies are at the forefront of innovation. Many are global leaders set to prosper over the long term. Yet, the sell side coverage for such exciting small and mid-cap companies remains limited. This gives us a considerable competitive advantage, as our large and dedicated team of Japanese equities analysts and fund managers based on the ground in Tokyo is ideally placed to discover exciting investment opportunities amongst smaller companies, and to capitalise on the long-term structural changes playing out in Japan. We therefore remain confident our investment approach and portfolio positioning will deliver positive and sustained returns to our shareholders over the medium and long term.

Thank you for your ongoing support.

For and on behalf of

JPMorgan Asset Management

Investment Manager

Miyako Urabe

Xuming Tao

Portfolio Managers

20th June 2024

PRINCIPAL AND EMERGING RISKS

The Board has overall responsibility for reviewing the effectiveness of the Company’s system of risk management and internal control.

The Board is supported by the Audit Committee in the management of risk. The risk management process is designed to identify, evaluate, manage, and mitigate risks faced.

Although the Board believes that it has a robust framework of internal controls in place this can provide only reasonable, and not absolute, assurance against material financial misstatement or loss and is designed to manage, not eliminate, risk.

The Directors confirm that they have carried out a robust assessment of the principal and emerging risks facing the Company, including those that would threaten its business model, future performance, solvency or liquidity. The risks identified and the ways in which they are managed or mitigated are summarised below.

With the assistance of JPMF, the Audit Committee has drawn up a risk matrix, which identifies the principal and emerging risks to the Company. These are reviewed and discussed on a regular basis by the Board, through the Audit Committee. These risks fall broadly into the following categories:

| Movement from | |||

| Principal risk | Description | Mitigation/Control | Prior Year |

| Investment and Strategy | An inappropriate investment strategy, poor asset allocation or the level of gearing, may lead to underperformance against the Company’s benchmark index and its peer companies, resulting in a lack of demand for the Company’s shares and leading to the shares trading on a wider discount. | The Company has a clearly defined strategy and investment remit, which is reviewed annually. The portfolio is managed by a highly experienced Investment Manager, with a defined investment appraisal process. The Board relies on the Investment Manager’s skills and judgment to make investment decisions based on research and analysis of individual stocks and sectors. To aid appropriate investment decisions, the Board has set investment guidelines and parameters for the portfolio managers to follow; these are discussed and reviewed at regular intervals. The AIFM also monitors the Investment Manager against the Company’s investment guidelines.The Board reviews the performance of the portfolio against the Company’s benchmark index, that of its competitors and the outlook for the markets on a regular basis, with the portfolio managers who attend Board meetings. Where necessary the portfolio managers will take action following a review of the performance.The Board also reviews the level of premium/discount to NAV at which the Company’s shares trade and movements in the share register. The Board regularly seeks the views of its investors. | ãThe risk remains high due to the Company’s under performance during the year. The Portfolio Managers continue to work to improve the Company’s performance against its benchmark index. |

| Market | Market risk arises from uncertainty about the future prices of the Company’s investments. This market risk comprises three elements – equity market risk, currency risk and interest rate risk. | The Board considers the split in the portfolio between small and large companies, sector and stock selection and levels of gearing on a regular basis and has set investment restrictions and guidelines, which are monitored and reported on by JPMF. The Board monitors the implementation and results of the investment process with the Manager. However, the fortunes of the portfolio are significantly determined by market movements in Japanese equities, the rate of exchange between the Japanese yen and sterling and interest rate changes. This is a risk that investors take having invested into a single country fund. The Board recognises the benefits of a closed-end fund structure in extremely volatile markets. During times of elevated market stress, the ability of a closed-ended fund structure to remain invested for the long term enables the Manager to adhere to disciplined fundamental analysis from a bottom-up approach and be ready to respond to dislocations in the market as opportunities present themselves. | âThe risk remains high but unchanged. The risk remains high subsequent to the recent developments in the Japanese equity market as discussed in the Investment Manager’s Report, which has adversely impacted the Company’s performance due to its bias towards quality and growth stocks. |

| Operational and Cybercrime | Disruption to, or failure of, the Investment Manager’s accounting, dealing or payments systems or the custodian’s or depositary’s records could prevent accurate reporting and monitoring of the Company’s financial position. | On 1st July 2014, the Company appointed Bank of New York Mellon (International) Limited to act as its depositary, responsible for overseeing the operations of the custodian, JPMorgan Chase Bank, N.A., and the Company’s cash flows. Details of how the Board monitors the services provided by the Investment Manager and its associates and the key elements designed to provide effective internal control are included in the Risk Management and Internal Control section of the Corporate Governance Report on pages 50 and 51 of the Annual Report.As an externally managed investment trust, there is a continued reliance on the Investment Manager and other third-party service providers.The Board reviews the overall performance of the Investment Manager and other key third-party service providers and compliance with the investment management agreement on a regular basis to ensure their continued competitiveness and effectiveness, which includes assessment of the providers’ control systems, whistle-blowing, anti-bribery and corruption policies and business continuity plans.The Investment Manager’s internal control processes are monitored throughout the year and are evidenced through its Service Organisation Control (SOC 1) reports, prepared by an independent auditor. The SOC 1 reports, which are reviewed annually by the Audit Committee, provide assurance in respect of the effective operation of internal controls.Service providers are appointed with clearly-documented contractual arrangements detailing service expectations. The Audit Committee receives assurance and internal controls reports from key service providers on an annual basis.The threat of cyber-attack, in all its guises, is regarded as at least as important as more traditional physical threats to business continuity and security. The Board has received the cyber security policies for its key third party service providers and JPMF has assured the Directors that the Company benefits directly or indirectly from all elements of JPMorgan’s Cyber Security programme. The information technology controls around the physical security of JPMorgan’s data centres, security of its networks and security of its trading applications are tested by independent reporting accountants and reported every six months against the Audit and Assurance Faculty Standard. | âRisk remains unchanged. The operational requirements of the Company, including from its key third-party service providers, have been subject to rigorous testing. To date the operational arrangements have proven robust and key third-party service providers have not experienced significant operational difficulties.To date the Investment Manager’s cyber security arrangements have proven robust and the Company has not been impacted by any cyber attacks threatening its operations. |

| Loss of Investment Team or Investment Managers | The sudden departure of the portfolio managers or several members of the wider investment management team could result in a short-term deterioration in investment performance. | The Investment Manager takes steps to reduce the likelihood of such an event by ensuring appropriate succession planning and the adoption of a team based approach. | âRisk remains unchanged. The Investment Manager has ensured the portfolio is managed by a robust portfolio management team i.e. the portfolio is co-managed by two portfolio managers who are supported by a number of on-the-ground investment professionals. |

| Share Price Relative to NAV per Share | If the share price of an investment trust is lower than the NAV per share, the shares are said to be trading at a discount, leading to volatile returns for shareholders. | The Board monitors the Company’s premium/discount level and, although the rating largely depends upon the relative attractiveness of the trust, the Board has authority to issue new shares or buy backs its existing shares when deemed by the Board to be in the best interests of the Company and its shareholders. The Board is committed to consider buying back the Company’s shares when/if they stand at anything more than a small discount to enhance the NAV per share for remaining shareholders. | ãThe risk has been heightened by the widening of the discount at which the share price trades to NAV.Although the widening of the Company’s discount is in line with the experience of other investment trusts, given the prolonged period of widened discount, the Board resumed buybacks for the first time since March 2018. |

| Accounting, Legal and Regulatory | In order to qualify as an investment trust, the Company must comply with Section 1158 of the Corporation Tax Act 2010 (‘Section 1158’). Details of the Company’s approval are given on page 28 of the Annual Report. Section 1158 requires, among other matters, that the Company does not retain more than 15% of its investment income, can demonstrate an appropriate diversification of risk and is not a close company. | Were the Company to breach Section 1158, it might lose its investment trust status and, as a consequence, gains within the Company’s portfolio would be subject to Capital Gains Tax. The Section 1158 qualification criteria are continually monitored by JPMF and the results reported to the Board each month. The Company must also comply with the provisions of the Companies Act 2006 and, as its shares are listed on the London Stock Exchange, the UKLA Listing Rules and Disclosure Guidance and Transparency Rules (‘DTRs’). A breach of the Companies Act 2006 could result in the Company and/or the Directors being fined or the subject of criminal proceedings. Breach of the UKLA Listing Rules or DTRs could result in the Company’s shares being suspended from listing, which in turn would breach Section 1158. The Directors seek to comply with all relevant regulation and legislation in the UK, Europe and the US and rely on the services of its Company Secretary, JPMF, and its professional advisers to monitor compliance with all relevant requirements. | âRisk remains unchanged. Compliance with relevant regulations is monitored on an ongoing basis by the Company Secretary and the Investment Manager who report regularly to the Board. |

| Political and Economic | Political changes in Japan and the resulting economic uncertainty may affect the Company, the value of its investments in Japan and capital allocation decision making. Changes in legislation globally, may adversely affect the Company either directly or because of restrictions or enforced changes on the operations of the Investment Manager. JPMAM makes recommendations to the Board on accounting, dividend and tax policies and the Board seeks external advice where appropriate. Significant political events could impact the health of the Japanese or UK economy, resulting in the imposition of restrictions on the free movement of capital. | The Company is at risk from changes to the regulatory, legislative and taxation framework within which it operates, whether such changes were designed to affect it or not. The Board monitors and receives advice from the Manager and other advisors on political and economic risks. | âRisk remains unchanged. Political risks have always been part of the investment process. |

| Geopolitical instability and Systematic Risk | Geopolitical Risk is the potential for political, socio-economic (including pandemic) and cultural events and developments to have an adverse effect on the value of the Company’s assets.The Company and its assets may be impacted by geopolitical instability, in particular concerns over global economic growth. The war in Ukraine immediately affected energy and commodity markets and the conflict in the Middle East as well as heightened tensions in other parts of the world may cause further damage to the global economy.Systematic risk in the financial system is defined as ‘a risk of disruption to financial services that is caused by an impairment of all or parts of the financial system and has the potential to have serious negative consequences for the real economy’. | There is little direct control of this risk possible. The Company addresses these global developments through regular questioning of the Manager and will continue to monitor these issues as they develop.The Board has the ability, with shareholder approval, to amend the policy and objectives of the Company to mitigate the risks arising from geopolitical concerns.Systematic risk is mitigated by the Investment Manager’s controls and procedures over areas such as counter-party risk. Further, areas such as gearing levels are closely monitored and subject to board-set limits. | âThe risk remains high but unchanged. Geopolitical instability and systematic risks are part of the investment process. In particular, geopolitical tensions and global economic pressures continue to have an unfavourable impact on global markets. |

| Climate Change | Climate change has become one of the most critical issues confronting companies and their investors. Climate change can have a significant impact on the business models, efficiency and even viability of individual companies, whole sectors and even asset classes. | The Board receives ESG reports from the Manager on the portfolio and the way ESG considerations are integrated into the investment decision-making, so as to mitigate risk at the level of stock selection and portfolio construction. As extreme weather events become more common, the resiliency, business continuity planning and the location strategies of the Company’s services providers will come under greater scrutiny. | âThe risk remains high but unchanged due to the continued rising of temperatures fueling environmental degradation, natural disasters, weather extremes, food and water insecurity and economic disruption. |

EMERGING RISKS

The Board is cognisant of emerging risks, which are characterised by a high degree of uncertainty in terms of probability of occurrence and possible effects on the Company.

Emerging risks are considered as they are identified and are incorporated into the Company’s risk matrix. The Board, through the Audit Committee, will continue to assess these risks on an ongoing basis. The following have been identified as emerging risks:

| Emerging risk | Description | Mitigation/Control |

| Artificial Intelligence (AI) | While it might equally be deemed a great opportunity and force for good, there appears also to be an increasing risk to business and society more widely from AI. Advances in computing power means that AI has become a powerful tool that will impact a huge range of areas and with a wide range of applications that include the potential to disrupt and even to harm. In addition the use of AI could be a significant disrupter to business processes and whole companies leading to added uncertainty in corporate valuations. | The Board will work with the Manager to monitor developments concerning AI as its use evolves and consider how it might threaten the Company’s activities, which may, for example, include a heightened threat to cybersecurity. The Board will work closely with the Manager in identifying these threats and, in addition, monitor the strategies of our service providers. Furthermore, the Company’s investment process includes consideration of technological advancement and the resultant potential to disrupt both individual companies and the wider markets. |

TRANSACTIONS WITH THE MANAGER

Details of the management contract are set out in the Directors’ Report on page 45 of the Annual Report. The management fee payable to the Manager for the year was £1,811,000 (2023: £1,856,000) of which £nil (2023: £nil) was outstanding at the year end.

Included in administration expenses in note 6 on page 76 in the Annual Report are safe custody fees payable to JPMorgan Chase group subsidiaries amounting to £16,000 (2023: £16,000) of which £2,000 (2023: £6,000) was outstanding at the year end.

The Manager may carry out some of its dealing transactions through group subsidiaries. These transactions are carried out at arm’s length. The commission payable to JPMorgan Securities Limited for the year was £nil (2023: £nil) of which £nil (2023: £nil) was outstanding at the year end.

Handling charges on dealing transactions amounting to £6,000 (2023: £5,000) were payable to JPMorgan Chase Bank N.A. during the year of which £1,000 (2023: £1,000) was outstanding at the year end.

At the year end, total cash of £3,083,000 (2023: £7,446,000) was held with JPMorgan Chase. A net amount of interest of £5,000 (2023: £3,000) was receivable by the Company during the year from JPMorgan Chase of which £nil (2023: £nil) was outstanding at the year end.

TRANSACTIONS WITH RELATED PARTIES

Full details of Directors’ remuneration and shareholdings can be found on pages 57 and 58 and in note 6 on page 76 of the Annual Report.

STATEMENT OF DIRECTORS’ RESPONSIBILITIES

The Directors are responsible for preparing the Annual Report and the financial statements in accordance with applicable law and regulation.

Company law requires the Directors to prepare financial statements for each financial year. Under that law the Directors have prepared the financial statements in accordance with United Kingdom Generally Accepted Accounting Practice (United Kingdom Accounting Standards, comprising FRS 102 ‘The Financial Reporting Standard applicable in the UK and Republic of Ireland’ and applicable law). Under company law the Directors must not approve the financial statements unless they are satisfied that they give a true and fair view of the state of affairs of the Company and of the profit or loss of the Company for that period. In preparing the financial statements, the Directors are required to:

• select suitable accounting policies and then apply them consistently;

• state whether applicable United Kingdom Accounting Standards, comprising FRS 102, have been followed, subject to any material departures disclosed and explained in the financial statements;

• make judgements and accounting estimates that are reasonable and prudent; and

• prepare the financial statements on the going concern basis unless it is inappropriate to presume that the Company will continue in business

and the Directors confirm that they have done so.

The Directors are responsible for keeping adequate accounting records that are sufficient to show and explain the Company’s transactions and disclose with reasonable accuracy at any time the financial position of the Company and enable them to ensure that the financial statements and the Directors’ Remuneration Report comply with the Companies Act 2006.

The Directors are also responsible for safeguarding the assets of the Company and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

The Directors are responsible for the maintenance and integrity of the Company’s website. Legislation in the United Kingdom governing the preparation and dissemination of financial statements may differ from legislation in other jurisdictions.

Under applicable law and regulations the Directors are also responsible for preparing a Strategic Report, a Directors’ Report and a Directors’ Remuneration Report that comply with the law and those regulations.

Each of the Directors, whose names and functions are listed in Directors’ Report confirm that, to the best of their knowledge:

• the Company’s financial statements, which have been prepared in accordance with United Kingdom Generally Accepted Accounting Practice (United Kingdom Accounting Standards, comprising FRS 102 ‘The Financial Reporting Standard applicable in the UK and Republic of Ireland’, and applicable law), give a true and fair view of the assets, liabilities, financial position and profit of the Company; and

• the Directors’ Strategic Report includes a fair review of the development and performance of the business and the position of the Company, together with a description of the principal risks and uncertainties that it faces.

The Directors consider that the Annual Report and Financial Statements, taken as a whole, is fair, balanced and understandable and provides the information necessary for shareholders to assess the Company’s position and performance, business model and strategy.

For and on behalf of the Board

Alexa Henderson

Chair

20th June 2024

JPMorgan Japan Small Cap Growth & Income (LONJSGI), targets Japan income without compromising on Japanese growth opportunities. This Japan income investing opportunity gives investors access to a diverse and fast growing sector managed by local managers.