Johnson Matthey PLC (LON:JMAT), today announced half year results for the six months ended 30th September 2018

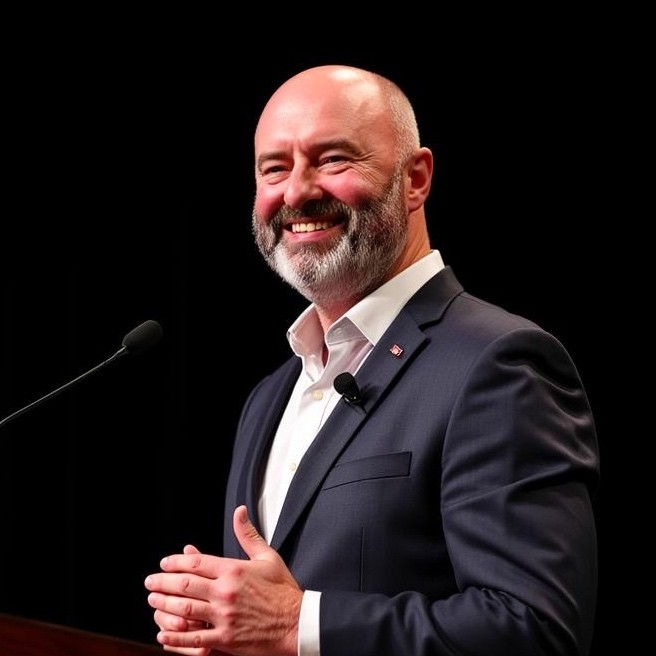

Robert MacLeod, Johnson Matthey Chief Executive, commented:

“We had a good half, delivering double digit sales and operating profit growth. I am pleased with the progress we are making on implementing our strategy and delivering solutions for our customers through the application of our strong science and technology.

Clean Air continues to grow strongly driven by our diesel share gains in light duty Europe which are coming through as planned. Heavy duty is also performing well, supported by strength in the Class 8 truck market in the US. Efficient Natural Resources saw good sales growth and margin improvement, and Health traded in line with our first half expectations. We remain on track with our plans to commercialise eLNOTM, our next generation battery material. Customer feedback remains positive and, in July, the board approved the initial investment in our first commercial plant.

The interim dividend was increased by 7% in line with medium term guidance, reflecting our continued confidence in the group’s future prospects. We now expect full year operating performance towards the upper end of our guidance of mid to high single digit growth.”

|

Reported results |

Half year ended |

% change |

||

|

2018 |

2017 |

|||

|

Revenue |

£ million |

7,108 |

6,478 |

+10 |

|

Operating profit |

£ million |

264 |

222 |

+19 |

|

Profit before tax (PBT) |

£ million |

244 |

205 |

+19 |

|

Earnings per share (EPS) |

pence |

106.1 |

87.9 |

+21 |

|

Interim dividend per share |

pence |

23.25 |

21.75 |

+7 |

|

Underlying1 performance |

Half year ended |

% change |

% change, constant rates2 |

||

|

2018 |

2017 |

||||

|

Sales excluding precious metals (Sales) |

£ million |

2,009 |

1,853 |

+8 |

+10 |

|

Operating profit |

£ million |

271 |

250 |

+8 |

+10 |

|

Profit before tax |

£ million |

251 |

233 |

+7 |

+9 |

|

Earnings per share |

pence |

109.0 |

99.8 |

+9 |

|

Underlying performance

·Sales grew 10% and underlying operating profit grew 10% at constant rates2 driven by continued strong growth in Clean Air

·Underlying EPS was up 9% and grew slightly ahead of operating profit benefiting from a lower underlying tax rate

·As indicated previously, free cash flow was lower due to platinum group metal (pgm) refinery downtime, driving higher precious metal working capital

·Average working capital days excluding precious metals improved by two days to 61 days

·Return on invested capital declined from 16.4% at 31st March 2018 to 16.0% at 30th September 2018 primarily due to an increase in the net pension fund asset

·Strong balance sheet maintained with net debt (including post tax pension deficits) to EBITDA of 1.5 times

By sector

· Continued strength in Clean Air with sales up 11%, well ahead of global vehicle production, driven by double digit growth in both light and heavy duty

· Sales growth of 3% in Efficient Natural Resources and strong operating profit growth reflecting improved efficiency and higher precious metal prices

· In Health, we have made good strategic progress and are trading in line with full year expectations. Sales remained stable but operating profit was lower, in line with our guidance, due to product mix and costs associated with manufacturing footprint optimisation

· We have made progress in commercialisation of our next generation battery material product, eLNO. In New Markets overall, we saw strong sales growth but lower operating profit

Reported results

· Reported revenue increased 10% slightly ahead of sales growth

· Reported operating profit was £264 million, up 19%, reflecting an £18 million major impairment and restructuring charge in the prior year

· Reported EPS was up 21%, reflecting higher operating profit and a lower tax rate following a change in US tax legislation

· Cash outflow from operating activities of £88 million due to an increase in precious metal working capital

· Interim dividend up 7% to 23.25 pence reflecting our confidence in the group’s future prospects

Outlook for the year ending 31st March 2019

· Johnson Matthey now expect growth in operating performance at constant rates towards the upper end of our previous guidance of mid to high single digit growth

· At current foreign exchange rates (£:$ 1.307, £:€ 1.129, £:RMB 8.85), transnational foreign exchange movements for the year ending 31st March 2019 are expected to benefit sales and underlying operating profit by £1 million and £2 million respectively