GSK plc with ticker (LON:GSK) now has a potential upside of 16.2% according to Deutsche.

Deutsche set a target price of 1,950 GBX for the company, which when compared to the GSK plc share price of 1,678 GBX at opening today (22/03/2024) indicates a potential upside of 16.2%. Trading has ranged between 1,303 (52 week low) and 1,726 (52 week high) with an average of 7,774,502 shares exchanging hands daily. The market capitalisation at the time of writing is £69,437,877,572.

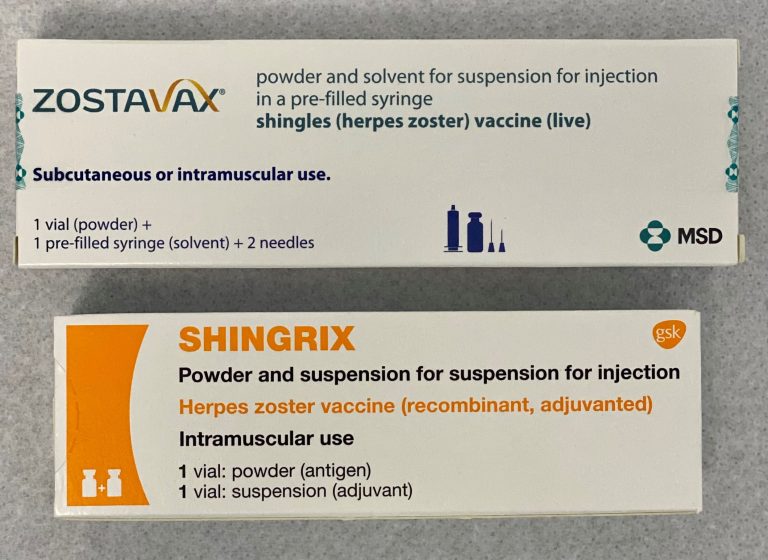

GSK plc is a global biopharma company. The Company’s segments include Commercial Operations and Research and Development. It develops cancer medicines for patients, including ovarian cancer, endometrial cancer, and multiple myeloma. It has developed monoclonal antibodies to help treat different diseases. Its product areas include vaccines, specialty medicines, and general medicine. It is also focused on addressing the unmet treatment needs of patients with respiratory and inflammatory conditions. Its vaccine portfolio includes more than 20 vaccines that help to protect people from a range of diseases and infections, including meningitis, shingles and flu, among others. Its specialty medicines include medicines for immune-mediated conditions. Its specialty medicines are also engaged in developing medicines for respiratory disease and HIV. Its general medicines include inhaled medicines for asthma and chronic obstructive pulmonary disease, antibiotics, and medicines for skin diseases.

GSK plc 16.2% potential upside indicated by Deutsche

- Written by: Charlotte Edwards

Latest Company News

GSK plc announced that the European Commission has approved Nucala (mepolizumab) as an add-on maintenance treatment for adults with uncontrolled COPD characterised by raised blood eosinophils.

GSK delivered a strong financial performance in 2025, with sales of £32.7 billion driven by double-digit growth in Specialty Medicines across Respiratory, Immunology & Inflammation, Oncology and HIV.

GSK plc announced that the European Commission has approved its RSV vaccine, Arexvy, for use in adults aged 18 years and older.

GSK has received European Commission approval for a prefilled syringe presentation of its Shingrix shingles vaccine.

GSK plc has announced that China’s National Medical Products Administration has approved Nucala (mepolizumab) as an add-on maintenance treatment for adults with inadequately controlled COPD characterised by raised blood eosinophils.

GSK has entered into an agreement with the US Administration to lower the cost of prescription medicines for American patients, including treatments across its respiratory portfolio for asthma and COPD.