Today, Johnson Matthey PLC (LON:JMAT) will hold a Capital Markets Day in which it will provide an update on its strategy for sustained growth and value creation, at a group level and across its sectors. This growth is underpinned by use of our world class science to address challenges posed by fundamental global trends including climate change, energy transition, population and longevity and resource challenges. Johnson Matthey has leading positions in high margin, technology driven growth markets and the company expects to deliver attractive and sustainable growth and returns over the medium term:

· Delivering mid to high single digit EPS CAGR

· Expanding group ROIC to 20%, and

· Continuing a progressive dividend

Clean Air: sustained growth for the next decade

Our Clean Air business will deliver mid single digit growth in operating performance to 2025 and sustained growth for the next decade. In the early years, we expect good growth as we start to see benefits from new legislation in Asia and tighter legislation in Europe. Over the medium term, we expect growth to accelerate with the full benefits of the new legislation in China and India coming through, which will more than double the size of our Asian business. In the longer term, growth is expected to moderate assuming penetration of pure battery electric vehicles increases substantially.

Efficient Natural Resources: growth accelerating and guidance upgraded

In Efficient Natural resources, we have undergone a period of restructuring, reorganisation and investment in R&D which has improved efficiency and built the platform for growth. These changes and the commercialisation of new technologies as we move into adjacent areas will drive higher growth for the overall sector. This gives us confidence in upgrading our financial guidance, to deliver mid to high single digit growth in operating performance to 2025.

Health: platform built for breakout growth, passed the point of inflection

We have made strong progress on operational improvements in Health and our increased investment has built a deeper and broader pipeline of new products. The business has now passed the inflection point and we are confident of delivering breakout growth with an additional £100m of operating profit from our generic and innovator pipeline by 2025.

New Markets: strong progress in Battery Materials

In New Markets, we are focused on Battery Materials and have made strong progress to commercialise eLNO®, our portfolio of next generation, ultra-high energy density cathode materials. Customer feedback from testing remains positive, in particular our ability to provide customised solutions and we have now moved to full cell testing with two customers. We expect our first commercial plant to be on stream in 2022 and to be supplying platforms in production in 2024. Our total investment when we have commercial production from our plant will amount to circa £350m.

Efficiencies remain a strong focus

We remain focused on building a more efficient business to strengthen our platform for growth and increase our agility. Today we commit to a further £40m in procurement savings over three years beginning 2020/21, giving total group savings announced of £145m since 2017/18. Of the additional £40m, two thirds will benefit the income statement and at least half will be reinvested.

Expanding return on invested capital to 20%

In order to deliver sustainable growth and value creation across the group and our sectors, we are investing in a number of strategic growth projects. The growth capex comprises spend on our new Clean Air plants in Poland, China and India, the commercialisation of eLNO, modernisation of our refineries in Efficient Natural Resources and upgrades to our IT systems. In future, maintenance capex will continue to be c.0.8-0.9x depreciation and we will further invest in strategic projects if they meet our disciplined investment criteria.

We continue to have a disciplined approach to our working capital position. We are targeting an improvement in non precious metal working capital to 50 days over the medium term, and expect to deliver £350m of savings in precious metal working capital, comprising £250m in backlog reduction and a further £100m of refinery efficiencies.

Over the medium term, these investments and the growth and efficiency they will generate give us confidence in expanding our ROIC to 20%.

Outlook unchanged for first half and full year 2019/20

Our group guidance, at constant rates, for the first half and the year ended 31st March 2020 remains unchanged. We expect growth in operating performance at constant rates to be within our medium term guidance of mid to high single digit growth.

· In terms of phasing, we expect performance to be more heavily weighted to the second half

· By sector, Clean Air performance is expected to be slightly below the prior year. This is expected to be compensated by better performance in Efficient Natural Resources driven by actions taken to improve efficiency, and other ongoing efficiencies across the group

We continue to expect capex of up to £500m in the fiscal year 2019/20.

At current foreign exchange rates (£:$ 1.218, £:€ 1.104, £:RMB 8.71) translational foreign exchange movements for the year ending 31st March 2020 are expected to benefit sales by £128 million and underlying operating profit by £21 million.

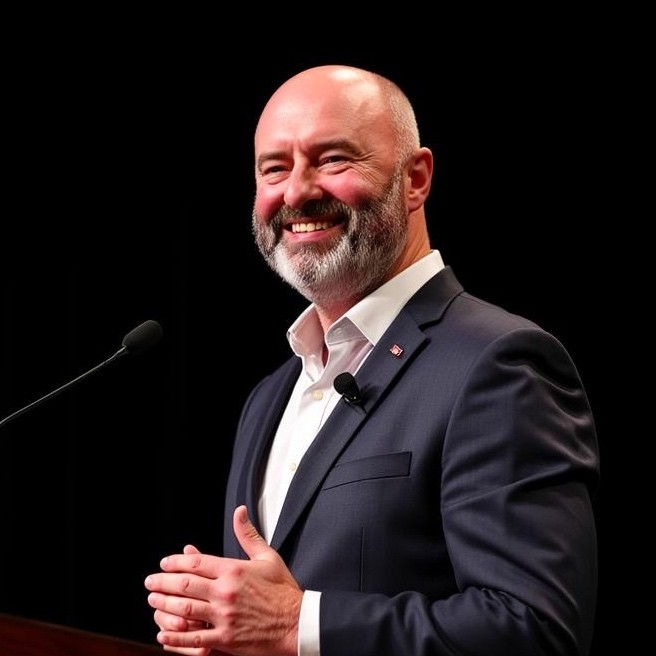

Commenting on the capital markets day, Robert MacLeod, Chief Executive said:

“Everything we do at Johnson Matthey is about helping to create a world that is cleaner and healthier. We apply our world class science to address key global challenges, solving our customers’ most challenging and increasingly complex problems. We are delivering on our strategy and will continue to execute with determination. As the world changes ever faster, we are increasingly excited by the significant opportunities we see for sustained growth and value creation.”