Accrol Group Holdings PLC (LON:ACRL) are the topic of conversation today when DirectorsTalk caught up with Mike Allen, Head of Research at Zeus Capital. Mike shares his thoughts on today’s trading statement from the company, explains his forecast assumptions and shares his view on the current stock valuation.

Accrol has this morning released an encouraging trading update, essentially confirming that the company is continuing to trade in line with expectations and the strategy is progressing well. We are maintaining our forecast assumptions for now, despite a “less favorable macro-economic environment”. While the shares have performed well of late, we believe the valuation remains attractive given its growth potential and unique market positioning and believe the risk/reward profile remains positive from here.

Trading update: The company have released a confident trading update, confirming that it has performed in line with market expectations for the 12-month period ended 30 April 2017. This is despite the macro economic environment being “less favorable.”, That said, we remain of the view that during a period of higher inflation, more consumers will move into the discount sector and private label products where Accrol is well positioned. We would also anticipate that hedging arrangements both in terms of US$ and agreed paper prices are in place for the new financial year to April 2018. Final results will be announced on 10 July.

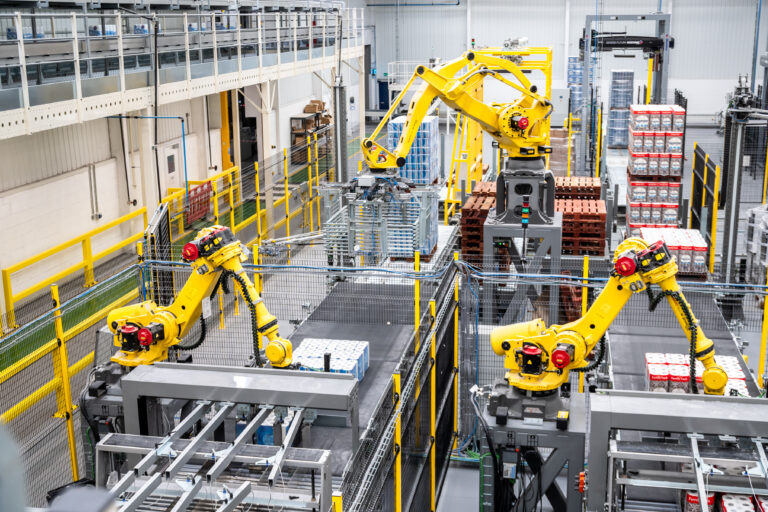

Consolidating its market position: Accrol Group Holdings Plc has consolidated its position as market leader in the discount sector and following the investment and smooth integration of its 168,000 sq.ft facility in Leyland, is running at production capacity of 143,000 tonnes per annum (118,000 at IPO). The company has announced, this morning, a 10-year lease agreement on a 368,000 sq.ft warehouse in West Lancashire to allow for further expansion, and this is testament to its confidence in executing its growth strategy, in our view. This facility will store finished goods and provide central distribution to all UK customers, enabling it to simplify and consolidate its existing warehouse facilities.

Forecast assumptions: We are maintaining our forecast assumptions at this juncture. We are forecasting a 4-year revenue CAGR through to 2019E of 10%, with cautious gross and EBITDA margins given the current environment, which will deliver a CAGR on the same basis in adjusted EPS of more than 20%, which is also backed by a rising ROCE (post tax) profile that should move in excess of 20% by 2019 vs. 15.4% expected in 2017E. We are also anticipating a 10% growth rate in DPS every year.

Valuation: The shares are currently trading on a 2018E P/E of 11.9x and an EV/EBITDA of 8.6x, which we believe remains attractive for a business expected to deliver EPS growth >15% per annum through to 2019E with a rising post tax ROCE >15% and a FCF yield of 8-10%. Given the significant investment in growth and capacity, we remain very comfortable with our original thesis that this should be a £30m+ EBITDA business based on 200,000 tonnage capacity. Overall, we remain comfortable with the investment case, and believe the risk/reward profile is positive from here.