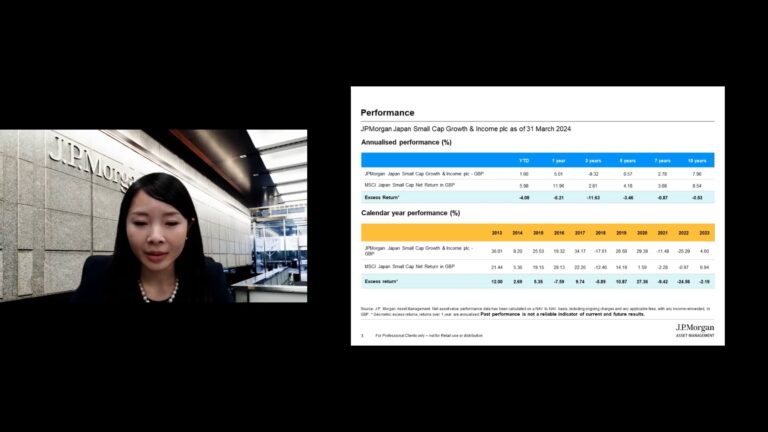

JPMorgan Japan Small Cap Growth and Income Plc (LON:JSGI) has reported its half year results, for the year ending 30 September 2021. Over the period JSGI has generated a NAV total return of 7.2% and a share price return of 9.1%, outperforming the 4.9% delivered by its benchmark, the MSCI Japan Small Cap Index. The trust now has a strong track record of outperformance of the benchmark, which it has beaten over three, five, and ten years, as of 13/12/2021.

A key element of JSGI’s strategy is its dividend profile, whereby the trust pays a quarterly dividend equal to 1% of the quarter end NAV, with the trust having paid a total dividend per share of 11p so far this financial year. This represents a 10% increase on the 10p dividend that was paid in the first six months of the previous financial year. JSGI has a current dividend yield of 4.4%, as of 13/12/2021.

Kepler View

JSGI is a good example of a trust using the unique structural advantages at its disposal to offer something different to investors; in this case the payment of a c. 4% dividend combined with a portfolio of growth-focused Japanese small-cap stocks. JSGI’s managers, Eiji Saito, Naohiro Ozawa, and Michiko Sakai, follow an investment process that aims to identify the highest quality growth opportunities, by assessing a company’s ‘Economics’, ‘Duration’, and ‘Governance’. While JSGI has all the characteristics of a growth portfolio, thanks to the team’s philosophy it also demonstrates much better quality metrics than its benchmark.

We believe that Japan income fund JSGI offers an attractive solution for both income and growth investors, something that cannot often be said for many strategies. The trust offers investors exposure to the structural growth opportunities which can be found among Japanese smaller companies as well as a solid yield, and could be an interesting diversifier for those seeking to broaden the sources of income within their portfolio. We note that the current 8% discount (as of 13/12/2021) is wide relative to JSGI’s average historical discount, and wide relative to its peers.