JPMorgan Japan Small Cap Growth & Income plc (LON:JSGI) has announced its final results for the year ended 31st March 2022.

CHAIRMAN’S STATEMENT

Investment Performance

Despite a positive first half, the financial year ended 31st March 2022 proved a challenging one for the Company. Performance in the first six months of the year was strong, supported by an improvement in Japan’s economic outlook as the pandemic’s grip on activity loosened. The Company returned +7.2% (in GBP) on an NAV basis over the half year, outperforming the benchmark, the MSCI Japan Small Cap Index, which returned +4.9%. However, performance worsened in the second half of the year, with the Company returning -24.6% on an NAV basis for the full year, compared to a benchmark return of -8.1%. The Company’s return to shareholders was -23.3% over the same period.

This underperformance was the result of the portfolio’s focus on quality and growth stocks. As in other major markets, high growth stocks, especially in the technology sector, were hit especially hard as investors focused on rising interest rates, spiralling inflation and the tragic events in Ukraine and tended to ignore the fundamental operational performance of businesses. Japanese growth stocks were caught up in this sell-off, even though inflation in Japan remains very low and the Bank of Japan is unlikely to raise interest rates in the foreseeable future.

It is useful to put the Company’s latest results into a broader context. The Company’s stock picking approach combined with a quality and growth bias means the portfolio tends to differ significantly from the benchmark, which is home to many low-quality companies. So it is therefore not unexpected that the performance will vary significantly from the benchmark. The Manager remains confident however that their bottom-up approach of focusing on good quality companies with strong growth prospects will always win out over the longer term despite temporary periods of underperformance. The Company has weathered previous bouts of short-term underperformance, while in years when growth stocks do well, the portfolio has outperformed. The prior financial year ended 31st March 2021 was one such year, which saw the portfolio deliver very strong absolute returns of over 40% in NAV terms, and outperformance against the benchmark of more than 20 percentage points. Whilst the Board and Manager share concerns over the poor results over the last six months, it is important not to lose sight of longer term performance. The Company’s track record of significant absolute gains, and outperformance, over periods of five years and more, attests to the effectiveness of its investment approach in delivering meaningful gains to patient investors over the long term.

The Company’s investment record and recent portfolio activity are explained in more depth in the Investment Managers’ Report. They also outline the themes they expect will drive Japan’s equity markets over the medium-term, and the reasons for their optimism about the Company’s long-term prospects.

Dividend Policy and Discount Management

The Company’s revised dividend policy has now been in place for four years. As a reminder, the dividend policy aims to pay, in the absence of unforeseen circumstances, a regular dividend equal to 1% of the Company’s NAV on the last business day of the preceding financial quarter, being the end of March, June, September and December. Over the year, this would approximate to 4% of the average NAV. This dividend is paid from other reserves. For the year ended 31st March 2022, quarterly dividends paid totalled 20.3p per share (2021: 21.9p).

One of the objectives of the revised dividend policy is to enhance the Company’s appeal to a broader range of investors. Since its introduction, it has therefore been pleasing to note some narrowing of the Company’s discount, driven by new demand, some favourable press coverage and positive absolute and relative longer-term performance. Over the review period, the Company’s discount remained relatively stable, ending the period at 7.4%, lower than the 8.7% at the same time last year, and 11.9% two years ago.

The Company did not repurchase any shares during the year. However, the Board continues to monitor the discount closely and is prepared to repurchase shares to narrow the discount, when it considers this is appropriate, taking account of market conditions. At the time of writing, the discount is 4.96%.

A resolution to approve the Company’s dividend policy will be put to shareholders at the forthcoming Annual General Meeting.

Manager Changes

In January 2022, the Board was informed by its Manager that Eiji Saito, the Company’s lead portfolio manager, would be leaving JPMorgan after 18 years’ service to return to university and pursue a degree in law. The Board worked closely with the Manager to oversee and agree on the proposed changes to the investment management team.

Miyako Urabe has replaced Eiji as the lead manager of the Company and the JPMorgan Asset Management’s Japan Small/Mid Cap strategy. Miyako has spent 14 years within the industry, including nine at JPMorgan, having joined the Japanese Equities team in 2013. Xuming Tao, who is also a small cap specialist fund manager, has joined Miyako as a portfolio manager of the Company. Xuming has spent nine years in the industry and three years with JPMorgan. Naohiro Ozawa continues as a portfolio manager of the Company, working alongside Miyako and Xuming. Naohiro has spent 16 years in the industry, 14 years with JPMorgan and four years managing the Company. Michiko Sakai has left the team to focus on the JPM Japan sustainable strategy responsibilities.

There has been no change to the Company’s investment objectives, or its investment and dividend policies, as a result of these changes. The three portfolio managers will continue to work as part of the highly experienced team in Tokyo who have been managing Japanese equities mandates since 1969. They are supported by JPMorgan Asset Management’s extensive resources around the world.

The Board would like to thank Eiji for his contribution to the management of the Company over the past five years. It looks forward to working with the portfolio management team and welcomes the new co-managers, Miyako and Xuming.

Gearing/Borrowing

The Managers seek, at times, to enhance investment returns for shareholders by borrowing money to buy more assets (‘gearing’), subject to their view on prevailing market conditions. The Company’s gearing is discussed regularly by the Board and the Managers, and the gearing level is reviewed by the Directors at each Board meeting.

The Company has a revolving credit facility of Yen 4.0 billion (with an option to increase available credit to Yen 6.0 billion) with Scotiabank, which was fully drawn at the year-end. The loan facility is on favourable and flexible terms, allowing the Company to repay the loan if required, without any penalties. This facility has a maturity date of October 2022 and the Managers will seek to renew or replace this facility, at the best available terms, on expiry.

Access to a credit facility provides the Managers with the ability to gear tactically within the set guidelines. The Company’s investment policy permits gearing within a range of 10% net cash to 25% geared. However, the Board requires the Managers to operate in the narrower range of 5% net cash to 15% geared, in normal market conditions. During the 12 months of the review period the Company’s gearing level ranged between 5.7% and 11.5%, ending the financial year at 6.1% (2021: 8.1%).

Environmental, Social and Governance Issues

As reported in the Investment Managers’ Report, environmental, social and governance (‘ESG’) considerations are integral to the Managers’ investment process. The Board shares the Managers’ view of the importance of ESG when making investments that are sustainable over the long term, and the necessity of continual engagement with investee companies throughout the duration of the investment. The Managers use their regular company meetings with potential and existing portfolio companies to discuss and challenge management on their adherence to ESG principles and best practice. The Board believes that effective stewardship can help to create sustainable value for shareholders.

The war in Ukraine is an immense humanitarian tragedy which we hope will end soon. While its impact on global financial markets has been significant, it has had no direct impact on the Company, as none of its portfolio holdings has any exposure to either the Russian or Ukrainian markets.

Further information on the Manager’s ESG process and engagement is set out in the ESG Report on pages 18 to 23 of the Annual Report.

The Board and Corporate Governance

There has been no change to the composition of the Board during the reporting period. Following the Board’s annual evaluation by the Nomination Committee, the Committee felt that the Board’s current composition and size are appropriate. The Board has a plan to refresh its membership in an orderly manner over time. As part of its long-term succession planning, and to ensure continuity, the Board will seek to recruit new non-executive Directors when current members approach retirement.

The Board supports annual re-election for all Directors, as recommended by the AIC Code of Corporate Governance, and all Directors will therefore stand for re-election at the forthcoming Annual General Meeting. Shareholders who wish to contact the Chairman or other members of the Board may do so through the Company Secretary or the Company’s website, details of which appear below.

Auditor Review

The last formal exercise of audit tender was undertaken in 2014, when Grant Thornton was appointed. The Company’s financial year ended 31st March 2021 was the last of a five-year tenure of Grant Thornton’s audit partner, Marcus Swales, and a new partner was expected to take over.

However, the Board took the view that this change provided an opportune moment to review the Company’s audit arrangements as a matter of good governance. The Board also felt that a review would give the Directors the chance to survey the market and ensure that the Company’s audit arrangements remain competitively priced, providing good value for shareholders, while also maintaining the same high quality of the statutory audits. To this end, the Audit Committee undertook a tender process for the 2022 statutory audit. Following a review of tender proposals from a number of firms, Johnston Carmichael LLP has been appointed as the Company’s new auditor.

Annual General Meeting

The Board is pleased to report that a more familiar format for the Annual General Meeting will be permissible for this year and, to that end, we will be holding the Company’s Annual General Meeting (‘AGM’) at 60 Victoria Embankment, London EC4Y 0JP on 27th July 2022 at 12 noon.

We are delighted that this year we will once again be able to invite shareholders to join us in person for the Company’s AGM, to hear from the new managers, who will present at the meeting via video link from Tokyo. Their presentation will be followed by a live question and answer session. Shareholders wishing to follow the AGM proceedings but choosing not to attend will be able to view them live and ask questions (but not vote) through conferencing software. Details on how to register, together with access details, will be available shortly on the Company’s website at www.jpmjapansmallcapgrowthandincome.co.uk or by contacting the Company Secretary at [email protected].

My fellow Board members, representatives of JPMorgan and I look forward to the opportunity to meet and speak with shareholders after the formalities of the meeting have been concluded.

Shareholders who are unable to attend the AGM are strongly encouraged to submit their proxy votes in advance of the meeting, so they are registered and recorded at the AGM. Proxy votes can be lodged in advance of the AGM either by post or electronically: detailed instructions are included in the Notes to the Notice of Annual General Meeting on pages 91 to 93 of the Annual Report.

If there are any changes to the above AGM arrangements, the Company will update shareholders through an announcement to the London Stock Exchange and on the Company’s website.

Outlook

The Board shares the Managers’ confidence in the outlook for Japan’s small cap companies. Japan is in the process of significant positive structural change, whose economic and societal benefits will resonate well into the future. Digitalisation is likely to be particularly positive for productivity over the medium term. Furthermore, Japan’s membership of the new regional trading bloc, the Regional Comprehensive Economic Partnership (‘RCEP’), should increase its access to Asia’s rapidly expanding economies, while the recent depreciation of the yen should boost export competitiveness.

Japan’s smaller, more entrepreneurial and innovative companies are leading the way across a variety of sectors and should thrive in this environment, generating many exciting investment opportunities. The Board remains confident that the Managers’ focus on quality and growth businesses, supported by JPMorgan’s extensive, Tokyo-based research resources, leaves the Company ideally placed to capitalise on these opportunities, and to continue to deliver a regular income, combined with attractive returns and outperformance, to shareholders over the longer term.

Alexa Henderson

Chairman 22 June 2022

INVESTMENT MANAGERS’ REPORT

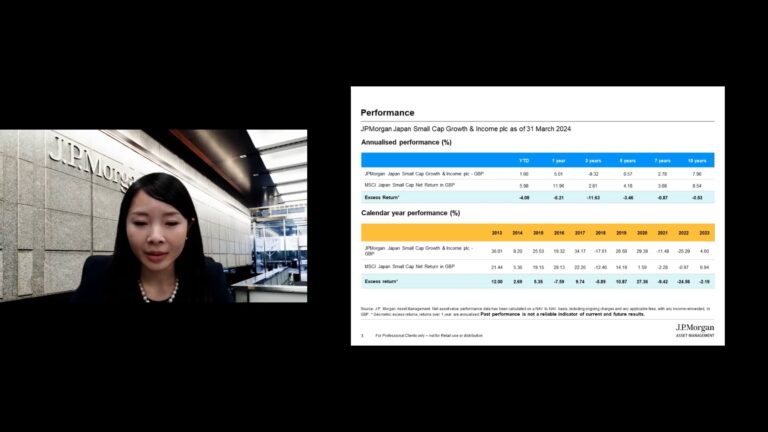

Performance

This is our first report having assumed responsibility for management of your portfolio during the year under review.

The second half of the financial year ended 31st March 2022 was an especially turbulent time for global financial markets due to increasing inflation, US interest rate increases and the war in Ukraine. Concerns about inflation and higher rates took a heavy toll on stocks whose valuations are based on their long-term growth prospects, as higher rates reduce the value of their expected future cashflows. As a result, the Company’s benchmark, the MSCI Japan Small Cap Index (in GBP terms), produced a total return of -8.1% for the year as a whole. However, our particular focus on quality and growth stocks meant this market volatility had a greater adverse impact on the Company’s performance. After delivering outright gains and outperforming the benchmark over the first half of the year, for the year as a whole, the Company’s net assets returned -24.6%, underperforming the index by 16.5 percentage points.

This result is extremely disappointing. It is not the first time that the Company has experienced short-term volatility in its returns relative to the benchmark. Indeed, our quality and growth bias means that the Company’s portfolio often differs markedly from the benchmark, which includes lower quality cyclical names. However, our investment strategy looks beyond such short-term market fluctuations, and adopts a long-term perspective, on the view that excess returns take time to accumulate, especially for smaller cap stocks. This approach has delivered attractive absolute growth and outperformance over the long run. The Company’s gains have outpaced the benchmark over five and ten years, delivering an average annualised return over ten years of 10.9% on an NAV basis, compared to a benchmark performance over ten years of 8.1% on the same basis.

Performance attribution

Year ended 31st March 2022

| % | % | |

| Contributions to total returns | ||

| Benchmark return | -8.1 | |

| Sector allocation | -3.0 | |

| Stock selection | -12.1 | |

| Gearing/cash | -0.4 | |

| Return relative to benchmark | -15.5 | |

| Portfolio return | -23.6 | |

| Management fee/other expenses | -1.0 | |

| Return on net assetsA | -24.6 | |

| Return to shareholdersA | -23.3 |

Source: Factset, JPMAM, Morningstar.

All figures are on a total return basis.

Performance attribution analyses how the Company achieved its recorded performance relative to its benchmark.

A Alternative Performance Measure (‘APM’).

A glossary of terms and APMs is provided on pages 94 and 95 of the Annual Report.

Market Background

In the first half of the year, Japanese equities, in line with other major markets, advanced on hopes that the global COVID vaccine roll-out would allow economic activity to return to normal. Japan’s state of emergency was lifted in September 2021 and the ruling Liberal Democratic Party (‘LDP’) re-assumed power in the autumn election, confirming Fumio Kishida as the new Prime Minister. However, in the latter half of the financial year market volatility increased sharply. As well as escalating geo-political tensions to levels unprecedented in the past half century, news of Russia’s invasion of Ukraine exacerbated existing energy and commodity price pressures, compelling the US Federal Reserve, and the Bank of England, to begin raising interest rates. In Japan, inflation remains low and the Bank of Japan has maintained its stimulatory monetary policy stance, but Japanese equities suffered the same sell-off as in other major markets, and, as elsewhere, technology and other growth stocks were the worst affected. In addition, widening interest rate differentials saw the Japanese yen weaken against the US dollar and sterling.

Spotlight on Stocks and Sectors

Stock selection was responsible for most of the underperformance during the 12 months under review, although sector selection also detracted from relative performance to a more modest extent.

At the stock level, several names made significant positive contributions to returns:

• MEC manufactures advanced adhesion enhancer products used in printed circuit boards. The company is a global leader in this niche market. Its products improve adhesion between the wiring and insulating materials in semiconductors, which is key to manufacturers’ efforts to reduce the size of semiconductor units. With semiconductors in significant and growing demand, for use in a vast array of products including electric vehicles, smartphones, wearable tech and many household items, we expect MEC to enjoy continued solid revenue growth over coming years and we have maintained our off benchmark holding.

• C. Uyemura is another niche market player and off benchmark position. The company produces specialist chemicals and plating machinery used in EVs, smartphones, and other home appliances. It is benefitting from structural changes in mobile telecommunications, as the sector transitions from 4G to 5G – the electronic parts used in 5G smartphone require higher quality and more extensive plating technology. C. Uyemura is well-positioned in high-end plating, with a dominant market share and few new competitors, as the market is too small for large players to enter aggressively.

• Litalico provides employment support to people with disabilities. Japanese society is becoming increasingly aware of the importance of diversity and inclusion, and companies are stepping up efforts to create welcoming workplaces for workers regardless of their gender, age, nationality, or disabilities. Litalico is Japan’s number one provider of support services for disabled people.

The favourable impact of these stocks on relative performance was more than offset by negative contributions from a number of holdings, including:

• Our holding in Miura, which is a pioneer in the manufacture of compact, energy-efficient gas boilers. These boilers are much more environmentally friendly than coal-fired versions. Miura has a dominant share of the Japanese market, with a high proportion of profits from recurring revenues, and there is a long-term growth opportunity in China, where the market is six times larger, and 80% of boilers are still coal-fired. Miura’s expansion into China has stalled due to China’s severe lockdowns, but we continue to hold this name due to our confidence in the company’s long-term growth potential.

• Another off benchmark position in SpiderPlus, which supplies digital drafting, photographic and other software services to the construction industry. These services deliver productivity gains by significantly reducing the amount of manual labour involved in such tasks. The company’s share price has corrected during the broad-based sell-off in growth stocks, rather than for stock specific reasons, and we continue to hold this name.

• RAKSUL, which is Japan’s leading provider of specialist EC printing services for businesses. Compared to other printing EC players who operate printing facilities, Raksul employs a sharing economy model utilising idle capacity in regional printing facilities to realise value without having to carry the cost of any fixed asset required for printing themselves. This allows them to continue improving user experience and enjoy a higher margin and return. EC printing still only comprises less than 5% of Japan’s overall market for business printing services, suggesting significant growth potential given that penetration rates are around 30% in countries such as Germany. As in the case of SpiderPlus, Raksul’s share price has been dragged lower in the recent sell-off without any underlying fundamental justification, and we continue to hold.

With respect to sector allocation, as mentioned above, the kind of stocks we favour tend to be concentrated in those sectors which have been hardest hit in the recent market decline, while lower-value, lower-quality stocks in economically-sensitive sectors such as transport, banks and consumer goods, which we generally avoid, have done relatively well. Accordingly, the top detractor from performance at the sector level over the past year, by a significant margin, was our overweight in IT software & services. The portfolio’s underweightings in transportation and real estate also detracted more modestly. However, our overweight in semiconductors & semiconductor equipment, and our underweight in food, beverage & tobacco, made positive contributions to returns.

Gearing stood at 6.1% at the end of the financial year, down from 8.1% at the end of FY21. Given the significant decline in the Company’s NAV, gearing negatively impacted returns over the year.

About Our Investment Philosophy

The Company aims to provide shareholders with access to the innovative and fast-growing smaller companies at the core of the Japanese economy. Our investment approach favours quality and structural growth, and we target companies (other than Japan’s largest 200) which we believe can compound earnings growth over the long term, supported by sustainable competitive advantages, good management teams and capital investment. We believe the strong and durable market positioning of such businesses will allow them substantially to increase their intrinsic value over time. We avoid stocks that have no clear differentiation and those that operate in industries plagued by excess supply and structural decline. Our focus on quality and growth means that the portfolio tends to benefit from the ability to invest the portfolio into stocks with different weightings to that of the benchmark, which provides a potential source for additional return, enhancing the Company’s scope to outperform over the long term.

Our stock selection is based on fundamental analysis, ‘on-the-ground’ knowledge and extensive contact with the management teams of prospective and current portfolio companies. The Company is managed by a team of three, supported by over 20 Tokyo-based investment professionals. Their knowledge of the local market provides us with significant strength in identifying investment opportunities in small cap companies – a sector of the market which is very under-researched and overlooked by many investors.

The starting point in our bottom-up investment process is our Strategic Classification framework, where we address the key question ‘Is this a business that we want to own?’. Through this process we assign a rating of Premium, Quality or Trading to each stock based on its fundamentals, governance and the sustainability of its revenues over the long term. We aim to maximise our exposure to Premium and Quality companies, and where possible, we invest from an early stage in order to benefit fully as companies realise their growth potential.

This patient perspective is key to generating excess return over the long term, although the portfolio’s focus on quality and growth means it tends to struggle during value rallies. Having said that, the Company does not target ‘growth at any price’. We always strive to acquire shares at a reasonable price. To this end, we use a five-year expected return framework to consider whether a stock’s price is at an attractive level. We believe it is also important to construct a well-balanced, diversified portfolio, to minimise exposure to unintended risks. The Company’s prospective and current portfolio holdings comprises around 75 stocks, in a range of sectors, including not only IT hardware and software, but materials, chemicals, construction, machinery and consumer goods and services.

We believe that well-run companies, which exhibit behaviour which respects the environment and the interests of their shareholders, customers, employees and other stakeholders, are most likely to deliver sustainable, long-term returns. Such environmental, social and governance (‘ESG’) considerations are thus integral to our investment process and a key driver of our quest to generate financial returns. ESG factors influence our decisions both at the portfolio construction stage and thereafter once companies are held in the portfolio, when ongoing engagement with managers can be effective in encouraging them to realise and maintain acceptable ESG standards. Our long-term holding in Litalico (discussed above) is one example of the way in which ESG considerations influence our investment decisions, as this company is at the forefront of Japan’s efforts to improve employee well-being and workplace diversity.

Trends and Themes

While our investment decisions are based on company-specific factors, there are also structural, long-term trends and themes that underlie our stock selection.

Our investment themes include:

• Changing demographics: Japan’s ageing and declining population is creating significant challenges for Japanese policymakers. The government is committed to tackling these issues through regulatory reforms and digitalisation, and this is providing opportunities for innovative smaller companies working to improve the quality of life for the elderly. For example, reducing the need for face-to-face medical appointments. The tele-medicine company, Medley, is an example of a holding benefitting from such innovation.

• Improving labour productivity via digitalisation: Japan’s ageing population is also leading to a contraction in labour supply, and once again digitalisation is a key part of the solution to this problem, as it raises labour productivity. The government wants to encourage the adoption of digitalisation across the economy, and to this end it has established an agency which is focused on digitalising the operations of national and local governments, as well as Japan’s education and healthcare systems. Portfolio holdings Rakus and Money Forward are benefiting from this drive, while Spiderplus, mentioned above, is one of many companies contributing to productivity improvements in the private sector.

• Technological innovation: While certain areas of the Japanese economy such as financial services lag other markets in terms of their technological sophistication, Japanese manufacturers are world class. The country is a leading global supplier of factory automation equipment, robots, electronics parts and materials, proving attractive investment opportunities for portfolio companies such as MEC and C. Uyemura, mentioned above, that specialise in niche technology markets.

• De-carbonisation: The Japanese government`s commitment to reduce carbon emissions to net zero by 2050 has galvanised efforts to transition the economy to renewable energy sources and take other necessary steps to mitigate climate change. Some smaller Japanese companies possess unique technologies related to the production of electric vehicles, solar and wind power and other forms of clean energy, and we continue our search for companies such as Canadian Solar Infrastructure Fund and Hirano Tecseed that are well-positioned to benefit from the global push towards carbon neutrality.

• Overseas growth: The Asian region is experiencing rapid structural growth. Japanese luxury goods producers and other strong brands such as our investments in Milbon and Casio Computer are likely to continue experiencing strong demand from new customers in China, India and other increasingly prosperous Asian countries.

• Corporate governance: Japan’s corporate sector is making a concerted effort to strengthen governance standards via the appointment of more independent, external directors to company boards, enhanced shareholder returns and tighter internal controls and disclosure rules. There is, however, room for further improvement, and we maintain a constructive dialogue with portfolio companies and potential investments on this broad theme, on the view that the market is likely to keep rewarding companies that upgrade their governance practices.

Portfolio Activity

The sharp share price correction which took place in the second half of the financial year has provided us with the opportunity to purchase some interesting businesses at attractive prices.

• Under the digitalisation theme, we purchased a new position in Rakus, a software company providing business services including digital invoicing, expense management and email management and distribution systems. The company has a mix of mature, very profitable and cash generative services, as well as a suite of new product offerings. This portfolio approach provides Rakus with earnings stability, as well as good growth potential.

• Our purchase of Yamato Kogyo aligns with our focus on the trend towards de-carbonisation. Yamato Kogyo is a steel producer which uses electric arc furnaces, rather than conventional blast furnaces, in its manufacturing process. Electric arc furnaces emit only around one sixth to a quarter of the greenhouse gases produced by conventional blast furnaces and Yamato Kogyo is one of the largest Japanese steelmakers using this technology. It also has joint venture operations and subsidiaries in the United States, Thailand, and other countries. The company is likely to see increased demand for its products as construction and manufacturing companies strive to reduce the carbon footprint of their steel inputs.

• Tokai Carbon is a play on the same theme. It is a leading global supplier of ultra-high quality graphite electrodes, which are a key component of electric arc furnaces. Demand for Tokai Carbon’s products is likely to escalate as steel companies phase out their use of conventional blast furnaces, in favour of more environmentally friendly electric arc furnaces.

• Shift is a leading software testing company in Japan. Japan is experiencing a structural shortage of software engineers as it is better for engineers to focus on software development rather than testing given the tight supply. Shift started targeting this specific testing market over a decade ago and has accumulated considerable know-how in software testing. Considering the fact that outsourcing penetration for the software testing market in Japan is still only 1-2%, we believe the growth runway is significant and that they can continue to deliver compound growth over the long term.

• Sanwa Holdings is the number one shutter maker in Japan. They have a very stable business model in Japan with only three companies dominating the market, of which Sanwa has the strongest position with a market share over 50%. They also provide business overseas, mainly in the US and Europe, through past acquisitions. The company is very well managed with consistently positive free cashflow, steady margins and proactive shareholder returns.

Two of our largest divestments over the past year were Nippon Prologis REIT and CyberAgent. The Company’s investment guidelines prohibit investment in Japan’s top 200 securities and Nippon Prologis, an industrial REIT, and CyberAgent, an internet advertiser and media content business, were approaching this threshold, so we closed our positions at a profit.

The Company’s portfolio holdings have no notable exposure to Russian or Ukrainian markets, either through any operational presence in, or sales revenues from, these markets.

Our bias towards quality and growth means the portfolio continues to have a higher return on equity and stronger earnings per share growth than its benchmark.

Outlook and Strategy

While most major economies are likely to be subjected to continuing upward pressures on prices and interest rates, we expect the Bank of Japan to maintain its expansionary monetary policy stance. Japan is not overly reliant on Russian oil and gas and there is a general absence of domestic price and wage pressures. While the weaker yen will put some upward pressure on import prices, it will enhance the competitiveness of Japanese exports. On the political front, continuity and stability remain the defining characteristics of Japanese politics, as the LDP secured a strong mandate to govern for the next few years, and we expect it to continue in broad terms to pursue the policies and reforms implemented by the previous two Prime Ministers, Shinzo Abe and Yoshihide Suga, over the last nine years.

Regardless of the concerns and uncertainties overshadowing global financial markets, we remain optimistic about the long-term outlook for Japanese small cap companies. Japanese businesses typically have large cash positions and stronger balance sheets than their peers in other countries. Average valuations of Japanese companies remain reasonable, both lower than historical averages and below those of most other major markets. As importantly, the pandemic has given added impetus to some positive long term structural trends developing in the Japanese economy, especially the application of technology and digitalisation to a multitude of goods and services. These trends are set to underpin growth, productivity and corporate earnings for many years to come. In sharp contrast to other developed economies, Japan’s smaller and more entrepreneurial companies are at the forefront of such innovation, and therefore, are ideally positioned to prosper over the longer term.

We believe that it is always important to focus on the best of these businesses – good quality companies with leading market positions and the potential for structural growth. In a part of the market where sell–side coverage is patchy at best, JPMorgan’s large team of Tokyo-based analysts puts the Company in a favourable position to uncover exciting investment opportunities amongst smaller companies, and thus to capitalise on the long-term structural changes playing out in Japan.

The allocated weightings to stocks in the portfolio illustrates how our portfolio differs substantially from the benchmark. This often leads to significant oscillations in relative performance as we have seen to our detriment over the last six months and in some previous periods. However, we believe our investment approach is capable of weathering these oscillations and any short-term shifts in sentiment driven by geo-political developments or economic roadblocks, just as it has done in the past. We are confident the Company will continue to deliver positive returns, and relative outperformance to our shareholders over the longer term.

Miyako Urabe

Xuming Tao

Naohiro Ozawa

Investment Managers 22 June 2022

PRINCIPAL AND EMERGING RISKS

The Board has overall responsibility for reviewing the effectiveness of the Company’s system of risk management and internal control.

The Board is supported by the Audit Committee in the management of risk. The risk management process is designed to identify, evaluate, manage, and mitigate risks faced.

Although the Board believes that it has a robust framework of internal controls in place this can provide only reasonable, and not absolute, assurance against material financial misstatement or loss and is designed to manage, not eliminate, risk.

The Directors confirm that they have carried out a robust assessment of the principal and emerging risks facing the Company, including those that would threaten its business model, future performance, solvency or liquidity. The risks identified and the ways in which they are managed or mitigated are summarised below.

With the assistance of JPMF, the Audit Committee has drawn up a risk matrix, which identifies the principal and emerging risks to the Company. These are reviewed and discussed on a regular basis by the Board, through the Audit Committee. These risks fall broadly into the following categories:

| Principal risk | Description | Mitigation/Control | Movement from Prior Year |

| Investment and Strategy | An inappropriate investment strategy, poor asset allocation or the level of gearing, may lead to underperformance against the Company’s benchmark index and its peer companies, resulting in the Company’s shares trading on a wider discount. | The Company has a clearly defined strategy and investment remit, which is reviewed annually. The portfolio is managed by a highly experienced Investment Manager, with a defined investment appraisal process. The Board relies on the Investment Manager’s skills and judgment to make investment decisions based on research and analysis of individual stocks and sectors. The AIFM also monitors the Investment Manager against the Company’s investment guidelines.The Board reviews the performance of the portfolio against the Company’s benchmark index, that of its competitors and the outlook for the markets on a regular basis, with the portfolio managers who attend Board meetings.The Board also reviews the level of premium/discount to NAV at which the Company’s shares trade and movements in the share register. The Board regularly seeks the views of its investors. | Risk has been heightened by the Company’s under-performance during the year together, with the resultant effects on global trade posed by supply issues, higher levels of inflation and volatility in stockmarkets. |

| Market | Market risk arises from uncertainty about the future prices of the Company’s investments. This market risk comprises three elements – equity market risk, currency risk and interest rate risk. | The Board considers the split in the portfolio between small and large companies, sector and stock selection and levels of gearing on a regular basis and has set investment restrictions and guidelines, which are monitored and reported on by JPMF. The Board monitors the implementation and results of the investment process with the Manager. However, the fortunes of the portfolio are significantly determined by market movements in Japanese equities, the rate of exchange between the Yen and sterling and interest rate changes. This is a risk that investors take having invested into a single country fund. The Board recognises the benefits of a closed-end fund structure in extremely volatile markets such as those affected by the COVID-19 pandemic. During times of elevated market stress, the ability of a closed-ended fund structure to remain invested for the long term enables the Manager to adhere to disciplined fundamental analysis from a bottom-up approach and be ready to respond to dislocations in the market as opportunities present themselves. | Risk has been heightened by a weakened economy in Japan at the start of the year, including inflationary increases, high import and energy costs. |

| Operational and Cybercrime | Disruption to, or failure of, the Manager’s accounting, dealing or payments systems or the custodian’s or depositary’s records could prevent accurate reporting and monitoring of the Company’s financial position. | On 1st July 2014, the Company appointed Bank of New York Mellon (International) Limited to act as its depositary, responsible for overseeing the operations of the custodian, JPMorgan Chase Bank, N.A., and the Company’s cash flows. Details of how the Board monitors the services provided by the Manager and its associates and the key elements designed to provide effective internal control are included in the Risk Management and Internal Control section of the Corporate Governance Report on pages 50 and 51 of the Annual Report.As an externally managed investment trust, there is a continued reliance on the Manager and other third-party service providers.The Board reviews the overall performance of the Manager and other key third-party service providers and compliance with the investment management agreement on a regular basis to ensure their continued competitiveness and effectiveness, which includes assessment of the providers’ control systems, whistle-blowing, anti-bribery and corruption policies and business continuity plans.The Manager’s internal control processes are monitored throughout the year and are evidenced through its Service Organisation Control (SOC 1) reports, prepared by an independent auditor. The SOC 1 reports, which are reviewed annually by the Audit Committee, provide assurance in respect of the effective operation of internal controls.Service providers are appointed with clearly-documented contractual arrangements detailing service expectations. The Audit Committee receives assurance and internal controls reports from key service providers on an annual basis.The threat of cyber-attack, in all its guises, is regarded as at least as important as more traditional physical threats to business continuity and security. The Board has received the cyber security policies for its key third party service providers and JPMF has assured the Directors that the Company benefits directly or indirectly from all elements of JPMorgan’s Cyber Security programme. The information technology controls around the physical security of JPMorgan’s data centres, security of its networks and security of its trading applications are tested by independent reporting accountants and reported every six months against the Audit and Assurance Faculty Standard. | Risk remains relatively unchanged.The operational requirements of the Company, including from its key third-party service providers, have been subject to rigorous testing as to their application during the COVID-19 pandemic, where working from home and online communication were required. To date the operational arrangements have proven robust and key third-party service providers have not experienced significant operational difficulties. |

| Loss of Investment Team or Investment Managers | The sudden departure of the investment managers or several members of the wider investment management team could result in a short-term deterioration in investment performance. | The Manager takes steps to reduce the likelihood of such an event by ensuring appropriate succession planning and the adoption of a team based approach. | Risk has been heightened by a weakened economy in Japan at the start of the year, including inflationary increases, high import and energy costs. |

| Share Price Relative to NAV per Share | If the share price of an investment trust is lower than the NAV per share, the shares are said to be trading at a discount. | The Board monitors the Company’s premium/discount level and, although the rating largely depends upon the relative attractiveness of the trust, the Board has authority to issue new shares or buy backs its existing shares when deemed by the Board to be in the best interests of the Company and its shareholders. The Board is committed to consider buying back the Company’s shares when/if they stand at anything more than a small discount to enhance the NAV per share for remaining shareholders. | Risk remains relatively unchanged.The Board regularly reviews and monitors the Company’s objective and investment policy and strategy, the investment portfolio and its performance, the level of discount/premium to net asset value at which the shares trade and movements in the share register. |

| Accounting, Legal and Regulatory | In order to qualify as an investment trust, the Company must comply with Section 1158 of the Corporation Tax Act 2010 (‘Section 1158’). Details of the Company’s approval are given on page 29 of the Annual Report. Section 1158 requires, among other matters, that the Company does not retain more than 15% of its investment income, can demonstrate an appropriate diversification of risk and is not a close company. | Were the Company to breach Section 1158, it might lose its investment trust status and, as a consequence, gains within the Company’s portfolio would be subject to Capital Gains Tax. The Section 1158 qualification criteria are continually monitored by JPMF and the results reported to the Board each month. The Company must also comply with the provisions of the Companies Act 2006 and, as its shares are listed on the London Stock Exchange, the UKLA Listing Rules and Disclosure Guidance and Transparency Rules (‘DTRs’). A breach of the Companies Act 2006 could result in the Company and/or the Directors being fined or the subject of criminal proceedings. Breach of the UKLA Listing Rules or DTRs could result in the Company’s shares being suspended from listing, which in turn would breach Section 1158. The Directors seek to comply with all relevant regulation and legislation in the UK, Europe and the US and rely on the services of its Company Secretary, JPMF, and its professional advisers to monitor compliance with all relevant requirements. | Risk remains relatively unchanged.Compliance with relevant regulations is monitored on an ongoing basis by the Company Secretary and Manager who report regularly to the Board. |

| Political and Economic | Political changes in Japan and the resulting economic uncertainty may affect the Company, the value of its investments in Japan and capital allocation decision making. Changes in legislation, including in Japan, the US, UK and the European Union, may adversely affect the Company either directly or because of restrictions or enforced changes on the operations of the Manager. JPMF makes recommendations to the Board on accounting, dividend and tax policies and the Board seeks external advice where appropriate. Significant political events could impact the health of the Japanese or UK economy, resulting in the imposition of restrictions on the free movement of capital. | The Company is at risk from changes to the regulatory, legislative and taxation framework within which it operates, whether such changes were designed to affect it or not. The Board monitors and receives advice from the Manager and other advisors on political and economic risks. | Risk remains relatively unchanged.Political risks have always been part of the investment process. |

| Global Pandemics | COVID-19 was identified initially as an emerging risk, but quickly moved to become a current significant risk. The emergence of COVID-19 has highlighted the speed and extent of economic damage that can arise from a pandemic. There is the risk that emergent strains may not respond to current vaccines and may be more lethal and that they may spread as global travel increases.The response to the Pandemic by the Japanese and other governments may potentially fail to mitigate the economic damage created by the Pandemic and public health responses to it, or may create new risks in their own right. | The Board receives reports on the business continuity plans of the Manager and other key service providers. The effectiveness of these measures has been assessed throughout the course of the COVID-19 pandemic and the Board will continue to monitor developments as they occur and seek to learn lessons which may be of use in the event of future pandemics.To date the portfolio’s holdings have not exhibited a long-term negative impact and have recovered as the containment measures eased, although the pandemic has yet to run its course.The Board seeks to manage these risks through: a broadly diversified equity portfolio, appropriate asset allocation, reviewing key economic and political events and regulatory changes, active management of risk and the application of relevant policies on gearing and liquidity. | Risk remains relatively unchanged.The economic impact of the COVID-19 pandemic has been considered. There are always exogenous risks and consequences, which are difficult to predict and plan for in advance. The Company does what it can to address these risks when they emerge, not least operationally and in trying to meet its investment objective. |

Emerging Risks

The Board is cognisant of emerging risks, which are characterised by a high degree of uncertainty in terms of probability of occurrence and possible effects on the Company.

Emerging risks are considered as they are identified and are incorporated into the Company’s risk matrix. The Board, through the Audit Committee, will continue to assess these risks on an ongoing basis. The following have been identified as emerging risks:

| Emerging risk | Description | Mitigation/Control |

| Environmental Risks | ||

| Climate Change | Climate change is one of the most critical emerging issues confronting asset managers and their investors. Climate change may have a disruptive effect on the business models and profitability of individual investee companies, and indeed, whole sectors. | The Manager’s investment process integrates consideration of environmental, social and governance factors into decisions on which stocks to buy, hold or sell. This includes the approach investee companies take to recognising and mitigating climate change risks.In the Company’s and Manager’s view, companies that successfully manage climate change risks will perform better in the long-term. Consideration of climate change risks and opportunities is an integral part of the investment process. |

| ESG requirements from investors | The Company’s policy on ESG and climate change may be out of line with ESG practices in accordance with which investors are looking to invest. | The Manager has integrated the consideration of ESG factors into the Company’s investment process. Further details are set out in the ESG report on pages 18 to 23 of the Annual Report. |

| Geopolitical Risks | ||

| Geopolitical Instability | Geopolitical Risk is the potential for political, socio-economic and cultural events and developments to have an adverse effect on the value of the Company’s assets.The Company and its assets may be impacted by geopolitical instability, in particular concerns over global economic growth. The crisis in Ukraine has already affected energy and commodity markets and may cause further damage to the global economy.The ongoing conflict between Russia and Ukraine has heightened the possibility that tensions will spill over and intensify geo-political unrest between other countries sharing a common border. | There is little direct control of risk possible. The Company addresses these global developments through regular questioning of the Manager and will continue to monitor these issues as they develop.The Board has the ability, with shareholder approval, to amend the policy and objectives of the Company to mitigate the risks arising from geopolitical concerns. |

TRANSACTIONS WITH THE MANAGER

Details of the management contract are set out in the Directors’ Report on page 45 of the Annual Report. The management fee payable to the Manager for the year was £2,498,000 (2021: £2,478,000) of which £nil (2021: £nil) was outstanding at the year end.

During the year £nil (2021: £nil) was paid to the Manager for the marketing and administration of savings scheme products, of which £nil (2021: £nil) was outstanding at the year end.

Included in administration expenses in note 6 on page 75 of the Annual Report are safe custody fees payable to JPMorgan Chase group subsidiaries amounting to £29,000 (2021: £35,000) of which £7,000 (2021: £13,000) was outstanding at the year end.

The Manager may carry out some of its dealing transactions through group subsidiaries. These transactions are carried out at arm’s length. The commission payable to JPMorgan Securities Limited for the year was £nil (2021: £nil) of which £nil (2021: £nil) was outstanding at the year end.

Handling charges on dealing transactions amounting to £4,000 (2021: £4,000) were payable to JPMorgan Chase Bank N.A. during the year of which £1,000 (2021: £nil) was outstanding at the year end.

At the year end, total cash of £10,143,000 (2021: £627,000) was held with JPMorgan Chase. A net amount of interest of £nil (2021: £nil) was receivable by the Company during the year from JPMorgan Chase of which £nil (2021: £nil) was outstanding at the year end.

TRANSACTIONS WITH RELATED PARTIES

Full details of Directors’ remuneration and shareholdings can be found on pages 56 and 57 and in note 6 on page 75 of the Annual Report.

STATEMENT OF DIRECTORS’ RESPONSIBILITIES

The Directors are responsible for preparing the Annual Report and the financial statements in accordance with applicable law and regulation.

Company law requires the Directors to prepare financial statements for each financial year. Under that law the Directors have prepared the financial statements in accordance with United Kingdom Generally Accepted Accounting Practice (United Kingdom Accounting Standards, comprising FRS 102 ‘The Financial Reporting Standard applicable in the UK and Republic of Ireland’ and applicable law). Under company law the Directors must not approve the financial statements unless they are satisfied that they give a true and fair view of the state of affairs of the Company and of the profit or loss of the Company for that period. In preparing the financial statements, the Directors are required to:

• select suitable accounting policies and then apply them consistently;

• state whether applicable United Kingdom Accounting Standards, comprising FRS 102, have been followed, subject to any material departures disclosed and explained in the financial statements;

• make judgements and accounting estimates that are reasonable and prudent; and

• prepare the financial statements on the going concern basis unless it is inappropriate to presume that the Company will continue in business

and the Directors confirm that they have done so.

The Directors are responsible for keeping adequate accounting records that are sufficient to show and explain the Company’s transactions and disclose with reasonable accuracy at any time the financial position of the Company and enable them to ensure that the financial statements and the Directors’ Remuneration Report comply with the Companies Act 2006.

The Directors are also responsible for safeguarding the assets of the Company and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

The Directors are responsible for the maintenance and integrity of the Company’s website. Legislation in the United Kingdom governing the preparation and dissemination of financial statements may differ from legislation in other jurisdictions.

Under applicable law and regulations the Directors are also responsible for preparing a Strategic Report, a Directors’ Report and a Directors’ Remuneration Report that comply with the law and those regulations.

Each of the Directors, whose names and functions are listed in Directors’ Report confirm that, to the best of their knowledge:

• the Company’s financial statements, which have been prepared in accordance with United Kingdom Generally Accepted Accounting Practice (United Kingdom Accounting Standards, comprising FRS 102 ‘The Financial Reporting Standard applicable in the UK and Republic of Ireland’, and applicable law), give a true and fair view of the assets, liabilities, financial position and profit of the Company; and

• the Directors’ Strategic Report includes a fair review of the development and performance of the business and the position of the Company, together with a description of the principal risks and uncertainties that it faces.

The Directors consider that the Annual Report and Financial Statements, taken as a whole, is fair, balanced and understandable and provides the information necessary for shareholders to assess the Company’s position and performance, business model and strategy.

For and on behalf of the Board

Deborah Guthrie

Director, JPMorgan Japan Small Cap Growth & Income

22 June 2022